Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Interim Report on Key Financial Controls of Major Entities

Please direct enquiries through our contact page.

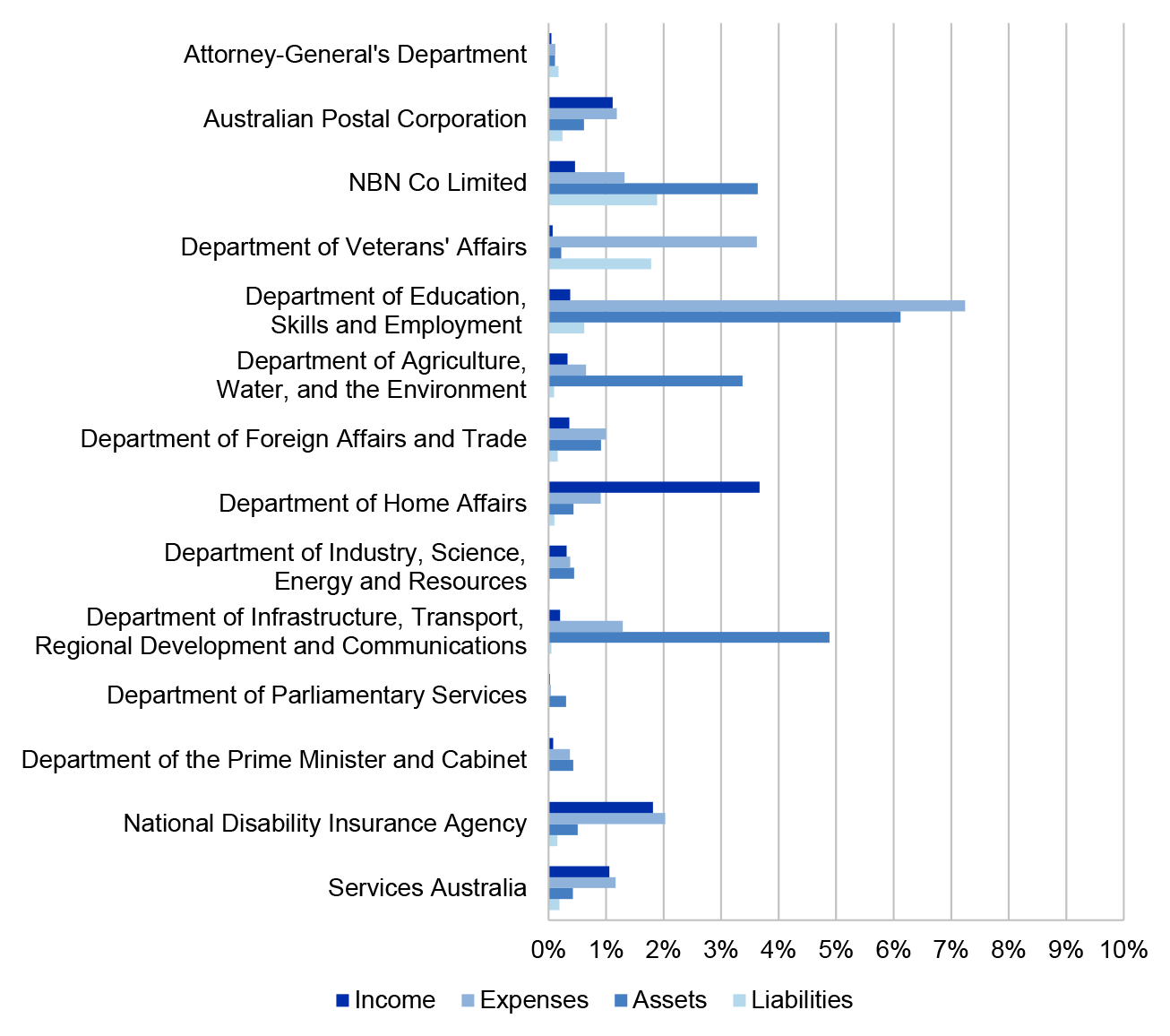

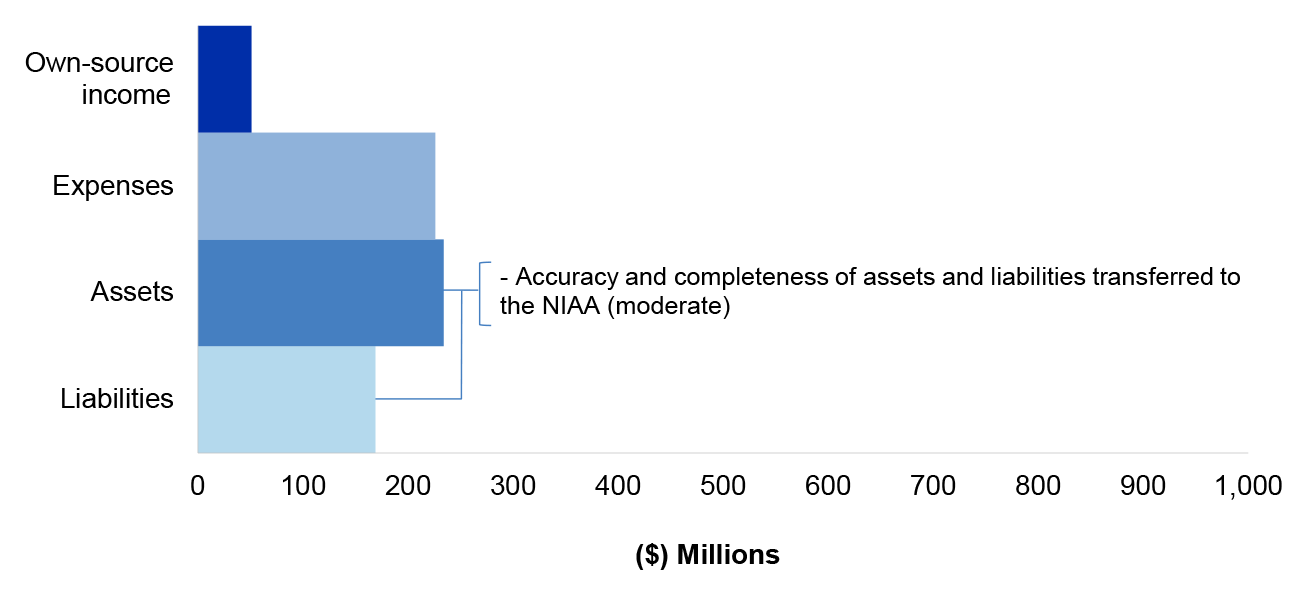

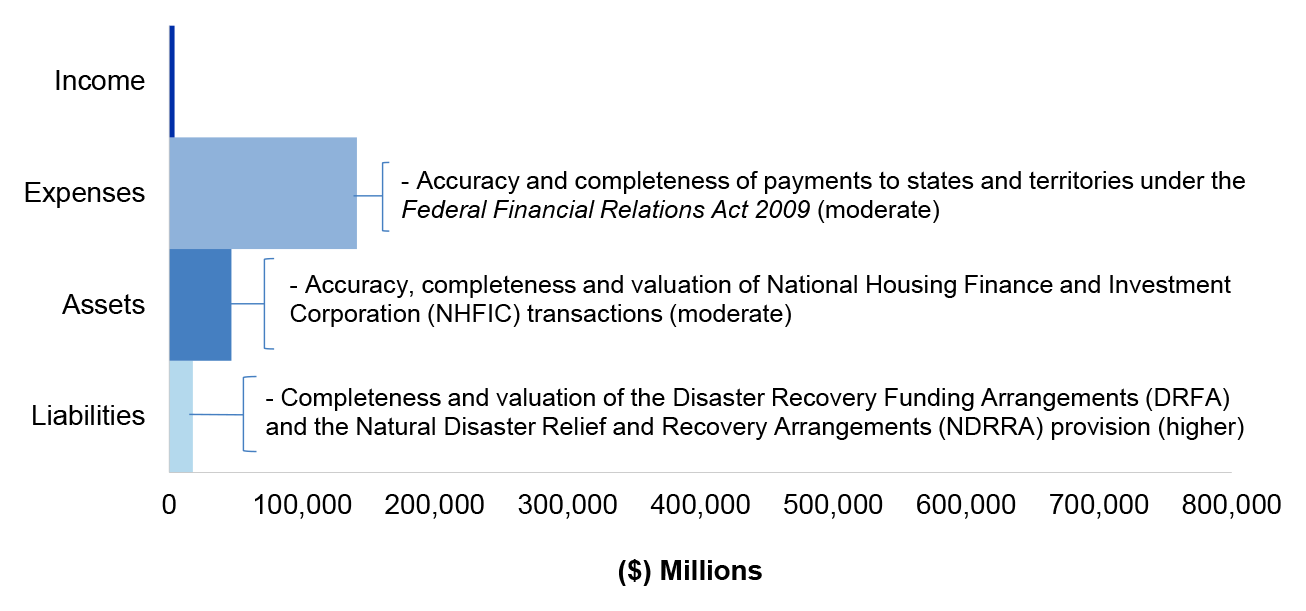

This report focuses on the results of the interim financial statements audits, including an assessment of entities’ key internal controls, supporting the 2019–20 financial statements audits. This report examines 24 entities, including all departments of state and a number of major Australian government entities. The entities included in the report are selected on the basis of their contribution to the income, expenses, assets and liabilities of the 2018–19 Consolidated Financial Statements (CFS). Significant and moderate findings arising from the interim audits are reported to the responsible Minister(s), and all findings are reported to those charged with governance of each entity.

Executive summary

1. The ANAO prepares two reports annually that provide insights at a point in time to the financial statements risks, governance arrangements and internal control frameworks of Commonwealth entities, drawing on information collected during audits. These reports explain how entities’ internal control frameworks are critical to executing an efficient and effective audit and underpin an entities capacity to transparently discharge their duties and obligations under the Public Governance, Performance and Accountability Act 2013 (PGPA Act). Deficiencies identified during audits that pose a significant or moderate risk to the entities ability to prepare financial statements free from material misstatements, are reported.

2. This report is the first in the series of reports and focuses on the results of the interim audits, including an assessment of entities’ key internal controls, supporting the 2019–20 financial statements audits. This report examines 24 entities, including all departments of state and a number of major Australian government entities. The entities included in the report are selected on the basis of their contribution to the income, expenses, assets and liabilities of the 2018–19 Consolidated Financial Statements (CFS). Significant and moderate findings arising from the interim audits are reported to the responsible Minister(s), and all findings are reported to those charged with governance of each entity.

Impact of COVID-19

3. The potential impact of the COVID-19 pandemic, and the Australian Government’s and global responses to the situation, on auditing frameworks, audit risks and audit opinions are covered throughout this report. However, it is important to acknowledge that the audit findings compiled in this report, were at a time largely before the COVID-19 pandemic. It is the ANAO’s intention to work co-operatively with audited entities to resolve any issues resulting from the COVID-19 pandemic, and audit teams will continue to assess the situation for each entity and revise audit approaches accordingly during what remains of the financial statements audit cycle.

4. The ANAO Auditing Standards require audit opinions to be modified where sufficient appropriate audit evidence is unable to be gathered and the possible effects of undetected misstatements arising from the lack of evidence are material. As a consequence of the COVID-19 pandemic, there may be a higher likelihood of disclaimers of opinions for entities’ 2019–20 financial statements. Where this occurs, it will be reported to Parliament in the second report of this series.

Summary of audit findings and related issues

Summary of audit findings

5. A total of 72 findings were reported to the entities included in this report as a result of interim audits, comprising of eight moderate and 64 minor findings. This is an overall increase in the number of findings but a decrease in both the significant and the moderate finding categories compared to the 2018–19 interim audit results. One significant legislative breach was also reported.

6. Fifty per cent of findings relate to the management of IT controls, particularly the management of privileged user access. The continued level of findings indicates that the IT control environment warrants further attention by entity management.

Policies reviews for compliance with finance law, gifts and benefit disclosures and cyber resilience

7. The ANAO observed that entities had processes in place for monitoring and reporting instances of non-compliance with finance law. Following changes in mandatory external reporting of non-compliance, there has been a trend towards entities reducing the level of internal reporting of non-compliance captured and reported to audit committees and accountable authorities.

8. The Australian Public Service Commissioner issued guidance requiring Commonwealth entities to publish quarterly, a register of all gifts and benefits valued at greater than $100, received by the agency head. It was observed that entities have largely made good progress in implementing these recommendations.

9. The Protective Security Policy Framework (PSPF) contains the Essential Eight mitigation strategies and recommended controls intended to strengthen cyber resilience and capacity of Government to mitigate cyber threats. Review of entities’ implementation and compliance with these strategies found that there continues to be limited improvement in the level of compliance with the controls, since being first mandated in 2013.

Entity internal controls

10. The interim audit phase includes an assessment of the effectiveness of each entity’s internal controls as they relate to the risk of misstatement in the financial statements. At the completion of interim audits for the 24 entities included in this report, the key elements of internal control were assessed as operating effectively for 17 entities. For the remaining seven entities, the key elements of internal control were operating effectively to support the preparation of financial statements that are free from material misstatement, except for particular finding/s outlined in chapter 4.1

Management of staff leave

Summary of developments

11. The increase in audit findings relating to human resource management and administration, and the significance of these as a proportion of all financial statements audit findings, has prompted the ANAO to undertake targeted assurance activities over the management of staff leave. The activities have been performed to facilitate an assessment of compliance of the management of leave accruals, and balances with human resource policies and requirements, and to further inform assurance activities for future audits. The entities selected were the Departments of: Home Affairs; the Prime Minister and Cabinet; and the Treasury.

12. The analysis performed to date has identified weaknesses in processes relating to staff leave and associated monitoring controls. In particular, improvements can be made in the timeliness of submission and approval of leave requests and the application of requirements including minimum and maximum entitlements. The ANAO has also identified that the Department of Home Affairs’ leave policy does not contain current information or requirements following the February 2019 Workplace Determination.

13. These observations potentially impact entities’ operations and financial reporting. Taking leave prior to approval being given may impact the ability of entities to effectively manage resources and deliverables, while also potentially overstating the related employee liability balances in the financial statements.

14. The ANAO will continue to progress the assessment of the above criteria and will report the results in Auditor-General report: Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2020 and in a separate report to Parliament.

Reporting and auditing frameworks

Summary of developments

15. As a consequence of the COVID-19 pandemic and revised accounting standards for revenue and leases, Commonwealth entities will need to review and update the information, systems, processes and controls relied on in the preparation of their 2019–20 financial statements. The ANAO will revise its risk assessments and modify planned audit procedures in response to the changes made by Commonwealth entities.

Cost of this report

16. The cost to the ANAO of producing this report is approximately $480,000.

1. Interim audit results and other matters

Chapter coverage

This chapter provides:

- an overview of the ANAO's audit approach to financial statements audits;

- a summary of observations regarding the internal control environments of the entities included in this report;

- a summary of audit findings identified at the conclusion of the interim audit; and

- observations relating to: machinery of government changes, board governance, reporting relating to compliance with finance law; application of the Australian Public Service Commissioner's guidance for reporting gifts and benefits; and the maturity of entity's processes for safeguarding financial information from cyber threats.

Conclusion

Key to ANAO audit process is assessment of entities' internal control frameworks as they apply to financial reporting. An effective internal control framework provides the ANAO with a level of assurance that entities are able to prepare financial statements that are free from material misstatement. At the completion of interim audits for the 24 entities included in this report the ANAO noted that key elements of internal control were operating effectively for 17 entities. For seven entitiesa, except for particular finding/s outlined in chapter 4, the key elements of internal control were operating effectively to support the preparation of financial statements that are free from material misstatement.

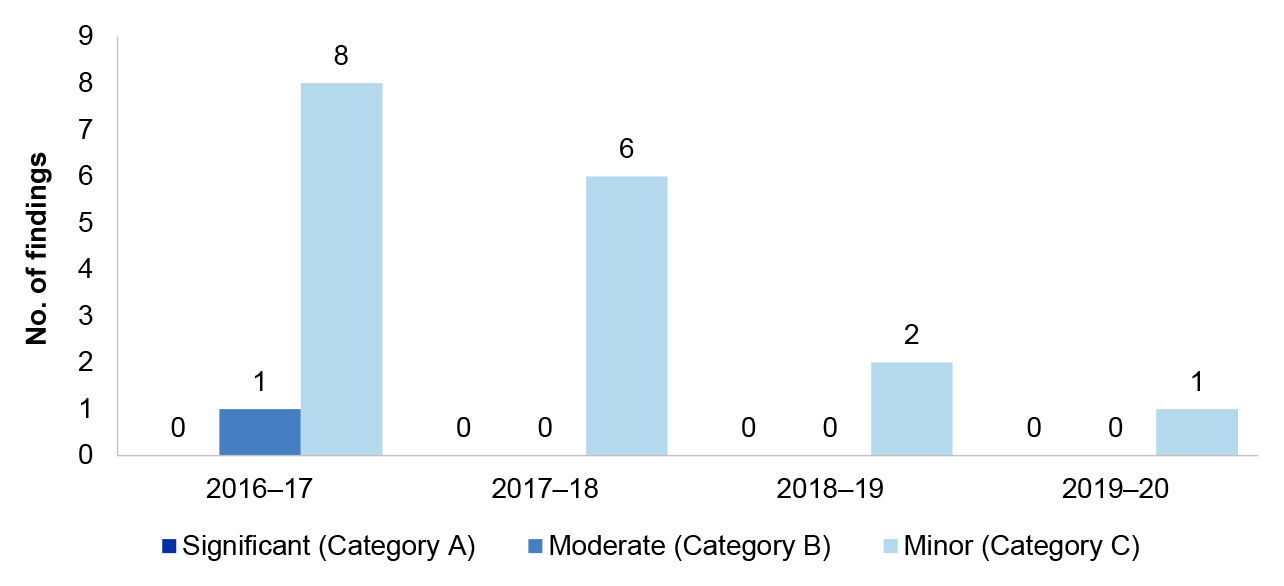

A total of 72 findings were reported to the entities included in this report as a result of interim audits, comprising of nil significant, 8 moderate and 64 minor findings. This is an overall increase in the number of findings but a decrease in both the significant and the moderate findings compared to the 2018–19 interim audit results, which reported one significant, 12 moderate and 57 minor findings. One significant legislative breach was also reported.

Eighty-seven per cent of moderate findings continue to be in the areas of: management of IT controls, particularly the management of privileged users and compliance and quality assurance frameworks supporting program payments. These areas warrant further attention by entity management.

The Australian Public Service Commissioner issued guidance requiring Commonwealth entities to publish quarterly, a register of all gifts and benefits valued at greater than $100, received by the agency head. It was observed that entities have largely made good progress in implementing these recommendations

The ANAO observed that entities had processes in place for monitoring and reporting instances of non-compliance with finance law. Following changes to the mandatory external reporting of non-compliance in 2015–16, there has been a trend towards entities reducing the level of internal reporting of non-compliance captured and reported to audit committees and accountable authorities.

The Protective Security Policy Framework (PSPF) contains the Essential Eight mitigation strategies and recommends controls intended to strengthen cyber resilience and the capacity of Government to mitigate cyber threats. Review of entities' implementation and compliance with these strategies found that there continues to be limited improvement in the level of compliance with the controls since being mandated in 2013.

Note a: The seven entities are the: Departments of: Agriculture, Water and the Environment; Defence; Education, Skills and Employment; Home Affairs; Infrastructure, Transport, Regional Development and Communications; National Disability Insurance Scheme Launch Transition Agency and Services Australia.

Introduction

1.1 The ANAO publishes an Annual Audit Work Program (AAWP) which reflects the ANAO's strategy and deliverables for the forward year. The purpose of the AAWP is to inform the Parliament, the public and government sector entities of the ANAO's planned audit coverage for Australian Government entities by way of financial statements audits, performance audits and other assurance activities.

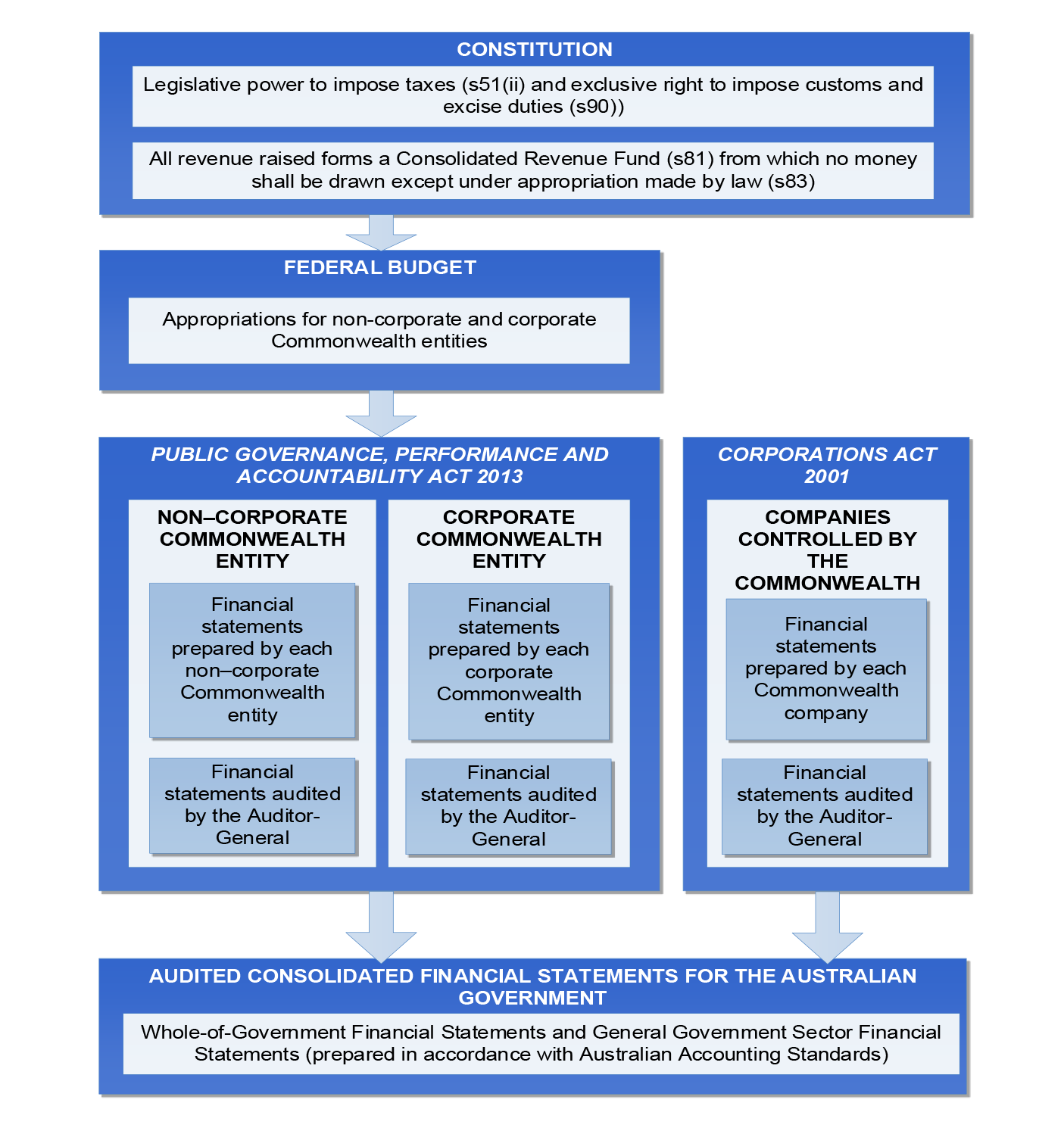

1.2 The financial statements audit coverage, as outlined in the AAWP, includes presenting two reports to the Parliament addressing the outcomes of the financial statements audits of Australian Government entities and the Consolidated Financial Statements of the Australian Government (CFS). These reports provide Parliament with an independent examination of the financial accounting and reporting of Commonwealth public sector entities.

1.3 This report focuses on the results of the interim audits of 24 entities2 including an assessment of key internal controls supporting the 2019–20 financial statements. The assessment includes a review of the governance arrangements related to entities' financial reporting responsibilities and the design and implementation of key internal controls relating to significant business processes. Where the auditor plans to rely upon key controls for assurance that financial statements are free from material misstatement, the controls are tested for operating effectiveness. Testing of controls during the interim audit phase allows the ANAO to form a conclusion on the operating effectiveness of those controls for the period up to the date of testing. During the final phase of the 2019–20 financial statements audit, the ANAO completes testing over the operating effectiveness of those controls upon which the ANAO intends to rely, and also controls not assessed at interim. The second report presents the final results of the financial statements audits of the CFS and all Australian Government entities.

1.4 The Government's response to the COVID-19 pandemic has included significant new measures and expenditure to enhance the capacity of Commonwealth entities to provide support to individuals and businesses impacted by the reduced economic activity and downturn originating from the containment strategies. Much of the interim controls testing was undertaken before major decisions on the implementation of the COVID-19 response measures. As such, entities should consider whether appropriate controls have been established for COVID-19 activities. Further detail on how the developing COVID-19 situation may result in additional financial statements preparation and audit risks for entities is included in chapter 4 of this report.

1.5 The entities included in this report are those entities that contribute significantly to the three sectors of the CFS: the General Government Sector (GGS), Public Non-Financial Corporation (PFNC) sector and Public Financial Corporation (PFC) sector. A listing of these entities is provided in Appendix 1.

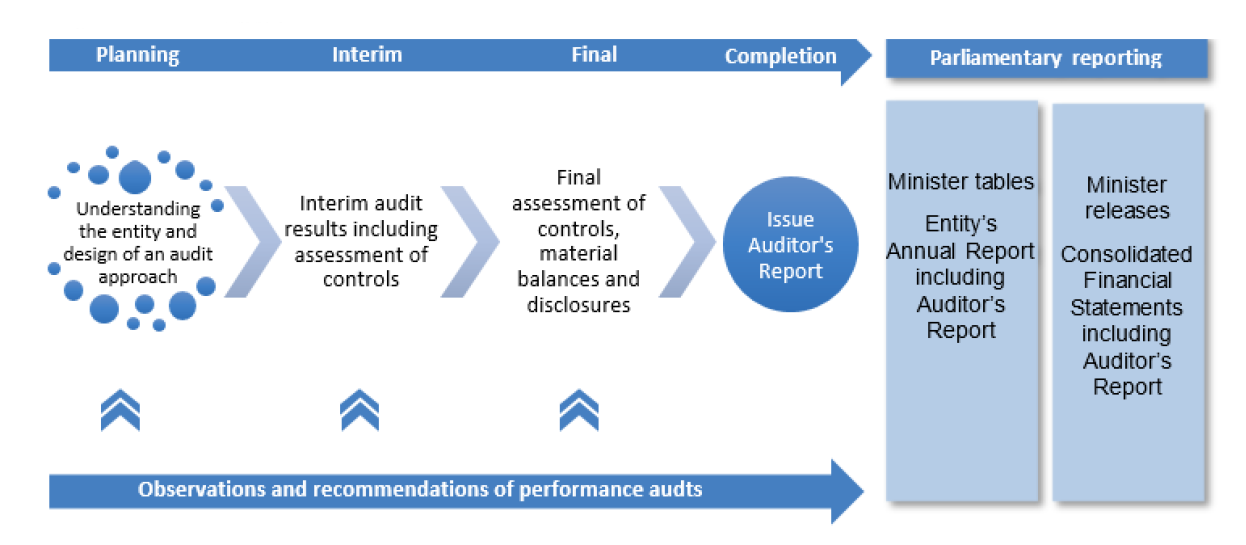

1.6 The ANAO conducts its financial statements audits in four phases: planning, interim, final and completion. Figure 1.1 outlines the key elements of each phase.

Figure 1.1: ANAO financial statements audit process

Source: ANAO data.

1.7 A central element of the ANAO's financial statements audit methodology, and the focus of the planning phase of ANAO audits, is a sound understanding of an entity's environment and internal controls relevant to assessing the risk of material misstatement in the financial statements. This understanding informs the ANAO's audit approach, including the reliance that may be placed on entity systems to produce financial statements that are free from material misstatement.

1.8 In accordance with generally accepted auditing practice, the ANAO accepts a low level of risk that an audit will fail to detect the financial statements are materially misstated. This low level of risk is accepted because it is too costly to perform an audit that is predicated on no level of risk. An understanding of the entity, its environment and its controls helps the ANAO design the required work and respond to risks that bear on financial reporting. The key areas of financial statements risks identified through this planning approach are discussed in chapter 4 for each entity included in this report.

1.9 A key component of understanding the entity and its environment is to understand the governance arrangements established by its accountable authority.3 Accountable authorities of all Commonwealth entities and companies subject to the Public Governance, Performance and Accountability Act 2013 (PGPA Act) are required to govern their entity in a way that promotes the proper use and management of public resources, the achievement of the purposes of the entity and the entity's financial sustainability.

1.10 The development and implementation of effective corporate governance arrangements and internal controls should be designed to meet the individual circumstances of each entity. These processes also assist in the orderly and efficient conduct of the entity's business and compliance with applicable legislative requirements, including the preparation of annual financial statements that present fairly the entity's financial position, financial performance and cash flows.

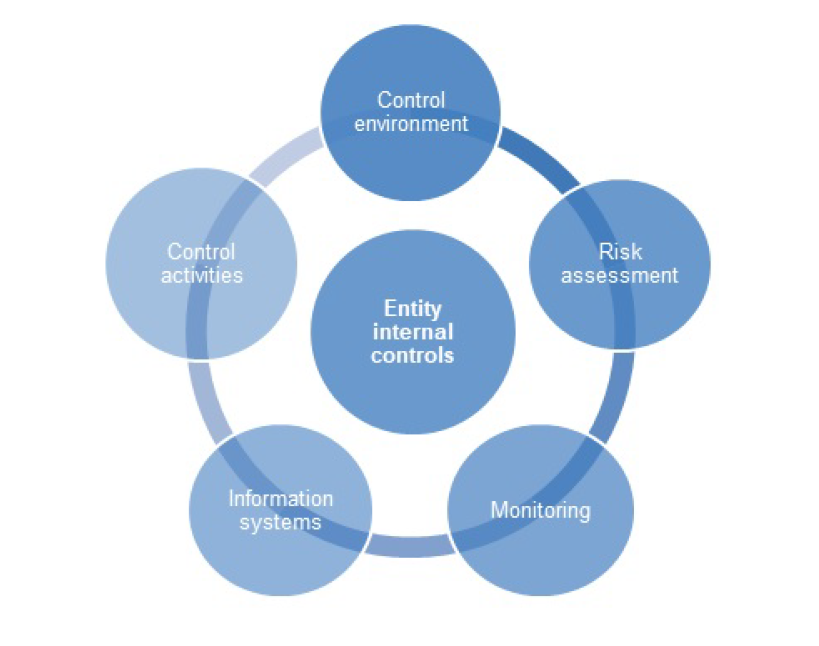

Understanding the entity

1.11 The ANAO uses the framework in the Australian Auditing Standards (ASA) 315 Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and its Environment to consider the impact of different elements of an entity's internal controls that support the preparation of financial statements. This approach provides a basis for designing and implementing the audit work program that reflects the ANAO's assessment of the risk of material misstatement. Deficiencies in the internal control framework increase the requirement of the ANAO to perform additional audit work in the final phase. Figure 1.2 outlines these elements.

Figure 1.2: Elements of entity internal controls

Source: ASA 315 Identifying and assessing the risk of material misstatement through understanding the entity and its environment, paragraph A59.

1.12 This chapter discusses each of these elements and outlines observations based on the ANAO's review of aspects of each entity's internal controls, relevant to the risk of material misstatement to the financial statements, including the detailed results of the interim audits.

1.13 At the completion of the interim audits for the 24 entities included in this report, the ANAO noted that key elements of internal control were operating effectively for 17 entities. For the remaining seven4 entities, except for particular finding/s outlined in chapter 4, the key elements of internal control were operating effectively to support the preparation of financial statements that are free from material misstatement.

1.14 The key elements of internal controls for the full financial year will be assessed in conjunction with additional audit testing during the 2019–20 final audits. The impact of changes to the control environment arising from the COVID-19 situation and the required audit response will also be considered at this time.

Control environment

1.15 The PGPA Act sets out the requirements to establish and maintain systems relating to risk and control. Division 2, section 16 of the PGPA Act states that:

The accountable authority of a Commonwealth entity must establish and maintain:

a) an appropriate system of risk oversight and management for the entity; and

b) an appropriate system of internal control for the entity.

including by implementing measures directed at ensuring officials5 of the entity comply with finance law.6

1.16 An effective control environment is underpinned by a fit-for-purpose governance structure. Indicators of an effective governance structure include whether management has established frameworks and processes that promote positive attitudes, awareness and actions concerning the entity's internal controls and their importance in the entity. The main elements reviewed included: governance structures relevant to the preparation of the financial statements; audit committee and assurance arrangements; systems of authorisation; and processes for recording financial transactions.

1.17 All entities included in this report have established executive management committees and/or sub-committees that meet at least monthly, which support financial decision making at strategic and operational levels.7 Consistent with previous years, consideration of financial reporting was included on the agendas of all 24 entities' executive and audit committees. The financial information provided to the entities' executives was supplemented by non-financial operational information.

1.18 Clear lines of accountability and reporting are important in establishing a strong internal control environment for the purposes of preparing financial statements. The involvement of those charged with governance is an important element of these structures. Just as important is ensuring that staff at all levels understand their own role in the control framework. This can be achieved through the issuance of accountable authority instructions, and delegation instruments. All entities have established accountable authority instructions and delegations reflecting current business arrangements.

1.19 A number of entities included in this report, were impacted by Machinery of Government changes during 2019–20 which are discussed further below.

Machinery of Government

1.20 Machinery of Government (MoG) changes as a result of a new Administrative Arrangements Order involve change management processes on the part of the entities involved. A MoG change occurs when the Government decides to change the way Commonwealth responsibilities are managed. It can involve the movement of functions, resources and people from one agency to another. Successful implementation of MoG changes requires effective communication between all the parties affected by the changes, the full cooperation and commitment of both central and line agencies and sound project management arrangements to be developed and implemented in a timely manner.

Scale of the MoGs

1.21 The MoGs implemented in 2019–20 and considered as part of the interim audit were extensive. In all, six portfolio departments merged to become three8, an existing department was established as an Executive Agency9 and a new agency was established.10 As a result a large number of functions and programs were transferred between departments and four departments were renamed.

1.22 The most significant changes were:

- transfer of responsibility for functions relating to employment and skills to the newly named Department of Education, Skills and Employment. The vocational education and training, and apprenticeships functions had previously been transferred from the Education portfolio to the former Employment portfolio as part of the 29 May 2019 MoG and were subsequently transferred back as a result of the 5 December 2019 MoG.

- transfer of the communications and arts functions to the renamed Department of Infrastructure, Transport, Regional Development and Communications;

- transfer of agriculture functions to the renamed Department of Agriculture, Water and the Environment;

- establishment of Services Australia (formerly known as the Department of Human Services) as a new Executive Agency, within the Social Services Portfolio;

- establishment of the National Indigenous Australians Agency which assumed responsibility for functions relating to Indigenous Australians from the Department of the Prime Minister and Cabinet;

- transfer of small business, energy and climate change functions (excluding climate science and adaptation) to the renamed Department of Industry, Science, Energy and Resources;

- transfer of responsibility for industrial relations from the former Employment portfolio to the Attorney-General's portfolio;

- transfer of responsibility for whole-of-government service delivery from the Prime Minister and Cabinet portfolio to Services Australia;

- transfer of migrant adult education functions from the Education portfolio to the Home Affairs portfolio;

- transfer of settlement services for refugees and humanitarian migrants from the Social Services portfolio to the Home Affairs portfolio;

- transfer of the information technology group functions from the Department of Social Services to Services Australia; and

- transfer of the National Redress Scheme Branch and the administered investment for Hearing Services Australia from Services Australia to the Department of Social Services.

1.23 Where MoG changes affect areas such as governance arrangements, appropriations, IT systems, internal controls and financial reporting, the ANAO takes these into account in developing its audit approach as part of the annual financial statement audits of Australian Government entities.

1.24 The ANAO 2019–20 interim audit has identified that MoG changes resulted in over 10 000 staff transferring between entities effected through determinations under section 72 of the Public Service Act 1999. Appropriations totalling approximately $1.2 billion were transferred between entities through determinations under section 75 of the Public Governance, Performance and Accountability Act 2013.

Implementing MoG changes

1.25 Implementing MoG changes can be resource-intensive and involve complexity in managing a range of issues. These include: reaching agreement on the staff and appropriations to be transferred; establishing communication mechanisms with both 'gaining' and 'losing' staff; connecting gaining staff to existing IT networks and disconnecting transferred staff from IT systems; arranging accommodation requirements for staff being transferred; and negotiating the most effective way to maintain the delivery of services in both the short and longer term, particularly arrangements for the processing of employee entitlements and program payments.

1.26 The Machinery of Government changes A Guide for Agencies — April 2019 (the Guide), jointly issued by the Australian Public Service Commission (APSC) and the Department of Finance (Finance), outlines a set of principles to assist entities in implementing changes resulting from a MoG. The principles are:

- taking a whole-of-government approach;

- constructive and open communication with staff; and

- accountability and compliance with legislation and policy.

1.27 Implementation of MoG changes requires entities to work co-operatively and openly in a timely manner. Entities are expected to implement changes as quickly as possible, with a focus on achieving the best outcomes for the Australian community across the whole of government.11 As the changes arise from an executive order of government, entities affected will have little or no notice of the specific changes that have been determined.

1.28 The Guide also outlines that where a completion date is not specified in relation to a MoG, entities are expected to complete changes within thirteen weeks from the date of effect of the MoG change. Agency heads are responsible for meeting this deadline and for implementing MoG changes in accordance with the principles set out in paragraph 1.26 above.

1.29 In order to achieve the best outcome, agencies are encouraged to:

- appoint an independent advisor to manage the MoG process, facilitate negotiations and to help resolve any contested issues (paragraph 6);

- establish a cross-agency steering committee that includes representatives from all affected agencies, has clear lines of responsibility and reporting (paragraph 12);

- complete a thorough due diligence exercise of all aspects of functions being transferred including statutory requirements, delegations, and related appropriations (paragraph 7); and

- develop a communications strategy to keep affected staff informed of the progress of changes relating to the timetable and impacts to conditions, hours and pay (Summary, page 11).

Observations

1.30 As part of the 2019–20 interim audit, the ANAO considered the application of the Guide by the entities subject to MoG changes in the current year. Ten entities included in this report, were impacted by MoG changes in 2019–20. The changes to entities varied in complexity and size, with a number of significant MoGs merging functions of entire entities. Although there was a range of complexities involved, the Attorney–General's Department was the only entity that appointed an independent arbitrator. The appointment was made in conjunction with the former Department of Employment, Skills, Small and Family Business and related to the transfer of industrial relations functions.

1.31 Nine12 of the ten entities impacted established a steering or implementation committee to manage the MoG process. These committees were comprised of senior staff members who were assigned responsibility for settling implementation issues. All committees included representatives from both the gaining and losing entities. Of the entities that established a steering or implementation committee, only the committee from the Department of Industry, Science, Energy and Resources reported to the Audit Committee. Services Australia managed the process through its existing governance and executive committees.

1.32 As outlined in the Guide, as soon as it is apparent that a MoG change will occur, losing agencies are expected to undertake an immediate and thorough due diligence assessment over the transferred function. The due diligence exercise requires a detailed examination of all aspects of the function being transferred.13 Of the ten entities impacted by the MoGs, six14 lost functions. These six entities used a variety of approaches to undertake their due diligence.

- The Department of Education, Skills and Employment and Services Australia undertook a detailed assessment or review in relation to the MoG.

- The Department of Social Services undertook an initial due diligence assessment in relation to the MoG. As at 30 April 2020, the ANAO has not been provided with documentation in respect of the due diligence process.

- The Department of Agriculture, Water and the Environment undertook due diligence processes in relation to functions transferred out as a result of the MoG.

- The Department of Infrastructure, Transport, Regional Development and Communications received all functions of the former Department of Communications and the Arts. The priority of the project team was to work on organisational integration and having appropriate systems and procedures in place from day one to facilitate both entities continuing their delivery. As such, the due diligence exercise was undertaken as part of the integration process.

- The Department of the Prime Minister and Cabinet did not undertake a separate due diligence process relating to the functions being transferred to the National Indigenous Australians Agency. The due diligence was undertaken concurrently with the risk management processes.

1.33 Four entities that gained functions as a result of the changes also performed a due diligence assessment. The Attorney–General's Department and the Department of Industry, Science, Energy and Resources performed assessments to obtain essential information relating to the functions they were receiving and included details relating to human resources and financial information.

1.34 The Department of Social Services performed due diligence over the functions gained from Services Australia. The Department of Agriculture, Water and the Environment undertook due diligence processes for functions received from the former Department of Agriculture, but not to the extent of those undertaken for functions that were transferred out.

1.35 The Guide outlines that a risk management approach15 relating to the impact of the MoG on an entity, is required to avoid delays in negotiations. Entities used a variety of approaches to manage the risks associated with the MoGs as detailed below.

- The Departments of: Agriculture, Water and the Environment; Industry, Science, Energy and Resources; Education, Skills and Employment; Home Affairs; and Social Services16 undertook a formalised risk assessment process in relation to the impact of the MoG. The Attorney–General's Department established and maintained a detailed issues and risk register relating to the MoG changes. A number of high risks were identified across these entities.

- The Department of the Prime Minister and Cabinet and the National Indigenous Australians Agency did not undertake a full risk analysis due to the limited time-frame to implement the changes. Risk was managed via agile project methodology using daily stand up meetings where challenges and risks to objectives were identified and mitigated on a daily basis.

- Services Australia did not perform an overall risk assessment relating to the MoG. Risks were captured and managed through the individual business and program areas. The Chief Financial Officer's group tracked the financial implications of these risks through briefing papers to the Financial Statements Sub Committee and Audit Committee.

- The Department of Infrastructure, Transport, Regional Development and Communications has identified that it intends to prepare a position paper17 relating to the impact of MoG changes on the 2019–20 financial statements.

1.36 In addition to the overall risk assessments outlined above, seven of the ten entities undertook a financial statements risk analysis. The Department of Social Services has undertaken an initial assessment as the transfer of functions between the department and Services Australia is still in progress.

1.37 The National Indigenous Australians Agency is a newly established entity. It initially adopted a number of risk and mitigation approaches from the Department of the Prime Minister and Cabinet. During 2019–20 it has been refining its governance and practices, including risk assessments for financial statements preparation.

1.38 The Department of Home Affairs did not perform a separate financial statements risk assessment, but did review and update the Financial Statements Assurance Framework and noted nil financial statements risk resulting from the MoG.

Conclusion

1.39 The additional guidance provided by the Guide provides entities with a set of principles to follow when they are subject to MoG changes. Best practice would include all entities applying the principles of the Guide regardless of whether they are the losing agency or the gaining agency and regardless of the scale of the MoG. Performing a due diligence review and undertaking detailed risk assessments from an operational and financial statements perspective, assists entities to identify any new risks that could impact on the timely preparation of complete and accurate financial statements.

1.40 The principles of the Guide provide entities with valuable insights that can assist in ensuring the focus remains on completing the MoG processes quickly and achieving the best outcomes for the Australian community across the whole-of-government.

Audit Committees

1.41 The PGPA Act requires audit committees to be established for Commonwealth entities and Commonwealth companies.18 An independent audit committee is a fundamental principle of good governance.19 The audit committee plays a key role in assisting the accountable authority to fulfil its governance, risk management and oversight responsibilities through the provision of independent assurance and advice.

1.42 Section 17 of the Public Governance Performance and Accountability Rule 2014 (PGPA Rule) sets out the minimum requirements relating to the audit committee of a Commonwealth entity. The key requirements of the PGPA Rule are outlined below.

- A written charter, set by the accountable authority, determining the functions of the audit committee for the entity. These functions must include reviewing the appropriateness of the accountable authority's financial reporting; performance reporting; system of risk oversight and management; and system of internal control for the entity.

- Membership of the committee20 to include at least three persons with appropriate qualifications, knowledge, skills or experience to assist the committee to perform its functions and a majority of committee members and the committee chair must be independent of the entity.

- Persons that must not be a member of the audit committee: the accountable authority or, if the accountable authority has more than one member, the head; the Chief Financial Officer; and the Chief Executive Officer.

1.43 All entities have established audit committees consisting of a majority of members assessed by the entity to be independent. All entities have an audit committee charter that is consistent with their obligations under subsection 17(2) of the PGPA Rule. Each entity has appointed an independent audit committee chair.

Board Governance Arrangements

1.44 The ANAO audit program has included topics on the implementation of the PGPA Act and the PGPA Rule. Under the PGPA Act, the accountable authority is responsible for leading, governing and setting the strategic direction for the entity. For corporate Commonwealth entities the governing body of the entity is the board, unless otherwise prescribed by the rules.21 In 2018–19, a series of performance audits reviewed whether corporate Commonwealth entities had established effective arrangements to comply with legislative and policy requirements, and adopted practices that support effective governance.22

1.45 The board plays a key role in the effective governance of an entity. Corporate governance involves two dimensions, performance and conformance. In this report the ANAO has analysed the following entities governed by boards: Australian Postal Corporation, the Future Fund Management Agency and the Board of Guardians23, NBN Co Limited (NBN Co) and the National Disability Insurance Scheme Launch Transition Agency (NDIA). The ANAO has also analysed the Reserve Bank of Australia's (RBA) Reserve Bank Board, noting that the RBA Governor is the accountable authority.

1.46 The interplay of the 'hard attributes' of governance (such as board composition, appointment processes and independence) and the 'soft attributes' of governance (such as the chair/CEO relationship, board behaviours and board culture) are critical to good governance and organisational performance.24 The design of the board structures for the entities listed above is consistent with legislative and policy requirements. The entities have actively engaged with the portfolio department and minister in relation to the skills requirements for prospective board appointments, and provided advice to the decision-maker accordingly. Upon appointment to the board, all entities had appropriate induction processes that included details of the board's role and responsibilities as the accountable authority.

1.47 Establishing a charter can assist board members by providing a single reference point that clearly sets out the functions, powers and membership of the board, as well as roles, responsibilities and accountabilities. For the five entities considered, a charter was in place and reviewed on a regular basis. The boards of all the entities meet on average at least every six weeks. Sufficient and appropriate documentation and the recording of decisions and actions is kept by the entities, as well as the declaration of conflicts of interests by members, including the managing director, or equivalent.

1.48 The boards maintain a strategic focus on risk within the entity with regular briefings from the relevant audit and/or risk committee. Other items discussed by the boards include approval of key policies and frameworks, assurance from management regarding internal controls and compliance with legislation, and reporting on progress against the corporate plan. All entities undertake regular reviews to evaluate board performance, with external assessments complemented by more frequent internal reviews. Periodically evaluating board performance can enable a board to reflect on its operations and assess whether it has effectively met its purpose, objectives and obligations.

Risk assessment processes

1.49 Section 16 of the PGPA Act sets out an accountable authority's responsibilities in regard to the establishment of appropriate risk oversight and management in an entity. An understanding of an entity's process to identify and manage risk is essential to an effective and efficient financial statements audit. A review of this process is done to assist the ANAO to understand how entities identify and manage risks relating to financial statements and assess the risk of material misstatement to an entity's financial statements.

1.50 For the 2019–20 interim audit phase the ANAO's review of entities' risk assessment processes was undertaken prior to the emergence of the COVID-19 pandemic. In order to minimise the impact on their financial statements, entities should review their current risk assessments. This is discussed further in paragraphs 2.6 to 2.8 of chapter 2.

1.51 All entities included in this report have a process to develop and update risk management plans at the organisational and strategic risk levels. In addition, each entity has developed processes for the identification and notification of risks relevant to financial statements preparation either as part of the overall risk management plan, or through a targeted risk identification exercise. The monitoring of risks and the entity's implementation of risk management strategies was typically assigned to either an executive committee and/or the audit committee.

1.52 Entities affected by machinery of government changes, including the Departments of: Agriculture, Water and the Environment; Education, Skills and Employment; and Infrastructure, Transport, Regional Development and Communications are currently applying risk management plans established at the former entities. The National Indigenous Australians Agency (NIAA) is adopting the risks assessed by the Department of the Prime Minister and Cabinet and will consider changes to risks for the new entity at a future date.

Monitoring of controls

1.53 Entities undertake many types of activities as part of their monitoring of control processes, including external reviews, self-assessment processes, post-implementation reviews and internal audits. The level of review of these activities by the ANAO is determined through a risk assessment approach that takes into consideration the nature, extent and timing of each activity and the activities application to the preparation of the financial statements.

Internal Audit

1.54 As part of the financial statements audit coverage, internal audit is reviewed to gain an understanding of its role and activities in the entity. Where an internal audit function has been established it can play an important role in providing assurance to the accountable authority that the internal control framework is operating effectively. Entities are encouraged to identify opportunities to leverage internal audit coverage as a means of providing increased assurance to accountable authorities to support their opinion on the entity's financial statements.

1.55 The extent to which the work of internal audit may be able to be used, in a constructive and complementary manner, varies between entities and is more likely to occur where internal audit work is focused on financial controls and legislative compliance. The ANAO is expecting to rely upon the work of internal audit for a number of entities.25 When it is anticipated that the work of internal audit will be used, in accordance with ASA 610 Using the Work of Internal Auditors, an assessment is required of whether the internal audit function has: appropriate organisational status; relevant policies and procedures to support their objectivity; an appropriate level of competence; and whether they apply a systematic and disciplined approach in the execution of their work including quality control.

1.56 When it is determined that the work of internal audit can be used to support an effective audit approach, additional work is performed to confirm its adequacy to support the external audit. This will include confirmation that the scope of the work is appropriate, that there is sufficient evidence to support the conclusions drawn and selected re-performance of internal audit's testing.

1.57 For the entities included in this report, it was observed that internal audit coverage is based on an internal audit plan that is aligned with entities' risk management plans and includes combinations of audits that address assurance, compliance, performance improvements and IT systems reviews. In addition, suggested topics from management, audit committees and external influences such as the ANAO's planned performance and financial statement coverage, are factors considered in the development of internal audit work plans.

Reporting relating to compliance with finance law

1.58 The introduction of the PGPA Act resulted in a move from a compliance-based approach to a principle-based financial framework for Commonwealth entities. To promote the safe custody and proper use of public resources whilst reducing red tape, a greater emphasis is placed on the robustness of an entity's self-assessment processes, strong governance structures and internal control frameworks to identify risks. A practical example of this is an entity's requirement to report on compliance with finance law.26

1.59 From 2015–16, the compliance reporting changed to require entities to report only significant non-compliance with finance law to both the Finance Minister and the responsible Minister. Prior to this, general government sector entities were required to submit an annual Certificate of Compliance to the Minister for Finance and the responsible Minister summarising all non-compliance with the PGPA Framework. To support the change in requirements, the Department of Finance issued guidance in relation to reporting of significant non-compliance through the Resource Management Guide 214 Notification of significant non-compliance with the finance law (RMG 214). The guide outlines factors which may be considered when determining whether significant non-compliance occurred including:

- failure to comply with the duties of accountable authorities (PGPA Act sections 15 to 19);

- serious breaches of the general duties of officials (PGPA Act sections 25 to 29) including any fraudulent activity by officials;

- systemic issues reflecting internal control failings or high volume instances of non-compliance; and

- non-compliance issues that are likely to impact on the entity's financial sustainability.

1.60 RMG 214 notes that the accountable authority should consider the entity's environment when determining whether instances of non-compliance are significant. In May 2019, the RMG was updated with additional guidance in the form of case studies. The case studies highlight the need for entities to consider the number of non-compliance issues in the context of the number of times the function had occurred within the entity. For example comparing the number of breaches relating to incorrect reporting of contracts on AusTender compared to the number of contracts executed in that year. As part of the interim audits the ANAO considered entities' application of RMG 214.27

1.61 Entities advised that professional judgement is applied and consideration given, to the nature and volume of breaches when assessing significance.28 Six entities29 provided further guidance within their definition of significant non-compliance, specifying a financial threshold above which non-compliance would be considered significant. The financial thresholds include a percentage of either departmental budget amounts, entity determined materiality thresholds; or a set dollar figure. The dollar range of thresholds varies from $50,000 to $20 million.

1.62 As part of an audit committee's governance role, it usually has oversight of the process for collating instances of non-compliance and the subsequent assessment regarding their significance. Changes to mandatory external compliance reporting process in 2015–16 removed the requirement for all instances of non-compliance to be centrally reported to the Department of Finance. As a consequence, the Department of Foreign Affairs and Trade, the NDIA and Services Australia reduced their level of reporting, requiring only significant non-compliance to be reported to their audit committee and accountable authorities. In addition, as a register of all non-compliance is not maintained, these entities are not able to perform analysis consistent with additional guidance provided in the May 2019 update to RMG 214. While the Australian Office of Financial Management does periodically report all instances of non-compliance to the audit committee, it also does not maintain a register of non-compliance.

1.63 In the absence of a register, capturing all instances of non-compliance, these entities have been excluded from the analysis of non-compliance summarised in Figure 1.3. Similarly as the National Indigenous Australians Agency was established from 1 July 2019 it is also excluded.

1.64 In addition to notifying the relevant Minister of any significant issues which occur, entities must also report any significant non-compliance in their annual reports in line with the PGPA Rule subsection 17AG. The following two entities reported significant non-compliance in their 2018–19 annual reports:

- Department of Veterans' Affairs reported one significant non-compliance30 relating to departmental transactions totalling $4.1 million found to be incorrectly recorded as administered items. They were subsequently transferred to departmental operations.

- Department of Defence reported 53 instances of significant non-compliance.31 Where these instances were proven as fraud committed by an official, Defence authorities addressed these instances through criminal or disciplinary prosecution action.

1.65 Entities undertake a range of activities to identify instances of non-compliance and support their assessment of whether identified breaches meet the definition of significant. These activities include self-reporting, internal assurance activities, and questionnaires completed by officers holding delegations. Through these processes, in 2018–19 entities included in this report identified a total of 4,203 instances of non-compliance.32 Two entities reported no non-compliance33, three entities account for more than 10 per cent of the total breaches34 and the remaining 13 entities each reported between one and nine per cent of the non-compliance. Figure 1.3 provides the ANAO analysis of instances of non-compliance by category as identified by entities in 2018–19.

Figure 1.3: Reported incidences of non-compliance 2018–19

Source: ANAO analysis of data provided by entities.

1.66 Further details of the areas of non-compliance depicted in Figure 1.3 are detailed below.

- The following three entities identified the highest number of instances of non-compliance with the Commonwealth Procurement Rules: Department of Home Affairs (775 instances); Department of the Prime Minister and Cabinet (302 instances); and Department of Veterans' Affairs (237 instances). Of the non-compliance with Commonwealth Procurement Rules, 61 per cent of breaches related to rule 7.16, which requires entities to report contracts entered into or amended over $10,000 on AusTender within 42 days.

- Breaches of section 23 of the PGPA Act include failure to obtain appropriate delegate approval prior to entering into contracts and exceeding a delegate's approval. The following three entities identified the highest number of instances of non-compliance in this area; Department of Defence (450 instances); Department of the Treasury (123 instances); and Department of Agriculture, Water and the Environment (86 instances).

- Non-compliance with the Commonwealth Grant Rules and Guidelines predominately resulted from entities not meeting the requirement to publish grants on GrantConnect35 within 21 days.

- Forty-one per cent of instances of non-compliance with the PGPA Act, excluding section 23, related to breaches of governing in a way that is not inconsistent with the policies of the Australian Government under section 21, specifically section 83 of the Australian Constitution where by no money shall be drawn from the Treasury of the Commonwealth except under appropriation made by law.

- The non-compliance with the PGPA Rule relates to failure to document the approvals to enter into arrangements under section 23 of the PGPA Act and banking monies within five days from receipt.

1.67 The additional guidance provided within the RMG 214 indicates that consideration should be given to the number of breaches in light of the entity's environment. The collation and reporting of non-compliance allows audit committees and accountable authorities to assess emerging risks and determine training requirements or changes to procedures required to address trends. Through its interim reports to Parliament, the ANAO has undertaken a detailed analysis of reporting of non-compliance, over the last three financial years, and observed both divergent practices between entities in identifying and assessing the significance of non-compliance, and a reduction in detailed reporting provided to audit committees and accountable authorities.

Gifts and Benefits

1.68 Auditor-General Report No. 47 2017–18: Interim Report on Key Financial Controls of Major Entities, provided analysis of the gifts and benefits policies of those entities included in the report. The report concluded that there would be merit in the development of a whole-of-government gifts and benefits policy approach across Commonwealth entities.36

1.69 In accordance with the Public Governance, Performance and Accountability Act 2013 and the Australian Public Service (APS) Code of Conduct, on 18 October 2019 the Australian Public Service Commissioner (the Commissioner) announced new guidance for reporting of gifts and benefits. The policy sets out a number of requirements for agency heads (including departmental secretaries)37 and provides guidance on areas of better practice.

1.70 The Commissioner stated that agency heads must:

- not accept gifts and benefits which might reasonably be seen to compromise their integrity (paragraph 26);

- create and keep a register of gifts and benefits accepted (paragraph 15);

- update the register of all gifts and benefits accepted with a value of more than AUD$100.00 (excluding GST), within 28 days of receiving the gift or benefit (paragraph 16);

- publish on their agency's website the register of gifts and benefits accepted where the value of the gift or benefit exceeds AUD$100.00 (excluding GST) on a quarterly basis (paragraph 17); and

- publish the first register by 31 January 2020, the second register by 31 March 2020 and quarterly thereafter. (paragraphs 12 and 13).38

1.71 The ANAO has reviewed the implementation of the policy across entities included in this report.39 Table 1.1 below provides a snapshot of the recommendations that have been implemented.

Table 1.1: Implementation of public reporting of gifts and benefits received by agency heads

|

APSC Guidance Recommendations |

Implemented |

Not implemented |

|

Establish a gifts and benefits register |

24 |

0 |

|

Record all gifts and benefits received by the agency head over $100 |

23 |

1a |

|

Publish all gifts and benefits received by agency heads valued at or more than $100 on the entity's website as at 31 January 2020. |

20 |

4 |

|

Publish all gifts and benefits received by agency heads valued at or more than $100 on the entity's website as at 31 March 2020. |

19 |

5 |

Note a: NBN Co as a Commonwealth company is strongly encouraged though not required to comply with the policy released by the Commissioner. NBN Co has not published a gifts and benefits register for the agency head and has set a minimum reporting threshold of $200.

Source: ANAO analysis.

1.72 As outlined in Table 1.1 four entities40 had not published any registers for their agency heads or equivalent by the 31 January 2020 deadline. As at 30 April 2020 the Australian Office of Financial Management and NBN Co had not published any gifts and benefits received by agency heads on their websites. The NBN Co as a corporate Commonwealth company is strongly encouraged, though not required to comply with the requirements issued by the Commissioner. The Department of Veterans' Affairs advised that it published the register on its website on 17 February 2020. The Future Fund Management Agency and the Board of Guardians has published a gifts and benefits register for the quarter ended 31 March 2020.

1.73 The ANAO has been advised that the Commissioner acknowledged in an email to portfolio secretaries on 20 March 2020, that reporting of gifts and benefits for the March 2020 quarter deadline may not be feasible given the COVID-19 pandemic. Publication was however encouraged and as indicated in Table 1.1 above, 19 entities had published this information by 30 April 2020.

1.74 To increase transparency and consistency across the Government and as a matter of best practice the Commissioner stated that:

- Departmental Secretaries should circulate the guidance to all statutory office holders and heads of Commonwealth entities and companies within their portfolios;

- Commonwealth statutory office holders and heads of Commonwealth entities and companies are strongly encouraged to adopt this guidance and mirror these arrangements; and

- there is strong expectation that registers including gifts and benefits received by all staff valued over $100 are published on the entity's website.

1.75 The Departmental Secretaries for 1141 of the 14 portfolio departments confirmed they had circulated guidance to entities within their portfolio.

1.76 In line with best practice, 16 entities included gifts and benefits received by all staff in the register published on entity websites applying the $100 reporting threshold. The Departments of: Agriculture, Water and the Environment and Parliamentary Services publish gifts and benefits received by the agency head only. The Department of Foreign Affairs and Trade, the Department of Veterans' Affairs; and the Future Fund Management Agency and the Board of Guardians have extended the disclosures to include staff in key management positions. The Reserve Bank of Australia publishes gifts and benefits received by the Governor and Deputy Governor.

1.77 As noted in paragraph 1.72, the Australian Office of Financial Management and NBN Co have not published a gifts and benefits register on their websites, however, both entities maintain internal registers to record the gifts and benefits received by all staff. The Australian Office of Financial Management requires staff to report all gifts and benefits received and NBN Co requires staff to report gifts and benefits received over a threshold of $200.

1.78 An important element of a gifts and benefits policy is that it provides a process for monitoring and managing the gifts and benefits offered and/or accepted by officers within the entity. The maintenance of a register enables an assessment of the effectiveness of implementation of an entity's policies; the types and frequency of gifts and benefits received by an entity; and the identification of potential conflict of interest risks. Best practice would include the public disclosure of gifts and benefits received by all staff.

Safeguarding financial information from cyber threats

1.79 The Protective Security Policy Framework (PSPF) requires non-corporate Commonwealth entities to consider and implement the Australian Signal Directorate's (ASD) Essential Eight mitigation strategies (Essential Eight).42 The initial requirements were defined in 2013 and are now specified in PSPF Policy 10, "Safeguarding information from cyber threats" (Policy 10).43 The Essential Eight is considered the baseline for cyber resilience within the Australian Government and provides advice on measures that entities can implement to mitigate cyber threats.44

1.80 Policy 10 requires each entity to:

- implement the following Australian Signals Directorate (ASD) Strategies to Mitigate Cyber Security Incidents (Top Four):

- consider which of the remaining Top Four Strategies need to be implemented to protect the entity.48

1.81 The PSPF and Essential Eight have defined maturity levels to help entities determine the maturity of their implementation of Policy 10 and Essential Eight requirements, respectively. Policy 10 states entities must achieve the maturity level 'Managing', which is equivalent to the Essential Eight 'Maturity Level Three'. The PSPF requires non-corporate Commonwealth entities to annually assess and report their performance against the PSPF information security requirements.

1.82 Since 2013, the ANAO has conducted a series of performance audits focused on assessing the progress of implementation against Policy 10 requirements. These performance audits continued to identify low levels of compliance with mandatory Policy 10 requirements and concerns relating to the accuracy of annual self-assessments. There was no evidence that the regulatory framework had driven sufficient improvement in entities mitigating their cyber security risks since 2013.

1.83 The Australian Cyber Security Centre (ACSC) was provided funding through the 'Cyber Uplift' budget measure, to strengthen the cyber security of Australian Government networks through enhanced technical guidance, improved verification, and increased transparency and accountability. The Cyber Uplift included a 'sprint' program which was focused on assessing and baselining the maturity of 25 Commonwealth entities' implementation of the Essential Eight. The sprint program also resulted in ACSC identifying additional measures for entities to strengthen their cyber security posture as a result of the program.

1.84 In 2019–20, the ANAO performed a review of the Policy 10 annual self-assessment as part of its assurance audit program of financial statements. This review focused on the protection of information relevant to the preparation of financial statements, specifically the Financial Management Information System (FMIS) and Human Resource Management Information System (HRMIS). The review was performed on 18 of the 2049 government entities included in this report, which are required to report annually against the Policy 10 requirements.50 The review was undertaken to confirm the accuracy of reporting and identify cyber security risks that may impact on the preparation of financial statements. The review consisted of analysis of policy and procedural documentation, testing of mitigation strategies specific to the FMIS and HRMIS, results of sprint assessments and interviews with entity personnel. Similarly to previous performance audits of non-corporate Commonwealth entities, the ANAO found maturity levels for most entities were significantly below the Policy 10 requirements. Of the 18 entities assessed, only one was rated as achieving a Managing maturity level across all eight controls. This is illustrated in Figure 1.4 below.

Figure 1.4: Compliance with the PSPF Policy 10 Requirements

Source: ANAO data.

1.85 The lowest levels of compliance were reported in the 'Application Hardening and Macro controls' and 'Multi-Factor Authentication' controls.

1.86 Achieving a Managing level for Application Hardening51 was viewed by entities to be difficult due to the number of applications in the entities' systems and the difficulty in identifying all applicable hardening controls. Entities have implementation plans focused on reducing the number of applications in their environments, with an aim to lowering their attack surface and minimising risk. Implementation of these plans is currently being actioned by the majority of entities, with most plans scheduled for completion by July 2020.

1.87 Restricting macros52 was reported to be difficult due to users relying heavily on macros to perform business activities. Entities differed in their maturity of addressing the associated risks, with some working with users to restrict macros in their environments and securely authorising business critical macros, while other entities accepted the risk of macros and relied on additional mitigations for protection.

1.88 For Multi-Factor Authentication53 to be assessed at the Managing maturity level, multi-factor authentication needed to be used to authenticate all users when accessing important data. Entities found the process of organising/distributing multi-factor authentication tokens for all users to be an onerous one, and most have accepted the risk and focused on achieving the Developing maturity level. Entities prioritised multi-factor controls for remote access and privileged users, rather than all users.

1.89 Most entities conducted their self-assessment at a system or environment level, and did not specifically assess the controls required to minimise cyber risks to their FMIS or HRMIS applications. The entities prioritised the protection of the environment which hosts the FMIS and HRMIS applications.

1.90 Four entities were found to be incorrect in their self-assessments. The entities attributed the inaccuracies in their assessments to their interpretation of the scope of the requirement and indicated that they found it challenging to determine whether they had met the intention of the mitigation strategies.

1.91 In a report to Parliament on April 201954, ACSC noted that "While all of the Commonwealth entities assessed through the Cyber Uplift sprints were found to be taking positive and proactive steps to improve their cyber security, the ACSC assessed that they had not yet achieved the recommended maturity level for the Essential Eight. As a result, these entities are vulnerable to current cyber threats targeting the Australian Government". This aligns with the observations of the ANAO, which identified significant progress was still required for entities to meet the required Policy 10 maturity level of Managing.

1.92 ANAO found that 76 per cent of controls were at an Ad-hoc or Developing maturity level. This is in line with ACSC findings, which noted '73 per cent of non-corporate Commonwealth entities reporting ad hoc or developing levels of maturity'.55 The majority of the entities reviewed are not meeting the required Policy 10 maturity level. The regulatory framework and self-assessments to date have not driven the achievement of the standard of cyber security required by Government policy.

1.93 The Policy 10 requirements, that non-corporate Commonwealth entities implement the Australian Signals Directorate (ASD) Mandatory Strategies to Mitigate Cyber Security Incidents (Top Four), have been in place since 2013. Entities' inability to meet these requirements indicates a weakness in implementing and maintaining strong security controls over time.

1.94 Previous audits of cyber security by the ANAO to assess the progress of implementation against Policy 10 requirements have not found an improvement in the level of compliance with the controls over time. The work undertaken as part of this review indicates that this pattern continues, with limited improvements.

1.95 The response to the COVID-19 pandemic has required the majority of entities to adapt IT systems to support remote working arrangements for their workforces. This change in business and control environment has brought additional security risk, with ACSC noting in its April 2020 Threat Report that 'Cybercrime actors are pivoting their online criminal methods to take advantage of the COVID-19 pandemic'.56 Threats noted by ACSC include COVID-19 themed phishing attacks57, exploitation of remote access weaknesses, as well as an increase in fraud based attacks.58

1.96 ACSC has released guidance on preparing for COVID-19 threats59, including reviewing business continuity plans and procedures, implementation of multi-factor authentication, hardening of systems60 and restriction of macros to reduce the impact of any phishing based attacks. Strong security controls introduced by entities would minimise the risks emerging due to COVID-19 and remote working practices.

1.97 While entities' compliance with Essential Eight remains low, there continues to be the risk of compromise to information relevant to the preparation of financial statements.

Interim audit results

1.98 Audit findings are raised in response to the identification of a potential business or financial risk posed to an entity. Often these risks arise from deficiencies within an entity's internal control processes or frameworks. Weaknesses in internal controls increase the possibility that a material misstatement of an entity's financial statements will not be prevented or detected in a timely manner. The ANAO rates audit findings according to the potential business or financial management risk posed to the entity. The rating scale is presented in Table 1.2.

Table 1.2: Findings rating scale

|

Rating |

Description |

|

Significant (A) |

Issues that pose a significant business or financial management risk to the entity. These include issues that could result in a material misstatement of the entity's financial statements. |

|

Moderate (B) |

Issues that pose a moderate business or financial management risk to the entity. These may include prior year issues that have not been satisfactorily addressed. |

|

Minor (C) |

Issues that pose a low business or financial management risk to the entity. These may include accounting issues that, if not addressed, could pose a moderate risk in the future. |

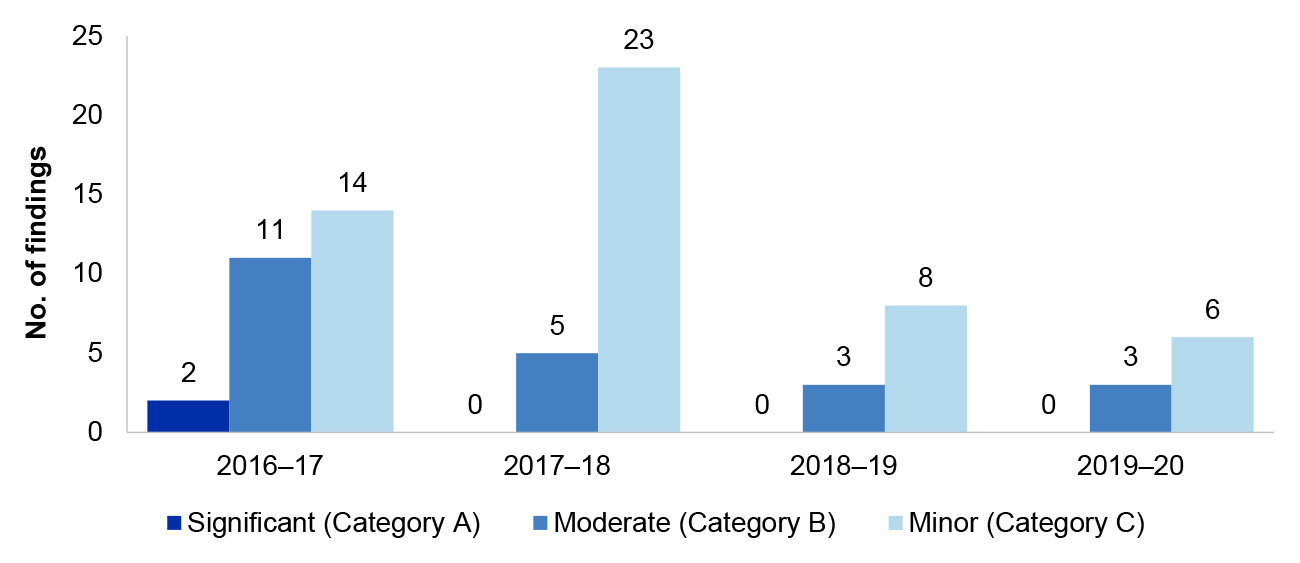

1.99 A summary of all significant, moderate and minor audit findings reported at the conclusion of the interim audit phase across the past four financial years is presented in Figure 1.5: below.

Figure 1.5: Trend in aggregate interim audit findings 2016–17 to 2019–20

Source: ANAO data.

1.100 The findings have been classified into broad categories as follows:

- IT control environment;

- compliance and quality assurance frameworks;

- accounting and control of non-financial assets;

- revenue, receivables and cash management processes;

- human resources financial processes; and

- purchases and payables management.

Table 1.3: Audit findings by category for the 2019–20 interim period

|

Category |

Significant |

Moderate |

Minor |

Main areas of weakness |

|

IT control environment |

– |

4 |

32 |

|

|

Compliance and quality assurance frameworks |

– |

3 |

6 |

|

|

Accounting and control of non-financial assets |

– |

1 |

3 |

|

|

Revenue, receivables and cash management |

– |

– |

1 |

|

|

Human resources financial processes |

– |

– |

9 |

|

|

Purchases and payables management |

– |

– |

6 |

|

|

Other audit findings |

– |

– |

7 |

|

|

Total |

– |

8 |

64 |

72 |

Source: Compilation of ANAO interim audit findings.

1.101 In addition, to the findings reported in Table 1.3 one new legislative breach was reported during 2019–20. The legislative breach reported that the Department of Education, Skills and Employment made GST payments to non-government schools without the authority of the Australian Education Act 2013. For further details please refer to chapter 4, paragraphs 4.5.24–4.5.27.

Information Technology Control Environment

1.102 The review of information systems and related controls is an integral part of an entity's control environment. This section summarises the results from interim tests of the operating effectiveness of IT general controls for each of the entities included in this report. It should be noted that the majority of this testing was performed in the period September 2019 — February 2020, and does not reflect any changes in the risk and control environment arising from the impact of COVID-19. This will be addressed in the final testing of information systems controls scheduled to be performed in June and July 2020.

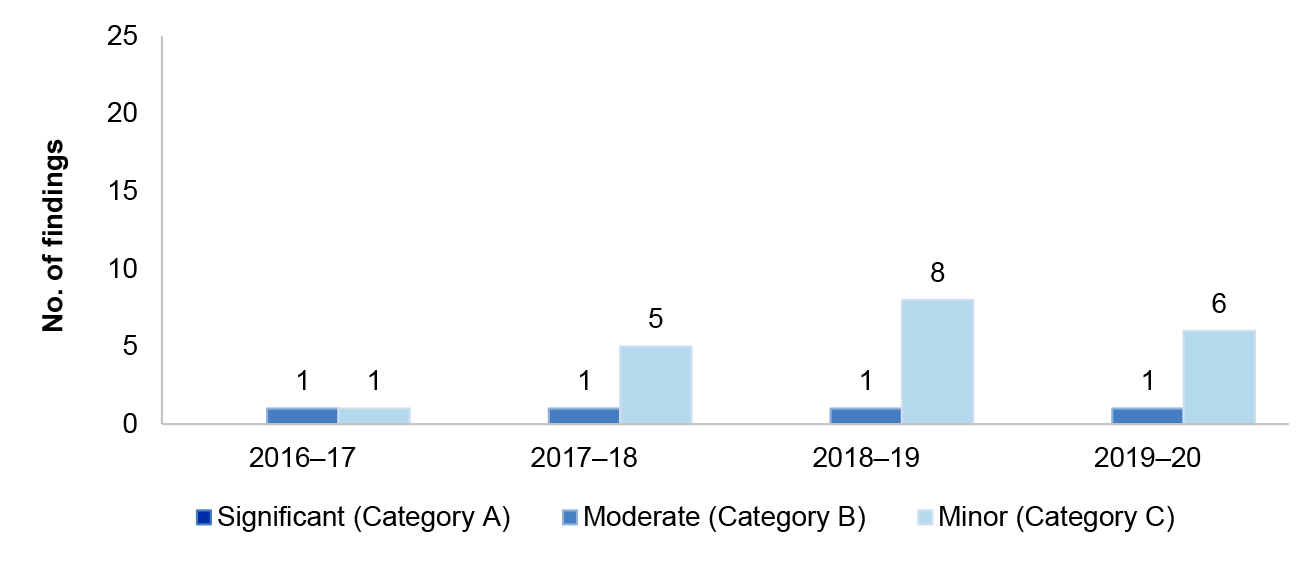

1.103 Figure 1.6 show the trends in interim audit findings related to entities' overall IT control environments from 2016–17 to 2019–20. At the time of this report, testing of the operating effectiveness of IT controls had not been completed for four entities61 and therefore those results are not reflected in this summary.

Figure 1.6: IT control environment interim audit findings 2016–17 to 2019–20

Source: ANAO data.

1.104 Findings related to entities' IT control environments represent 50 per cent of total findings identified during the 2019–20 interim period. IT control environment findings continue to represent the highest proportion of all findings. One new moderate finding was reported in 2019–20, which is a decrease of six from the previous year. Further detail regarding the new finding is detailed in chapter 4 for Services Australia. Three moderate findings were carried over from the previous year.62 While there has been a decline in the number of moderate findings reported this year, and in the number of findings overall, the need to focus on processes to monitor IT controls to prevent reoccurrence of issues continues to be of importance. This was a recommendation by the Joint Committee of Public Accounts and Audit (JCPAA).63

1.105 The information systems control environment findings reported at the conclusion of the 2019–20 interim audits for entities included in this report have been grouped as follows:

- IT security;

- IT change management; and

- disaster recovery arrangements.

IT Security

1.106 IT security is concerned with protecting an entity's information assets from internal and external threats. It includes controls to prevent or detect unauthorised access to systems, programs and data. In the context of the financial statements audit, the focus is on the financially significant systems and data only.

1.107 The key controls areas that address risks relating to IT security and that are assessed as part of the interim audit are:

- IT security governance;

- general and privileged user access; and

- monitoring and reporting.

1.108 Figure 1.7 illustrates the trends in findings observed in entities' IT security arrangements between 2016–17 and 2019–20.

Figure 1.7: IT security interim audit findings 2016–17 to 2019–20

Note: The comparative numbers in this figure have been updated to include findings previously categorised as IT application controls which related to IT security.

Source: ANAO data.

1.109 The IT security findings represent 77 per cent of all IT related findings reported in 2019–20. Three moderate findings were reported in the current year (2018–19: six). Further details of the moderate findings are detailed in chapter 4.64 Findings related to:

- logging and monitoring of privileged user activity;

- user access management, including approving new user access and performing regular user access reviews;

- removal of user access when it is no longer required;

- password configuration; and

- the overall governance and assurance framework to support the above activities.

1.110 Users with administrative access privileges, commonly referred to as privileged users, are able to make significant changes to IT systems' configuration and operation, bypass critical security settings and access sensitive information. As part of reviewing IT security arrangements, different groups of privileged users were examined, including:

- application administrators, sometimes referred to as super users;

- database administrators;

- system administrators; and

- network or domain administrators.

1.111 To reduce the risks associated with this access, the Australian Government Information Security Manual (ISM) recommends that privileged user access be appropriately restricted and when provided, that the access is logged, regularly reviewed and monitored. Two moderate65 and seven minor findings relate to entities that have not implemented adequate logging and monitoring procedures over privileged user accounts. The risk of inappropriate changes to financially significant systems and data arising from these findings is partially mitigated through alternate controls.

1.112 All users with access to financial systems may have the ability to change financial information, and therefore access should only be granted where it is required for the performance of the role; and should be reviewed whenever the role changes. One moderate and three minor findings in paragraph 1.111 also identified issues with user access management, and there were a further six minor findings in this area.

1.113 Entities must remove or suspend user access on the same day a user no longer has a legitimate business requirement for its use.66 Terminating a user account when the user no longer has a requirement to access it, such as upon departure from an entity, can prevent unauthorised use. Two minor findings in paragraph 1.111 and one minor finding in user access management also related to issues where access was not removed on a timely basis, and there were a further nine minor findings in this area.

1.114 Two minor findings relate to inadequate password controls increasing the likelihood of unauthorised access to systems and data. The ISM provides guidance on the password requirements for Australian Government systems.

1.115 One moderate and one minor finding relates to the governance and monitoring processes that support the overall information security framework. For further details on the moderate finding, refer to the detailed results in chapter 4 for Services Australia.