Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2021

Please direct enquiries through our contact page.

This report complements the Interim Report on Key Financial Controls of Major Entities financial statement audit report published in June 2021. It provides a summary of the final results of the audits of the Consolidated Financial Statements for the Australian Government and the financial statements of Australian Government entities for the period ended 30 June 2021.

Executive summary

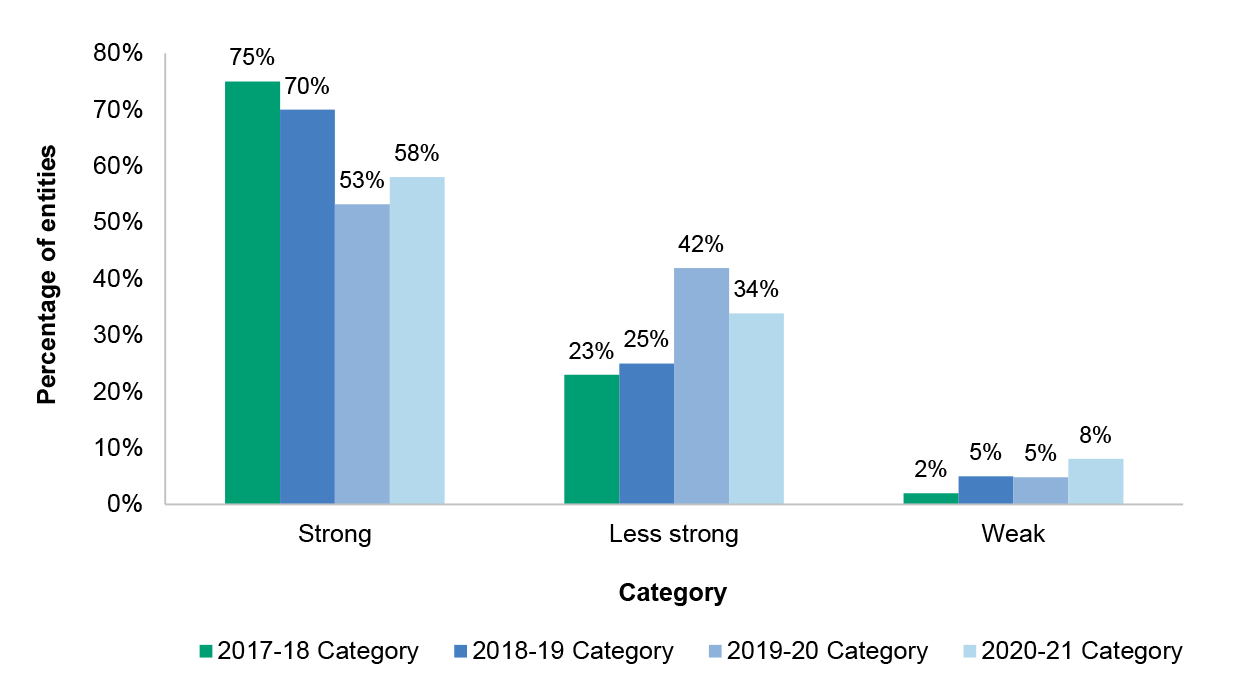

1. The ANAO publishes an annual audit work program (AAWP) which reflects the audit strategy and deliverables for the forward year. The purpose of the AAWP is to inform the Parliament, the public and government sector entities of the planned audit coverage for the Australian Government sector by way of financial statements audits, performance audits and other assurance activities. As set out in the AAWP, the ANAO prepares two reports annually that, drawing on information collected during financial statements audits, provide insights at a point in time to the financial statements risks, governance arrangements and internal control frameworks of Commonwealth entities. These reports provide Parliament with an independent examination of the financial accounting and reporting of public sector entities.

2. These reports explain how entities’ internal control frameworks are critical to executing an efficient and effective audit and underpin an entity’s capacity to transparently discharge its duties and obligations under the Public Governance, Performance and Accountability Act 2013 (PGPA Act). Deficiencies identified during audits that pose either a significant or moderate risk to an entity’s ability to prepare financial statements free from material misstatement are reported.

3. This report presents the final results of the 2020–21 audits of the Consolidated Financial Statements (CFS) and 244 Australian Government entities. The Auditor-General Report No.40 2020–21 Interim Report on Key Financial Controls of Major Entities (ANAO Report No.40), focused on the interim results of the audits of 25 of these major entities.

Consolidated financial statements

Audit results

4. The CFS presents the whole of government and the General Government Sector financial statements. The 2020–21 CFS was signed by the Minister for Finance on 12 November 2021 and an unmodified auditor’s report was issued on 15 November 2021.

5. There were no significant or moderate audit issues identified in the audit of the CFS in 2020–21 or 2019–20.

Australian Government financial position

6. The Australian Government’s net worth deficiency increased from $679.9 billion in 2019–20 to $743.2 billion in 2020–21. Over the period 2011–12 to 2020–21, total assets have increased from $390.6 billion to $1,000.1 billion, total liabilities increased from $647.5 billion to $1,743.3 billion and net worth has decreased from a deficit of $256.9 billion to a deficit of $743.2 billion.

Financial audit results and other matters

Quality and timeliness of financial statements preparation

7. The ANAO issued 241 unmodified auditor’s reports, including the CFS, and one modified auditor’s report, as at 19 November 2021. A quality financial statements preparation process will reduce the risk of untimely, inaccurate or unreliable reporting.

8. The ANAO noted a decrease in findings relating to processes supporting financial statements preparation improved delivery of draft financial statements in line with entity financial statements project plans, a decrease in the number of unadjusted audit differences and a decrease in overall total value of unadjusted audit differences reported to entities in 2020–21 compared to 2019–20.

Timeliness of financial reporting

9. The financial statements were finalised, and auditor’s reports issued for 89 per cent of entities within three months of the financial year-end. On average it took entities 41 days after the auditor’s report was issued to table their annual reports in Parliament. Eighty-four per cent of entities that are required to table an annual report in Parliament tabled prior to or on the date that the portfolio’s Senate estimates hearing commenced. Of the remaining entities, eight per cent had not tabled an annual report as at 19 November 2021.

Key audit matter reporting

10. The ANAO has applied ASA 701 Communicating Key Audit Matters in the Independent Auditor’s Report for the 25 entities included in Auditor-General Report No.40 Interim Report on Key Financial Controls of Major Entities and the CFS. In 2020–21 a total of 58 key audit matters (KAM) were included across the 25 entities and seven KAM were included in the CFS auditor’s report.

Removal of user access

11. ISM Security Control 0430 specifies that access is removed or suspended on the same day personnel no longer have a legitimate requirement for access. An assessment of the IT control environment was performed on 18 interim report entities. The assessment includes a review of Security Control 0430. The ANAO identified eight of these entities did not adequately implement Security Control 0430 which resulted in user accounts remaining active after staff no longer required the access. Five out of the eight entities had user accounts that were accessed after the date where access was no longer required.

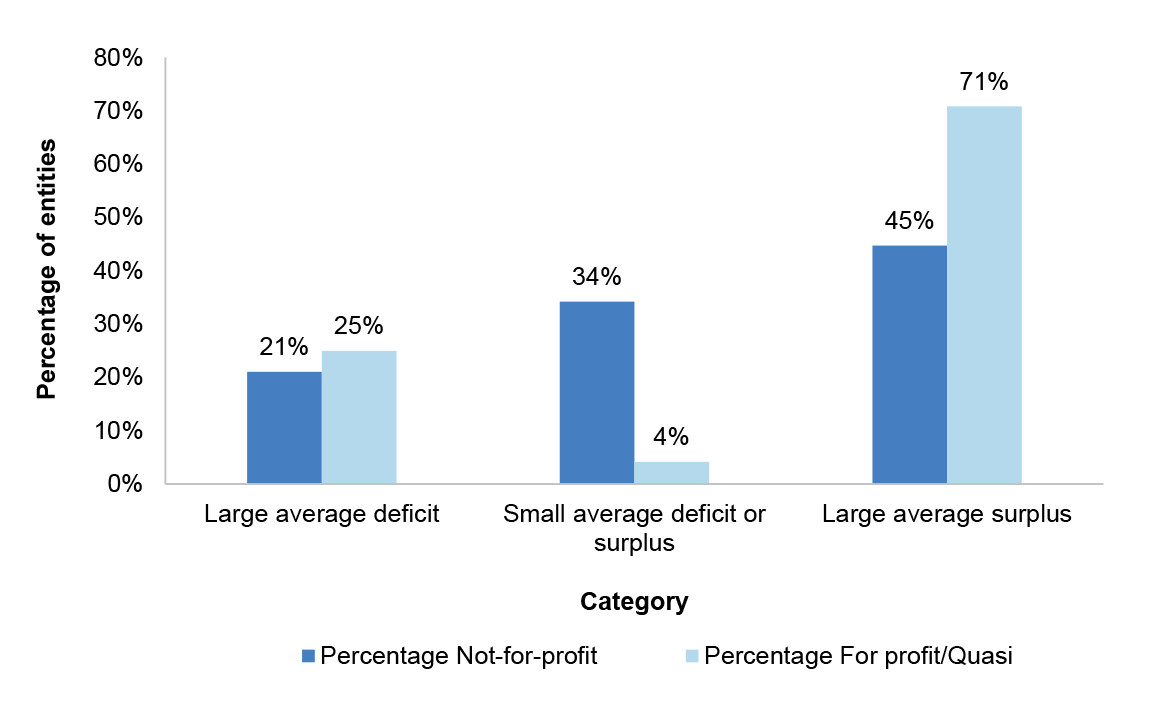

Financial sustainability

12. An assessment of an entity’s financial sustainability can provide an indication of financial management issues or signal a risk that the entity will require additional or refocused funding. Our analysis concluded that the financial sustainability of the majority of entities was not at risk.

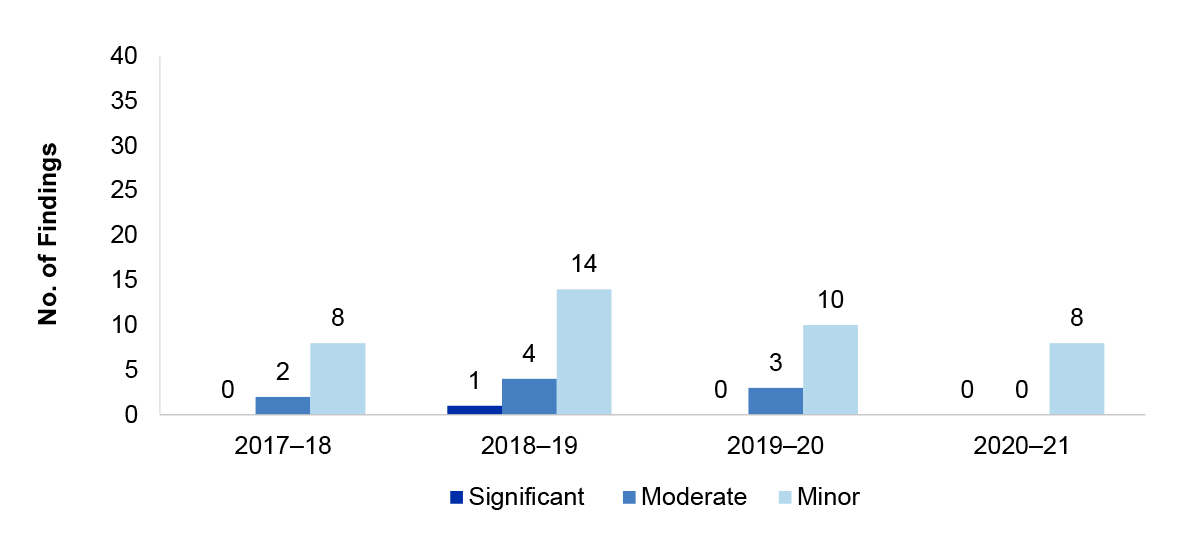

Summary of audit findings

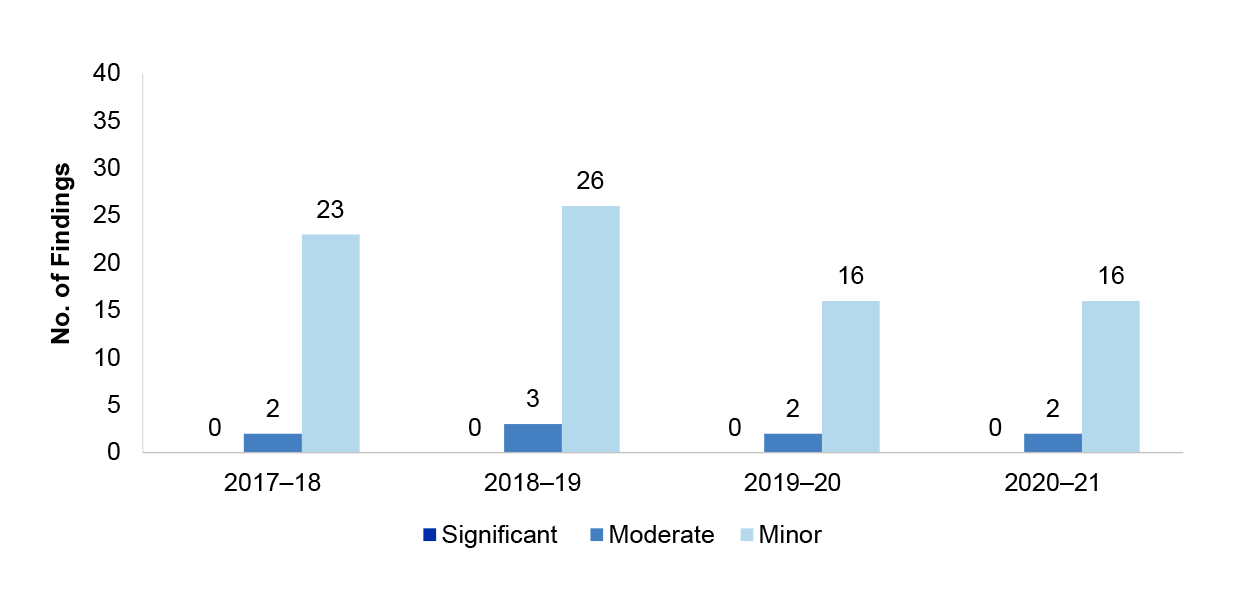

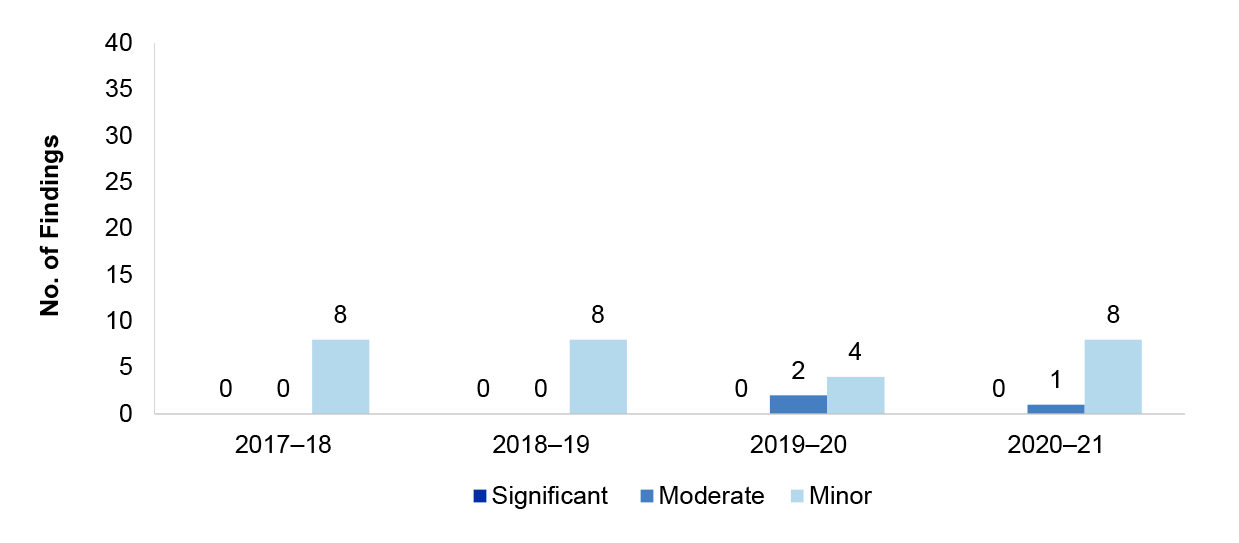

13. A total of 164 findings were reported to entities as a result of the 2020–21 financial statements audits. These comprised two significant, 21 moderate, 127 minor findings and 14 legislative findings. The highest number of findings are in the categories of:

- IT security management and user access, in particular the management of privileged users; and

- accounting and control of non-financial assets.

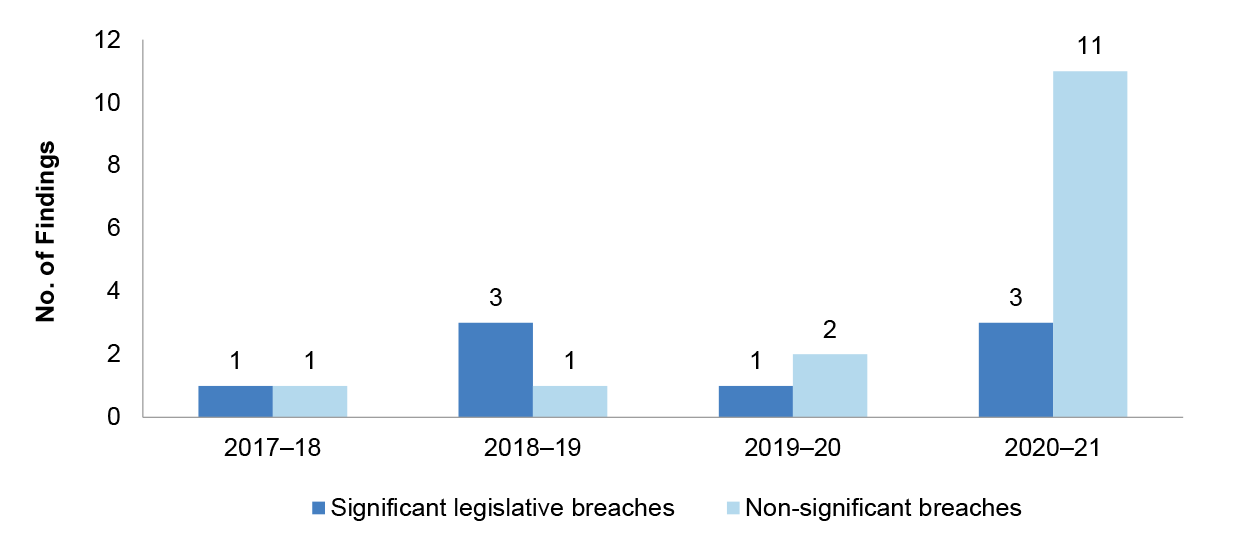

14. The total findings included three significant legislative breaches, one of which has remained open since 2012–13. Eight of the 14 legislative breaches related to remuneration of key management personnel.

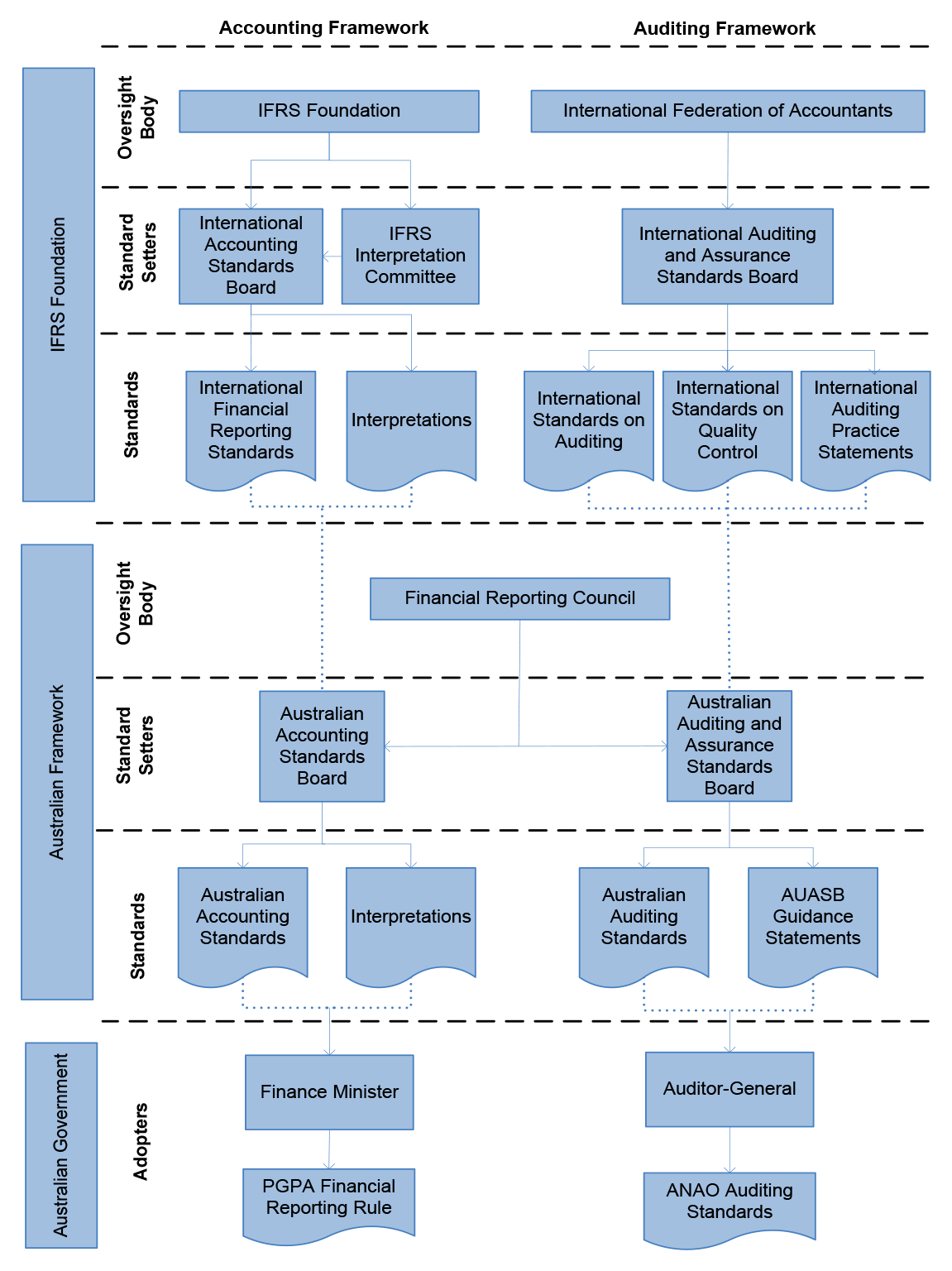

Reporting and auditing frameworks

Changes to the Australian public sector reporting framework

15. There were no significant changes in accounting standards in 2020–21. A revised ASA 540 Auditing Accounting Estimates and Related Disclosures was issued in December 2018 and was implemented in ANAO audits of financial statements in 2020–21. The ANAO introduced new methodology templates to address the requirements.

16. The auditing of performance information is an emerging area of interest for both national and international auditing standard setters. For the ANAO, this is an area of strategic priority as it enhances accountability and transparency to the Parliament.

17. Data analytics continues to be a focus for the ANAO, and audits undertaken in 2020–21 have continued to build on previous initiatives to enhance audit quality and efficiency. In 2021, the ANAO applied four standardised data analytics solutions to audits, at least one of which was used by more than 35 audit teams.

Cost of this report

18. The cost to the ANAO of producing this report is approximately $430,000.

1. The Consolidated Financial Statements

Chapter coverage

This chapter outlines the results of the audit of the Consolidated Financial Statements (CFS) of the Australian Government, which includes the Whole of Government and the General Government Sector (GGS) financial statements for the year ended 30 June 2021, and the Australian Government’s financial results for 2020–21.

The chapter also includes:

- the key audit matters (KAM) reported for the CFS;

- an analysis of the Australian Government’s financial outcome and financial position; and

- an analysis of the Australian Government loans and equity issued, including investments made for policy purposes in public corporations and concessional loans.

Audit results

The 2020–21 CFS was signed by the Minister for Finance on 12 November 2021 and the Auditor-General’s unmodified auditor’s report was issued on 15 November 2021.

There were no significant or moderate audit issues identified in the audit of the CFS in 2020–21 or 2019–20.

In 2020–21 there was one new KAM relating to the valuation of Australian Government securities. The KAM relating to the occurrence and accuracy of JobKeeper payments and cash flow boost to support businesses, reported in 2019–20, was removed.

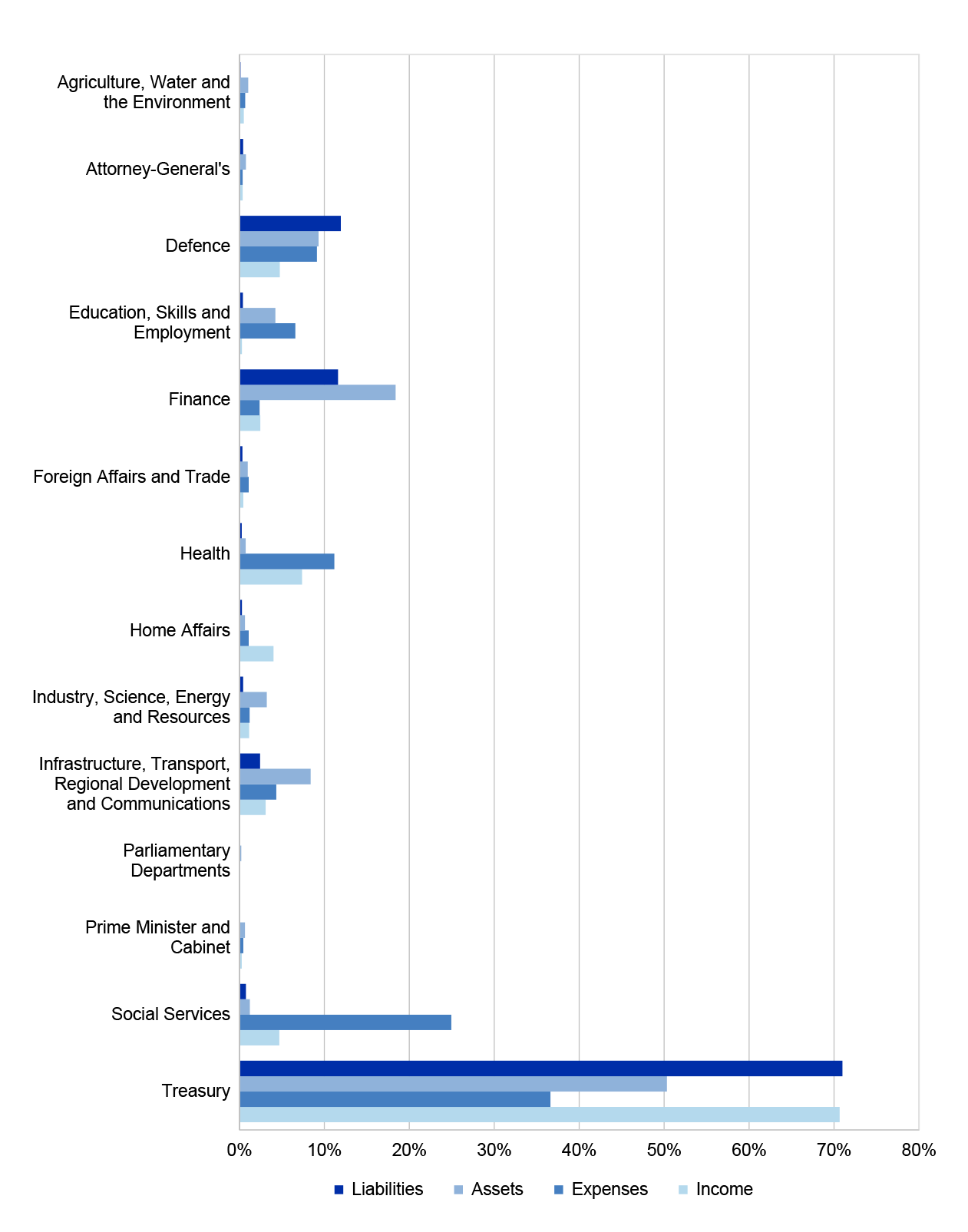

Expenses of the Australian Government totalling $671.6 billion for the year ended 30 June 2021 were funded by $541.2 billion of revenue and approximately $130.4 billion net borrowings. The borrowings represent 19.4 per cent of the total expenses for 2020–21 (compared to 16.6 per cent in 2019–20).

The Australian Government’s net worth deficiency increased from $679.9 billion in 2019–20 to $743.2 billion in 2020–21.

Over the period 2011–12 to 2020–21, total assets increased from $390.6 billion to $1,000.1 billion, total liabilities increased from $647.5 billion to $1,743.3 billion and net worth has decreased from a deficit of $256.9 billion to a deficit of $743.2 billion.

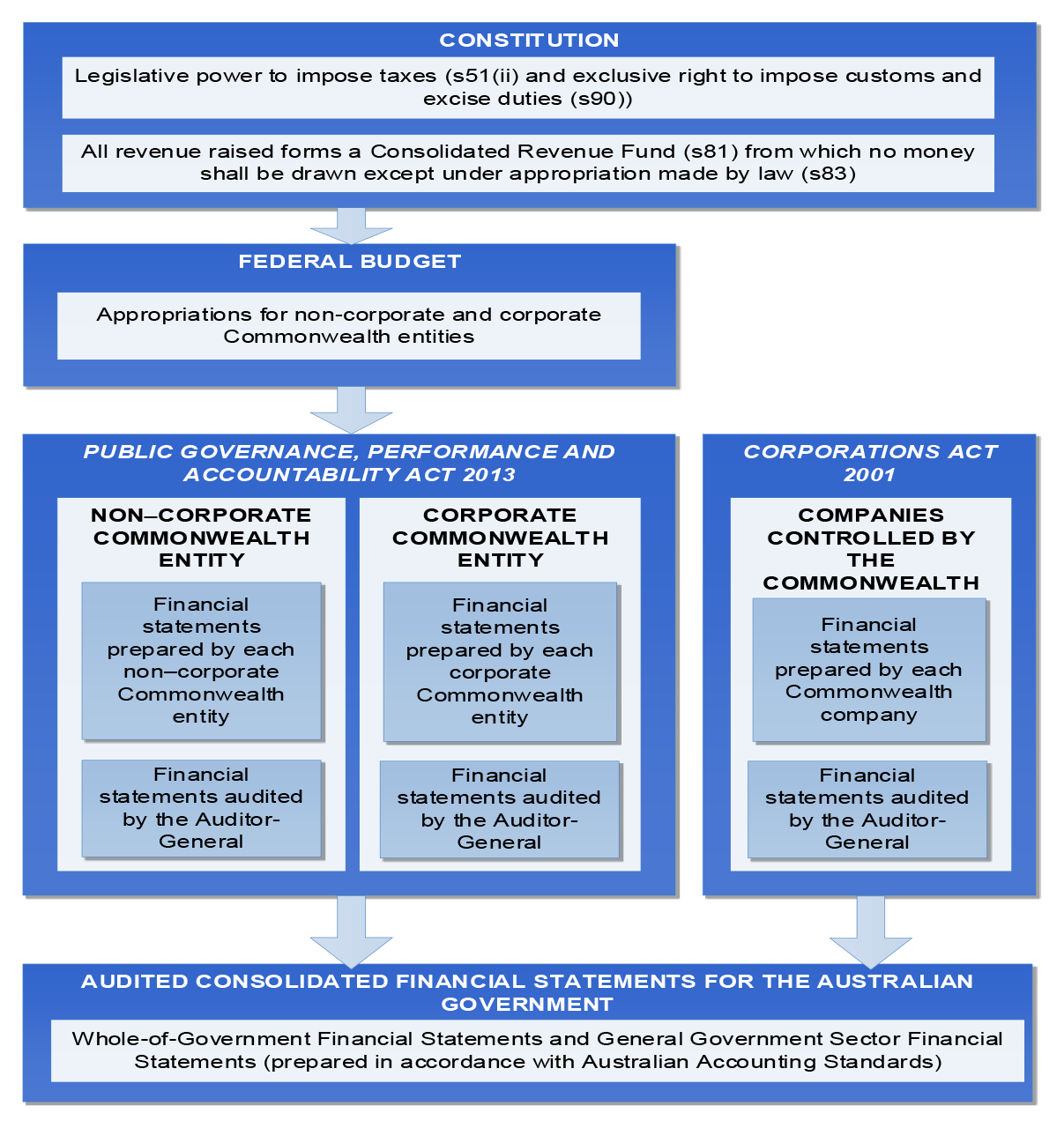

Background

1.1 Government accountability and transparency is supported by the preparation and audit of the Australian Government’s CFS. The CFS and the associated financial analysis provide information to assist users in assessing the financial performance and position of the Australian Government. The CFS is prepared by the Department of Finance (Finance) and issued by the Minister for Finance.

1.2 The CFS presents the consolidated whole of government financial results which includes the results of all Australian Government controlled entities, as well as the GGS financial statements. The 2020–21 CFS is prepared in accordance with section 48 of the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the requirements of the Australian Accounting Standards, including AASB 1049 Whole of Government and General Government Sector Financial Reporting (AASB 1049).

1.3 AASB 1049 requires, with limited exceptions, the principles and rules in the Australian Bureau of Statistics’ Government Finance Statistics (GFS) Manual to be applied where compliance with the GFS Manual would not conflict with Australian Accounting Standards.

Key audit matters

1.4 The ANAO’s 2020–21 audit approach identified seven key areas of financial statements risk that had the potential to impact the CFS and which were considered key audit matters (KAM). In 2020–21 there is one new KAM relating to the valuation of Australian Government securities. The KAM relating to the occurrence and accuracy of JobKeeper payments and cash flow boost to support businesses, reported in 2019–20, was removed. The KAM for 2020–21 are provided below in Table 1.1.

Table 1.1: CFS key audit matters

|

Relevant financial statements itema |

Key audit matters |

Audit risk rating |

Factors contributing to the risk assessment |

|

Taxation revenue $479.9 billion Australian Taxation Office Department of Home Affairs |

Accuracy of taxation revenue

|

Higher |

|

|

Personal benefits expense $160.5 billion Australian Taxation Office Department of Education, Skills and Employment Department of Social Services National Disability Insurance Scheme Launch Transition Agency |

Accuracy and occurrence of personal benefits expense

|

Higher |

|

|

Advances paid $71.6 billion other receivables and accrued revenue $59.3 billion Australian Taxation Office Department of Education, Skills and Employment Department of Social Services |

Valuation of advances paid and receivables

|

Moderate |

|

|

Collective investment vehicles (component of investments, loans, and placements) $90.4 billion Future Fund Management Agency (Future Fund) Department of Finance

|

Valuation of collective investment vehicles

|

Moderate |

|

|

Australian Government Securities $683.9 billion Australian Office of Financial Management |

Valuation and disclosure of Australian Government Securities

|

Moderate |

|

|

Specialist military equipment (SME) $74.4 billion Department of Defence other plant, equipment and infrastructure $69.5 billion Numerous entities |

Valuation of specialist military equipment and other plant, equipment and infrastructure assets

|

Moderate |

|

|

Superannuation liabilitiesb $407.5 billion Department of Defence Department of Finance |

Valuation of superannuation liabilities

|

Higher |

|

Note a: Table 1.1 may differ from the financial statements of individual entities as a result of eliminations and adjustments at the CFS level or where the entities identified contribute a majority to the balance of the financial statements line item.

Note b: These are the main government entities responsible for administration and reporting of Australian Government superannuation liabilities. Liabilities also include schemes managed by other entities, such as the Australian Postal Corporation.

Source: ANAO 2020–21 audit results, and the CFS for the year ended 30 June 2021.

Audit results

1.5 There were no significant or moderate audit findings arising from the 2019–20 or 2020–21 financial statements audits of the CFS.

Australian Government’s financial outcome

Operating result

1.6 The following key financial measures were reported for 2020–21:

- net operating balance was a deficit of $130.5 billion (compared to a deficit of $98.8 billion in 2019–20);

- operating result was a deficit of $97.9 billion (compared to a deficit of $133.7 billion in 2019–20); and

- comprehensive result (change in net worth) was a decrease in net worth of $63.4 billion (compared to a decrease of $135.4 billion in 2019–20).

1.7 The decrease in the Australian Government’s net operating balance was due to an increase in expenses of $72.3 billion (12.1 per cent), partially offset by an increase in revenue of $40.7 billion (8.1 per cent).

1.8 The increase in expenses was due to the Australian Government’s ongoing economic response to the impact of the COVID-19 pandemic. Key movements in expenses include:

- an increase of $16.2 billion for additional benefits to households in goods and services such as payments relating to the National Disability Insurance Scheme ($5.8 billion) and medical and pharmaceutical benefits ($4.2 billion);

- an increase of current grants expenses of $17.2 billion relating to payments to states and territories under national partnership arrangements and for goods and services tax (GST) distribution;

- subsidy expenses increased by $18.0 billion, reflecting an additional $25.5 billion of JobKeeper payments, partially offset by a decrease in cash flow boost to support business of $11.3 billion; and

- additional personal benefit expenses of $15.8 billion, including working age payments such as JobSeeker and support for seniors and students.

1.9 Total revenue increased by $40.7 billion primarily due to higher taxation revenue (mainly individual income and company taxation) as a result of the improved economic conditions including a stronger labour market, higher commodity prices and strong household consumption compared with the 2019–20 which was impacted by the onset of the COVID-19 pandemic.

1.10 The Australian Government remained in deficit for 2020–21. The operating result deficit improved compared to 2019–20 as a result of fair value gains of $53.7 billion, primarily attributable to collective investment vehicles and investments administered by the Future Fund (compared to fair value losses in 2019–20 of $18.8 billion). These gains were partly offset by an increase in the net write-down of assets. In 2020–21 the net write-down of assets was $12.0 billion (compared to $9.1 billion in 2019–20), reflecting additional impairment due to the impacts of the COVID-19 pandemic on small businesses.

1.11 The comprehensive result (total change in net worth) is the sum of the operating result deficit of $97.9 billion and actuarial gains on the superannuation liability of $33.5 billion. The actuarial gain reflects an increase in the Australian Government bond rate resulting in a higher discount rate being applied in the calculation of the superannuation liability.

1.12 The expenses of the Australian Government of $671.6 billion for the year ended 30 June 2021 were funded by $541.2 billion of revenue and approximately $130.4 billion net borrowings. The additional borrowings, representing 19.4 per cent of total expenses, were applied to fund expenses resulting from the various stimulus and support packages comprising payments for personal benefits, subsidy and grants expenses in response to the COVID-19 pandemic. The Australian Government’s borrowings are expected to continue to increase through the period of the forward estimates. 1

Revenue by source

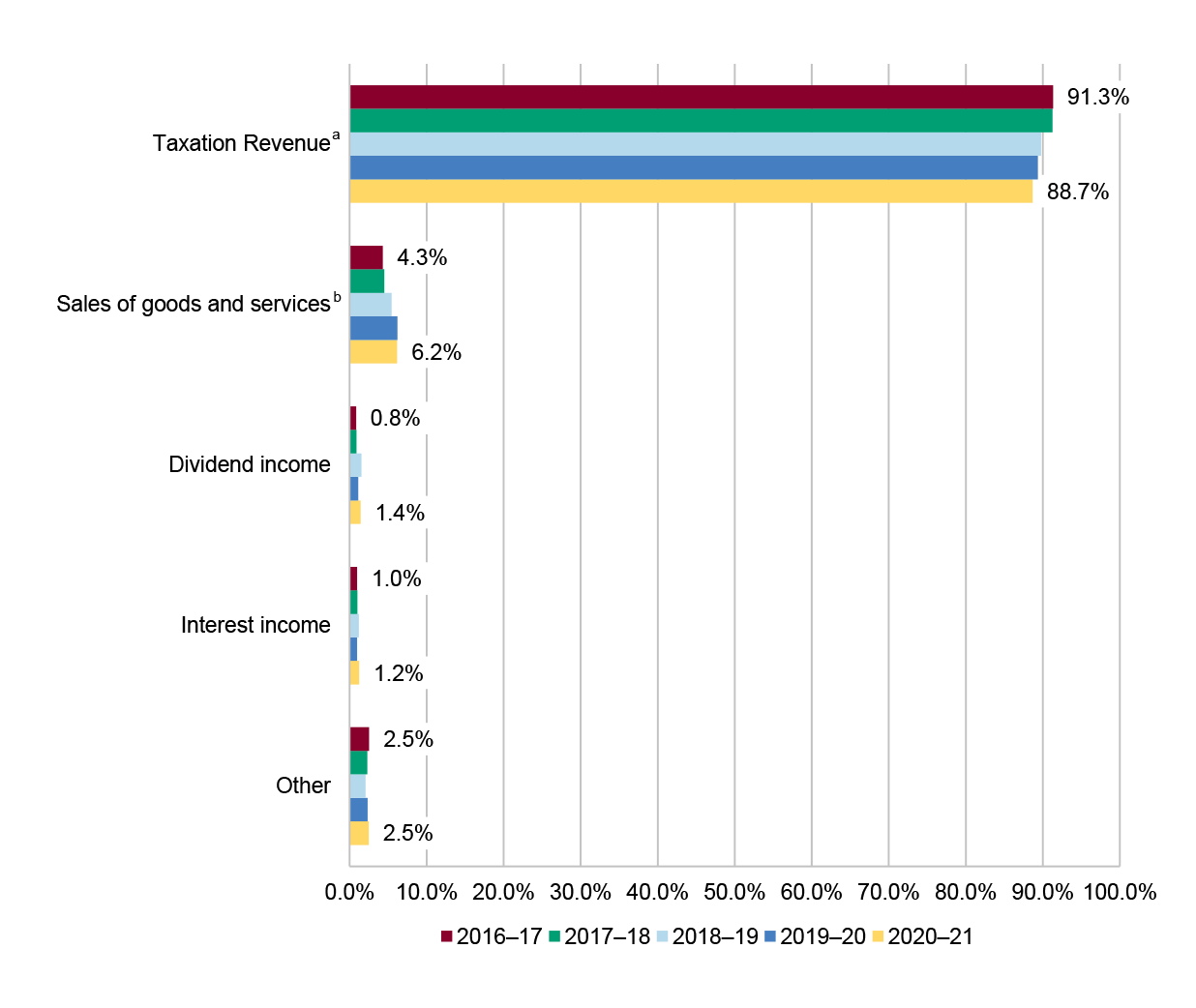

1.13 The Australian Government’s revenue for the year ended 30 June 2021 was $541.2 billion (compared to $500.5 billion for the year ended 30 June 2020). Figure 1.1 provides an analysis of revenue by source from 1 July 2016 to 30 June 2021. Each revenue source as a percentage of total revenue has remained steady with the proportion of taxation revenue decreasing slightly from 91.3 per cent in 2016–17 to 88.7 per cent in 2020–21. Sales of goods and services has increased from 4.3 per cent to 6.2 per cent during the same period. Taxation revenue including company tax, individual tax and sales taxes remains the major source of Australian Government revenue.

Figure 1.1: Australian Government revenue by source from 2016–17 to 2020–21

Note a: In 2020–21 the main sources of taxation revenue included individual tax (49.1 per cent), company tax (20.6 per cent), sales taxes (16.0 per cent), excise duty (5.1 per cent), and customs duty (3.8 per cent).

Note b: Sales of goods and services include revenue received from the provision of regulatory services, rental income, sale of electricity by Snowy Hydro Limited, postal services and the broadband network.

Source: ANAO analysis of CFS from 2016–17 to 2020–21.

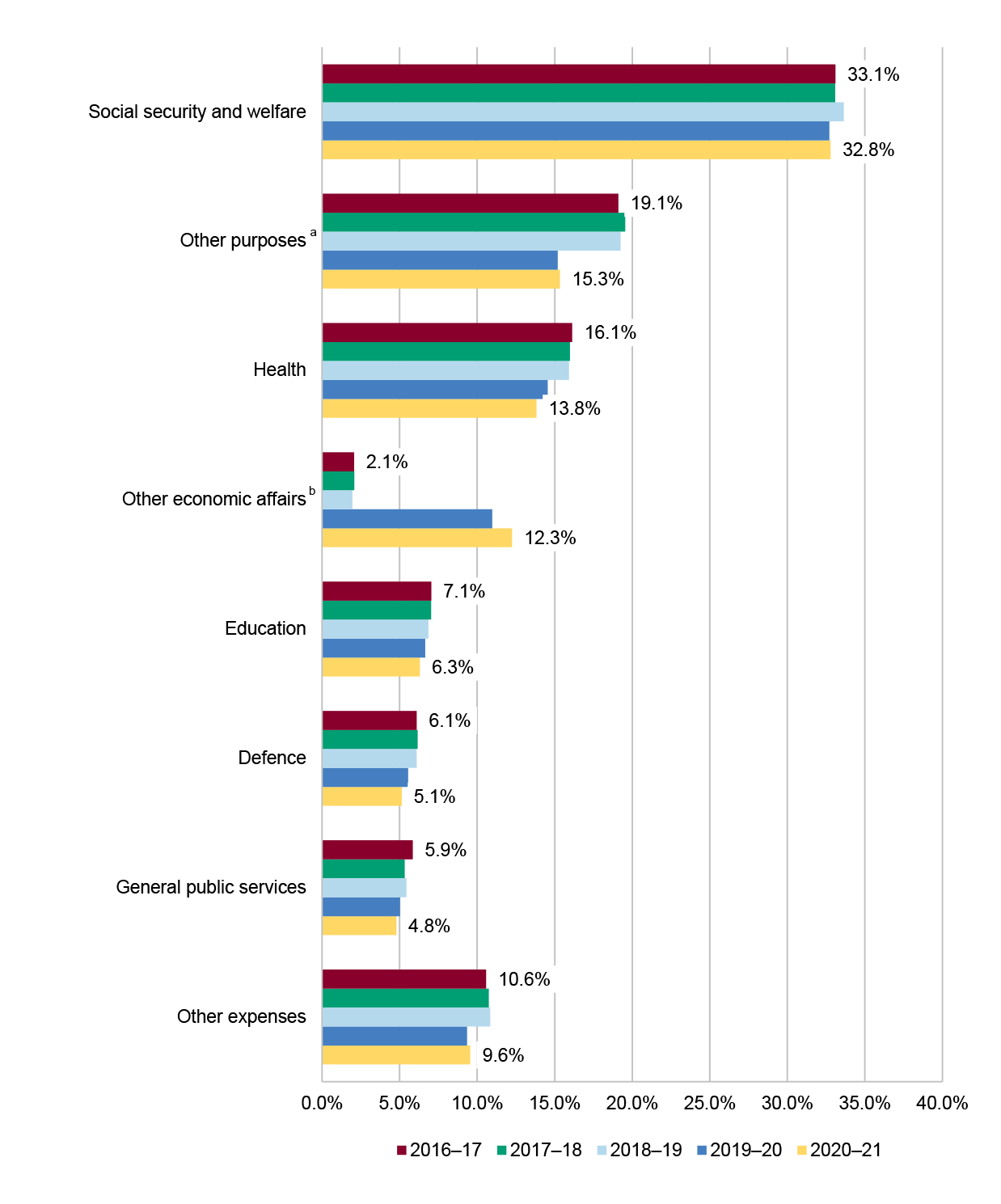

Classification of expenses by the functions of Government

1.14 Figure 1.2 provides an analysis of the Australian Government’s expenses by function from 1 July 2016 to 30 June 2021. As a percentage of total expenses, each function has remained stable during this period with the exception of ‘Other economic affairs’, which increased from 2.1 per cent in 2016–17 to 12.3 per cent in 2020–21. The ‘Other economic affairs’ function had higher expenses in 2019–20 and 2020–21 due to the JobKeeper payments and cash flow boost measures administered by the Australian Taxation Office to support businesses impacted by the effects of the COVID-19 pandemic.

Figure 1.2: Proportion of expenses of Government by function from 2016–17 to 2020–21

Note a: The ‘Other purposes’ function includes payments to: agriculture, forestry and fishing; fuel and energy; housing and community amenities; mining, manufacturing and construction; public order and safety; and transport and communications.

Note b: The ‘Other economic affairs’ function represents non-standard payments including storage, tourism promotion, labour market assistance to industry and industrial relations.

Source: ANAO analysis of the CFS from 2016–17 to 2020–21.

Australian Government’s financial position

Net worth

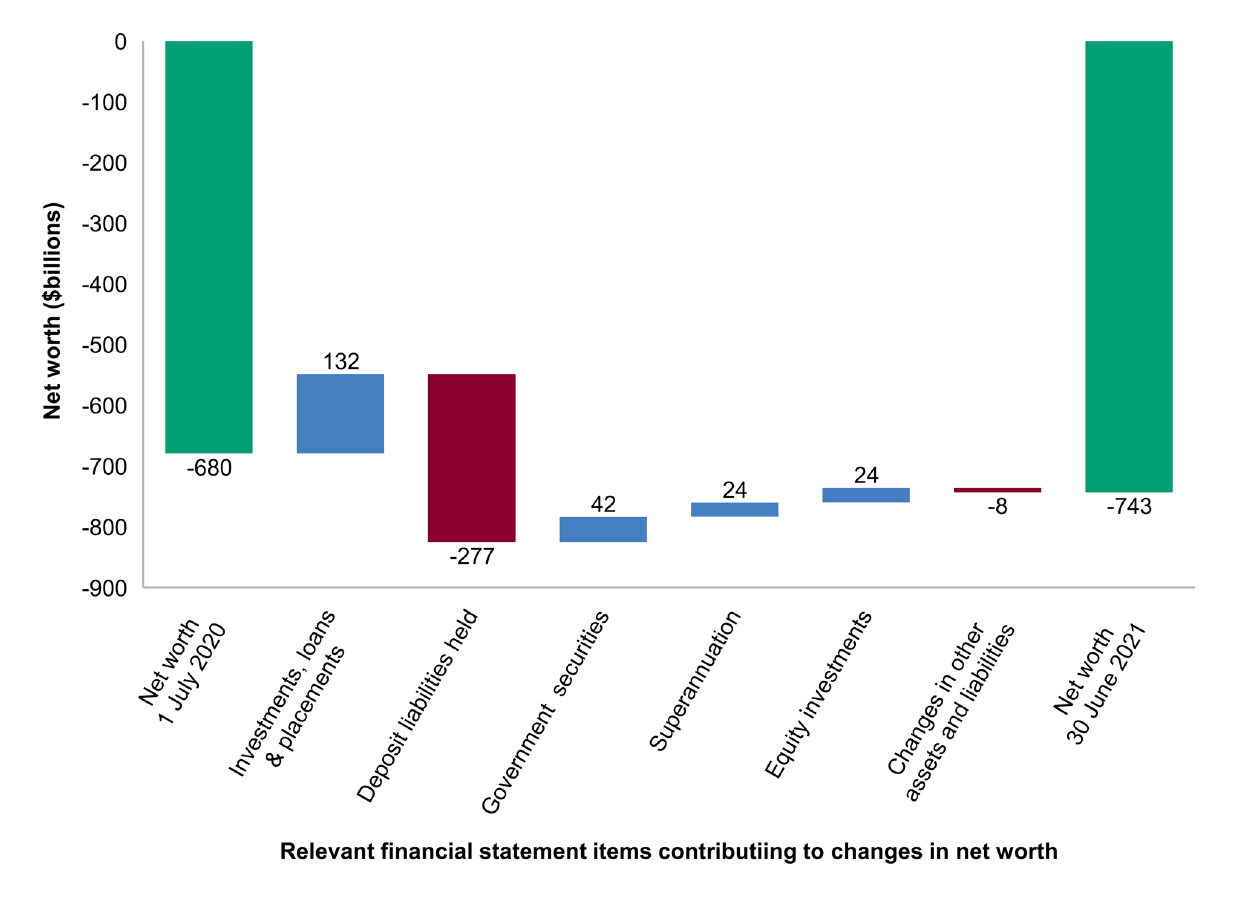

Change in net worth from 1 July 2020 to 30 June 2021

1.15 The Australian Government’s net worth deficiency increased from $679.9 billion in 2019–20 to $743.2 billion in 2020–21. Figure 1.3 provides an analysis of the change in net worth from 1 July 2020 to 30 June 2021.

Figure 1.3: Changes in the Australian Government’s net worth from 1 July 2020 to 30 June 2021

Source: ANAO analysis of 2020–21 CFS.

1.16 Table 1.2 provides an explanation of the key contributors to the change in net worth of the Australian Government between 1 July 2020 and 30 June 2021 identified in Figure 1.3.

Table 1.2: Explanation of key changes in net worth from 1 July 2020 to 30 June 2021

|

Relevant financial statements item |

Explanation for key changes in net worth from 1 July 2020 to 30 June 2021 |

|

Investments, loans & placements |

Investments, loans and placements comprise securities and other non-equity investments held for liquidity or policy purposes. The increase of $131.6 billion includes:

|

|

Deposit liabilities held |

Deposit liabilities held represent the exchange liabilities reported by the RBA. The RBA operates and maintains the interbank settlement system, the Reserve Bank Information and Transfer System (RITS). RITS facilitates the settlement of interbank obligations arising from the range of payments used in Australia including electronic transfer, card, cheque and high value payments. The increase of $277.0 billion is primarily the result of additional deposits by financial institutions to facilitate the expansion of the Term Fund Facility for banks by the RBA in response to the impact of the COVID-19 pandemic. |

|

Government securities |

The Australian Office of Financial Management (AOFM), on behalf of the Australian Government, undertakes debt management activities including the issuance of Australian Government securities, such as, Treasury Bonds, Treasury Indexed Bonds and Treasury Notes, to meet the Australian Government’s financing objectives. The reported value of Government securities for the Australian Government decreased by $42.0 billion. This is primarily driven by:

|

|

Superannuation liabilities |

There was a decrease in the value of the Australian Government’s defined benefit superannuation liability of $23.6 billion due to an increase in the discount rate that has been applied in the calculation of the liability. The discount rate applied in the calculation of superannuation liabilities is consistent with the long-term Australian Government bond rate which increased during the period. An increase in the discount rate has the effect of reducing the present value of the estimated value of future superannuation liabilities. |

|

Equity investments |

Equity investments primarily comprise the Future Fund’s holdings of listed equities and listed managed investment schemes. There was a $24.3 billion increase in the value of these investments due to improvement in fair values as markets recover from the impact of the COVID-19 pandemic. |

|

Changes in other assets and liabilities |

Significant movements in other assets and liabilities include:

|

Source: ANAO analysis of 2020–21 CFS.

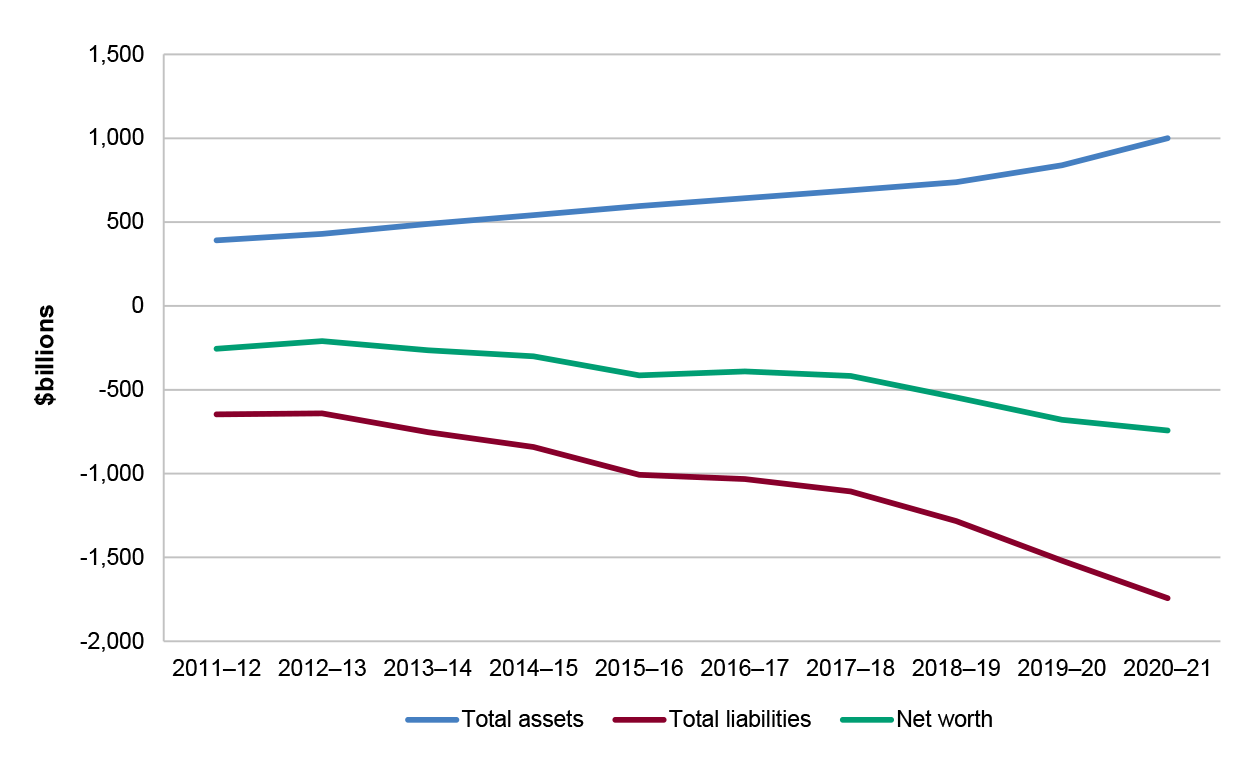

Changes in the Australian Government’s net worth from 2011–12 to 2020–21

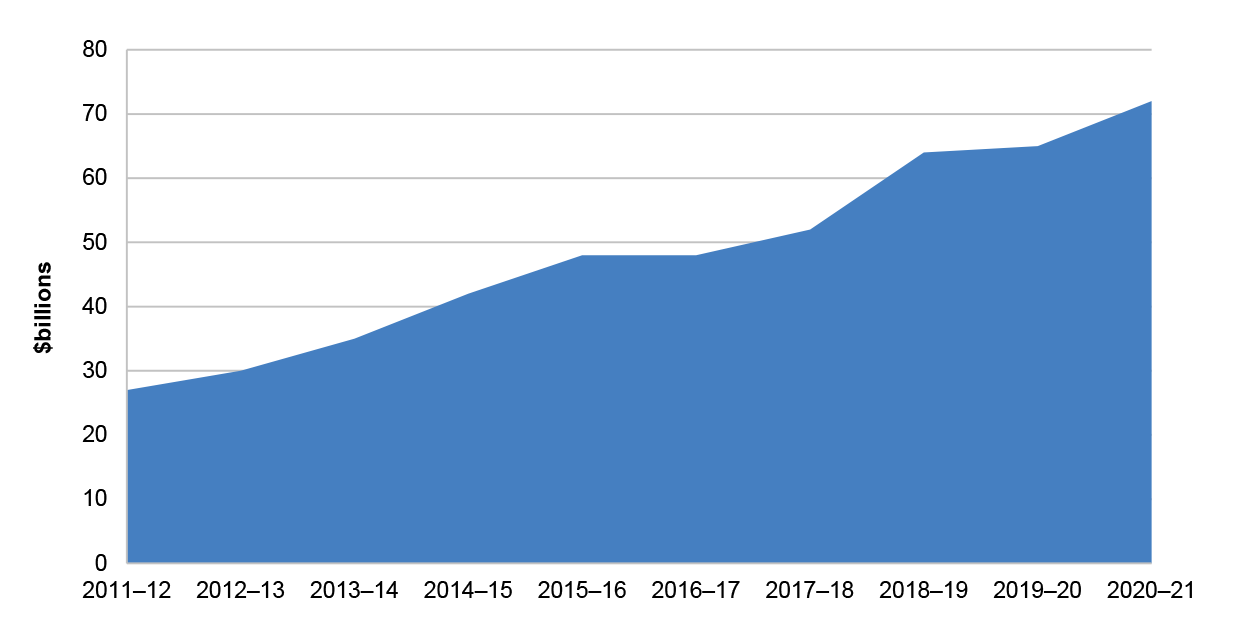

1.17 Figure 1.4 demonstrates the changes in the Australian Government’s total assets, total liabilities and net worth over the period 2011–12 to 2020–21. Total assets increased from $390.6 billion to $1,000.1 billion, total liabilities increased from $647.5 billion to $1,743.3 billion and net worth has decreased from a deficit of $256.9 billion to a deficit of $743.2 billion.

Figure 1.4: Australian Government’s total assets, total liabilities and net worth, from 2011–12 to 2020–21

Source: ANAO analysis of 2011–12 to 2020–21 CFS.

1.18 The primary reasons for the increase in total assets include:

- investments, loans and placements and equity investments increased from $167.2 billion in 2011–12 to in $613.5 billion in 2020–21. A major contributor to this class of assets is the Australian Government’s holding of investments in the Future Fund ($191.4 billion); and

- advances paid and receivables, such as student loans, which increased from $66.6 billion in 2011–12 to $130.8 billion in 2020–21.

1.19 The increase in total liabilities is the result of:

- government securities, from $201.3 billion in 2011–12 to $683.9 billion in 2020–21;

- deposit liabilities held, from $3.0 billion in 2011–12 to $356.0 billion in 2020–21; and

- employee liabilities, including superannuation liabilities and military compensation provision, from $253.1 billion in 2011–12 to $447.5 billion in 2020–21.

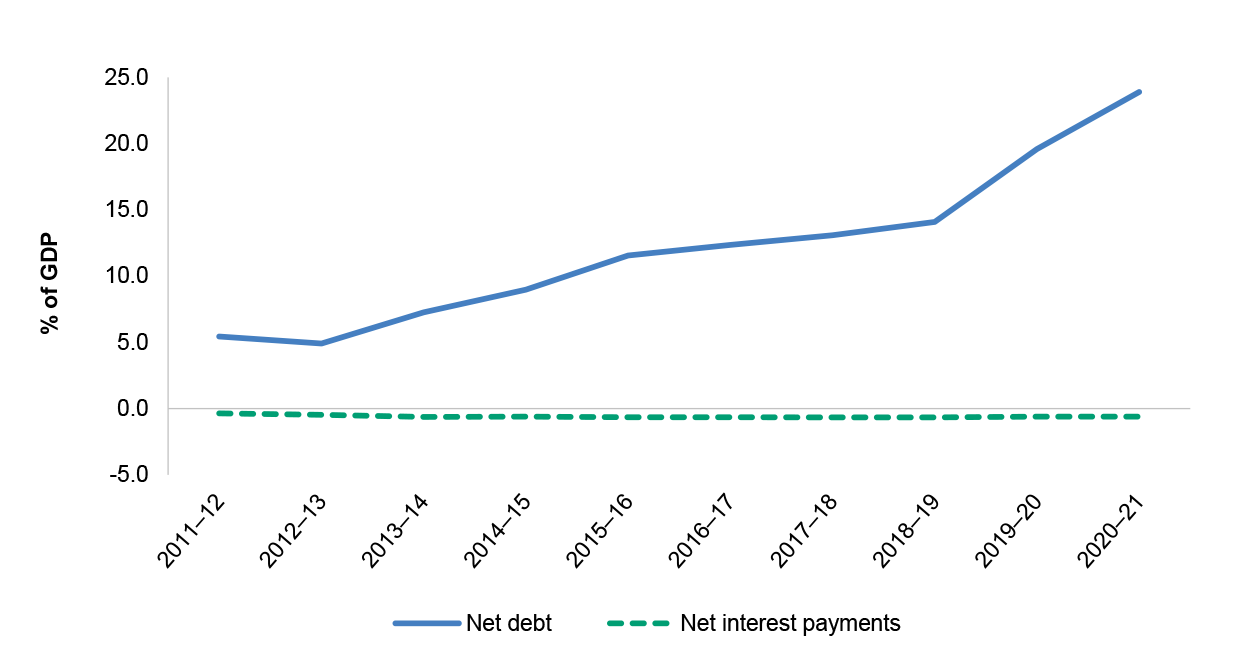

1.20 There has continued to be a steady growth in net debt as a per cent of Gross Domestic Product (GDP) since 2011–12. Figure 1.5 below illustrates the change in the indicators of the net financial position of the Australian Government since 2011–12 as a per cent of GDP.

Figure 1.5: Australian Government net debt position as a per cent of GDP, from 2011–12 to 2020–21

Source: ANAO analysis of 2020–21 commentary on the CFS.

1.21 Net interest payments were $12.9 billion in 2020–21, remaining stable compared to $13.5 billion in 2019–20, reflecting the low interest rates incurred on Government Securities as a result of global economic conditions and the impact of the COVID-19 pandemic on financial markets.3

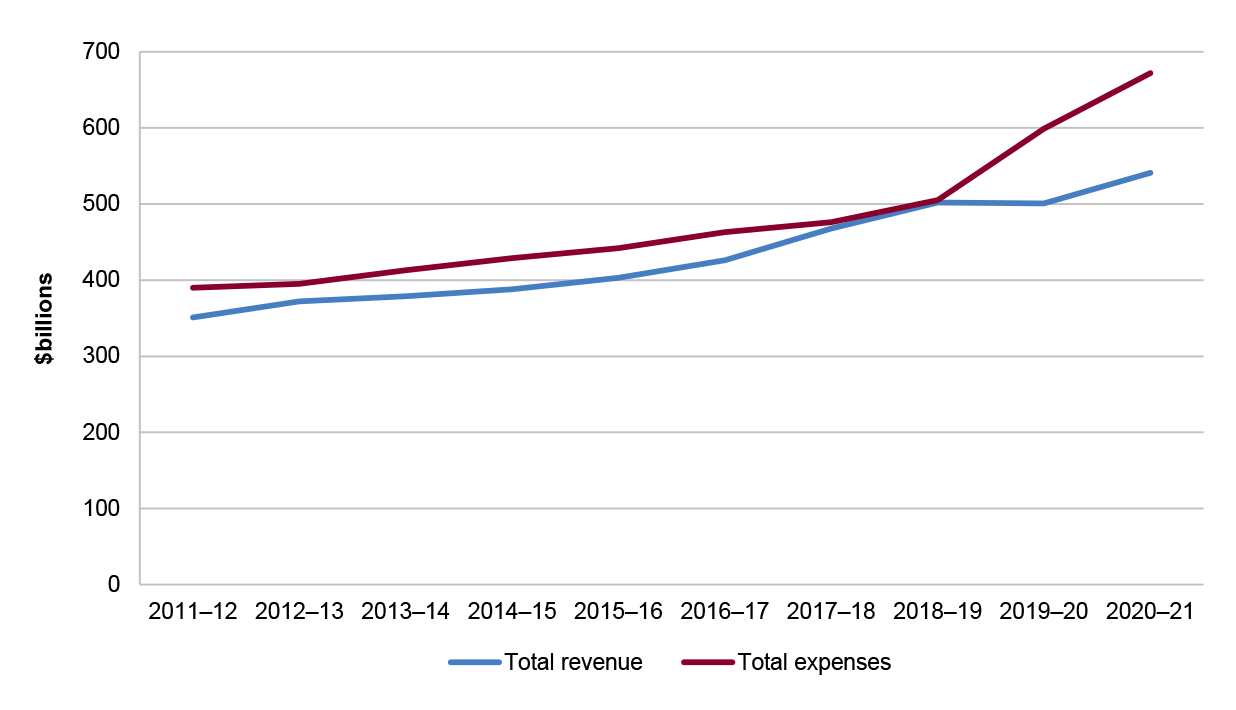

Government securities

1.22 Government securities are primarily issued to meet the financing needs of the Australian Government. Since 2011–12 there has been continued growth in the value of Government securities issued in order to fund the operations of the Australian Government because expenses have been greater than revenue received. Figure 1.6 below illustrates the growth of Australian Government revenue and expenses over the period 2011–12 to 2020–21.

Figure 1.6: Australian Government revenue and expense for the period 2011–12 to 2020–21

Source: ANAO analysis of 2011–12 to 2020–21 CFS.

1.23 Government Securities on issue from the AOFM increased by $132.3 billion (GGS) during the period. However, as a portion of the securities issued are purchased by the RBA for monetary policy purposes, after eliminations for these related transactions, Government Securities decreased by $42.0 billion at the Australian Government level in 2020–21.

1.24 The decrease in the fair value reflects the impact of the increase in yields incurred on Government Securities. For financial reporting purposes the value of Government Securities liabilities is discounted by the yield on the security over the term of the security to settlement. As the yield on these securities increases, the present value of the liability decreases.

Superannuation liabilities and the Future Fund

1.25 The Australian Government has superannuation liabilities arising from obligations to employees for defined benefit superannuation schemes. Note 9C of the CFS provides information on the nature of these schemes. The total superannuation net liability as at 30 June 2021 for these schemes was $407.5 billion (compared to $431.1 billion as at 30 June 2020). The significant balances of the reported net liability relate to the following schemes that are closed to new members:

- Commonwealth Superannuation Scheme ($86.2 billion);

- Public Sector Superannuation Scheme ($137.4 billion);

- Military Superannuation Benefits Scheme ($131.7 billion); and

- Defence Force Retirement and Death Benefits Scheme ($45.8 billion).

1.26 The primary reason for the decrease in the liability is the increase in the discount rate used in valuing the superannuation liability between 30 June 2020 and 30 June 2021.4 The long-term nature of the superannuation liability means that small changes to the discount rate can have a large impact on the estimation of the value of the liability.

1.27 The Future Fund was established by the Future Fund Act 2006 to strengthen the Australian Government’s long-term financial position through the acquisition of financial assets and investments to assist in the discharge of the Australian Government’s superannuation liabilities. The Future Fund’s Board of Guardians is responsible for deciding how to invest the assets of the Future Fund through balancing the risk aspects of each investment mandate to maximise returns.

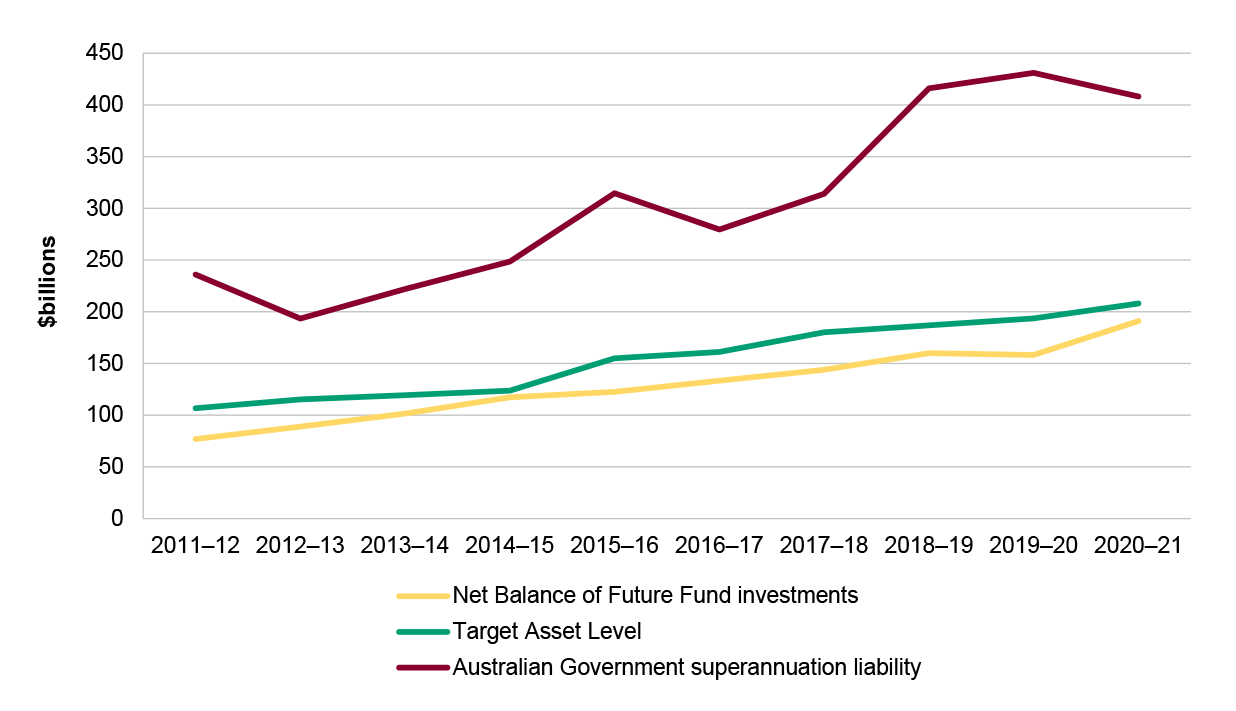

1.28 Figure 1.7 provides an overview of the balances of the Australian Government superannuation liabilities, the net investment balance of the Future Fund and the Target Asset Level (TAL) from 2011–12 to 2020–21.

Figure 1.7: Total value of Australian Government superannuation liabilities and Future Fund investments, and the Target Asset Level, from 2011–12 to 2020–21

Source: ANAO analysis of 2020–21 CFS and the Target Asset Level Declaration issued by the designated actuary of the Future Fund on 25 June 2021.

1.29 The TAL represents the best estimate of the assets required, together with investment earnings on those assets, which would be sufficient to meet future unfunded superannuation benefit payments. As such, the discount rate used to calculate the present value of future payments for TAL purposes represents the expected investment return on Future Fund assets. The Australian Government superannuation liability included in Figure 1.7 reflects the present value of future unfunded superannuation benefits payments discounted using the Commonwealth bond rate, in accordance with Australian Accounting Standards.

1.30 Figure 1.7 illustrates that the 2020–21 estimate of the TAL is $207.5 billion, which is above the current Future Fund net asset balance of $191.4 billion (compared to $158.2 billion in 2019 – 20).5 The Future Fund Act 2006 permits drawdowns, to fund superannuation payments, from 1 July 2020 or when the balance of the Future Fund equals or exceeds the TAL. In 2017 the Australian Government announced it would delay drawdowns from the Future Fund until at least 2026–27.

Non-financial assets

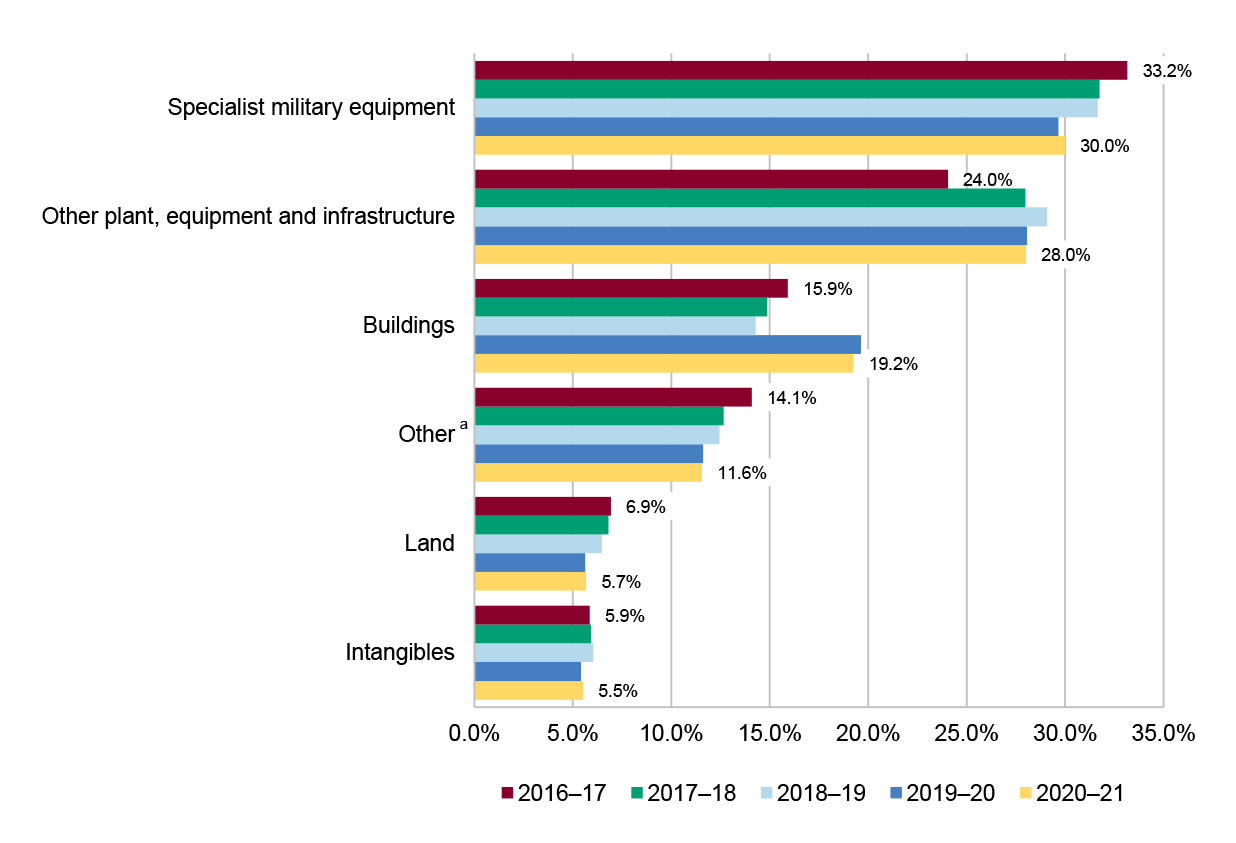

1.31 Non-financial assets comprise the Australian Government’s holdings of land, buildings, plant, equipment and infrastructure, heritage and cultural assets, investment properties and intangibles. The Australian Government’s non-financial assets for the year ended 30 June 2021 was $248.0 billion ($241.8 billion for the year ended 30 June 2020). Figure 1.8 provides an analysis of non-financial assets by source from 1 July 2016 to 30 June 2021.

Figure 1.8: Australian Government assets by class from 2016–17 to 2020–21

Note a: Other comprises inventory, heritage and cultural assets, investment properties and other non-financial assets.

Source: ANAO analysis of CFS from 2016–17 to 2020–21.

1.32 During the period 2016–17 to 2020–21 there have been changes in the composition of the balance of non-financial assets, particularly in relation to specialist military equipment, other plant, equipment and infrastructure and buildings. These changes are:

- specialist military equipment declined from 33.2 per cent in 2016–17 to 30.0 per cent in 2020–21. Whilst the total proportion of the balance of total non-financial assets has decreased, the balance increased by $15.8 billion over the period reflecting capability acquisition and development and fair value changes;

- other infrastructure, plant and equipment increased from 24.0 per cent in 2016–17 to 28.0 per cent in 2020–21. The increase mainly relates to the acquisition or construction of additional infrastructure assets including broadband network infrastructure by NBN Co Limited, electricity generation assets by Snowy Hydro Limited and infrastructure projects such as the construction of the Nancy Bird Walton Western Sydney International Airport; and

- buildings increased from 15.9 per cent in 2016–17 to 19.2 per cent in 2020–21. This change was due to the implementation of Australian Accounting Standard AASB 16 Leases on 1 July 2019, for which a right-of-use asset corresponding to the discounted future cash flows for rented premises was recognised for the first time.

Australian Government loans and equity issued

Investments for policy purposes

1.33 The Australian Government reports fiscal aggregates including net operating balance and underlying cash. These aggregates exclude cash or accounting movements that are of an investment or financing nature, such as investments made for policy purposes and the fair value losses on these investments.

1.34 Investments made for policy purposes have elements of economic and social benefits in addition to providing commercial returns to the Australian Government. There may be some benefits in segregating the commercial and non-commercial portions of the investments to better reflect the implications on key fiscal aggregates.6

1.35 Two key items included in investments made for policy purposes are investments in public corporations and concessional loans. The accounting treatment of investments in public corporations and concessional loans is discussed below.

Investment in public corporations (GGS)

1.36 Investments in Australian Government controlled entities has increased. Consistent with reporting requirements, these investments do not impact net operating balance or underlying cash.

1.37 The majority of these investments are in entities that provide a positive real return to the GGS over the life of the investment and are classified as equity injections. Examples of the difference between these types of equity injections are demonstrated by:

- WSA Co Limited is constructing and operating the Nancy Bird-Walton Western Sydney International Airport. The Australian Government is providing up to $5.3 billion in equity injections to the entity to construct the airport. There is an expectation that the investment will make a positive return over the long-term following the completion of the construction and commencement of the airport operations; and

- Australian Rail Track Corporation Limited (ARTC) is undertaking the construction of the Melbourne to Brisbane Inland Rail line. The Australian Government will provide up to $14.5 billion in equity injections to the entity to construct the Inland Rail Line which will be operated in addition to the entity’s existing business units. The Australian Government makes a return on the entity’s existing operations.

1.38 The impact of the equity injections or operations of these entities is not reflected in the net operating balance unless dividends are received from the entities. The ongoing valuations of these entities are reflected in net worth. If the valuation of these entities deteriorates (for example as a result of accumulating losses or the valuation of future cash flows associated with assets procured through equity injections being less than their purchase costs), the deterioration in the position will be reflected in the GGS’ net worth but not impact on the net operating balance even if the deterioration was a predictable result of a non-commercial policy decision.

1.39 For instance, ARTC’s accounting policy for the assets constructed in relation to the Inland Rail Line is to impair the balance of expenditure to nil value on the construction of Inland Rail. This impairment is based on the judgement that ARTC does not expect the future cash flows from the operation of the Inland Rail Line to exceed the cost of construction and operation, and as a result will not make a real rate of return. At the time of making payments for each equity injection to the entity the Australian Government is aware that no returns are expected from the investment being made to fund the construction of Inland Rail. As the injection is made to an existing entity that achieves a real positive rate of return from existing operations, the injection of equity is treated as an investment. As a result, changes in value of the entity are reflected as a change in net worth, but the cost of making an investment that is not expected to maintain a real positive rate of return is not reflected in the net operating balance or underlying cash balance.

1.40 Table 1.3 shows investments made in Australian Government entities where the equity contributed is greater than $300.0 million.

Table 1.3: Australian Government entities’ contributed equity, net assets and GGS fair value

|

Entity |

Contributed equity $000 |

Net assets $000 |

Fair value (GGS) $000 |

|

Australian Naval Infrastructure Pty Ltd |

1,395,823 |

1,425,775 |

1,425,775 |

|

Australian Postal Corporation |

400,000 |

2,487,900 |

2,300,000 |

|

Australian Rail Track Corporation |

4,291,332 |

2,719,221 |

2,728,400 |

|

Moorebank Intermodal Company |

466,172 |

321,406 |

321,406 |

|

NBN Co Limited |

29,500,000 |

(1,740,000)a |

18,000,000 |

|

Snowy Hydro Limited |

1,375,100b |

2,522,000 |

11,000,000 |

|

WSA Co Limited |

1,744,165 |

612,212c |

999,248c |

Note a: The net equity deficiency reported by NBN Co Limited is mainly due to an increase in the company’s borrowings for medium term notes and private debt during 2020–21.

Note b: Snowy Hydro Limited is currently receiving contributed equity from the Australian Government for the delivery of the Snowy 2.0 hydro-electricity generation project. The balance of contributed equity comprises $816.1 million recognised prior to the Australian Government taking full ownership of the company in July 2018. The remaining contributed equity relates to contributions by the Australian Government after the purchase date.

Note c: The differential in these values is due to the land transferred held under finance lease by WSA Co Limited at nil value. The land has a value for GGS purposes.

Source: ANAO analysis of entity 2020–21 financial statements and the CFS for the year ended 30 June 2021.

Concessional loans

1.41 There has been a continual growth in loans provided by the Australian Government, with a large proportion of these loans being concessional. Concessional loans are loans provided on favourable terms, for example, the interest rate may be below the current market rate for loans of similar risk. Figure 1.9 illustrates the growth in loans and advances paid during the period 2011–12 to 2020–21.

Figure 1.9: Australian Government loans and advances paid from 2011–12 to 2020–21

Source: ANAO analysis of 2011–12 to 2020–21 CFS.

Higher Education Loan Program

1.42 The Higher Education Loan Program (HELP) is the largest Australian Government concessional loan program and is administered by the Department of Education, Skills and Employment (DESE). HELP provides financial assistance to students through income contingent loans to remove up-front cost barriers to tertiary education.

1.43 These loans are indexed to the Consumer Price Index and repayments are linked to the ability to pay based on income thresholds. The income contingent conditions associated with these loans includes not recovering the value of loans outstanding for individuals where income does not meet an annual threshold. In these circumstances the Australian Government forgoes repayment of some loans.

1.44 The policy of making HELP and other student loans income contingent has a significant cost to the Australian Government. The fair value of student loans at 30 June 2021 was $55.5 billion compared to the nominal value of the loans of $70.3 billion. The difference between the nominal value and the fair value includes a total of $14.8 billion that is made up of amounts not expected to be repaid and the impact of the yield curve movement based on 2020–21 actuarial assessment.7 This reflects the accumulated cost to the Australian Government of making the loans income contingent.

1.45 Prior to 2020–21, the Australian Government recognised the change in value of debt not expected to be repaid on HELP loans as a change in fair value. The change in fair value was recognised as an ‘other economic flow’ in the operating statement. Other economic flows include revaluations of assets and liabilities. Under AASB 1049, other economic flows are included in some, but not all, fiscal aggregates reported in the CFS. In particular, they are not included in the net operating balance.

1.46 In preparing the 2020–21 CFS, the Australian Government amended its accounting policy in respect of the treatment of HELP and other student loans. The amended accounting policy now reports the change in value of debt not expected to be repaid as a ‘mutually agreed write down’. Mutually agreed write-downs represent transactions where both parties agree to write-off an amount owing. As a result of the change in accounting policy, the movement in the value of debt not expected to be repaid within a financial year is now recorded in the net operating balance.

Administration of concessional loans

1.47 Five Australian Government entities are established for the purpose of issuing concessional loans, in addition to the HELP loans administered by DESE. The Commonwealth entities are as follows:

- Export Finance Australia (EFA) was established in its current form as a corporate Commonwealth entity in 1991. EFA provides and manages a loan portfolio to support Australian based companies seeking to grow internationally, and overseas infrastructure development.

- AOFM was established as a non-corporate Commonwealth entity in 1999 and undertakes debt management activities including the issuance of Government securities such as Treasury Bonds and Treasury Indexed Bonds. AOFM issues, manages and administers debt.

- National Housing Financing and Investment Corporation (NHFIC) was established as a corporate Commonwealth entity on 30 June 2018. NHFIC provides finance to the community housing sector and uses EFA to provide loan management services and other administrative support. During 2020–21, NHFIC raised $805.0 million through a bond issue to fund the significant portion of the loans it issued. NHFIC reports the loan transactions in its financial statements.

- Regional Investment Corporation (RIC) was established as a corporate Commonwealth entity on 8 March 2018. The RIC administers farm business loans and engages Bendigo Bank as a third-party provider to provide loan management services. The loan balances are reported by the Department of Agriculture, Water and the Environment.

- Northern Australia Infrastructure Facility (NAIF) was established as a corporate Commonwealth entity on 1 July 2016. The primary objective of the entity is to assess infrastructure projects loans. The NAIF utilises the services of EFA to provide back office administrative support. Similar to the RIC, NAIF does not report the loan balances in its financial statements. The infrastructure project loans are reported by the Department of Industry, Science, Energy and Resources.8

1.48 During the financial year NHFIC, RIC and NAIF have either approved the commitment of loans, or made loan advances, as set out in Table 1.4 below. The value of loan commitments and advances made by these entities has increased during 2020–21 compared with 2019–20.

Table 1.4: Loan transactions during 2020–21

|

Entity |

Summary of loan transactions during 2020–21 |

|

Northern Australia Infrastructure Facility |

$1.1 billion of commitments approved. |

|

National Housing Finance Investment Commission |

$948.4 million in loans were advanced. |

|

Regional Investment Corporation |

$2.1 billion of commitments approved. $922.0 million in loans were advanced. |

Source: ANAO analysis of data provided by entities and 2020–21 annual reports.

Definitions used in this chapter

1.49 Table 1.5 below provides a glossary of the key fiscal aggregates and other terminology used in this chapter to explain the Australian Government’s net worth and financial performance.

Table 1.5: Definitions of terms used

|

Name |

Definition |

|

Net operating balance |

This is calculated as income from transactions minus expenses from transactions. It is equivalent to the change in net worth arising from transactions. |

|

Operating result |

Income less expenses, excluding the components of other comprehensive income. Also known as ‘profit and loss’. The operating result includes the net operating balance plus items including net write-down of assets, net gains/(losses) from the sale of assets, net foreign exchange gains/(losses), net interest on derivatives gains/(losses), net fair value gains/(losses) and net other gains/(losses). |

|

Other economic flows |

Changes in the volume or value of an asset or liability that do not result from transactions (e.g. revaluations). |

|

Comprehensive result |

Total change in net worth before transactions with owners in their capacity as owners. Also known as ‘total change in net worth’. |

|

Fiscal balance |

The financing requirement of government, calculated as the net operating balance less the net acquisition of non-financial assets. A positive result reflects a net lending position and a negative result reflects a net borrowing position. Also known as net lending/(borrowing). |

|

Net worth |

Assets less liabilities and shares/contributed capital. The net worth of the Australian Government is defined as assets less liabilities. |

|

Net debt |

Net debt is equal to gross debt minus the stock position in financial assets corresponding to debt instruments. |

|

Net financial worth |

Net financial worth is equal to financial assets minus liabilities. It is a broader measure than net debt in that it incorporates provisions made (such as superannuation but excluding depreciation and bad debts) as well as holdings of equity. Net financial worth includes all classes of financial assets and liabilities, only some of which are included in net debt. |

|

Australian Government Securities |

All securities issued by the Australian Government at tenders conducted by the AOFM. They comprise Treasury Bonds, Treasury Notes, Treasury Indexed Bonds. |

|

Investments for policy purposes |

Acquisitions of financial assets for policy purposes are distinguished from investments by the underlying government motivation for acquiring the assets. Where assets are acquired for the purpose of implementing or promoting government policy (e.g. loans to assist industry development), the acquisition of the assets is treated as being for policy purposes. Acquisition of financial assets for policy purposes includes government policies encouraging the development of certain industries or assisting citizens affected by natural disaster. |

|

Cash surplus/deficit |

Net cash flows from operating activities plus net cash flows from acquisition and disposal of non-financial assets less distributions paid less the value of assets acquired under finance leases and similar arrangements. |

|

Underlying cash balance |

Net cash receipts from operations less net capital investment (including by finance lease). |

Source: Australian Bureau of Statistics (2015). Australian System of Government Finance Statistics: Concepts, Sources and Methods; AASB 101 Preparation of Financial Statements, paragraph 5 and 7; AASB 1049 Whole of Government and General Government Sector Financial Reporting, Appendix A; and Reserve Bank of Australia (2017). Glossary RBA. [online] Available at: https://www.rba.gov.au/glossary/> [Accessed 27 October 2021].

2. Financial audit results and other matters

Chapter coverage

This chapter provides a summary of the:

- 2020–21 auditor’s reports issued by the ANAO;

- observations regarding entities’ internal control environments;

- a summary of unadjusted audit differences;

- a summary of the reporting of key audit matters (KAM); and

- findings identified during the course of the 2020–21 financial statements audits of entities.

This chapter also provides analysis of the:

- quality and timeliness of financial statements preparation;

- timeliness of entities’ financial reporting;

- removal of user access; and

- financial sustainability of material entities.

Conclusion

The ANAO issued 241 unmodified auditor’s reports, including the Australian Government’s Consolidated Financial Statements (CFS), and one modified auditor’s report as at 19 November 2021. For the majority of entities, at the completion of the final audits, key elements of internal control were operating effectively to provide reasonable assurance that the entities were able to prepare financial statements that were free from material misstatement. For two entities, significant findings were identified which reduced the level of confidence and assurance that could be placed on key elements of internal control.

A quality financial statements preparation process will reduce the risk of untimely, inaccurate or unreliable reporting. Seventy-two per cent of entities delivered financial statements in line with an agreed timetable. The ANAO noted a decrease in findings relating to processes supporting financial statements preparation; improved delivery of draft financial statements in line with entity financial statements project plans; a decrease in the number of unadjusted audit differences; and a decrease in overall total value of unadjusted audit differences reported to entities in 2020–21 compared to 2019–20.

The financial statements were finalised and auditor’s reports issued for 89 per cent of entities within three months of financial year-end. On average it took entities 41 days after the auditor’s report was issued to table their annual reports in Parliament. Eighty-four per cent of entities that are required to table an annual report in Parliament tabled prior to or on the date that the portfolio’s Senate estimates hearing commenced. Of the remaining entities, eight per cent had not tabled an annual report as at 19 November 2021.

The ANAO has applied ASA 701 Communicating Key Audit Matters in the Independent Auditor’s Report for the 25 entities included in Auditor-General Report No.40 Interim Report on Key Financial Controls of Major Entities and the CFS. In 2020–21 a total of 58 key audit matters (KAM) were included across the 25 entities and seven KAM were included in the CFS auditor’s report.

An analysis of the operating results and balance sheet positions for material entities concluded that the financial sustainability for the majority of those entities was not at risk. Nevertheless, there would be benefit in the Government developing performance targets or benchmarks. This would enable an entity to assess its own financial sustainability against agreed parameters over time, and against like entities.

ISM Security Control 0430 specifies that access is removed or suspended on the same day personnel no longer have a legitimate requirement for access. An assessment of the IT control environment was performed on 18 interim report entities. The assessment includes a review of Security Control 0430. The ANAO identified eight of these entities did not adequately implement Security Control 0430 which resulted in user accounts remaining active after staff no longer required the access. Five out of the eight entities had user accounts that were accessed after the date where access was no longer required.

A total of 164 findings were reported to entities as a result of the 2020–21 financial statements audits. These comprised two significant, 21 moderate, 127 minor findings and 14 legislative findings. The highest number of significant and moderate findings are in the categories of:

- IT security management and user access, in particular the management of privileged users; and

- accounting and control of non-financial assets.

Three significant legislative breaches were reported, one of which has remained open since 2012–13. Eight of the 14 legislative breaches related to remuneration of key management personnel.

Introduction

2.1 The Auditor-General is required to complete the financial statements audits of all Australian Government entities and controlled subsidiaries on an annual basis.9 This chapter summarises the results of the 2020–21 financial statements audits and provides commentary on specific topics which relate to the governance and administration of entities.

Summary of 2020–21 auditor’s reports

2.2 A comparison of the number and type of auditor’s reports issued by the Auditor-General and his delegates in 2019–20 and 2020–21 (as at 19 November 2021), including the CFS is summarised at Table 2.1. Additional detail relating to the financial reporting frameworks applicable to the Australian Government, and the form and content of auditor’s reports is outlined in appendices 3 and 4.

Table 2.1: Summary of auditor’s reports issued and outstanding as at 19 November 2021

|

Auditor’s report |

2020–21 |

2019–20 |

|

Unmodified |

241 |

232 |

|

Included an emphasis of matter |

7a |

5 |

|

Included a Report on other legal and regulatory requirements |

0 |

0 |

|

Modified |

1b |

1b |

|

Auditor’s reports issued |

242 |

233 |

|

Not yet issued |

3c |

13d |

|

Total number of financial statements auditse |

245f |

246f |

Note a: Australian Human Rights Commission, ANSTO Nuclear Medicine Pty Ltd, Department of Veterans’ Affairs, Gagudju Crocodile Hotel Trust, Indigenous Land and Sea Corporation, Kakadu Tourism (GCH) Pty Ltd, Voyages Indigenous Tourism Australia Pty Ltd.

Note b: National Australia Day Council. For further details of the current year qualification, refer to Chapter 4, paragraphs 4.12.60 – 4.12.64.

Note c: The 2020–21 financial statements audit had not been finalised for the following entities: Anindilyakwa Land Council, Australian Secret Intelligence Service and Tiwi Land Council.

Note d: As at 24 November 2020, the 2019–20 financial statements audit had not been finalised for the following entities: Darwin Hotel Partnership, Gagudju Crocodile Hotel Trust; Gagudju Lodge Cooinda Trust; Ikara Wilpena Enterprises Pty Ltd; Ikara Wilpena Holdings Trust; Kakadu Tourism (GCH) Pty Ltd; Kakadu Tourism (GLC) Pty Ltd; North Australia Aboriginal Corporation; Northern Australian Aboriginal Charitable Trust; Northern Land Council; Tennant Creek Land Holding Trust; Tjapukai Aboriginal Cultural Park Partnership and Wilpena Pound Aerodrome Services Pty Ltd.

Note e: An additional Commonwealth entity existed at 30 June 2021 that was not included in the total number of financial statements audits in the table above. The Royal Australian Navy Central Canteens Board registered a new subsidiary, Win with Navy Ltd, on 13 April 2021. Under section 323D of the Corporations Act 2001, the directors of this new entity have the option of extending the initial financial year to 30 June 2022 if this extension is no longer than 18 months from the date of registration. On this basis, no financial statements were produced by Win with Navy Ltd for the year ended 30 June 2021.

Note f: The Consolidated Financial Statements was included in the total number of financial statements audits.

Source: 2019–20 and 2020–21 ANAO auditor’s reports.

Internal control environment

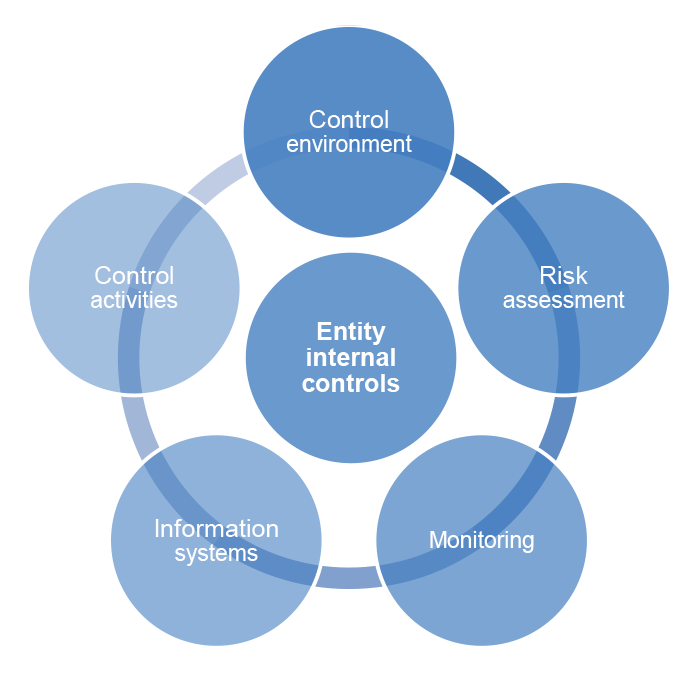

2.3 The ANAO uses the framework in ASA 315 Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and its Environment to consider the impact of elements of an entity’s internal controls supporting the preparation of financial statements. This approach provides a basis for designing and implementing responses to the assessed risk of material misstatement. Figure 2.1 below outlines these elements.

Figure 2.1: Elements of entity internal controls

Source: ASA 315 Identifying and assessing the risk of material misstatement through understanding the entity and its environment, paragraph A59.

2.4 In assessing the effectiveness of an entity’s control environment to support the preparation of financial statements, the ANAO examines aspects of entities’ governance structures. The ANAO considers whether management has established frameworks and processes that promote positive attitudes, awareness and actions concerning the entity’s internal controls and the importance of these to the entity. The main elements reviewed include: governance structures relevant to the preparation of the financial statements; audit committee and assurance arrangements; and systems of authorisation, recording and procedures. For information relating to the assessment of the removal of user access, refer to paragraphs 2.35 to 2.50.

2.5 An effective internal control framework provides a level of assurance that entities are able to prepare financial statements that are free from material misstatement. For the majority of entities, key elements of internal control were operating effectively, providing the ANAO with reasonable assurance that the prepared financial statements were free from material misstatement.

2.6 For 11 entities, except for moderate finding/s outlined in Chapter 4, the key elements of internal control were operating effectively to support the preparation of financial statements free from material misstatement.10 ANAO identified significant findings for two entities which reduced the level of confidence and assurance that could be placed on the key elements of internal control.11

Quality and timeliness of financial statements preparation

2.7 The primary purpose of financial statements is to provide relevant and reliable information to users about a reporting entity’s financial position. Public sector auditors have additional responsibilities to report on compliance with law, regulation or other authority. As a result, their review of internal control may be broader and more detailed.12

2.8 The ANAO applies these objectives in undertaking financial statements audits and considers areas that may give rise to risks of non-compliance with mandatory reporting requirements, or risks relating to the effectiveness of internal control when planning and performing the audit. Financial statements preparation is often a complex task, involving compliance with a number of requirements established by Australian accounting standards and the Public Governance, Performance and Accountability (Financial Reporting) Rule 2015 (the FRR).

2.9 In order to provide relevant and reliable financial information to the users, entities should prepare quality financial statements in a timely manner to support entities to meet legislative reporting obligations including the tabling of annual reports. The preparation of quality financial statements will be evidenced by adherence to a well-defined financial statements preparation timetable with minimal adjustments required to financial statements throughout the audit process.

2.10 Each year the ANAO reports on the quality of financial statements preparation to entities. At the completion of the 2020–21 financial statements audit, the ANAO reported 8 minor findings relating to processes supporting financial statements preparation. This is a decrease from 2019–20 where 3 moderate and 10 minor findings were reported to entities.

2.11 In 2020–21, the ANAO also assessed the timeliness of financial statements preparation. Timeliness in preparation was assessed by comparing the date of delivery of the financial statements to agreed timeframes. The timeframe was established by entities and agreed with audit teams for the delivery of financial statements.

2.12 Timeliness in financial statements preparation improved compared to the prior year, with delivery of financial statements in line with the agreed timeframes achieved by 72 per cent of entities (compared with 64 per cent in 2019–20). A further 13 per cent of entities delivered financial statements within one week of the agreed timeframe (compared to 25 per cent in 2019–20). The remaining 15 per cent of entities provided their financial statements on average 16 working days after the agreed timeframe (compared with 11 days in 2019–20).

2.13 The quality of financial statements preparation was assessed by considering the number and value of audit differences identified. Throughout the financial statements audit process, audit differences other than those considered trivial are communicated to entities. Entities are encouraged to adjust all audit differences.13

2.14 There was a decrease in the number of unadjusted audit differences in 2020–21, with 91 unadjusted audit differences reported (compared with 98 in 2019–20). Of these unadjusted differences, 50 related to material entities compared with 61 in 2019–20).14 With the exception of the National Australia Day Council, the unadjusted differences, both in aggregate and individually, did not result in a material misstatement to the financial statements of the audited entities.15

2.15 While there was a decrease in the total number of unadjusted audit differences compared to 2019–20, Table 2.2 shows that the net value impact has increased in 2020–21 for two of the five categories.

Table 2.2: Total value of unadjusted audit differences ($ million)

|

|

2020–21 |

2019–20 |

||||

|

|

Debit impact |

Credit impact |

Net impact |

Debit impact |

Credit impact |

Net impact |

|

Revenue |

577.9 |

(353.5) |

224.5 |

76.7 |

(1,014.1) |

(937.4) |

|

Expenses |

526.9 |

(457.3) |

69.6 |

981.6 |

(106.2) |

875.4 |

|

Assets |

326.2 |

(644.9) |

(318.8) |

198.2 |

(112.2) |

86.0 |

|

Liabilities |

345.9 |

(276.2) |

69.7 |

135.6 |

(106.6) |

29.0 |

|

Equity |

514.4 |

(559.5) |

(45.0) |

31.1 |

(84.1) |

(53.0) |

Source: ANAO analysis of entity closing reports.

2.16 Of the unadjusted differences identified as a result of the 2020–21 financial statements audits, a total of five adjustments relating to two entities were made at the CFS level. The two entities were the Australian Taxation Office and the Department of Defence.

2.17 The ANAO reported a decrease in findings related to processes supporting financial statements preparation, a decrease in the number of unadjusted audit differences and a decrease in overall total value of unadjusted audit differences reported to entities in 2020–21 compared to 2019–20. Noting the reductions indicate some improvements have been made, there still remains an opportunity to improve quality assurance frameworks over financial statements processes.

2.18 The ANAO recommends that entities continue to enhance their quality assurance frameworks, to ensure that significant accounting policies, estimates and adjustments underpinning financial statements are reviewed as early as possible in the preparation process. In their assurance role, audit committees are encouraged to actively support management through the critical evaluation of accounting papers and holding entities to account for delivering on agreed timetables and taking up all identified audit adjustments.

Timeliness of financial reporting

2.19 The finalisation of financial statements preparation and audit is marked by the signing of financial statements and associated auditor’s report.

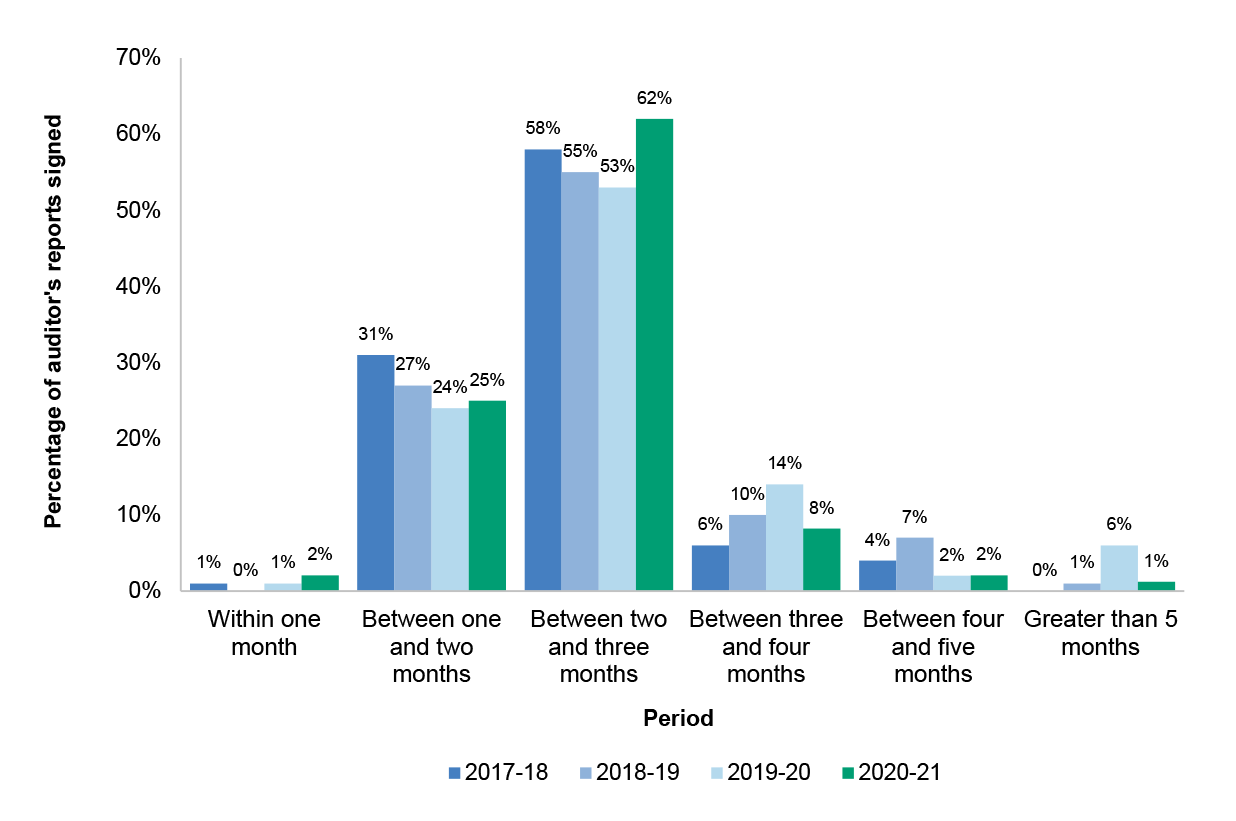

2.20 Figure 2.2 shows that the percentage of entities with financial statements and the associated auditor’s report signed within three months of the reporting year-end has significantly improved between 2019–20 and 2020–21. Eighty-nine per cent of financial statements were signed and associated auditor’s reports issued, within three months of year-end compared to 78 per cent in 2019–20. The ANAO issued 98 per cent of auditor’s reports within two business days of the signing of the financial statements by the accountable authority, compared with 91 per cent in 2019–20.

Figure 2.2: Timeframes for auditor’s report signing from the end of financial year

Source: ANAO data.

2.21 Annual reports inform the Parliament, the community and other stakeholders about the performance of entities. The publication of the annual report containing the audited financial statements is a key means to meet accountability and legislative obligations. Of the 244 mandated financial statements audits, 186 are required to present annual reports to the responsible minister under the Public Governance, Performance and Accountability Act 2013.16

2.22 Annual reports are approved by the entity’s accountable authority before being provided to the minister and tabled in Parliament. The Resource Management Guides (RMG) 135 Annual report for non-corporate Commonwealth entities, and 136 Annual report for corporate Commonwealth entities state that annual reports are to be provided to the relevant minister by the 15th day of the fourth month after the end of the reporting period. The RMG 137 Annual report for Commonwealth companies states that Commonwealth company directors must give the annual report to the responsible Minister the earlier of 21 days before the next annual general meeting after the end of the reporting period for the company or 4 months after the end of the reporting period for the company.

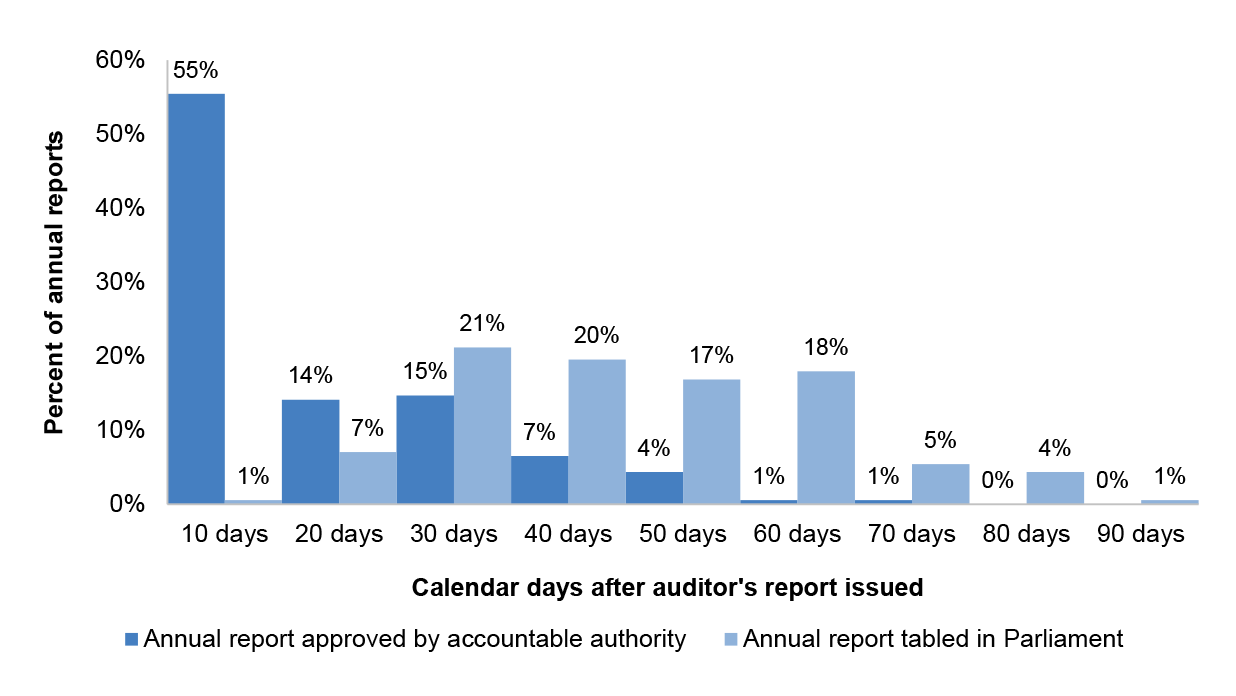

2.23 Figure 2.3 shows the time in days between the issue of the auditor’s report to the:

- approval of the annual report by the accountable authority; and

- tabling of the annual report in Parliament.

Figure 2.3: Timeframe for tabling 2020–21 annual reports from issuance of auditor’s report

Source: ANAO analysis.

2.24 The analysis above shows that accountable authorities approved 55 per cent of annual reports within 10 days of the issue of the auditor’s report (compared to 58 per cent in 2019–20), with an overall average of 12 days. The average days between the accountable authority’s approval of the annual report and tabling in Parliament was 29 days (one day more than in 2019–20).

2.25 Twenty-nine per cent of annual reports were tabled within 30 calendar days from the issue of the auditor’s report (compared to 35 per cent in 2019–20). The tabling of annual reports in Parliament occurred on average 41 days after the auditor’s report was issued (one day less than compared with 2019–20). There are 12 entities that are required to table an annual report for 2020–21 which have not done so as at 19 November 2021.

2.26 Annual reports should be tabled in Parliament to allow sufficient time for review before Senate estimates hearings. The RMGs on annual reports indicate that normally annual reports are tabled on or before 31 October and it is expected annual reports are tabled prior to the October estimates hearings.

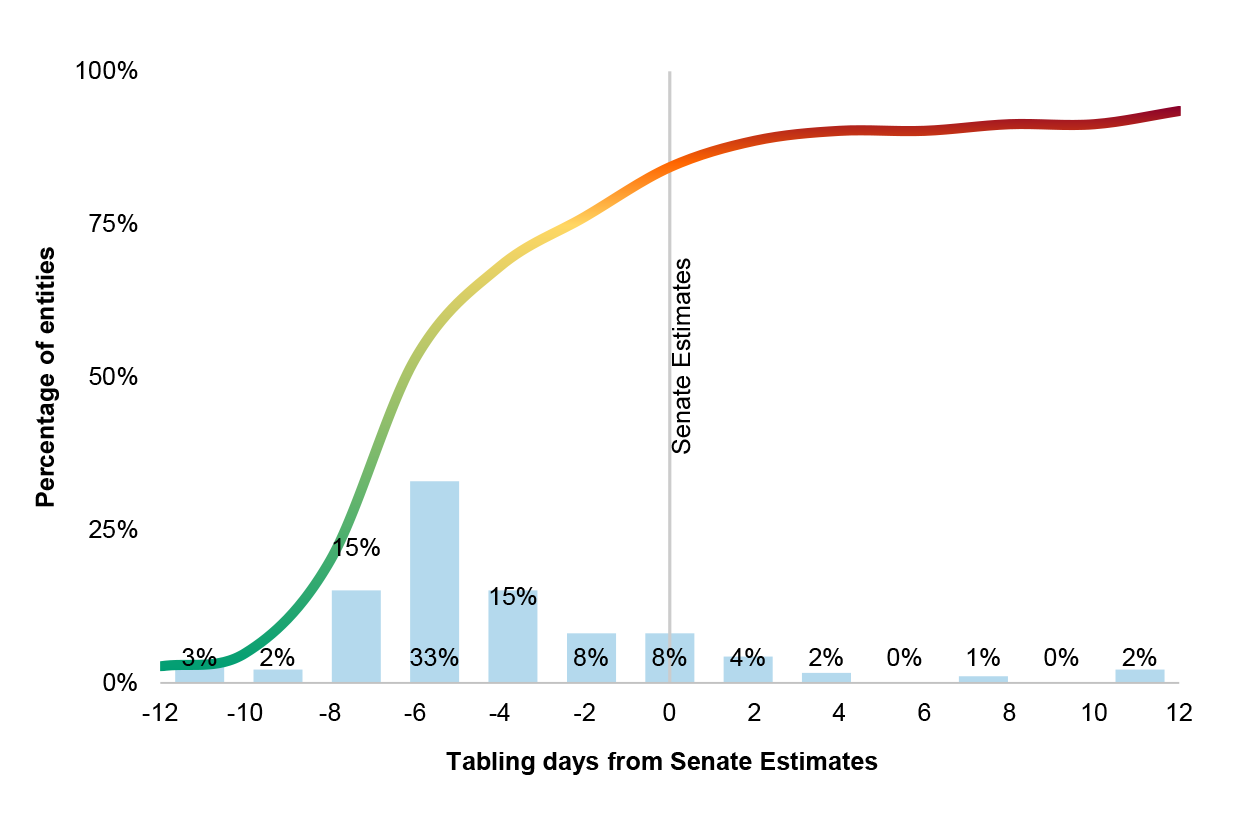

Figure 2.4: 2020–21 annual report tabling date in relation to Senate estimates hearing, as at 19 November 2021

Source: ANAO analysis.

2.27 Figure 2.4 above shows that 84 per cent of annual reports were tabled on or before the 2020–21 estimates hearing dates compared to 62 per cent in 2019–20. There were eight material entities across six portfolios which either tabled annual reports after the portfolio’s 2021–22 Senate estimates hearing (consistent with 2019–20) or had not tabled as at 19 November 2021. Table 2.3 includes further details about those entities that did not provide 2020–21 annual reports prior to Senate estimate hearings.

Table 2.3: Annual reports tabled after the portfolio’s Senate estimates hearings for material entities, as at 19 November 2021

|

Reporting entity |

Date auditor’s report issued |

Approval of annual reporta |

Annual report tabling date |

Senate estimates dateb |

|

Attorney-General’s portfolio |

||||

|

High Court of Australiac |

25 Aug 21 |

8 Nov 21 |

|

26 Oct 21 |

|

Defence portfolio |

||||

|

Australian War Memorial |

30 Aug 21 |

20 Sept 21 |

4 Nov 21 |

27 Oct 21 |

|

Health portfolio |

||||

|

National Blood Authority |

2 Sept 21 |

12 Oct 21 |

|

27 Oct 21 |

|

Infrastructure, Transport, Regional Development and Communications portfolio |

||||

|

Moorebank Intermodal Company Limited |

8 Oct 21 |

30 Sept 21 |

29 Oct 21 |

25 Oct 21 |

|

National Capital Authority |

31 Aug 21 |

12 Oct 21 |

29 Oct 21 |

25 Oct 21 |

|

National Library of Australia |

13 Aug 21 |

13 Aug 21 |

26 Oct 21 |

25 Oct 21 |

|

Prime Minister and Cabinet portfolio |

||||

|

Indigenous Business Australia |

22 Sept 21 |

28 Sept 21 |

26 Oct 21 |

25 Oct 21 |

|

Treasury portfolio |

||||

|

Australian Office of Financial Management |

31 Aug 21 |

12 Oct 21 |

29 Oct 21 |

27 Oct 21 |

Note a: The date of the accountable authority’s approval of the annual report is taken as either the date on the transmittal letter or the date the board approved the annual report.

Note b: This date is the first appearance for the portfolio at the 2021–22 Senate budget estimates hearing.

Note c: The requirements for the tabling of the annual report for the High Court of Australia are outlined in s47(1) of the High Court of Australia Act 1979 (Cth). The High Court of Australia must, as soon as practicable after 30 June, prepare and submit to the Minister a report relating to the administration of the affairs of the High Court under section 17 during the year that ended on that 30 June, together with financial statements in respect of that year in such form as the Minister for Finance approves.

Source: ANAO analysis.

Key audit matters

2.28 ASA 701 Communicating Key Audit Matters in the Independent Auditor’s Report (ASA 701) has been applicable since 2016–17. While ASA 701 only requires KAM reporting for listed entities, the Auditor-General considers including KAM to be good practice for financial statements auditing. The Auditor-General initially adopted inclusion of KAM in 2016–17 and has continued to include KAM in 2020–21 for the entities included in Auditor-General Report No. 40 Interim Report on Key Financial Controls of Major Entities (ANAO Report No.40). KAM have also been communicated for the Consolidated Financial Statements (CFS) from 2017–18.

2.29 In addition to the CFS, KAM have been reported for the following entities17:

- Australian Office of Financial Management;

- Australian Postal Corporation;

- Australian Taxation Office;

- Departments of: Agriculture, Water and the Environment; Defence; Education, Skills and Employment; Finance; Foreign Affairs and Trade; Health; Home Affairs; Industry, Science, Energy and Resources; Infrastructure, Transport, Regional Development and Communications; Parliamentary Services; Social Services; the Prime Minister and Cabinet; the Treasury; and Veterans’ Affairs;

- Future Fund Management Agency and the Board of Guardians;

- National Disability Insurance Scheme Launch Transition Agency (National Disability Insurance Agency);

- National Indigenous Australians Agency;

- NBN Co Limited;

- Reserve Bank of Australia;

- Services Australia; and

- Snowy Hydro Limited.18

2.30 The purpose of communicating KAM is to provide greater transparency about the audit that was performed. Communicating KAM helps users of financial statements better understand those matters that, in the auditor’s professional judgement, were of the most significance in the audit of the financial statements. The audit opinion is made for the financial statements as a whole. Accordingly, the description of KAM does not provide a separate conclusion on the matter being described, nor does it imply that the matter has been appropriately resolved in forming the overall opinion.

2.31 At the commencement of each financial statements audit, an assessment is made on the relevance of KAM for that year. In 2020–21, a total of 58 KAM were reported across 24 entities (compared with 56 KAM reported from 23 entities in 2019–20). The number of KAM per entity for 2020–21 ranged from one to five (same as for 2019–20). A number of factors were considered in determining KAM, including reliance on third parties for data and balances that are underpinned by significant judgements and assumptions.

2.32 The majority of KAM in 2020–21 related to the valuation assertion for assets and liabilities such as:

- loans and other receivables;

- property, plant and equipment;

- investments;

- intangibles;

- provisions; and

- concessional loans.

2.33 Other KAM included: completeness and accuracy of expenses relating to subsidies and personal benefits, and other payments; and completeness and accuracy of revenue relating to taxation, royalty and other revenue.

2.34 Snowy Hydro Limited was included in 2020–21. Three new KAM were reported:

- valuation, existence and completeness of financial instruments - energy derivatives;

- valuation of property, plant and equipment – construction in progress; and

- valuation of allowance for doubtful debts.19

Removal of user access

2.35 The operating environment has changed significantly since the Australian Government released the Digital Transformation Strategy in 2018.20 The global COVID-19 pandemic has resulted in Australians shifting towards digital services and the Australian Government shifting its workforce to remote working arrangements to support the delivery of services and outcomes.

2.36 The changes in the operating environment have expanded the boundaries of government entities’ computer networks and have increased the opportunities for malicious actors. The Australian Cyber Security Centre (ACSC) stated that cyber threats will continue to increase as technology is further utilised to support Australians, government and business activities.21 The persistent threats require organisations to control access to their computer networks and to reduce the risks of unauthorised access to important information.

2.37 The Protective Security Policy Framework (PSPF) and Australian Government Information Security Manual (ISM) assist organisations to use their risk management framework to protect information and systems from both internal and external threats. The PSPF governs the security of government Information Communications Technology (ICT) systems across non-corporate Commonwealth entities and the ISM provides the guidance to implementing appropriate security controls.

2.38 PSPF Policy 9 Access to Information, requires entities to control access to supporting ICT systems, networks, infrastructure, devices and applications.22 Entities must ensure access to sensitive information or resources is only provided to people with a need-to-know.

2.39 The ISM provides guidance on security controls that can assist with implementing the Policy 9 requirements, specifically preventing access to sensitive information when it is no longer required. ISM Security Control 0430 specifies that access is removed or suspended on the same day personnel no longer have a legitimate requirement for access.23

2.40 The review of information systems and related controls is an integral part of an entity’s control environment. An assessment of the IT control environment was performed on 18 interim report entities. The assessment includes a review of Security Control 0430. The 18 entities were selected on the basis of their: contribution to the income, expenses, assets and liabilities of the 2020–21 CFS; requirement to annually report against the PSPF; and IT risk and complexity.24

2.41 The ANAO’s analysis identified that eight of the 18 selected entities did not adequately implement Security Control 0430 which resulted in user accounts of staff who no longer needed access to systems still being active.

2.42 The majority of the identified eight entities did not remove access in a timely manner from key financial and business applications. Some entities did not remove access for user accounts from both their computer networks and applications, which further increases the risk of unauthorised access in entities that have also implemented a single point of authentication. A user account that has not had access appropriately removed could be compromised and used to access sensitive information within the computer network and across business applications. The user accounts concerned did not have privileged access, which can reduce the impact of external and internal threats.

2.43 One of the eight entities had over 650 user accounts that were still active. Some of the 650 user accounts still had access 150 days after the date it was required to be removed. The large number of user accounts retaining access increases the potential points where cyber adversaries can enter or attack the entities’ systems.25

2.44 The user accounts identified comprised of government staff and contractors. The poor management of contractor access increases the risk of security compromise through supply chain networks. The persistent threats and focus reported by ACSC on supply chain networks gives further importance to reducing the number of user accounts required on a computer network and to remove contractor access when it is no longer required.26 These results support ANAO’s focus on reviewing entities’ arrangements for administering contract obligations.27

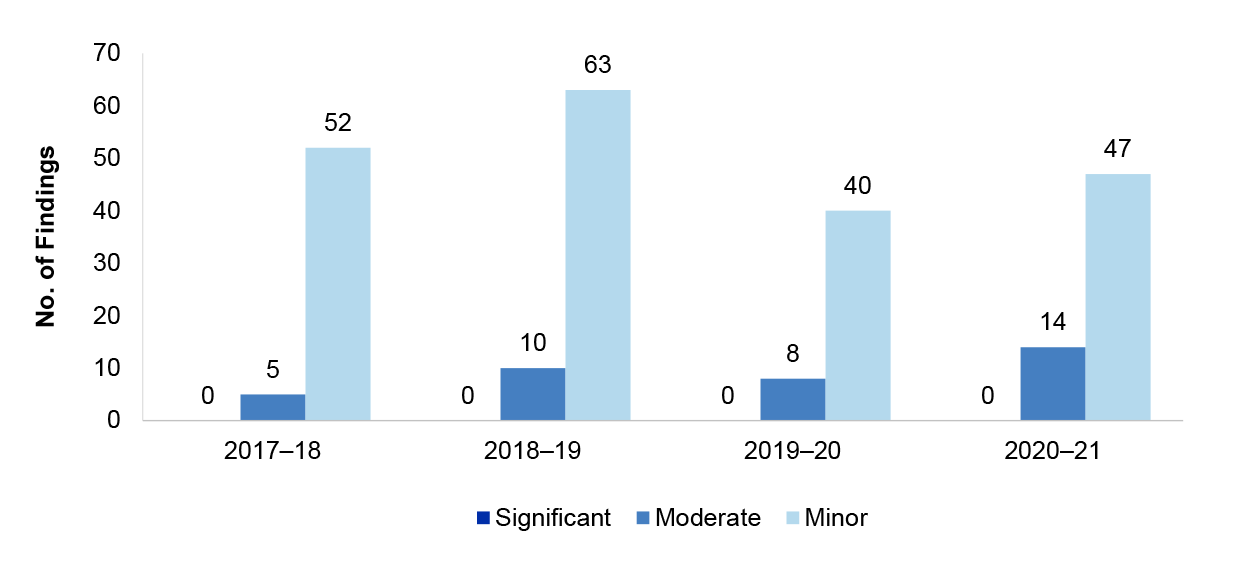

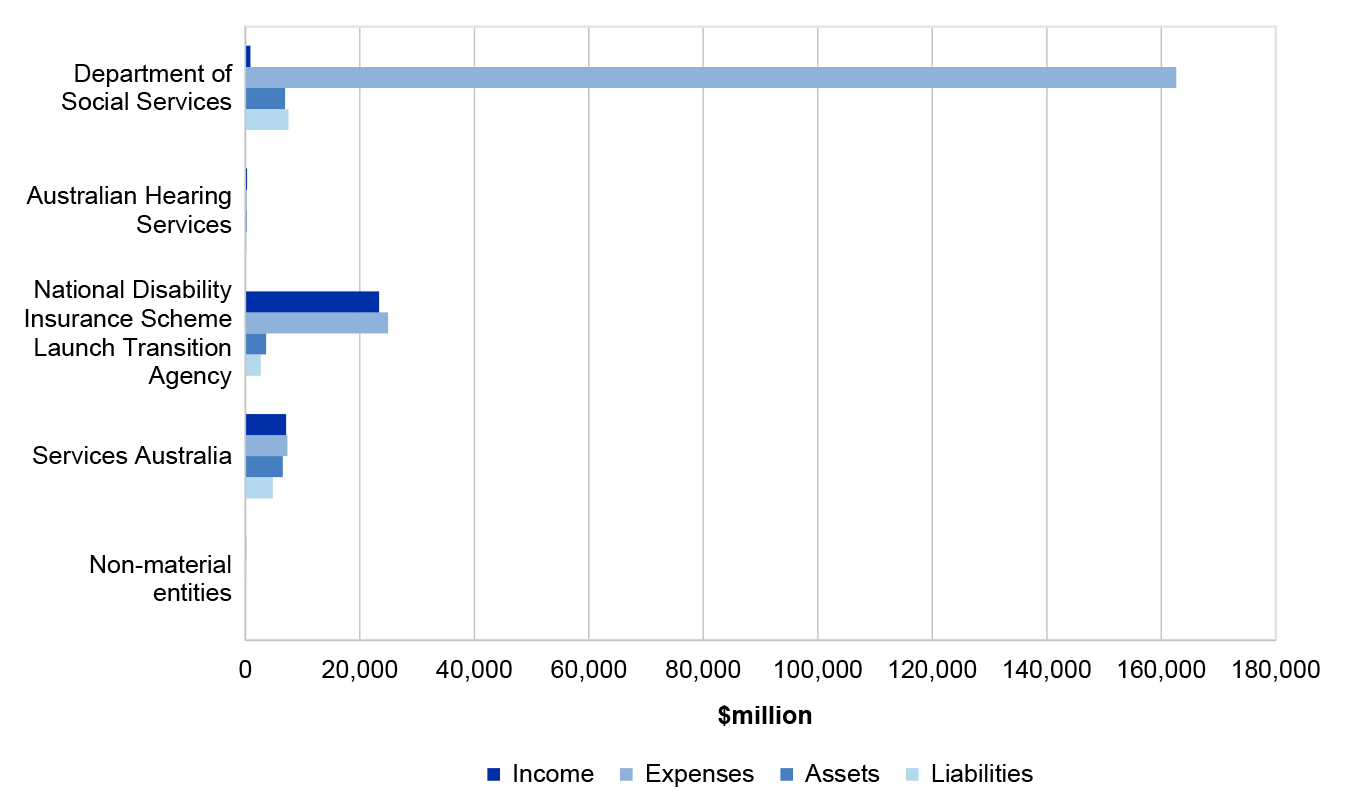

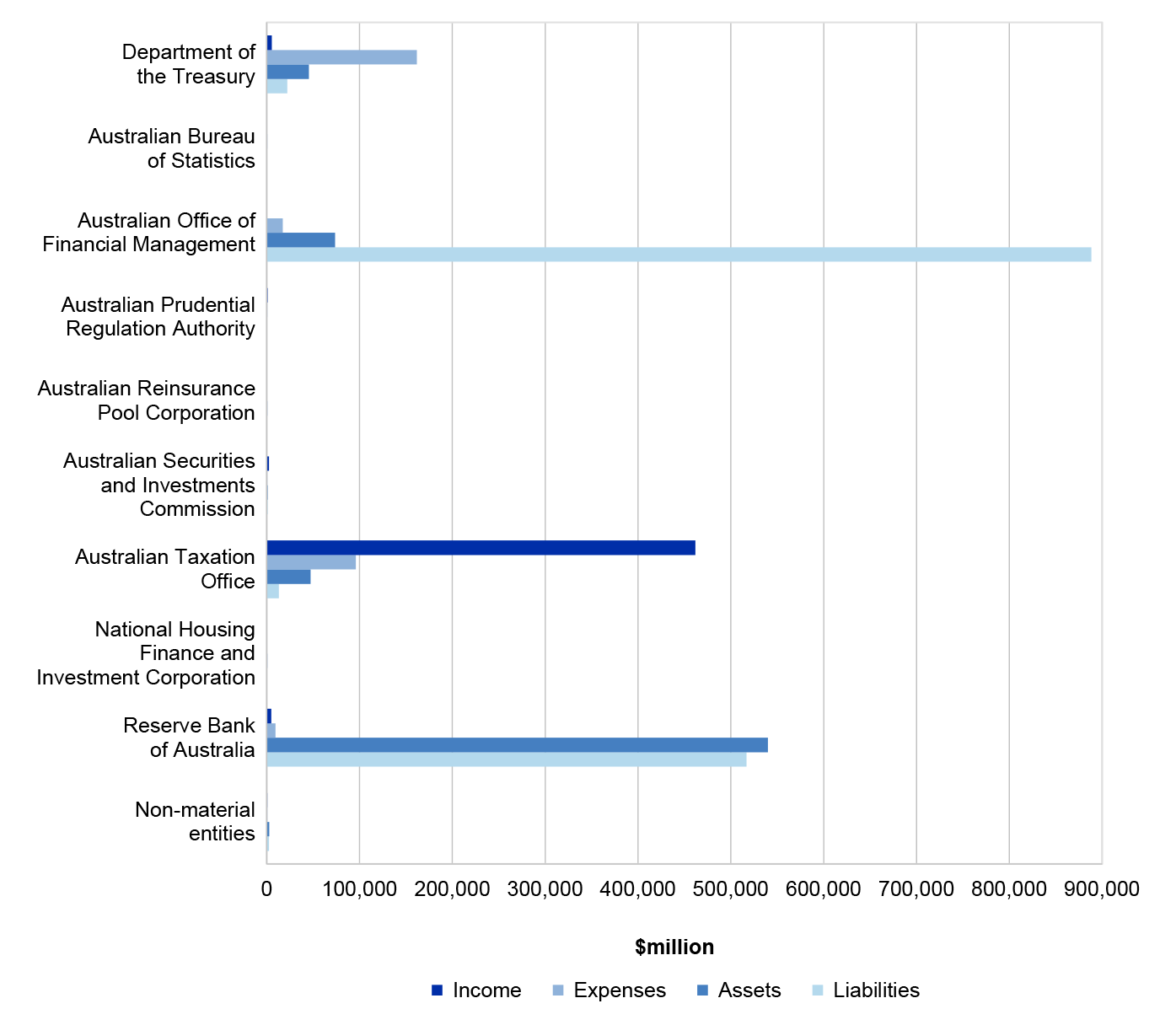

2.45 Five out of the eight entities had user accounts that were accessed after the date where access was no longer required.28 The five entities did not have adequate mitigating controls to detect the unauthorised and inappropriate use of those user accounts. Mitigating controls for the five entities, such as monitoring of user activities and periodic validation of user access, were not operating effectively during 2020–21, and in some instances had not been established.