Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Interim Phase of the Audits of the Financial Statements of Major General Government Sector Entities for the year ending 30 June 2015

Please direct enquiries relating to reports through our contact page.

This report outlines the ANAO’s assessment of the internal controls of major entities, including governance arrangements, information systems and control procedures. The findings summarised in this report are the results of the interim phase of the financial statement audits of 23 major General Government Sector entities that represent some 95 per cent of total General Government Sector revenues and expenses.

Summary

Introduction

1. The Auditor-General Act 1997 establishes the mandate for the Auditor-General to undertake financial statement audits of all Australian Government entities including those of non-corporate Commonwealth entities, corporate Commonwealth entities and Commonwealth companies.

2. The preparation of audited financial statements in compliance with the Australian Accounting Standards and other requirements prescribed by the Public Governance, Performance and Accountability (Financial Reporting) Rule 20151 is a key element of the financial management, governance and accountability regime applicable to Australian Government entities. It is generally accepted in both the private and public sectors that a good indicator of the effectiveness of an entity’s financial management is the timely finalisation of its annual financial statements, accompanied by an unmodified audit opinion. Australian Government entities, in cooperation with the Australian National Audit Office (ANAO), devote considerable effort to achieving such an outcome.

3. Financial statement audits are an independent examination of entities’ financial statements and the results of the examination are presented in an auditor’s report. This report expresses the auditor’s opinion on whether the financial statements as a whole, and the information contained therein, fairly present each entity’s financial position and the results of its operations and cash flows. The accounting treatments and disclosures reflected in the financial statements by the entity are assessed against relevant accounting standards and legislative reporting requirements.

4. Under section 43 of the Public Governance, Performance and Accountability Act 2013 (PGPA Act), the Auditor-General is required to report each year to the relevant Minister on whether the financial statements of entities2 comply with the accounting standards and any other requirements prescribed by the FRR, and present fairly the entity’s financial position, financial performance and cash flows.

5. To assist entities to manage their responsibilities, the ANAO periodically publishes better practice guides on a range of aspects of public administration. In 2014–15, the ANAO has published three Better Practice Guides: Successful Implementation of Policy Initiatives; Public Sector Audit Committees: Independent assurance and advice for Accountable Authorities; and Public Sector Financial Statements: High-quality reporting through good governance and processes. Better Practice Guides are well received by entities and contribute to entities maintaining the maturity of their internal control systems and enhancing their performance.

6. The interim phase of the audit of entities, the focus of this report, encompasses a review of governance arrangements related to entities’ financial reporting responsibilities, and an examination of relevant internal controls, including information technology system controls. The ANAO’s examination of these areas is designed to assess the reliance that can be placed on entities’ internal controls to produce complete and accurate information for financial reporting purposes.

7. The audit findings in this report have been reported to the management of each entity and to the responsible Minister(s).

Developments in financial reporting and auditing frameworks

8. The most significant change to Australian Accounting Standards applicable to reporting periods commencing on or after 1 January 2015 is the new standard AASB 1055 Budgetary Reporting. AASB 1055 requires Commonwealth entities to compare their financial results to the original budgets as presented to the Parliament, and to explain major variances in their financial statements.

9. Other changes, that will take effect from 2016–17, include extending related party disclosures currently applicable to the private sector to not-for-profit public sector entities, and improving the quality of disclosures by clarifying entities are only required to disclose information relevant to users of their financial statements. The ANAO Better Practice Guide Public Sector Financial Statements, published in March 2015, includes a discussion and associated examples designed to assist entities improve the presentation of financial statements by omitting information that is not relevant or useful to users.

10. A proposed change to the Australian Auditing Standards is the introduction of ASA 701 Communicating Key Audit Matters in the Independent Auditor’s Report. This standard will apply to audits of the financial statements of listed entities and also to circumstances when the auditor otherwise decides or is required by law to communicate key audit mattes in the auditor’s report. The standard proposes to enhance the value of the auditor’s report by providing greater transparency and assisting users to understand the entity and areas of significant management judgement in the financial statements. This change is proposed to apply for reporting periods ending on or after 15 December 2016 and the ANAO will give consideration to applying the standard to the audits of the more significant Australian Government entities.

Summary of audit results

Internal control in entities3

11. A central element of the ANAO’s financial statement audit methodology, and the focus of the interim phase of ANAO audits, is a sound understanding of an entity’s responsibilities and internal controls. This understanding informs our audit approach, including the reliance we may place on entity systems to produce financial statements that are free from material misstatement. To do this, the ANAO uses the framework contained in the ASA 315 Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and its Environment. The key elements of internal control, as discussed in ASA 315, are the control environment; the risk assessment process; the information system, including the related business processes relevant to financial reporting and communication; control activities; and monitoring of controls.

Control environment

12. The ANAO assesses whether an entity’s control environment includes measures that contribute positively to sound corporate governance in the context of the preparation of an entity’s financial statements. These measures should be designed to mitigate identified risks of material misstatement in the financial statements, and reflect the specific governance requirements of each entity.

13. The ANAO observed that entities have in place mature financial control environments designed to provide a sound basis for the effective preparation of the entity’s financial statements. Audit committees, in particular, continue to have a positive influence on the effectiveness of entities’ control environments particularly in the areas of risk assessment, legislative compliance and financial system controls.

Risk assessment process

14. An understanding of an entity’s risk assessment processes is an essential element of the ANAO’s financial statement audits. Entities are expected to manage the key risks specific to their environment and the interim audit phase includes a review of controls relating to risks that may have a material impact on entities’ financial statements. Generally, the ANAO found that entities have established formal risk assessment processes, reviewed by audit committees or a separate committee with specific responsibilities for risk.

15. An important element of the risk assessment process common to all entities is fraud control management. All major entities have fraud control plans and have formal processes for updating, reviewing and monitoring these plans.

Information system

16. Information technology facilitates the way in which Australian Government entities operate, and supports the business processes that deliver services to the Australian community.

17. Consistent with past practice, during the 2014–15 interim audits, the ANAO assessed the design and operation of key IT controls to determine the effectiveness of these controls and their impact on reducing risks affecting the integrity of financial information presented in entities’ financial statements.

18. The majority of IT controls continued to be well maintained by most entities during 2014–15. This includes IT controls in relation to change management, IT security governance and monitoring and financial management information system and human resources management information master file maintenance. There has, however, been an increase in the number of entities where improvements were warranted in the management of privileged and other user access to key financial business systems. While business continuity and disaster recovery plans were also generally well designed and testing of these arrangements had been undertaken, changes in organisational and system arrangements that are occurring in the Australian Public Sector will require entities to be alert to the need to review, and as necessary revise, these plans.

Control activities

19. The results of the 2014–15 interim audit phase indicated that, overall, control activities relating to financial and accounting processes have continued to be maintained at an effective level, and there has been a small decrease in the total number of audit findings compared with 2013–14.

20. A total of 129 category A, B, C and L1 findings4 were identified in the 2014–15 interim audit phase, with the majority of these findings posing a low business or financial management risk, a small decrease compared with the 135 findings identified in 2013–14. Within this total number of findings, there was also a decrease in the combined number of significant and moderate findings discussed further at the entity level in chapter 5 of this report. Common control issues identified by the audits related to areas such as IT general and application controls, the management of non-financial assets and the effectiveness of quality assurance and compliance processes.

21. The ANAO continues to include an assessment of compliance in relation to annual appropriations, special appropriations, special accounts and the investment of public moneys in its financial statement audits, as a result of interest shown by the Joint Committee of Public Accounts and Audit in past years. The 2014–15 interim audits continued to identify a high level of compliance in these areas, although actual or potential breaches of section 83 of the Constitution5 continue to be identified by a number of entities. At the time of the 2014–15 interim audits, risk assessments by a number of entities in relation to potential section 83 breaches were in progress. This matter is discussed at paragraphs 3.17 to 3.30 of chapter 3 of this report.

Monitoring of controls

22. Entities’ arrangements for the monitoring of controls include quality assurance arrangements, internal and external reviews, control self-assessment processes, and internal audit. In particular, all entities have in place arrangements to enable Accountable Authorities to provide an annual Compliance Report6.

Entity audit findings

23. Entity control regimes overall continue to be stable and well maintained and entities have generally addressed prior year audit findings in a timely manner. The Machinery of Government changes that took place in December 2014 have required some entities to review their governance and operating arrangements, in addition to the continuing effects of the September 2013 Machinery of Government changes, resulting in some delays in the completion of planned audit coverage as part of the 2014–15 interim audit phase. A sustained effort will be required by the entities concerned and the ANAO to ensure that the 2014–15 financial statements are prepared and audited in a timely manner.

24. However, as noted above, audits continue to identify control weaknesses in a number of areas such as IT general and application controls, particularly the management of privileged and other user access to key financial business systems; non-financial assets management, including the timely capitalisation of assets to enable the accurate calculation of depreciation, the maintenance of complete and accurate asset registers and the appropriateness of impairment assessments; and the effectiveness of quality assurance and compliance processes.

25. Generally, entities have been positive and timely in their response to ANAO audit findings.

26. The following summary outlines the trend in category A, B and L1 audit findings between 2013–14 and 2014–15 reported at the completion of the interim audit phase. There were:

- two category A findings reported for two entities in 2014–15, an increase on nil reported during 2013–14;

- twenty category B audit findings across 12 entities in 2014–15. This is a decrease from 26 findings reported in 2013–14. Five entities decreased their number of category B audit findings; four showed an increase; six remained constant; and eight entities had no category B findings in either 2013–14 or 2014–15; and

- twelve category L1 findings reported in 2014–15 compared to 15 in 2013–14.

27. A summary of category A, B and L1 audit findings by entity is provided in table 5.1 in chapter 5 of this report.

Future audit coverage

28. In completing the audits of entities’ 2014–15 financial statements, the ANAO will complete its assessment of the effectiveness of internal controls and areas of audit focus in each entity. The summary results of this work is expected to be reported by the ANAO in December 2015.

1. Introduction

This chapter provides background to the audits of the financial statements of Australian Government entities and sets out the structure of this report that covers 23 major General Government Sector entities.

Background

1.1 In addition to undertaking financial statement audits of individual entities, the ANAO tables two reports annually that summarise the findings of the financial statement audits of public sector entities. These reports also discuss contemporary issues and practices affecting public sector entities’ financial reporting responsibilities and the ANAO’s responsibilities. This report outlines the ANAO’s assessment of the internal controls of major entities, including governance arrangements, information systems and control procedures. The findings summarised in this report are the results of the interim phase7 of the financial statement audits of 23 major General Government Sector8 (GGS) entities that represent some 95 per cent of total GGS revenues and expenses.

1.2 In reporting on the results of the interim phase of the financial statement audit program, the ANAO is providing assurance to the Parliament that the systems, controls and processes that are in place in major Australian Government entities are operating in a way that allows entities to prepare financial statements that present fairly their financial position, performance and cash flows at financial year end.

1.3 The audit coverage undertaken forms an integral part of the ANAO’s audit of the 2014–15 financial statements of these entities. This report includes reference to issues that pose a significant or moderate business or financial risk to the entity and other issues requiring attention by entity management.

1.4 At the individual entity level, a report on the results of the audit is provided to each entity chief executive and audit committee. Audit activity can act as a catalyst for improvement and provide a stimulus to entity management for the resolution of issues, where this is warranted.

1.5 The preparation of financial statements in compliance with the Australian Accounting Standards and other requirements prescribed by the Public Governance, Performance and Accountability (Financial Reporting) Rule 20159 is a key element of the financial management and accountability regime applicable to Australian Government entities. It is generally accepted in both the private and public sectors that a good indicator of the effectiveness of an entity’s financial management is the timely finalisation of its annual financial statements, accompanied by an unmodified audit opinion. Australian Government entities, in cooperation with the ANAO, devote considerable effort to achieving timeliness in financial reporting.

Report structure

1.6 The report is organised as follows:

- Chapter 2 discusses a number of recent developments in accounting and auditing requirements and, in doing so, provides an overview of changes impacting the Australian Government’s reporting and accountability frameworks.

- Chapter 3 provides summary observations relating to various elements of entities’ internal controls (including the control environment, the risk assessment process, the information system, control activities and monitoring of controls). This chapter also includes a discussion of audit findings over the period 2011–12 to 2014–15.

- Chapter 4 outlines findings relating to the audit of Information Technology (IT) systems, focusing on the IT control environment, IT security and application controls in financial management and human resource management information systems. There is also a discussion of business continuity and disaster recovery arrangements.

- Chapter 5 outlines, for each entity covered by this report, details of business operations that influence financial statement audit coverage; governance arrangements relevant to the entity’s financial statements; areas of audit focus; and any significant and moderate audit issues identified during the 2014–15 interim audit phase. The chapter is structured in accordance with the portfolio arrangements established by the Administrative Arrangements Order (AAO) of 23 December 2014.

Acknowledgements

1.7 Based on the work completed during the interim audit phase, the ANAO is well placed to complete the audit program following the preparation by entities of their financial statements after the close of the 2014–15 financial year. This is due to the commitment and application of the staff of the ANAO. The contribution and cooperation of Chief Finance Officers, other entity staff, and the key role undertaken by audit committee members is also greatly appreciated.

2. Financial Reporting and Auditing Frameworks

This chapter provides commentary on recent developments in the financial reporting and auditing frameworks relevant to the Australian Government and its reporting entities.

Introduction

2.1 The Australian Government’s financial reporting and auditing frameworks are based, in large part, on standards made independently by the Australian Accounting Standards Board (AASB) and the Australian Auditing and Assurance Standards Board (AUASB). These frameworks are designed to support decision‐making by, and accountability to, the Parliament. The financial reporting and auditing frameworks that applied in 2014–15 are illustrated in appendices 2 and 3 of this report.

2.2 The AASB bases its accounting standards on the International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB). Because IFRS are designed primarily for use by for‐profit organisations, the AASB amends the IFRS to reflect significant transactions and events that are particularly prevalent in the public and not‐for‐profit private sectors. In doing so, it takes into account standards issued by the International Public Sector Accounting Standards Board. The Finance Minister prescribes additional financial reporting requirements for Australian Government entities; from 2014–15 these are contained in the Public Governance, Performance and Accountability (Financial Reporting) Rule 2015 (FRR). This rule is made under the Public Governance, Performance and Accountability Act 2013 (PGPA Act) which came into full effect on 1 July 2104. This Act sets out the responsibilities of Commonwealth entities and Commonwealth companies to prepare annual financial statements and the requirements for the audit of the financial statements by the Auditor-General. The Act also requires the Finance Minister to prepare annual consolidated financial statements and for these to be audited by the Auditor-General.

2.3 The most significant change to Australian Accounting Standards effective from 2014–15 is the new standard AASB 1055 Budgetary Reporting. Other changes, that will take effect from 2016–17, include related party disclosures by not-for-profit public sector entities and measures to improve the quality of disclosures.

2.4 Major developments in accounting standards internationally continue to be a significant driver of changes to Australian Accounting Standards. At the international level, a new standard on the accounting for leases is expected to be released later in 2015.

2.5 The audits of the financial statements of Australian Government entities are conducted in accordance with ANAO Auditing Standards, which are made by the Auditor-General under section 24 of the Auditor-General Act 1997. The ANAO Auditing Standards incorporate, by reference, the auditing standards made by the AUASB. The AUASB bases its standards on those made by the International Auditing and Assurance Standards Board (IAASB), an independent standard setting board of the International Federation of Accountants.

Recent changes to the Australian public sector reporting framework

Budgetary Reporting

2.6 The Australian Government prepares its financial statements under AASB 1049 Whole of Government and General Government Sector Financial Reporting. AASB 1049 requires governments to compare their financial results to the original budgets as presented to the Parliament, and to explain major variances.

2.7 In March 2013, the AASB issued AASB 1055 Budgetary Reporting, extending the budget reporting requirements to all not-for-profit entities in the General Government Sector. This standard applies to reporting periods beginning on or after 1 July 2014.

Transactions with Related Parties

2.8 AASB 124 Related Party Transactions requires an entity to disclose transactions with its related parties. AASB has recently extended the application of this standard to all not-for-profit public sector entities. These entities will be required to identify and disclose related parties transactions, such as those with key management personnel, including Ministers. This new requirement applies to reporting periods beginning on or after 1 July 2016.

Improving the quality of disclosures

2.9 There are ongoing initiatives by both Australian and international standard setters to reduce the volume and complexity of disclosures in financial statements to make them more useful to users. In 2014, the AASB published a staff paper10 proposing ways in which entities can remove unnecessary clutter from their financial statements. More recently, the AASB amended AASB 101 Presentation of Financial Statements as a result of the IASB’s project to improve disclosures. The amendments clarify that entities are only required to disclose information that is relevant to users of their financial statements. The amendments apply to reporting periods beginning on or after 1 January 2016.

2.10 The ANAO supports initiatives that reduce the compliance workload of Australian Government entities and make financial statements easier to read, while preserving sufficient disclosures to satisfy the needs of the Parliament. The ANAO Better Practice Guide Public Sector Financial Statements, published in March 2015, includes a discussion and associated examples designed to assist entities to improve the presentation of financial statements.

Future changes to the public sector reporting framework

2.11 Further changes to the financial reporting framework are expected over the next few years, as projects by Australian and international accounting standard setters lead to new accounting standards for both the public and private sectors.

2.12 Projects specific to the public sector include: fair value disclosures; reporting of service performance information; and new accounting requirements for grants, taxes and appropriations. Projects aimed primarily at the private sector, but with public sector implications, include the continuing initiative to improve the quality of disclosures, and major revisions to lease accounting.

Recent changes to the Australian auditing framework

2.13 As previously mentioned, the AUASB uses International Standards on Auditing as the primary basis for the Australian Auditing Standards. In making its standards and guidance, the AUASB consults formally with organisations representing stakeholders, including users of financial statements, regulators and the accounting profession. The consultative processes are scheduled so that the AUASB can consider stakeholder views in making submissions on proposals from the IAASB. The AUASB also works closely with the New Zealand Auditing and Assurance Standards Board to facilitate harmonisation of auditing and assurance standards in Australia and New Zealand.

2.14 During 2014–15 there were no major changes to existing standards or new standards issued by the AUASB related to the audit of financial statements.

Future changes to the Australian auditing framework

Auditor reporting

2.15 In April 2015, the AUASB released an exposure draft Reporting on Audited Financial Reports – New and Revised Auditor Reporting Standards and Related Conforming Amendments, following the release of new and revised standards by the IAASB. The major change proposed is the introduction of a new standard, ASA 701, Communicating Key Audit Matters in the Independent Auditor’s Report. This standard will apply to audits of the financial statements of listed entities and also to circumstances when the auditor otherwise decides or is required by law to communicate key audit matters in the auditor’s report.

2.16 The purpose of communicating key audit matters is to enhance the value of the auditor’s report by providing greater transparency about how the audit was performed. Communicating key audit matters provides additional information to intended users of the financial statements to assist them in understanding those matters that, in the auditor’s professional judgment, were of most significance in the audit of the financial statements. It may also assist intended users to understand the entity and the areas of significant management judgment in the financial statements.

2.17 This change is proposed to apply for reporting periods ending on or after 15 December 2016. The ANAO will give consideration to applying these standards to the audits of the more significant Australian Government entities.

Other changes to the auditing standards

2.18 The auditing standard-setting Boards are also working on other new and revised standards, including in relation to the auditor’s responsibility for other information published with the audited financial statements, the auditing of financial statement disclosures and the audits of special purpose financial reports.

Conclusion

2.19 Ongoing developments in accounting and auditing frameworks and standards continue to have an impact on the financial reporting responsibilities of public sector entities and on the ANAOʹs auditing methodology. The ANAO will continue to assist Australian Government entities through client seminars and publications that explain new regulatory and accounting requirements.

2.20 The only major change in Australian Accounting Standards for the public sector during 2014–15 was the introduction of AASB 1055 Budgetary Reporting. However, significant changes to the financial reporting framework are under way, both in Australia and internationally.

2.21 The proposed changes to auditor reporting of key audit matters, while not currently directed to the public sector, indicate a clear trend towards enhanced reporting by auditors, which the ANAO will monitor closely for application to the audits of the more significant Australian Government entities.

3. Summary of Audit Findings and Related Issues

This chapter provides a summary of the ANAO’s review of internal controls as part of the audit of the financial statements of major entities.

Introduction

3.1 Accountable Authorities11 of General Government Sector (GGS) entities subject to the PGPA Act are required to prepare annual financial statements and present them to the Auditor-General for audit.12 For large entities, the audit is conducted in two main phases, interim and final. The interim phase focuses on an assessment of entities’ key internal controls; in the final audit phase the ANAO completes its assessment of the effectiveness of key controls for the full year, substantively tests material balances and disclosures in the financial statements, and finalises its audit opinion on the entities’ financial statements. This report focuses on the results of the interim audit phase of the 2014–15 financial statement audits of all portfolio departments and other major General Government Sector entities that collectively represent some 95 per cent of total GGS revenues and expenses.

3.2 Accountable Authorities are also required to govern their entity in a way that promotes the proper use and management of public resources, the achievement of the purposes of the entity and the entity’s financial sustainability.13 This requires the development and implementation of effective corporate governance arrangements and internal controls designed to meet the individual circumstances of each entity and to assist in the orderly and efficient conduct of its business and compliance with applicable legislative requirements, including the preparation of annual financial statements that present fairly the entity’s financial position, financial performance and cash flows.14

3.3 The overall objective of an audit of an entity’s financial statements, as identified in the Australian Auditing Standards, is to form an opinion on whether the financial statements, in all material15 respects, are in accordance with the Australian Government financial reporting framework.16 In planning the audit, audit procedures are designed to achieve reasonable assurance that the financial statements taken as a whole are free from material misstatement, whether due to fraud or error. The auditor is concerned with material misstatements, and is not responsible for the detection of misstatements that are not material to the financial statements taken as a whole.17

3.4 A central component of the ANAO’s financial statement audit methodology, and the focus of the interim phase of our financial statement audits, is a sound understanding of the entity and its environment, including its internal controls, as they relate to the preparation of the financial statements. This enables the ANAO to make a preliminary assessment of the risk of material misstatement in an entity’s financial statements and to plan an audit approach to reduce audit risk to an acceptable level. The ANAO evaluates an entity’s key internal controls to assess its capacity to prevent and detect errors that may result in a material misstatement of the financial statements. In doing so, the ANAO recognises that the reliability of business processes, accounting records and financial systems can be enhanced through effective internal controls, and this influences the timing and extent of audit work required.

3.5 The auditor’s understanding of the entity, its environment and its internal controls, helps the auditor design the work needed and respond to significant risks that bear on financial reporting.18 Broad areas of audit focus determined as a result of this planning approach are discussed in chapter 5 for each entity covered by this report.

3.6 In accordance with generally accepted auditing practice, the ANAO accepts a low level of risk that the audit procedures will fail to detect that the financial statements are materially misstated. This low level of risk is accepted because it is too costly to perform an audit that is predicated on no level of risk. Specific audit procedures are performed to ensure that the risk accepted is low. These procedures include, for example, obtaining knowledge of the entity and its environment, reviewing the operation of internal controls, undertaking analytical reviews, testing a sample of transactions and account balances, and confirming significant year end balances with third parties.

Internal control

3.7 The ANAO uses the framework in ASA 315 Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and its Environment to consider the impact of different elements of an entity’s internal controls on the design and conduct of an audit. These elements, as detailed in ASA 31519, are the:

- control environment;

- entity’s risk assessment process;

- information system, including the related business processes, relevant to financial reporting, and communication;

- control activities relevant to the audit; and

- monitoring of controls.

3.8 This chapter discusses each of these elements and outlines our observations in relation to each one, based on our review of relevant aspects of each entity’s control environment and the results of our interim audits. As such it includes, where relevant, summary comments on category A, B, C and L1 audit findings.20

Control environment

3.9 An entity’s business and operations influence the control environment, which needs to be carefully reviewed as part of the audit process when assessing the risk of material misstatement in financial systems and reports. ASA 315 at paragraph A76 states:

The control environment includes the governance and management functions and the attitudes, awareness, and actions of those charged with governance and management concerning the entity’s internal control and its importance in the entity. The control environment sets the tone of an organisation, influencing the control consciousness of its people.

3.10 In conducting an audit of an entity’s financial statements, the ANAO focuses on specific elements of the control environment. In doing this, the ANAO establishes whether the environment in place comprises elements that contribute positively to establishing a foundation for effective internal control, and whether it minimises both financial and non-financial risks to the entity. This judgement has a major influence on the way that the audit is conducted, including the amount of audit work needed to form the audit opinion. Generally, the main elements reviewed are:

- governance arrangements—including the framework within which an entity’s activities for achieving its objectives are planned, executed, controlled and reviewed;

- audit committee arrangements—including the arrangements in place to meet the committee’s assurance role, including as a forum for communication between management and internal and external audit;

- assurance arrangements—including the internal audit function and quality assurance systems and processes;

- systems of authorisation, recording and procedures—designed to ensure that transactions are processed, recorded and accounted for correctly, including the assignment of appropriate authority and that responsibilities and compliance arrangements accord with applicable legislative requirements; and

- a financial performance management regime—that involves the preparation of financial reports, including comparison of actual results to budgets, variance analysis and relevant commentary to provide assurance about the financial performance of the entity.

3.11 The ongoing performance and effectiveness of these measures can make a significant contribution to the level of assurance that an entity’s management and, in turn, the ANAO obtains for financial statement purposes.

Observations

3.12 Entities generally have mature governance arrangements in place to provide direction, guidance and control over the financial management of their organisations21. Executive management committees met regularly to plan and monitor strategic direction and financial performance. Each entity produces a corporate plan or similar document that outlines the entity’s goals and objectives, and thereby facilitates measuring entities’ progress in meeting them. Accountable Authorities, their senior management group, and governance committees such as audit or risk committees, continued to give attention to financial and risk management, including entity control environments.

3.13 The audit committee arrangements of entities are well-established. These include a formal charter that outlines each committee’s composition, roles, responsibilities and reporting lines, and processes for the regular reporting to the Accountable Authority and the periodic self-assessment of performance. The requirements for audit committee arrangements are set out in the Public Governance, Performance and Accountability Rule 2014, section 17.

3.14 To provide guidance to entities on the composition and role of the audit committee following the implementation of the PGPA Act, the ANAO issued a Better Practice Guide Public Sector Audit Committees: Independent assurance and advice for Accountable Authorities in March 2015.

3.15 Under the PGPA Act, all entities were required to establish Accountable Authority Instructions (AAIs). The ANAO observed that all entities had established AAIs, and in line with the requirements of the PGPA Act established processes to facilitate the review of those AAIs periodically, with the objective of ensuring that they remain relevant. In addition, the ANAO observed that all delegations and authorisations were updated to reflect the new financial management framework that came into full effect on 1 July 2014.

3.16 Consistent with previous years, consideration of the financial position regarding current and future operations is included on the agenda of entities’ executive management meetings. Periodic financial performance reports to entities’ executives included budget forecasts and commentary on performance. The financial information provided to the entities’ executives was generally supplemented by non-financial operational information, to provide a balanced view of performance.

Legislative compliance

3.17 As previously mentioned, the financial framework for the Australian Government entities included in this report is established by the PGPA Act and its subsidiary legislation. The key feature of the framework is that the Accountable Authority of each entity is responsible for the financial management of their entity, including compliance with applicable laws and associated policies.

3.18 In reviewing an entity’s control environment, the ANAO assesses whether management has established adequate controls to enable the entity to comply with key aspects of the financial framework.

3.19 In more recent years, the ANAO has increased its focus on legislative compliance as part of its financial statement audit coverage. This recognises the importance of the authority that the Parliament has conveyed to the executive government in relation to these arrangements and the concerns expressed by the Joint Committee of Public Accounts and Audit in the past in relation to legislative compliance by entities.

3.20 The coverage by the ANAO involves assessing key aspects of legislative compliance in relation to annual appropriations, special appropriations, special accounts and the investment of public monies. Audit testing includes confirming the presence of key documents or authorities, and testing of relevant transactions directed at obtaining reasonable assurance about entities’ compliance with these key components of the financial management framework. ANAO audits also review the results of compliance self-assessment processes and other reviews undertaken in the context of entities’ compliance responsibilities that involve the annual reporting to the Finance Minister of any known breaches of the financial management framework.

Observations

3.21 As in previous years, overall, the ANAO identified a high level of compliance in these areas, except in respect of potential or actual breaches of section 83 of the Constitution, which is discussed at paragraphs 3.27 to 3.30 below.

3.22 The 2014–15 interim audits identified that, generally, entities continue to maintain updated listings of the laws, regulations and associated government policies that are relevant to their responsibilities. Entities also have well-established processes to monitor compliance with legislation to enable Accountable Authorities to provide an annual report on compliance (Compliance Report) to their Minister and the Finance Minister.

3.23 Generally, audit committees are responsible for reviewing the effectiveness of legislative compliance arrangements, particularly in relation to financial management requirements. An entity’s internal audit function often assists with the monitoring of these arrangements.

3.24 Entities also have established a variety of mechanisms to communicate the importance of compliance with legislation through documents such as AAIs, corporate plans, fraud control plans and delegation instruments. These mechanisms support entities in meeting their responsibilities under the PGPA Act, and facilitating the annual Compliance Report process.

3.25 Entities’ reporting of legislative compliance with the Australian Government’s financial management framework was first established in 2006–07 to improve compliance and ensure that Ministers are kept informed of compliance issues within their Portfolios. This requirement has been carried forward under the PGPA Act, with Accountable Authorities required to certify to their portfolio Minister the entity’s compliance with the components of the Government’s financial management framework for the previous financial year.

3.26 As part of the 2014–15 interim audits the ANAO reviewed entities’ progress in addressing the risk of breaches of section 83 of the Constitution.

Section 83 of the Constitution

3.27 Section 83 of the Constitution provides that no money shall be drawn from the Treasury of the Commonwealth except under appropriation made by law. The effect of section 83 is that all spending by the executive government from the Consolidated Revenue Fund must be in accordance with an authority given by the Parliament. Breaches of section 83 can occur when conditions legislated by the Parliament are not met before payments are made from special appropriations and special accounts. In these circumstances the payments may be made without a valid appropriation. This includes situations where an administrative error such as a duplicate payment occurs, even if the overpayment is able to be recovered.

3.28 Potential breaches can take many forms, including:

- a payment or overpayment made as a result of an error, including payments made based on incorrect or inaccurate information used in assessing payment eligibility; or

- a payment made despite certain legislative preconditions, such as those that regulate an entitlement to a payment, not being fulfilled.

3.29 As reported in ANAO Audit Report No.16 2014–15 Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2014, the 2013–14 financial statements of 15 entities, including 14 of the entities covered by this report, included a reference to potential or actual breaches of section 83 of the Constitution. The auditors’ reports on the financial statements of these entities contained a report on other legal and regulatory requirements which drew attention to these disclosures due to their importance in a public sector context, but the audit opinions were unqualified as the financial statements fairly represented the financial operations and position of the entity at year end.22

3.30 As part of the 2014–15 interim audits, the ANAO reviewed progress made by entities in assessing the ongoing risk of breaches of section 83 of the Constitution and actions taken to address these risks. Chapter 5 of this report includes details of these reviews for relevant entities.

Shared services arrangements

3.31 The increasing utilisation of shared services arrangements in entities can have important implications on the control environment of both entities providing these arrangements and those entities purchasing services.

3.32 Within the Australian Government, shared services arrangements can differ in size and scope, ranging from the clustering of a particular business function or activity with one or more entities, to larger scale operations involving all support functions being centralised with a single shared services provider. The shared services provider can be a Commonwealth entity, a contracted third party, or a combination of both. These arrangements can at times represent a significant portion of the business operations of an entity.

3.33 Government shared services arrangements can support efficient and well managed business services, including in relation to information technology services where methods such as internet based solutions provide increased flexibility for entities. Such arrangements have the potential, if well managed, to deliver overall savings in providing government services, and allow for the implementation of more uniform operational controls.

3.34 At the time of our interim audit work, 13 of the 23 entities covered by this report were providers of shared services, six entities were purchasers and some entities operated as both providers and purchasers. Of the 13 entities providing shared services, ten advised the ANAO they had plans to expand the number of purchasers and seven of these were actively seeking further purchasers of shared services. Three of the six entities using shared services expected to purchase additional shared services.

3.35 Based on a review of information provided by entities, including governance and policy documentation covering shared services arrangements, the ANAO observed that increased management attention may be required in some entities to ensure there are sound agreements in place between providers and purchasers that clearly outline respective governance arrangements and responsibilities, costing arrangements, performance standards and mechanisms for the review and reporting of performance against these standards.

3.36 From a financial statement perspective, our enquiries also reinforced that financial statement preparation can be put at risk if entities do not have in place appropriate governance arrangements and well-designed system controls to mitigate the risk of difficulties arising during the preparation of financial statements by entities utilising shared services arrangements. These, and a number of other measures that can mitigate the risk of difficulties arising during the preparation of financial statements by entities utilising shared services arrangements, are discussed in the ANAO’s Better Practice Guide Public Sector Financial Statements23.

Risk assessment process

3.37 An understanding of an entity’s risk assessment process is essential to an effective and efficient financial statement audit. The ANAO reviews how entities identify risks relevant to their financial statements, how these risks are managed and considers the risk of material misstatement of an entity’s financial statements.

3.38 The ANAO found that entities generally had well established arrangements in place for developing and updating risk management plans at the organisational and work area levels. The risk assessments of most entities also included consideration of the risks relevant to financial statement preparation. The process is generally reviewed by the entity’s audit committee or a separate committee with specific responsibility for risk management.

Fraud control management

3.39 The Commonwealth Fraud Control Framework outlines the principles for fraud control within the Australian Government and sets minimum standards to assist entities in carrying out their responsibilities to combat fraud24 against their programs. The Framework consists of both binding and non-binding rules, policy and guidance including section 10 of the Public Governance, Performance and Accountability Rule 2014, the Commonwealth Fraud Control Policy, and the Resource Management Guide No. 201 Preventing, detecting and dealing with fraud.

3.40 The importance of entities establishing effective fraud control arrangements is recognised in section 10 of the Public Governance, Performance and Accountability Rule 2014 which specifies that Accountable Authorities must develop and implement a fraud control plan for their entity. The Framework requires entities to conduct fraud risk assessments regularly and when there is a substantial change in the structure, functions or activities of the entity.

3.41 All entities are required to provide the Australian Institute of Criminology (AIC) with fraud control information on fraud against the Australian Government, and fraud control arrangements within Australian Government entities.

3.42 Unaudited data provided to the AIC for the year ended 30 June 2014 showed that:

- the Australian Federal Police accepted 76 referrals of fraud-related matters in 2013–14 and estimated the value of these referrals to be $304.4 million;

- 1 134 referrals for prosecution were made to the Commonwealth Director of Public Prosecutions, leading to 1 271 defendants prosecuted by the Commonwealth Director of Public Prosecutions in fraud type matters; and

- of those prosecuted in fraud type matters, 946 convictions for fraud were achieved, 13 defendants were acquitted and a further 312 matters resulted in other outcomes such as matters not proceeding or being withdrawn.

3.43 These results continue to highlight the risk of fraud and the importance of entities effectively managing their fraud control responsibilities.

3.44 An explanation of an auditor’s responsibility for preventing and detecting fraud is provided in Australian Auditing Standard ASA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of a Financial Report, which notes in paragraph 5:

An auditor conducting an audit in accordance with Australian Auditing Standards is responsible for obtaining reasonable assurance that the financial report taken as a whole is free from material misstatement, whether caused by fraud or error. Owing to the inherent limitations of an audit, there is an unavoidable risk that some material misstatements of the financial report may not be detected, even though the audit is properly planned and performed in accordance with the Australian Auditing Standards.

3.45 In considering the risks of material misstatement of the financial statements due to fraud, ASA 240 requires that a number of audit procedures be undertaken. These include making enquiries of entities regarding their risk assessment processes for identifying and responding to the risks of fraud, and the controls that management has established to mitigate these risks.

3.46 As with risk management plans, fraud control plans need to be reviewed regularly and updated when significant changes to roles or functions occur, so that they reflect an entity’s current fraud risk and control environment. There are benefits in entities assessing their fraud risks as part of their risk management processes.

Observations

3.47 ANAO enquiries, as part of the 2014–15 interim audits, identified that entities continue to recognise the importance of adhering to the Commonwealth Fraud Control Framework, with all entities having a fraud control plan. Entities also had a formal process for updating fraud control plans, and oversight and monitoring of fraud control strategies and initiatives.

Information system

3.48 An entity’s information system is used extensively for the processing of financial information that is used to prepare its financial statements. As a consequence, the review of each entity’s information system and its related controls forms a significant part of the ANAO audit examination of internal controls. Information system controls include entity-wide general controls that establish an entity’s IT infrastructures, policies and procedures, together with specific application controls that validate, authorise, monitor and report financial and human resource transactions.

Observations

3.49 The ANAO observed that the majority of entities had effective IT general controls and IT application controls that support the preparation of entities’ financial statements, although increased attention to the management of privileged and other user access was required in a number of entities. A discussion on the results of the ANAO’s review of information systems that underpin the financial transactions processing within major Australian Government entities is provided in chapter 4 of this report.

Control activities

3.50 Australian Auditing Standard ASA 315 at paragraph A96 states:

Control activities are the policies and procedures that help ensure that management directives are carried out.

3.51 The auditor is required to obtain an understanding of control activities relevant to the audit, being those that the auditor considers it is necessary to understand in order to assess the risks of material misstatement. Further audit procedures responsive to these risks then need to be designed.

3.52 To illustrate trends in audit findings, that generally relate to entities’ control environments, aggregate details of category A, B and C findings25 over the last four years have been grouped into the following categories:

- IT control environment;

- purchases and payables;

- grant accounting;

- accounting and control of non-financial assets;

- revenues, receivables and cash management;

- human resource management processes; and

- other control matters.

Aggregate audit findings

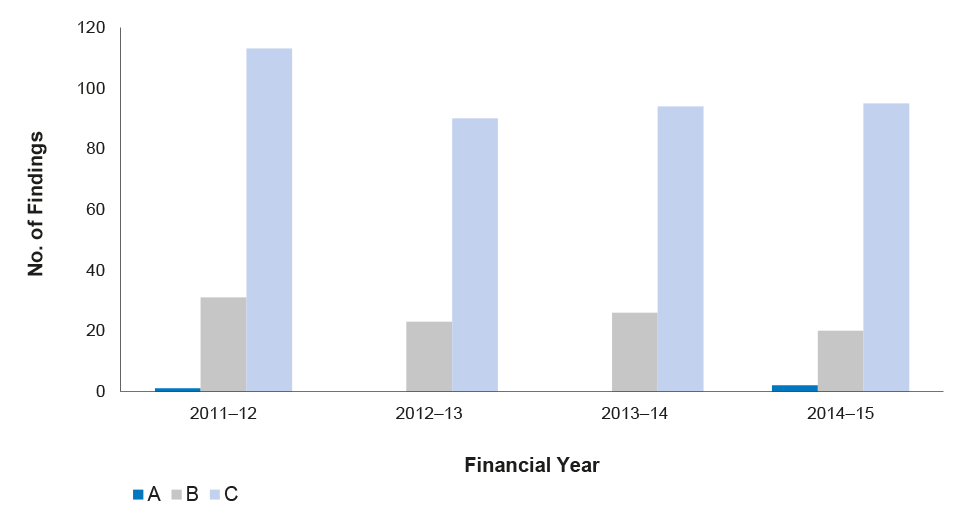

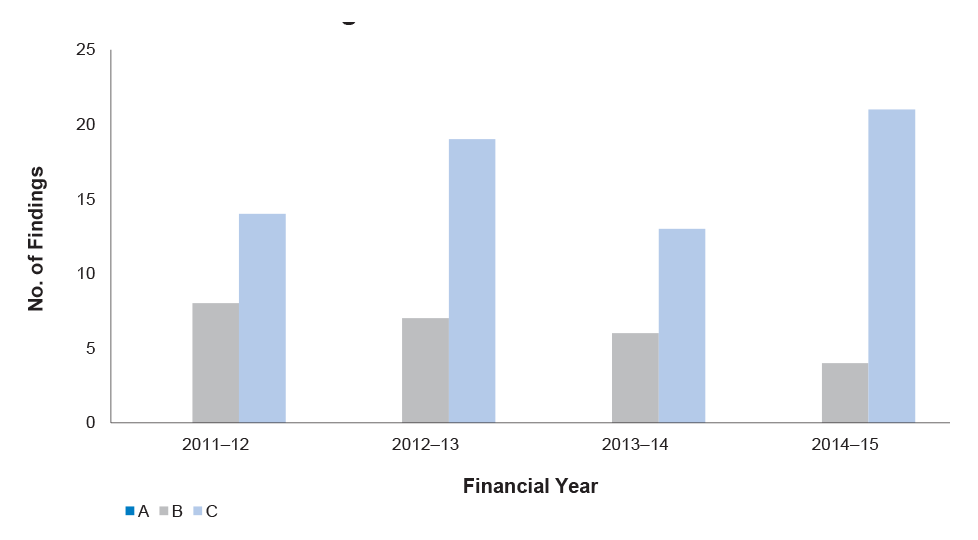

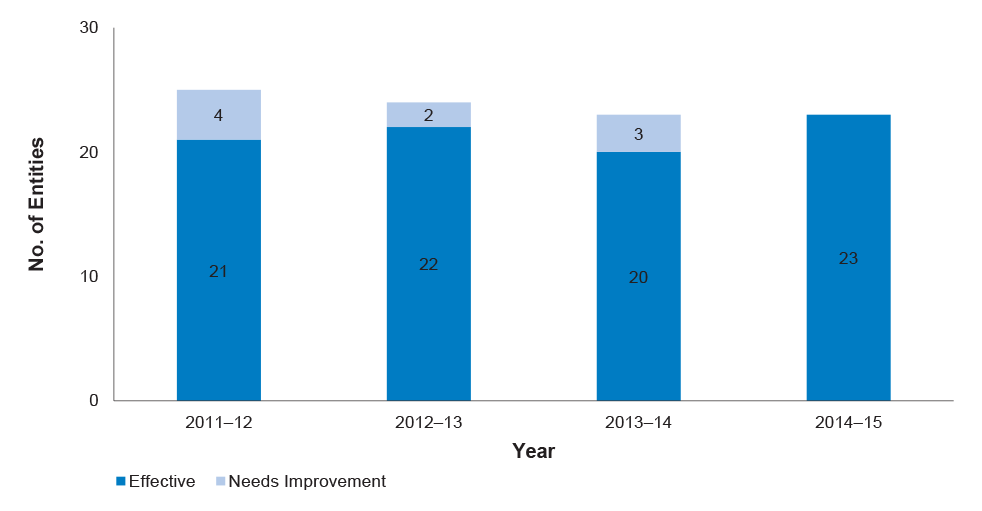

3.53 Aggregate audit findings for the last four years, identified during our interim audit phases, are outlined in figure 3.1 below.

Figure 3.1: Aggregate audit findings – categories A, B and C

3.54 Over the last four years, the ANAO’s interim audits have identified around 495 audit findings.26 Over this period, there has been a reduction in the total number of findings, with the majority being category C findings. There were two category A findings identified in 2014–15, up from nil in 2013–14. The number of category B findings decreased from 26 in 2013–14 to 20 in 2014–15 and category C findings increased from 94 in 2013–14 to 95 in 2014–15. The trend in the number of audit findings is reflected in the analysis of findings by category outlined below.

IT control environment

3.55 As mentioned above, the review of information systems and their related controls are an integral part of an entity’s internal control environment. The main components reviewed are: IT general controls that encompass an entity’s IT infrastructure, policies, procedures and standards that support accounting and business processes; and IT application controls that validate, authorise, monitor and report financial and human resource transactions.

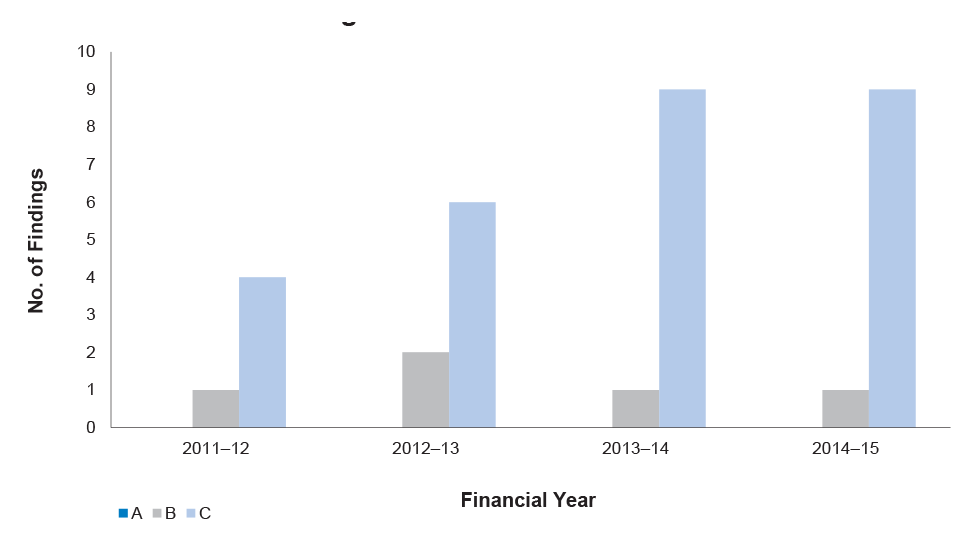

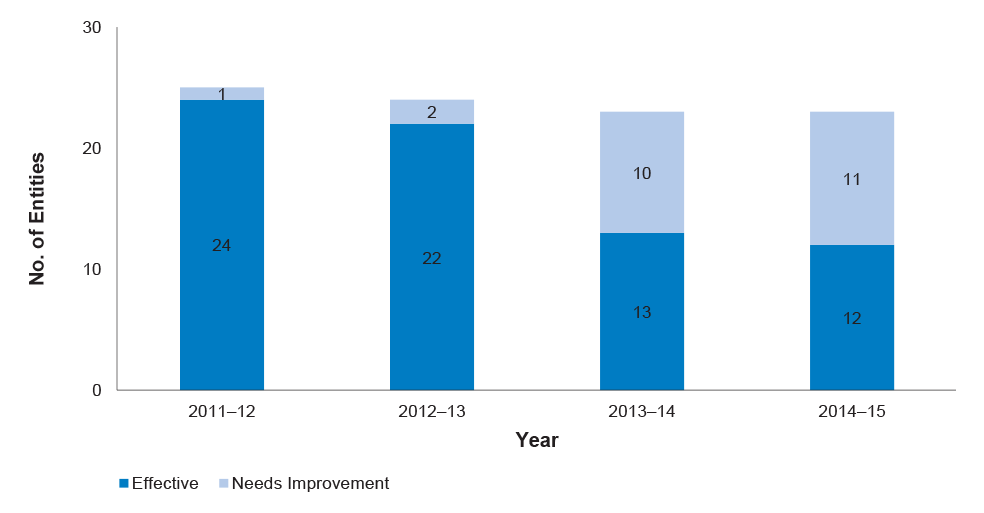

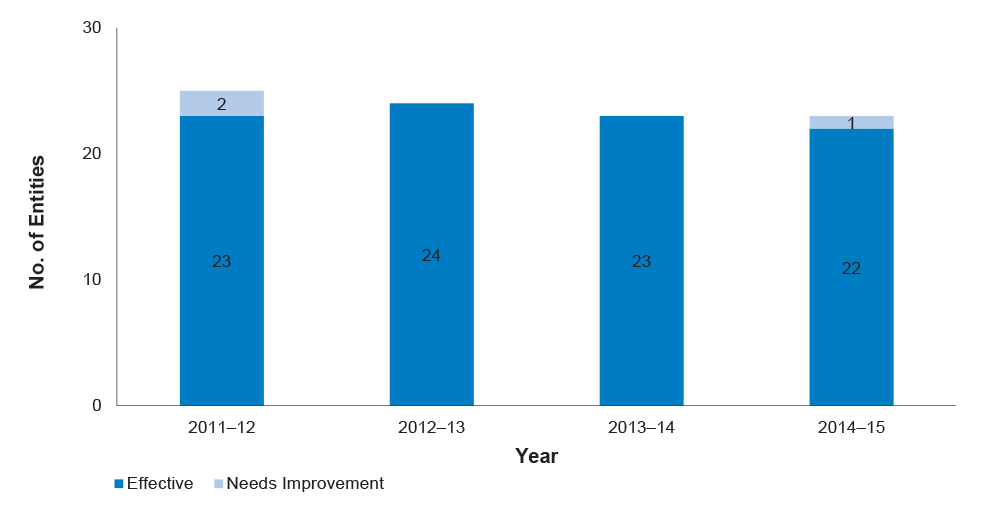

3.56 The number of audit findings over the last four years is outlined in figure 3.2 below.

Figure 3.2: IT control environment – aggregate audit findings

3.57 Findings in relation to entities’ IT control environments represent some 33 per cent of all findings, with 165 findings in total over the four years. The ANAO has observed an overall improvement in the management of IT controls over the past four years. In particular, the number of category B findings decreased from 13 in 2013–14 to four in 2014–15.

3.58 Common issues noted for attention over the four years include controls to manage IT incidents and change management, the regular review and updating of change management processes, and the management of user access to key financial systems. The 2014–15 interim audits continued to identify the need for improvements in the management of FMIS and HRMIS privileged and other user access in a number of entities, and a number of instances of non-compliance with the requirements of the Protective Security Policy Framework and the Australian Government Information Security Manual27.

3.59 A discussion on the results of the ANAO’s review of information systems that underpin the financial transactions processing within major Australian Government entities is provided in chapter 4.

Purchases and payables

3.60 The main component of purchases and payables is payments to suppliers, including contractor and consultancy expenses, lease payments and general administrative and utility payments. Payments to suppliers generally represent a significant percentage of total departmental expenses incurred by entities.

3.61 In 2013–14, the Consolidated Financial Statements, that include entities in the General Government Sector, reported total expenses for the payments of goods and services of $84.5 billion.

3.62 The main controls over purchases and payables which are given particular focus in our interim audits include: approval of the commitment and expenditure of public monies in accordance with delegations and authorisations; segregation of duties; controls to prevent duplicate payments; and controls over expenditure associated with credit cards and major contracts.

3.63 The number of audit findings over the last four years is outlined in figure 3.3 below.

Figure 3.3: Purchases and payables – aggregate audit findings

3.64 Over the last four years, entities’ controls over purchases and payables subject to audit review have been generally effective with a relatively small number of audit findings, representing some six per cent of total audit findings. The results of our 2014–15 interim audits continue to indicate effective controls in place over purchase and payables. The small number of category C issues identified related to controls over credit card expenditure and accounting for lease expenditure.

Grant accounting

3.65 Many entities administer grant programs that involve the provision of funds to eligible recipients in accordance with legislative and policy requirements. Grant recipients include state and local governments and community organisations.

3.66 To assist decision-makers and administering entities to understand, implement and comply with policy requirements and related guidance, the ANAO issued a Better Practice Guide Implementing Better Practice Grants Administration in December 2013.

3.67 The main controls over the accounting of grant expenditure include: approval of the commitment and expenditure of grants to eligible recipients; the payment of grants in accordance with funding agreements; and controls over grant acquittals. Our interim audit work assessed these control areas.

3.68 In 2013–14, the Consolidated Financial Statements reported total grant expenditure of $128.3 billion.

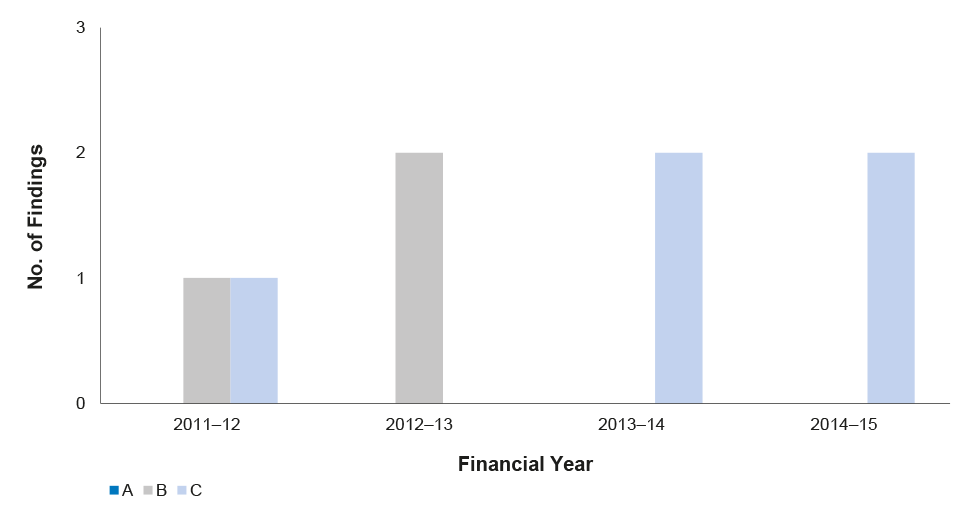

3.69 The number of audit findings over the last four years is outlined in figure 3.4 below.

Figure 3.4: Grant accounting – aggregate audit findings

3.70 Entities’ controls over the payment of grants have been generally effective, with a very small number of audit findings representing less than two per cent of total audit findings.

3.71 Audits of the general administration and the effectiveness of grant programs by entities are included in the ANAO’s performance audit program. These audits generally include: an examination of the design of the program to reflect policy intention and legislative requirements for the expenditure of public money; the processes by which grant applications are sought, received and assessed; and the monitoring and reporting arrangements undertaken to measure progress against the program objective.

3.72 ANAO performance audits continue to identify the need for an improvement in a number of aspects of the administration of grants by entities, including the establishment and application of clear eligibility requirements; appropriately documenting decisions relating to the assessment and selection of applicants; the monitoring of the delivery of programs and the management of funding agreements.28

Accounting and control of non-financial assets

3.73 The accounting and control of non-financial assets represents an important aspect of entities’ financial management responsibilities. Entities control a diverse range of non-financial assets on behalf of the Commonwealth, with the main classes of assets being land and buildings, leasehold improvements, infrastructure plant and equipment, inventories and internally developed software.

3.74 In 2013–14, the Consolidated Financial Statements reported total non-financial assets of some $137.3 billion.

3.75 The main controls over assets that are given particular focus in our interim audits include: the approval of the commitment and expenditure of public monies in accordance with authorisations and delegations; reconciliations between the general ledger and subsidiary asset accounts; the maintenance of a reliable asset register that includes information about assets acquired, disposed of, and asset locations; physical security over assets including asset identification numbers; the appropriateness of depreciation rates and useful lives; approval of, and the accounting for, the disposal of assets; and the periodic conduct of stocktakes. The valuation of assets is covered as part of our final audit phase.

3.76 The number of audit findings over the last four years is outlined in figure 3.5 below.

Figure 3.5: Accounting and control of non-financial assets – aggregate audit findings

3.77 Over the last four years there have been 92 audit findings relating to the accounting and control of non-financial assets, representing approximately 19 per cent of the total number of audit findings. The results of our 2014–15 interim audits indicate a number of areas requiring improvement. These include issues relating to the timely capitalisation of assets to enable the accurate calculation of depreciation, the maintenance of complete and accurate fixed asset registers, and the appropriateness of impairment assessments.

Revenue, receivables and cash management

3.78 The main components of revenue and receivables consist of Parliamentary appropriations, taxation revenue, customs and excise duties and administered levies. Other revenue is also generated by entities from the sale of goods and services and a range of other sources including from interest earned from cash funds on deposit. Cash management involves the collection and receipt of public monies and the management of official bank accounts.

3.79 In 2013–14, the Consolidated Financial Statements reported total taxation revenues of $349.1 billion, and non-taxation revenues of $37.1 billion and reported cash holdings totalling $4.5 billion.

3.80 The main controls over revenue and receivables that are given particular focus in our interim audits include: policies for the recognition of revenue; the regular review of receivables and accounting for impairment; and the segregation of receipting and recording of cash functions.

3.81 The main controls over the management of cash that are given particular focus in our interim audits include: the approval to open and close bank accounts; the exercise of delegations; and the preparation of bank reconciliations on a regular basis.

3.82 The number of audit findings over the last four years is outlined in figure 3.6 below.

Figure 3.6: Revenue, receivables and cash management – aggregate audit findings

3.83 Over the last four years, the interim audits have identified that entities’ key controls over revenue, receivables and cash have generally been effective, with audit findings in respect of these areas representing seven per cent of total findings.

3.84 There has been no change in the total number of findings in 2014–15, with the issues identified continuing to mainly relate to cash reconciliation processes and the management of receivables.

Human resource management processes

3.85 Human resource management processes encompass the day-to-day management and administration of employee entitlements and payroll functions. The main components of employee expenses consist of salary and wages, leave and other entitlements, employer superannuation contributions, separation and redundancy payments and workers compensation expenses. These items represent the largest departmental expenditure for most entities. Employee entitlement liabilities, particularly relating to annual and long service leave, generally are one of the larger liabilities on an entity’s balance sheet.

3.86 In 2013–14, the Consolidated Financial Statements reported $45.1 billion in employee benefits expenses.

3.87 The main controls over human resource management processes that are given particular focus in our interim audits include: approvals over new employees; independent checks of employee salary and personnel details entered into the HRMIS; approval of changes of key HRMIS data; independent checks over payroll processes including leave entitlement calculations; the timely conduct and review of reconciliations; and the approval of leave and termination payments. To assist HR systems managers and practitioners to implement better practice the ANAO issued a Better Practice Guide Human Resource Management Information Systems: Risks and Controls in June 2013.

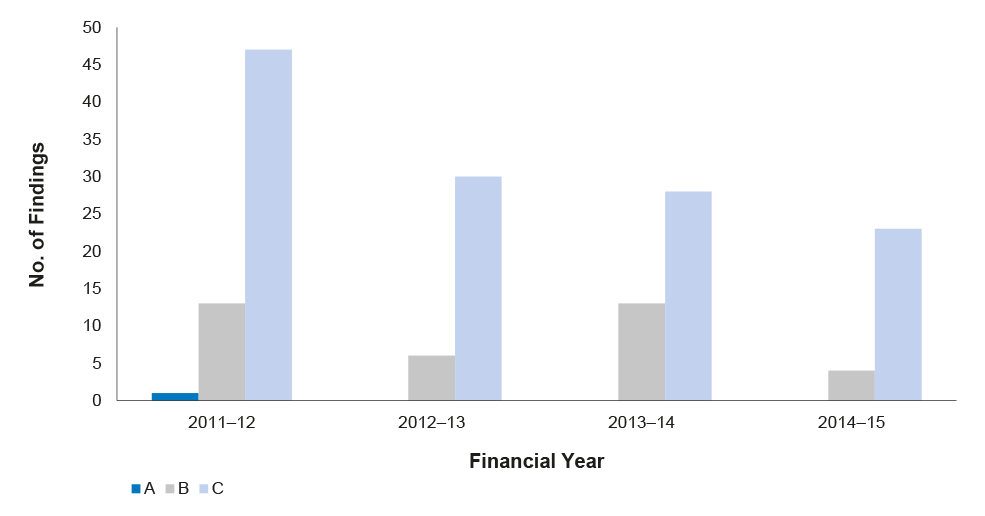

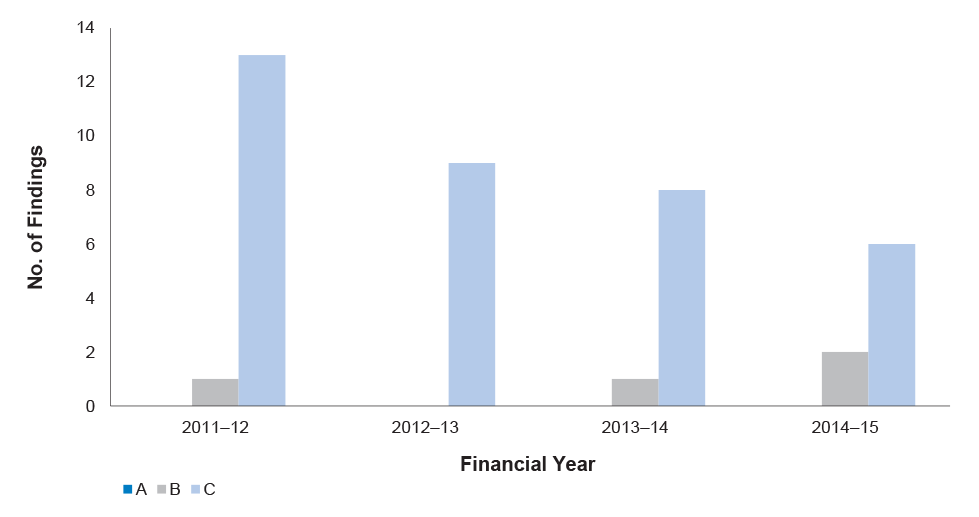

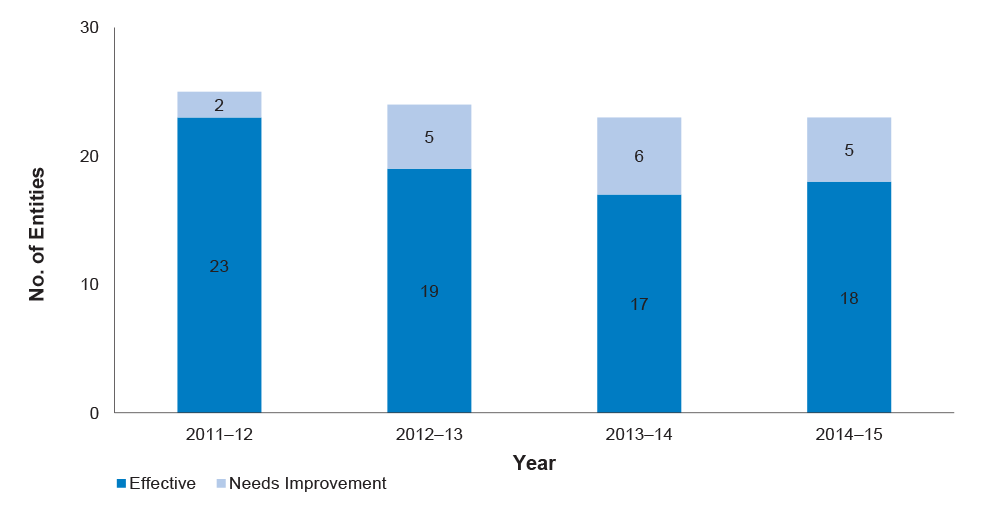

3.88 The number of audit findings over the last four years is outlined in figure 3.7 below.

Figure 3.7: Human resource management process – aggregate audit findings

3.89 Over the four year period, there have been 40 findings in this category, representing approximately eight per cent of total audit findings. There has been an increase in the number of category B audit findings reported in 2014–15 relating mainly to processes for the commencement and termination of employees, including quality assurance and review processes. The number of category C findings has consistently decreased over the four years from 13 in 2011–12 to six in 2014–15.

Other control matters

3.90 Our audits also include a review of entities’ general control environments, particularly when they impact on entities’ financial statements. Issues considered include such matters as: compliance and assurance processes; areas of estimation and judgement; the management of service level agreements and memoranda of understanding; risk management; and financial statements quality assurance processes.

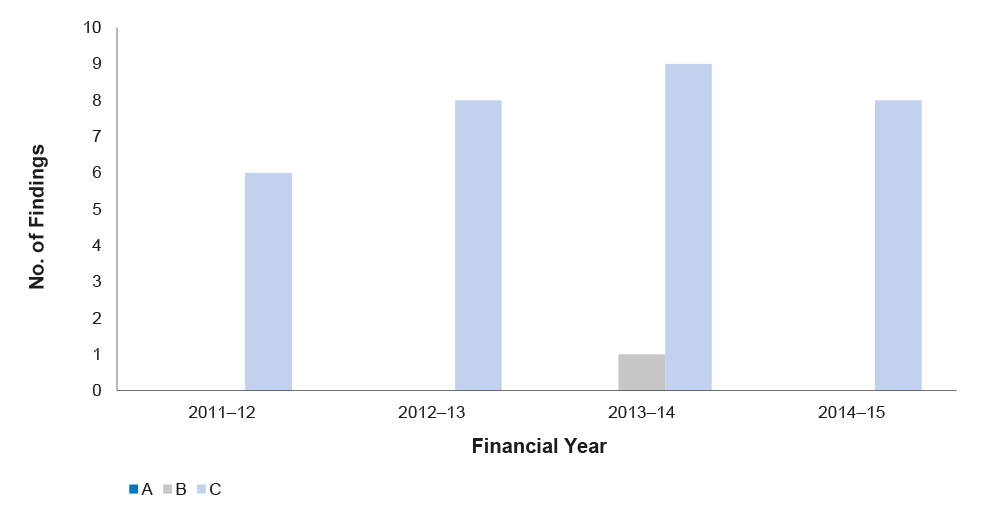

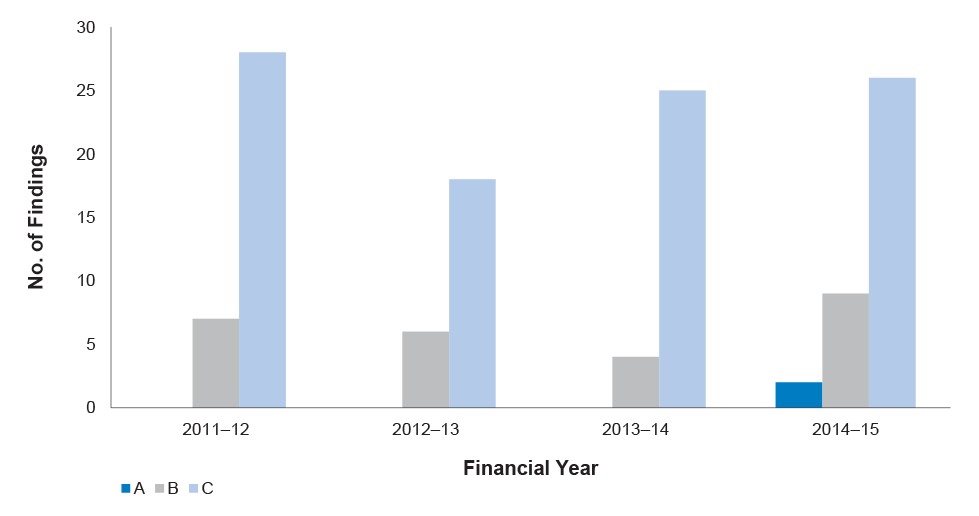

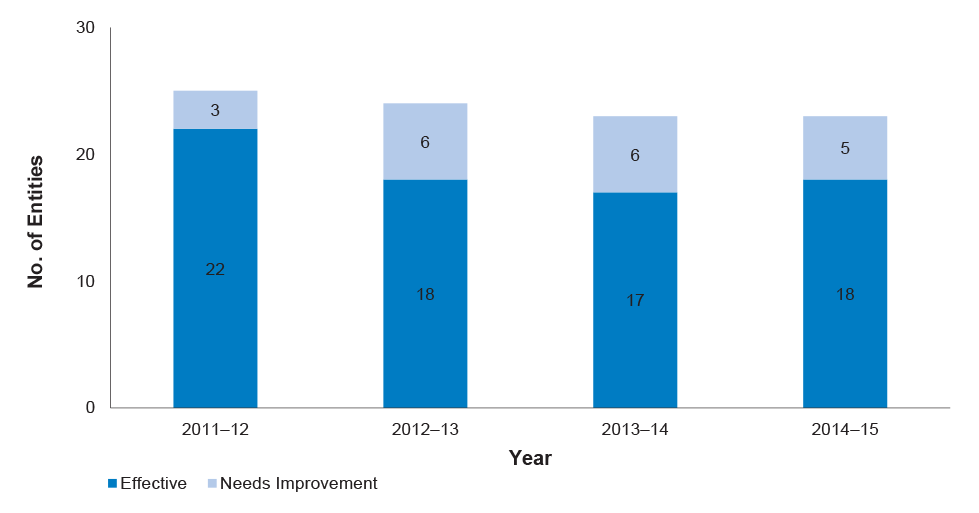

3.91 The number of audit findings over the last four years is outlined in figure 3.8 below.

Figure 3.8: Other control matters – aggregate audit findings

3.92 There have been 125 findings in this category over the last four years, representing approximately 25 per cent of total audit findings. There has been an increase in all three findings categories from the previous year, with the most noticeable being two category A findings reported in 2014–15 compared to nil in 2013–14, and nine category B findings compared to four. These mainly related to quality assurance and compliance processes in programs involving significant expenditure. The details of these issues are discussed further in chapter 5. Common category C issues noted over the four years include control weaknesses across a range of business and quality assurance processes.

Monitoring of controls

3.93 Australian Auditing Standard ASA 315 at paragraph A106 states:

Monitoring of controls is a process to assess the effectiveness of internal control performance over time. It involves assessing the effectiveness of controls on a timely basis and taking necessary remedial actions. Management accomplishes monitoring of controls through ongoing activities, separate evaluations, or a combination of the two. Ongoing monitoring activities are often built into the normal recurring activities of an entity and include regular management and supervisory activities.

3.94 Entities undertake many types of activities as part of their monitoring of control processes, including external evaluation reviews, control self-assessment processes, post-implementation reviews and internal audits. The level of review of different types of activities by the ANAO is dependent on the nature of each entity. However, given the significance of the internal audit function to Australian Government entities, this function is reviewed by the ANAO each year to gain an understanding of its contribution to the overall control environment.

Internal audit function

3.95 In the public and private sectors, internal audit has long been recognised by better practice entities as a valuable resource, and entities have given internal audit a key role in their governance arrangements.

3.96 Internal audit is a key source of independent and objective assurance advice on an entity’s risk framework and internal control. Depending on the role and mandate of an entity’s internal audit function, it can play an important role in assessing the adequacy of both the financial systems that underpin an entity’s financial statements, and the preparation process.

3.97 To assist entities in the management of their internal audit functions, the ANAO issued a Better Practice Guide Public Sector Internal Audit in September 2012. The Better Practice Guide outlines the key characteristics of a well performing Internal Audit function. The presence of these characteristics will provide confidence and assurance to chief executives and, where relevant, Boards that those financial and operational controls, which manage organisational risks, are operating in an efficient and effective manner.

3.98 As part of its financial statement coverage, the ANAO reviews the activities of internal audit in accordance with Australian Auditing Standard ASA 610 Using the Work of Internal Auditors29. The ANAO approach takes into account the work completed by internal audit, and, where appropriate, reliance is placed on it to ensure an effective audit approach.

Observations

3.99 The ANAO observed that internal audit coverage is generally based on an internal audit plan that is aligned with entities’ risk management plans and includes a combination of audits that address assurance, compliance, performance improvements and IT systems reviews. In addition, recommendations from management, audit committees and external influences such as the ANAO work program are factors considered in the development of internal audit work plans.

3.100 Where appropriate, the ANAO places reliance on internal audit work with aspects of the work being used to determine the nature, timing and extent of the ANAO audit procedures. The extent of reliance varies between entities. Greater reliance is placed on internal audit work where the work is focused on financial controls and legislative compliance. The ANAO continues to encourage entities to identify opportunities for internal audit coverage of key financial systems and controls as a means of providing increased assurance to Accountable Authorities to support their expressing an opinion on the entity’s financial statements.

3.101 The ANAO also found that the internal audit functions of most entities are generally subject to periodic review by their respective audit committee and/or by external reviewers. These reviews are generally based on a balanced set of indicators to assess internal audit performance. At the time of the 2014–15 interim audits, those internal audit functions that had been reviewed had been assessed as generally providing a satisfactory service.

Conclusion

3.102 The results of our 2014–15 interim audits identified that the effectiveness of controls over finance and accounting processes in the majority of entities supports the production of reliable financial statement information, reflecting the general maturity of entities’ control environments, demonstrated by the decrease in category B findings. Nevertheless, there has been a small increase in category A and C findings arising from the 2014–15 interim audits compared to the number of these findings in 2013–14. Entities have an ongoing responsibility to monitor the effectiveness of their systems and related controls to be confident of the integrity of the financial information reported to management and in their annual financial statements.

4. Information Technology Controls

This chapter presents the results of the ANAO’s assessment of selected elements of the information technology control environments that underpin the processing of financial information used in the preparation of entities’ financial statements. This chapter also includes an assessment of the business continuity and disaster recovery arrangements operating in entities.

Introduction

4.1 Information Technology (IT) systems facilitate the way in which Australian Government entities operate and support the business processes that deliver services to the Australian community. Accordingly, systems are required to be accurate, reliable, and sustainable.

4.2 The Australian Government has reported that total government IT expenditure in recent years has been between $5 billion and $6 billion per annum.

4.3 The business processes that support financial statement preparation and reporting also require the support of IT systems. As a result, an assessment of IT controls is a core component of the assessment of an entity’s control environment, and the financial statement audit process. The ANAO assesses both IT general controls30 and application controls31 for significant financial systems.

4.4 The issues identified in this chapter are reported to entities as category B or C findings, with details of category B audit findings included in chapter 5 of this report.32 Aggregate findings relating to the IT control environment, including category C findings, are discussed at paragraphs 3.55 to 3.59 of chapter 3 of this report.

4.5 This chapter includes a discussion on trends observed in the four year period 2011–12 to 2014–15 in relation to a number of IT control categories. An assessment of business continuity and disaster recovery arrangements in entities33 is also included.

IT control environment

4.6 The ANAO assesses the design, implementation and operation of key IT controls that are designed to ensure the integrity of financial information presented in entities’ financial statements. The ANAO undertakes this assessment each year in accordance with the Australian Auditing Standards. The accuracy, completeness and integrity of entities’ financial transactions and information are important considerations in formulating an entity’s overall audit risk profile and, as such, it is important that controls are well designed and operate effectively.

Changes to the IT control environment

4.7 As part of the overall audit approach, an assessment is made each year of significant changes to entities’ control environments. By its nature, the IT environment is subject to change and modification on a regular basis. For some entities, changes to their IT systems, applications and processes represent major business change initiatives. Such changes may have a significant impact on the underlying IT control environment.

Elements of the IT control environment

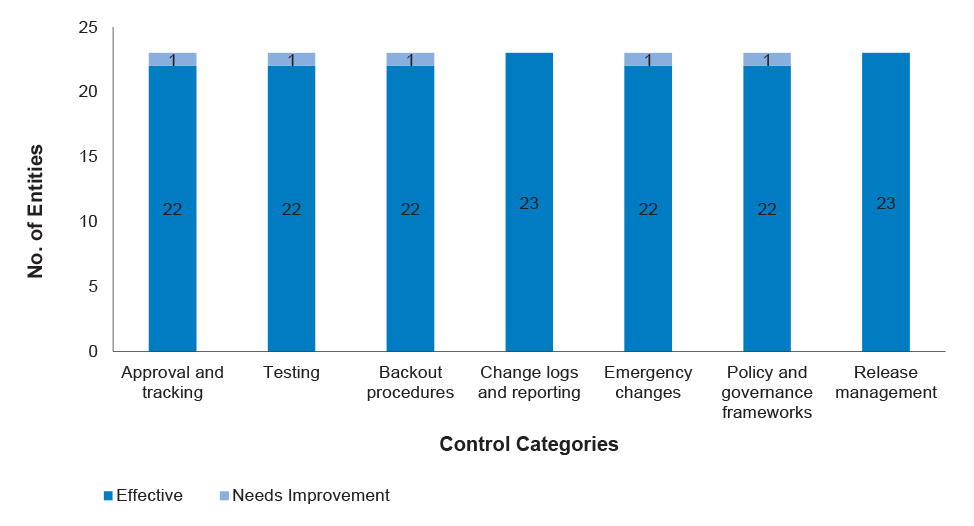

4.8 Table 4.1 outlines the elements of the IT control environment34 assessed by the ANAO as part of the 2014–15 financial statement audits of the major entities covered by this report. The total number of entities can vary from year to year35, with 23 entities reported in 2014–15.

Table 4.1: Elements of the IT control environment

|

Control Area |

Control Element |

Control Categories |

|

General IT controls |

IT security management |

General user access management Systems privileged user access management Network security Security governance Security monitoring and reporting |

|

IT change management |

Approval and tracking Testing Backout procedures Change logs and reporting Emergency changes Policy and governance frameworks Release management |

|

|

Application controls |

Financial management information system |

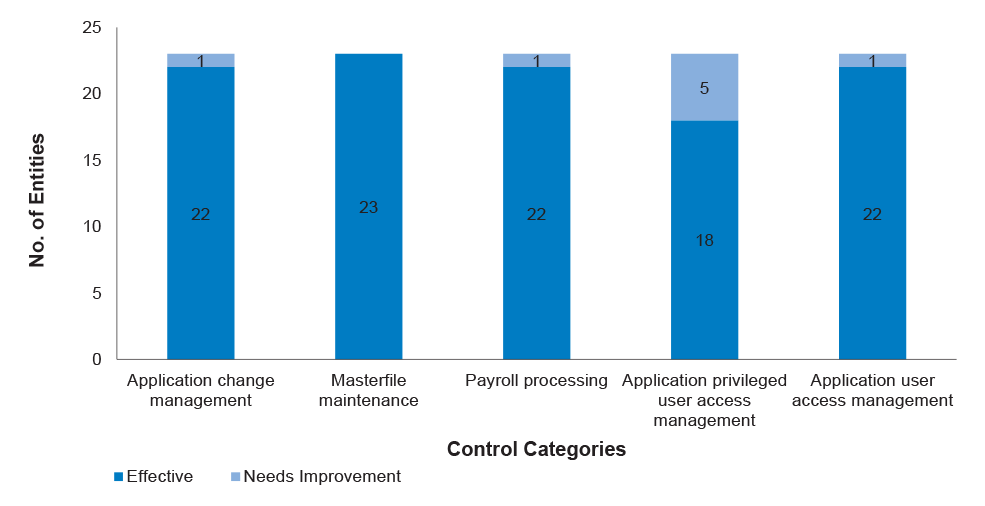

Application change management Masterfile maintenance Payment processing Application privileged user access management Application user access management |

|

Human resource management information system |

Application change management Masterfile maintenance Payroll processing Application privileged user access management Application user access management |

|

|

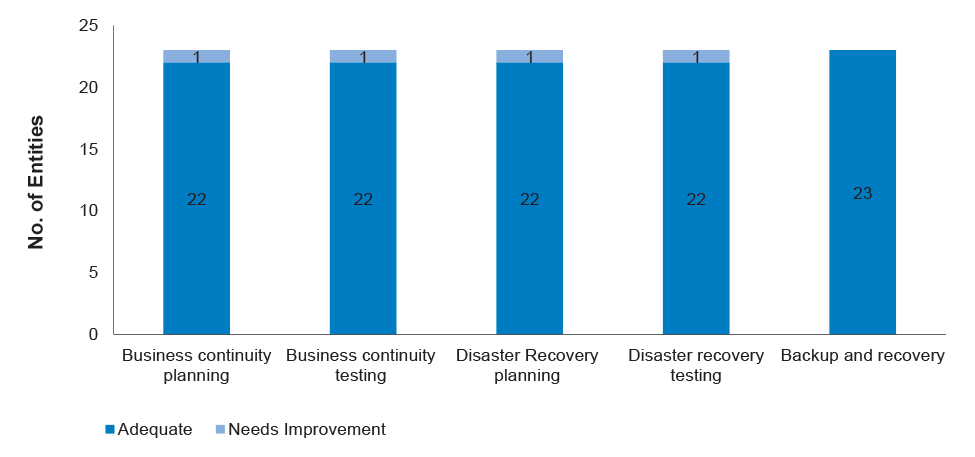

Business continuity arrangements |

Significant systems including:

|

Business continuity Disaster recovery Backup and recovery |

Source: ANAO compilation

4.9 The charts and associated discussion that follow outline the ANAO’s assessment of the integrity of general IT controls and application controls, as categorised in table 4.1. The discussion of audit findings in these areas focusses on those controls where increased management attention was warranted in some entities.

General IT controls

4.10 General IT controls are the foundation of an entity’s IT control environment. These controls commonly relate to all information systems and establish the environment in which application systems and controls operate in an entity. The ANAO’s assessment of IT general controls focused on the controls present in the IT environment relevant to those systems that process financial transactions and information.

IT security management