Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Achieving Value for Money from the Fair Entitlements Guarantee Recovery Program

Please direct enquiries through our contact page.

The objective of this review was to determine whether the establishment and early implementation of the Fair Entitlements Guarantee Recovery Program by the Department of Jobs and Small Business has provided a sound basis for achieving value for money.

Assurance review — section 19A of the Auditor-General Act 1997

INDEPENDENT ASSURANCE REPORT

Achieving Value for Money from the Fair Entitlements Guarantee Recovery Program

Conclusion

Based on the procedures I have performed and the evidence I have obtained, nothing has come to my attention that causes me to believe that the establishment and early implementation of the Fair Entitlements Guarantee Recovery Program (FEG Recovery Program) by the Department of Jobs and Small Business has not, in all material respects, provided a sound basis for achieving value for money, as evaluated against the criteria.

I have undertaken a limited assurance review of the Department of Jobs and Small Business’ achievement of value for money from the FEG Recovery Program. The limited assurance review examined whether the establishment and early implementation of the FEG Recovery Program has, in all material respects, provided a sound basis for achieving value for money. The review evaluated the following criteria:

- Has the Department of Jobs and Small Business established and implemented processes to monitor and report on the value for money of the FEG Recovery Program?

- Has the Department of Jobs and Small Business established and implemented administrative arrangements to achieve value for money from the FEG Recovery Program?

Basis for conclusion

I have conducted the review in accordance with the ANAO Auditing Standards, which include the relevant Standard on Assurance Engagements ASAE 3000 Assurance Engagements Other than Audits or Reviews of Historical Financial Information (ASAE 3000) issued by the Auditing and Assurance Standards Board.

I believe that the evidence I have obtained is sufficient and appropriate to provide a basis for my conclusion.

Responsibilities of the Secretary of the Department of Jobs and Small Business

The Secretary of the Department of Jobs and Small Business is responsible for the Department of Jobs and Small Business’ provision of policies and delivery of programs that facilitate jobs growth, increase workforce participation and promote safe, fair, productive and flexible workplaces. This responsibility includes the administration of payments under the Fair Entitlements Guarantee Scheme to assist redundant workers who have unpaid employment entitlements due to the liquidation or bankruptcy of their employer. To protect the sustainability of the Fair Entitlements Guarantee Scheme, the Secretary is also responsible for the Department of Jobs and Small Business’ administration of the FEG Recovery Program to recover funds advanced under the scheme.1

Independence and quality control

I have complied with the independence and other relevant ethical requirements relating to assurance engagements, and applied Auditing Standard ASQC 1 Quality Control for Firms that Perform Audits and Reviews of Financial Reports and Other Financial Information, Other Assurance Engagements and Related Services Engagements in undertaking this assurance review.

Responsibilities of the Auditor-General

My responsibility is to express a limited assurance conclusion on whether the Department of Jobs and Small Business’ establishment and early implementation of the FEG Recovery Program has, in all material respects, provided a sound basis for achieving value for money, as evaluated against the criteria. ASAE 3000 requires that I plan and perform my procedures to obtain limited assurance about whether anything has come to my attention that the Department of Jobs and Small Business’ establishment and early implementation of the FEG Recovery Program has not, in all material respects, provided a sound basis for achieving value for money.

I have conducted my limited assurance review by making such enquiries and performing such procedures I considered reasonable in the circumstances, including examination and assessment of:

- policies, procedures and supporting documentation relevant to the operation of the FEG Recovery Program;

- data recorded in the case management and financial reporting tool for the FEG Recovery Program;

- financial data and information provided by the Department of Jobs and Small Business to support the achievements of the FEG Recovery Program activities and measurement of program performance;

- documents relevant to the Department of Jobs and Small Business’ development of the costing methodology and attribution framework for the additional recoveries to be achieved by the FEG Recovery Program;

- the Recovery and Litigation Branch Business Plan 2017–18 and the Department of Jobs and Small Business’ corporate plans, annual reports, and portfolio budget statements for 2015–16 to 2017–18;

- internal performance reports and external interagency update reports on the FEG Recovery Program;

- oral advice and responses to enquiries provided by staff of the Department of Jobs and Small Business with responsibilities for the administration of the FEG Recovery Program; and

- submissions from external stakeholders.

The procedures selected depend on my professional judgement, including identifying areas of risk that the establishment and implementation of the FEG Recovery Program has not provided a sound basis for achieving value for money.

The procedures performed in a limited assurance review vary in nature and timing from, and are less in extent than for, a reasonable assurance engagement and consequently the level of assurance obtained in a limited assurance review is substantially lower than the assurance that would have been obtained had a reasonable assurance engagement been performed. Accordingly, I do not express a reasonable assurance opinion on the achievement of value for money from the establishment and implementation of the FEG Recovery Program, as evaluated against the criteria.

Australian National Audit Office

Grant Hehir

Auditor-General

Canberra

15 May 2018

Appendix A — Findings in respect of specific aspects of the engagement

1. During the conduct of the limited assurance review, the following findings were made in respect of specific aspects of the review. These matters were addressed in the context of my assurance review as a whole, and in forming my conclusion thereon, and I do not provide a separate conclusion on these matters.

Background

2. The ANAO conducted this review in response to a suggestion in a previous ANAO report that the Department of Employment2 more actively pursues the recovery of insolvency related debt arising from the Fair Entitlements Guarantee Scheme.3

Overview of insolvency and the Fair Entitlements Guarantee Scheme

3. A business or an individual is considered to be insolvent when they are unable to pay their debts as they fall due for payment. Corporate insolvency in Australia is regulated by the Corporations Act 2001 (Cth) (Corporations Act). Liquidation4 is one of the three most common procedures for corporate insolvency. The other two common insolvency procedures are voluntary administration5 and receivership6. The purpose of liquidation is to have an independent and suitably qualified liquidator take control of the company so that it can be fairly and orderly wound up for the benefit of the insolvent entity’s creditors.7

4. Except for lodging reports and documents required under the Corporations Act, a liquidator is not required to incur any expense in relation to the winding up of the insolvent entity unless there are enough assets available to pay their costs. If there are funds left over after the payment of the liquidator fees and expenses, employees of the insolvent entity are entitled to be paid, in priority to other unsecured creditors, their outstanding entitlements of wages, superannuation, leave of absence and retrenchment pay.8

5. Employees who are owed certain employee entitlements after losing their job due to the liquidation or bankruptcy9 of their employer on or after 5 December 2012 are able to apply for financial assistance from the Australian Government through the Fair Entitlements Guarantee (FEG) Scheme. Employees have to meet eligibility requirements to claim FEG assistance.10 The Department of Jobs and Small Business administers the FEG Scheme pursuant to the Fair Entitlements Guarantee Act 2012 (Cth). The legislated FEG Scheme replaces its predecessor, the General Employee Entitlements and Redundancy Scheme (GEERS) that operated as an administrative program.11

6. The FEG Scheme is a legislative safety net scheme of last resort to help protect accrued employee entitlements in insolvency where no alternative avenue exists for the employees to be paid. Employee entitlements that can be paid under the FEG scheme include:

- unpaid wages (capped at 13 weeks);

- unpaid annual leave and long service leave;

- payment in lieu of notice (capped at five weeks); and

- redundancy pay (capped at four weeks per full year of service).12

7. Once entitlements are advanced to an eligible employee under the FEG Scheme, the Australian Government stands in the shoes of the employee and becomes a subrogated creditor of the relevant insolvent entity with standing to recover the FEG amount through the insolvency process.

Fair Entitlements Guarantee Recovery Program

8. The payments of financial assistance under the FEG Scheme and its predecessor GEERS have been increasing since their inception. According to the Department of Jobs and Small Business, average annual FEG assistance advanced had risen from $87.4 million in the five years to 2009–10 to $223.6 million in the five years to 2014–15. Recoveries of FEG amounts13 advanced through the insolvency process have been low historically. Data from the department shows that the recovery rate of FEG amounts advanced from 2009–10 to 2014–15 averaged around 11 per cent.

9. In the 2015–16 Federal Budget, the Australian Government launched a two-year trial of the Fair Entitlements Guarantee Recovery Program (FEG Recovery Program) to strengthen the integrity and sustainability of the FEG Scheme. The pilot FEG Recovery Program achieved $22.6 million of increased recoveries in the first year of operation and improved the overall FEG recovery rate to 19 per cent for 2015–16.

10. Based on the results delivered by the pilot, the Australian Government made the FEG Recovery Program an ongoing demand driven measure from 1 January 2017, with increased funding and resources. The Australian Government has committed funding of $47.2 million over four years from 2016–17 and there is a facility for the Department of Jobs and Small Business to obtain additional funding as demand requires with the agreement of the Minister of Finance. The aim of the FEG Recovery Program is to increase the rate of return on the amounts advanced under the FEG Scheme, by funding case assessment and litigation activities to recover assets of insolvent entities, to help reduce the overall cost of the scheme. It was estimated that the FEG Recovery Program would achieve additional FEG recoveries of $165.7 million over four years.14

11. The Recovery and Litigation Branch within the Department of Jobs and Small Business administers the FEG Recovery Program. The branch is a multidisciplinary team with a mix of professional APS staff, consultant litigation lawyers and forensic accountants. The Recovery and Litigation Branch administers the program via its four key practice areas: Litigation Funding; Investigations and Claims; Active Creditor; and Policy, Law and Industry Reform. Table 1 outlines the key responsibilities of each practice area.

Table 1: Recovery and Litigation Branch practice areas

|

Practice area |

Key responsibilities |

|

Litigation Funding |

Competitively funds insolvency practitioners to pursue recovery of FEG advances having regard to commercial factors. |

|

Investigations and Claims |

Investigates and analyses the insolvency industry’s administration of priority employee creditor entitlements where funds have been advanced under the FEG Scheme. |

|

Active Creditor |

Seeks to minimise or prevent FEG claims from arising, increase returns to the Commonwealth and positively influence outcomes in liquidations via early intervention and active monitoring of insolvencies. |

|

Policy, Law and Industry Reform |

Influences and enhances legal frameworks, policy settings and the insolvency industry’s administrative practices. |

Source: Recovery and Litigation Branch Operations Manual.

12. The Recovery and Litigation Branch undertakes three types of recovery activities:

- department-initiated (direct funded);

- liquidator-initiated (liquidator funded); and

- self-funded (unfunded).

13. Department-initiated and liquidator-initiated activities are funded through the Department of Jobs and Small Business’ administered appropriations, while self-funded activities are funded through its departmental appropriations.

14. Direct funded activities are recovery actions initiated by the Department of Jobs and Small Business on behalf of the Commonwealth to recover FEG advances. The department engages external legal service providers to pursue direct recovery actions against insolvency practitioners. The direct actions are predominantly to respond to suspected breaches by liquidators and receivers of sections 433 and 561 of the Corporations Act. The provisions in sections 433 and 561 give priority to the payment of employee entitlements ahead of the claims of the circulating security interest15 holder. Liquidators and receivers should apply the statutory priorities under these sections when distributing the proceeds of the sale of circulating assets of the business. The department advised that the key disputed issue for its legal actions against insolvency practitioners often concerns circulating assets.

15. Liquidator funded activities are instigated by applications for funding from insolvency practitioners to undertake recovery actions and legal proceedings against company directors that are likely to improve the return of FEG advances for the benefit of creditors. Liquidator funding is managed by the Litigation Funding practice area of the Recovery and Litigation Branch. Liquidator funding provides an opportunity for insolvency practitioners to pursue claims and actions against directors that they would not otherwise have the financial resources to pursue. The funding is often provided for the pursuit of actions that include: insolvent trading claims; other breaches of directors’ duties; uncommercial transactions; or transactions entered into to avoid employee entitlements.

16. Self-funded activities are actions where initial investigations have led the Department of Jobs and Small Business to correspond with the relevant insolvency practitioner to make a formal demand for repayment of FEG advances, and consequential negotiated settlements have brought recoveries without having to resort to funding external lawyers to make a legal claim.16

Has the Department of Jobs and Small Business established and implemented processes to monitor and report on the value for money of the Fair Entitlements Guarantee Recovery Program?

Performance measures

17. Prior to the FEG Recovery Program being made permanent, a methodology was agreed between the Department of Jobs and Small Business and the Department of Finance for the attribution of financial returns. It was agreed that in calculating the return on investment for the FEG Recovery Program, the nominal expenditure (the litigation funding spent) would be measured against the nominal revenue recovered (the return achieved from the recovery actions).17

18. The Department of Jobs and Small Business advised that it has consequently adopted a conservative approach to the attribution of recoveries to the FEG Recovery Program. To ensure that the additional revenue achieved by the FEG Recovery Program is not overstated, recoveries are attributable to the program where they are the result of the activities undertaken by the department in insolvency matters.18 In other words, there must be a direct nexus between a recovery and the efforts of the program. The standard accrual accounting methodology has been adopted for recognising revenues and expenses for recovery matters that are attributable to the program.

19. The attribution approach acknowledges that not all activities undertaken by the FEG Recovery Program will result in an increased return to the Department of Jobs and Small Business, particularly in matters where the funds recovered could reasonably have been expected to be paid without intervention from the program. Examples of recoveries not being attributed to the program include: recoveries received prior to the commencement of recovery actions under the program; where there is doubt that the recovery is due to the efforts of the program; and where an insolvency practitioner ascertains and agrees repayment of FEG with minimal effort from the program.

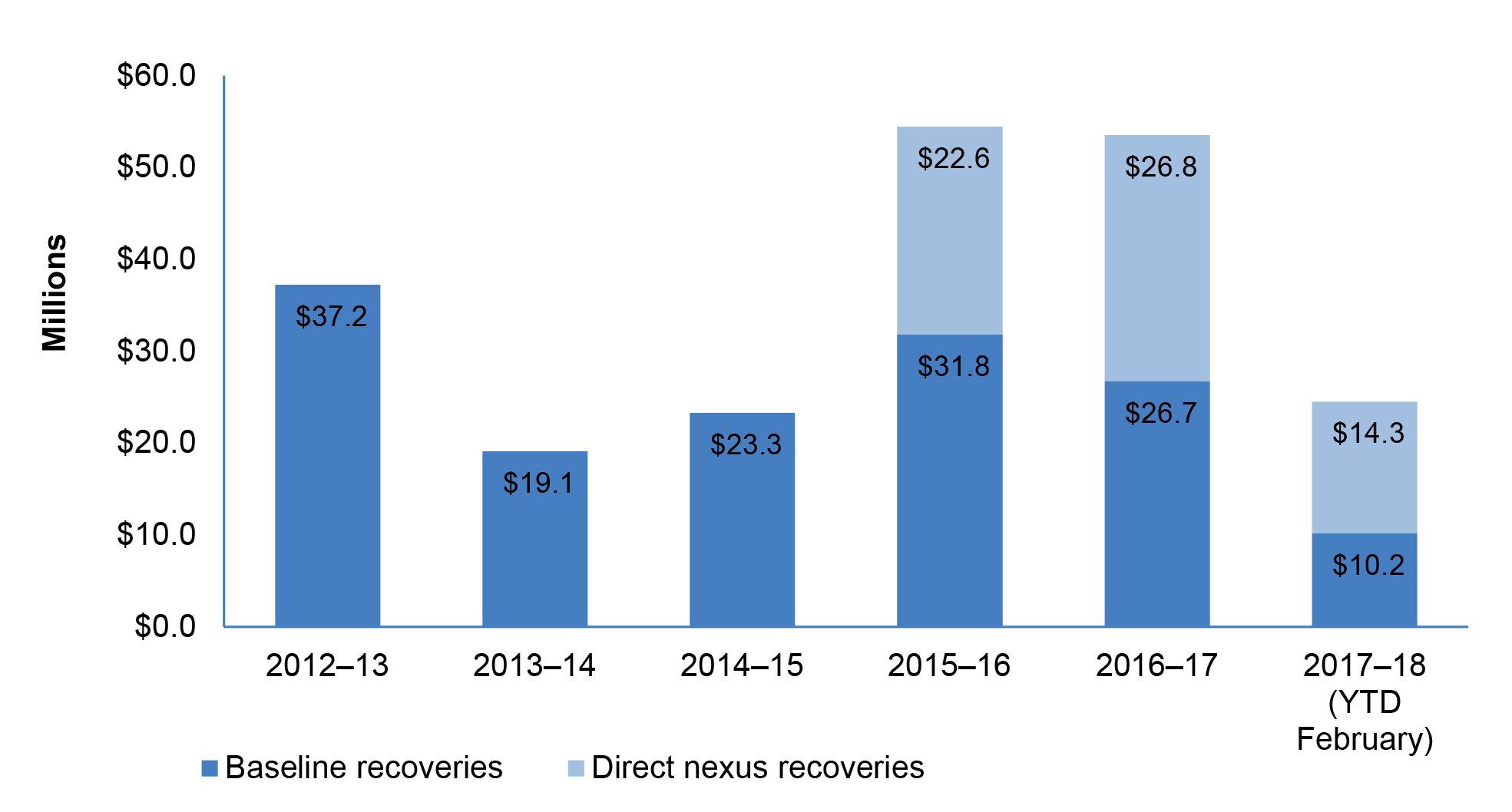

20. The Department of Jobs and Small Business has established measures that monitor the additional recoveries attributable to the FEG Recovery Program and the business-as-usual baseline recoveries from pre-existing FEG activities. Figure 1 illustrates the additional recoveries with direct nexus to the FEG Recovery Program since its commencement from 1 July 2015 and the baseline recoveries from the inception of the FEG Scheme to February 2018.

Figure 1: Additional recoveries and baseline recoveries, 2012–13 to 2017–18 (YTD February 2018)

Source: ANAO analysis of recoveries data from the Department of Jobs and Small Business.

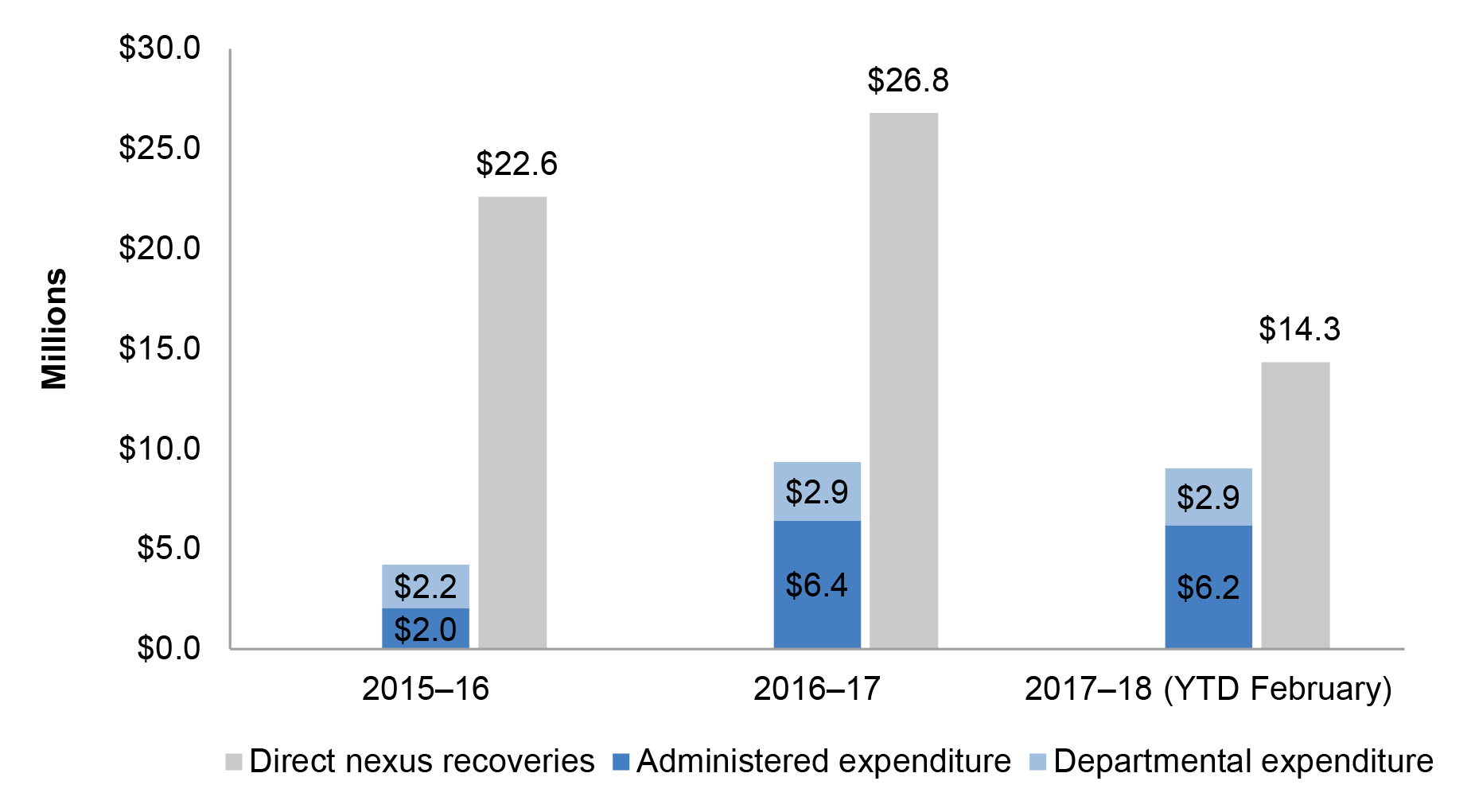

21. The Department of Jobs and Small Business also monitors the expenses incurred in administering the FEG Recovery Program. The FEG Recovery Program has recovered more revenue than it has incurred in costs, as illustrated in Figure 2.

Figure 2: Recoveries and costs incurred for the FEG Recovery Program, 2015–16 to 2017–18 (YTD February 2018)

Source: ANAO analysis of data from the Department of Jobs and Small Business.

22. As shown in Figure 2, the early establishment and implementation of the FEG Recovery Program has produced positive net revenue to date. According to budget estimation and costing documents, it was estimated that the ongoing FEG Recovery Program would achieve approximately $11.7 million in net revenue after all costs for 2016–17. The actual net revenue of $17.5 million generated by the FEG Recovery Program in 2016–17 exceeded the budget estimate. The Department of Jobs and Small Business expects strong recovery results to be achieved for 2017–18 on the basis that a number of actions undertaken by the FEG Recovery Program will bring in further additional recoveries in the third and fourth quarters.

23. Based on data provided by the Department of Jobs and Small Business for the period 1 July 2015 to 28 February 2018, the FEG Recovery Program has achieved additional recoveries of $63.7 million. In the same period, the total administered costs of the FEG Recovery Program were $14.6 million and the total departmental costs were $8.0 million. Based on these figures, the ANAO has calculated a return on investment for the FEG Recovery Program of 282 per cent (net revenue was $41.1 million).

24. Information provided in the course of the review showed that the Department of Jobs and Small Business had calculated return on investment based on administered expenditure only. This had resulted in return on investment calculations that exceeded 400 per cent. The department advised the ANAO that it had not considered departmental costs when calculating the program’s return on investment due to a substantial proportion of the costs not being directly relevant to the program’s core activity of obtaining a recovery of FEG advances, including the Recovery and Litigation Branch’s policy area and administrative support activities. It is appropriate to consider departmental expenditure when calculating the return on investment for the FEG Recovery Program given that departmental appropriations had been provided and expended to administer the recovery activities.19 The Recovery and Litigation Branch could consider apportioning the departmental costs incurred to derive a more accurate calculation of the return on investment for the program. This would be consistent with the department’s conservative approach to attributing recoveries to the FEG Recovery Program.

25. In addition to direct recoveries of FEG payments, the FEG Recovery Program also achieves incidental recoveries for employees and other unsecured creditors such as the Australian Taxation Office. As shown in Table 2, data provided by the Department of Jobs and Small Business indicates that the FEG Recovery Program had delivered $2.4 million of third-party benefits from 1 July 2015 to 28 February 2018.

Table 2: Incidental non-FEG recoveries, 2015–16 to 2017–18 (YTD February 2018)

|

Type of incidental recoveries |

2015–16 |

2016–17 |

2017–18 (YTD February) |

Total |

|

Non-FEG employee entitlements |

$0 |

$557 615 |

$1 168 467 |

$1 726 082 |

|

Superannuation guarantee contributions |

$0 |

$189 199 |

$466 383 |

$655 582 |

Source: Data provided by the Department of Jobs and Small Business.

26. Furthermore, intangible benefits arise from activities undertaken by the FEG Recovery Program that are difficult to measure or unquantifiable. The types of activities undertaken by the Active Creditor practice area would ordinarily fall into this category. The Department of Jobs and Small Business informed the ANAO that by being an active litigant against non-compliant corporate practices, it is demonstrating to the market that it will actively pursue its rights as a creditor and will not tolerate non-compliant practices. The department advised that the FEG Recovery Program is making a positive impact by influencing market behaviour and increasing voluntary compliance with employer obligations, which in turn will help minimise inappropriate access to the FEG scheme.20

Data collection for performance measures

27. Data in relation to FEG recoveries and associated costs are recorded in the Department of Jobs and Small Business’ SAP financial system. In August 2017, the department commenced using a Finance Tool to collate various sources of information on recovery matters and report on the metrics of recovery activities undertaken by the FEG Recovery Program. The Finance Tool was developed in conjunction with Mercer Consulting (Australia) Pty Ltd (Mercer) as a dynamic data collection and reporting dashboard tool in Excel.

28. The Finance Tool consists of a combination of matters management spreadsheets and financial reports exported from the SAP financial system. It is updated weekly with SAP data in relation to revenue, invoices, contracts and purchase orders for the recovery activities. The Finance Tool is maintained by staff in the Recovery and Litigation Branch in their different capacities. Following the development of the Finance Tool, the branch conducted a back capture exercise to populate the tool with all prior matters. The Finance Tool provides several reporting functions, including: a summary of the performance and budget of the FEG Recovery Program; various reports on committed funding, revenue, quantum of claims being pursued, expenses and cash flow; individual matter summary; and monitoring reports on the funding limit for each stage of a matter.

29. The Recovery and Litigation Branch undertakes data validation and quality assurance on the following aspects of the Finance Tool:

- monthly checks on the revenue recorded in FEG Recovery cost centres to confirm that only revenue with a direct nexus is in the FEG Recovery’s cost centres;

- monthly checks on the funded matter summary table and supporting data prior to Internal Steering Committee meetings (refer paragraph 47). The purpose of the checks is to ensure that the amount expended for each funded matter is consistent with the approved funding amount. The checks also aim to ensure that the Internal Steering Committee is accurately advised on the program’s expended budget, committed funding and available funding for the remainder of the financial year; and

- quarterly reconciliations between the SAP data and the reports extracted into the Finance Tool are conducted to ensure there are no discrepancies with the data.

30. At the time of the ANAO’s review, not all required data was being extracted from the SAP system into the Finance Tool and manual reconciliations were required to ensure the accuracy of data in the Finance Tool.

31. In September 2017, the Recovery and Litigation Branch introduced a process whereby no revenue would be accrued and attributed to the FEG Recovery Program without a closure note being prepared to record the outcome of program activities. In addition, all closure notes have to be approved by the Branch Manager. The closure note is designed to capture and summarise, matter by matter, the cost-effectiveness of the recovery activities. It also ensures that assessment of a sufficient nexus between a recovery and activities of the FEG Recovery Program is undertaken and recorded so that the recovery is in accordance with the program’s attribution framework (see paragraphs 18 and 19).

32. Prior to September 2017, closure notes were only prepared for revenue obtained on funded activities (direct funded and liquidator funded activities). The completion of the Recovery and Litigation Branch Operations Manual in August 2017 established the procedure that closure notes would constitute the key document that records all recoveries, for funded and unfunded matters, of the FEG Recovery Program. The branch subsequently undertook an internal review of the outcomes of all historic unfunded matters. The internal review examined 55 unfunded matters and identified 16 matters whose outcomes should not be attributed to the FEG Recovery Program due to insufficient nexus, a lack of contemporaneous records or unquantifiable impact such as a positive behavioural outcome. The 16 unfunded matters with inaccurate attributions accounted for $4.9 million (eight per cent) of total accrued recoveries since 1 July 2015.

33. The Recovery and Litigation Branch completed the review on unfunded matters in late February 2018, during the course of the ANAO review. The Department of Jobs and Small Business advised the ANAO that the inaccurate attributions identified were yet to be reversed from the revenue achieved by the FEG Recovery Program and were awaiting sign-off from the relevant authority. Based on a conservative calculation without making adjustment to the costs, the return on investment for the FEG Recovery Program would be approximately 260 per cent with the exclusion of the inaccurately attributed recoveries.

34. The Department of Jobs and Small Business also advised the ANAO that measures have been put in place to avoid inaccurate attributions in the future and to maintain better record keeping and documentation. The measures include a new practice note outlining the guidelines for preparing a closure note, a refined closure note template, staff training and presentation of closure notes at Internal Steering Committee meetings.

35. The Department of Jobs and Small Business has established a measurement methodology that enables monitoring of the baseline revenue received from prevailing activities and attribution of additional revenue to the FEG Recovery Program. Further, the department has collected information to apply the methodology in order to measure the net financial benefits of the FEG Recovery Program, with data assurance processes in place.

Performance reporting

36. FEG Recovery Program activities and performance are included in internal quarterly FEG performance reports to the Secretary of the Department of Jobs and Small Business. The quarterly reports provide information on administrative issues, significant case matters, key results achieved and the return on investment for the FEG Recovery Program.

37. An external Fair Entitlements Guarantee Recovery Program Interagency Steering Committee was formed at the commencement of the pilot to provide strategic oversight and advice for the FEG Recovery Program.21 The Department of Jobs and Small Business provides the Interagency Steering Committee with updates on funded matters, significant cases and issues of interest for the FEG Recovery Program at its biannual meetings. In the December 2017 meeting, the department reported to the committee on progress of recovery activities and results achieved for the second year of operation of the FEG Recovery Program.

38. With respect to public reporting of the performance of the FEG Recovery Program, the only information reported in departmental annual reports for 2015–16 and 2016–17 was that the FEG Recovery Program had made a positive impact on the overall proportion of FEG funds recovered. The annual reports for 2015–16 and 2016–17 reported the total amount of FEG funds recovered overall. There was no reporting on the additional recoveries that were derived or the achievement of value for money from the FEG Recovery Program.

39. Performance criteria and targets in relation to the FEG Recovery Program were not set out in the portfolio budget statements or corporate plans of the Department of Jobs and Small Business. Consequently, there was no reporting of the FEG Recovery Program performance in the Annual Performance Statements for 2015–16 and 2016–17. While the Recovery and Litigation Branch Business Plan 2017–18 sets out a suite of deliverables and performance measures to which the branch commits for the year, there is scope to improve the performance measures outlined in the plan. The department advised the ANAO that it is considering developing performance measures for the FEG Recovery Program for 2018–19 that will provide a sound basis for transparent public reporting of the program’s performance going forward. In enhancing the performance measures for the FEG Recovery Program, there is benefit in considering the findings and recommendations in ANAO Report No.33 of 2017–18 Implementation of the Annual Performance Statements Requirements 2016–17, which included examination of the department’s implementation of the annual performance statements requirements.22

40. The Department of Jobs and Small Business further advised the ANAO that to support more transparent public reporting and to demonstrate the achievement of value for money, its intention is to capture all relevant data on the performance of the FEG Recovery Program including all costs, recoveries and broader outcomes of the program. This would encompass all direct and indirect achievements and outcomes of the FEG Recovery Program, in addition to all departmental and administered costs. The department advised that it intends to publicly report a summary of this information in the 2017–18 annual report.

Has the Department of Jobs and Small Business established and implemented administrative arrangements to achieve value for money from the Fair Entitlements Guarantee Recovery Program?

41. In March 2017, the Department of Jobs and Small Business took steps to formalise the policies, processes and governance framework that underpin the FEG Recovery Program. As part of this process, the department engaged Mercer in May 2017 to collaboratively develop materials to support operational, business, risk management and compliance processes. A Recovery and Litigation Branch Operations Manual was finalised in August 2017. As discussed in paragraph 27, a Finance Tool was developed in collaboration with Mercer to support data collection and financial reporting for the recovery activities of the FEG Recovery Program. Various supporting documentation, including standard templates and forms to be used for the recovery activity processes, were also developed. In addition, the department has developed a comprehensive suite of practice notes to provide guidance to staff and outline the policies and procedures to be followed when undertaking program activities. As at April 2018, 11 practice notes were in place.

Assessment and selection of matters to pursue

42. The Recovery and Litigation Branch investigates and analyses possible recoveries in liquidation matters where FEG payments have been advanced. The branch also investigates the administration of receiverships and other external administrations where there are unpaid employee entitlements irrespective of whether claims for FEG assistance have been made. To identify opportunities to pursue recovery, the branch reviews a global dataset of information including insolvency matters in the electronic FEG database (eFEG), Australian Securities and Investments Commission and insolvency reports, and liquidators’ payments. To maximise the chances of a commercial recovery, the branch focuses on examining matters where $100 000 or more of FEG payments had been advanced.

43. Insolvency matters with a potential recoverable amount of $200 000 in FEG payments are automatically flagged to the Recovery and Litigation Branch and insolvency practitioners are notified of liquidator funding option via eFEG. Potential litigation funding opportunities may also be identified by liquidators who are able to directly contact the branch to seek funding.

44. Once the matters have been reviewed and pre-qualified, they are further assessed using the Investigations and Claims Assessment Tool developed to determine the merits of pursuing the matter. Funding applications received from insolvency practitioners are assessed using the Litigation Funding Assessment Tool and the Estimated Outcomes Model. These assessment tools support the selection of matters to pursue on a cost-effective basis and the estimation of the value for money achievable for various types of actions undertaken.

45. If the further assessment is that the matter is worth pursuing, a Funding Proposal document will be prepared that sets out the background and analysis of the matter, and requests for funding to commence recovery actions. The potential commercial return on the proposed funding is the key consideration for a funding proposal. The relevant factors to consider with respect to the business case and commerciality of a funding proposal include:

- the merits, risks and prospects of success of the proposed action;

- the complexity of the proposed action and its likely duration;

- the total costs that are likely to be incurred for the proposed action, compared to the admitted value of the Department of Jobs and Small Business’ claim as creditor;

- the amount of preliminary investigative work that has been undertaken, and the quality and quantity of evidence available; and

- whether any of the proposed defendants, including any insurer, have sufficient assets to pay a judgement sum or settlements if the action was successful.

46. Other relevant considerations include whether the proposed action enhances the prospects of future recovery of FEG funds advanced, or reduces future claims upon the FEG Scheme, in circumstances where: the matter is one of public interest; whole of Australian Government policy interests apply; or a point of law needs to be settled by a court to remove ambiguity.

47. The Branch Manager has the authority to approve proposals for funding commitments up to a certain monetary threshold (minor funding decisions). Major funding decisions for funding commitments above the monetary threshold have to be approved by the Internal Steering Committee.23 Matters that involve court proceedings, arbitrations, mediations or formal appointment of external administrators must be reviewed and approved by the Internal Steering Committee regardless of the monetary threshold. The Internal Steering Committee meets monthly or otherwise as circumstances and urgency of matters may require. To ensure appropriate governance and accountability of funding decisions made, all funding decisions approved or declined by the Branch Manager are reported to the Internal Steering Committee. The Internal Steering Committee are also provided with updates on funding commitments and budget position at the monthly meetings.

48. The assessment criteria outlined in paragraphs 45 and 46 are the terms of reference used by the Branch Manager and Internal Steering Committee when considering each funding proposal. These terms of reference helps to ensure appropriate and consistent matters are selected for funding, and to minimise financial risks for the department in funding matters.

49. The Department of Jobs and Small Business has developed guidelines and procedures that support a risk-based, commercial approach to the assessment and selection of matters to pursue under the FEG Recovery Program. Based on the ANAO’s review, nothing has come to our attention that policies and procedures have not been implemented accordingly to assess and select matters to fund for recovery actions.24

Conduct of recovery actions

50. As outlined in paragraphs 12 to 16, the Department of Jobs and Small Business conducts three main types of recovery actions for FEG advances: direct funded activities; liquidator funded activities; and unfunded activities.

51. In direct funded matters, external legal service providers are engaged to pursue the recovery actions, for which guidelines and procedures have been established with respect to the legal service engagement.

52. In liquidator funded matters, the Department of Jobs and Small Business will enter into a funding agreement with the liquidator that governs the provision of funding to the liquidator to pursue recovery actions. The agreement specifies the purpose of the funding, funding amount and mechanisms for the liquidator to seek payment. A funding agreement template has been developed that enable agreements to be tailored to a broad range of litigation proceedings.

53. Since 1 July 2015, the Recovery and Litigation Branch has undertaken file reviews of 1650 matters. Of the matters reviewed, 122 matters were referred to the Internal Steering Committee or Branch Manager to request for funding.25 Subsequently, funding has been approved for the pursuit of recovery actions for 118 matters—80 direct funded matters and 38 liquidator funded matters—under the FEG Recovery Program. In addition, the Department of Jobs and Small Business has pursued recovery actions in 58 unfunded matters. In total, the department has undertaken recovery actions for 176 FEG matters (funded and unfunded) under the FEG Recovery Program in the period 1 July 2015 to 28 February 2018.

54. The Department of Jobs and Small Business approved 38 of the 58 applications for liquidator funding matters (66 per cent) in the period 1 July 2015 to 28 February 2018.26 The service charter for liquidator funding provides that the department will aim to reach a decision within six weeks of receiving a funding application, or inform the applicant if this is not possible and give reasons for the delay. In the submissions received by the ANAO for this review, one stakeholder commented on the prompt response received for their applications, and two stakeholders cited slow response time and lack of update on the application process in some matters.

55. Of the 176 funded and unfunded matters pursued under the FEG Recovery Program from 1 July 2015 to 28 February 2018, 83 matters achieved a direct nexus recovery.27 Table 3 shows the aggregated revenue obtained against the funding committed and spent for these 83 matters. Most recoveries were from unfunded and direct funded matters. Liquidator funded matters had not generated a positive net return at that time28, and it would be prudent for the Department of Jobs and Small Business to closely monitor its investment in liquidator funded matters to help ensure that the activities achieve value for money.

Table 3: Funded and unfunded matters that have achieved a direct nexus recovery, 1 July 2015 to 28 February 2018

|

Type of matters |

Number of matters |

Funding committed |

Funding expended |

Revenue recovered |

|

Direct funded matters |

25 |

$3.3 million |

$2.0 million |

$25.5 million |

|

Liquidator funded matters |

5 |

$23.8 million |

$10.6 million |

$4.8 million |

|

Unfunded matters |

53 |

$0 |

$0 |

$33.4 million |

|

Total |

83 |

$27.1 million |

$12.6 milliona |

$63.7 million |

Note a: A further $2 million of administered expenditure has been spent on recovery matters that are yet to obtain a direct nexus recovery for the program to date. This brings the total accrued administered expenditure to $14.6 million, as shown in Figure 2 and paragraph 23.

Source: ANAO analysis of data from the Department of Jobs and Small Business.

56. The FEG Recovery Program uses a staged funding approach to manage the risks related to the program’s funded recovery matters. Under this approach, funding is provided to insolvency practitioners undertaking recovery action in stages rather than in entirety. There are usually three stages in recovery actions: preliminary assessment of a matter to gather information; preparation of legal advice about the prospects of recovery; and commencement of litigation. There is no set number of stages for a recovery action and if increased funding is required, the new proposition has to be considered by the Internal Steering Committee or Branch Manager. The staged funding approach is built into relevant procurement documentation and contracts to enable the Department of Jobs and Small Business to discontinue recovery if an action is no longer considered cost-effective.

57. Insolvency practitioners and external lawyers funded by the FEG Recovery Program are required to submit claims for payment or invoices to the Department of Jobs and Small Business on a regular basis (preferably monthly). All claims and invoices will be reviewed by recovery officers or internal lawyers prior to payment. Once it is confirmed that the charges invoiced have been reasonably incurred and are within scope, the invoice will be paid. The legal service providers are unable to charge above the agreed amounts without prior approval. In one of the submissions received by the ANAO, the stakeholder commented that there is scope to improve the timeliness in which claims for payment are processed.

58. Overall, the Department of Jobs and Small Business has developed and implemented plans, guidelines and procedures to support the cost-effective conduct of recovery activities under the FEG Recovery Program. The ANAO’s review of relevant documentation and processes found that recovery activities had been conducted using a risk-based, staged funding approach and discontinued if no longer achieving value for money. There are governance arrangements for funding decisions made under the program, and monitoring of costs incurred in undertaking recovery activities. Variances in funding require approval from the relevant authority to ensure expenditure is within the committed funding level.

Footnotes

1 Department of Jobs and Small Business, Corporate Plan 2017–18 [Internet], 2018, available from <https://docs.jobs.gov.au/documents/2017-18-department-jobs-and-small-business-corporate-plan> [accessed February 2018].

2 The former Department of Employment has been renamed the Department of Jobs and Small Business, pursuant to Administrative Arrangements Order amendments issued on 20 December 2017.

3 ANAO Audit Report No.32 2014–15 Administration of the Fair Entitlements Guarantee, pp. 51–53, available from <https://www.anao.gov.au/work/performance-audit/administration-fair-entitlements-guarantee>.

4 Liquidation is the orderly winding up of a company’s affairs that involves realising the company assets and distributing the proceeds of realisation among its creditors.

5 Voluntary administration is where an external administrator is appointed to investigate the company’s affairs, report to creditors and recommend to creditors whether the company should enter into a deed of company arrangement, enter liquidation or be returned to the control of the directors.

6 Receivership is where a receiver is appointed (usually by a secured creditor) over some or all of the company’s assets.

7 Australian Securities and Investments Commission, Insolvency: Resources on insolvency for directors, practitioners, employees, creditors and investors [Internet], ASIC, available from <http://www.asic.gov.au/regulatory-resources/insolvency/> [accessed March 2018].

8 Australian Securities and Investments Commission, Liquidation: A guide for employees [Internet], ASIC, available from <http://www.asic.gov.au/regulatory-resources/insolvency/insolvency-for-employees/liquidation-a-guide-for-employees/> [accessed March 2018].

9 Bankruptcy is an insolvency procedure that applies to a natural person, not to a company.

10 The eligibility requirements for FEG assistance are: the employment has ended due to the employer’s liquidation or bankruptcy on or after 5 December 2012; employee entitlements are owed; the employee was an Australian citizen or the holder of a permanent visa or special category visa at the time the employment ended; and an effective claim has been lodged within 12 months after the end of the employment or the insolvency event.

11 The first government assistance program for the protection of employee entitlements was the Employee Entitlements Support Scheme established in January 2000. The Employee Entitlements Support Scheme was replaced by the GEERS in September 2001.

12 The FEG Scheme does not cover unpaid superannuation guarantee contributions. A payment threshold based on a maximum weekly wage—indexed at $2451 as at April 2018—applies to the FEG assistance payable to eligible employees. Department of Jobs and Small Business, Fair Entitlements Guarantee (FEG) [Internet], available from <https://www.jobs.gov.au/fair-entitlements-guarantee-feg> [accessed February 2018].

13 References made to FEG amounts herein encompass financial assistance amounts advanced under the FEG Scheme and GEERS.

14 Australian Government, Mid-Year Economic and Fiscal Outlook 2016–17, Commonwealth of Australia, Canberra, December 2016, p. 106.

15 A circulating security interest is an interest held by a secured creditor in the circulating assets of a business. A business is usually able to use and dispose circulating assets, such as trading stock and debtors, in the ordinary course of business without the need to obtain the secured creditor’s consent.

16 Departmental resources and expenditure would, nevertheless, be incurred for the conduct of ‘unfunded’ activities that are settled without requiring any funding of recovery actions.

17 In this way, the return on investment calculation focuses solely on revenues and expenditures associated with FEG recovery activities, and does not incorporate revenues and expenditures associated with making advances under the FEG Scheme.

18 Activities of the FEG Recovery Program that may give rise to recoveries include all stages of action taken. Such activities include: sending initial correspondence to insolvency practitioners; correspondence from lawyers representing the Department of Jobs and Small Business; public examinations; serving of originating applications/claims; mediations; settlements; and judgements. Prior to the introduction of the FEG Recovery Program and its pilot, the department did not undertake specific activities to recover FEG advances. Rather, recoveries would typically arise in the course of broader actions taken by liquidators to recover money from the insolvency process for the benefit of creditors.

19 As the calculated revenues include those arising from the self-funded activities, it is reasonable that the costs incurred on these activities are also included in the calculation of return on investment.

20 In March 2018, the department developed a practice note setting out the policies and procedures to capture and document the broader outcomes and indirect achievements of the FEG Recovery Program. Broad outcomes of the FEG Recovery Program may include the value of a favourable legal precedent derived from a funded litigation or the program’s influence on corporate behaviours. Also, in early 2018 the department had favourable judgements delivered in litigations it had undertaken to clarify the application of the statutory priority regime in relation to the asset distribution of businesses conducted through trading trusts.

21 The Interagency Steering Committee consists of representatives from the Department of Finance, the Australian Taxation Office and the Australian Securities and Investments Commission. It is chaired by the Department of Jobs and Small Business and meets biannually.

22 The Department of Jobs and Small Business had also undertaken and completed an organisation-wide review of the appropriateness of performance criteria presented in its corporate plan and portfolio budget statements in June 2017. The department advised that it intends to consider the recommended improvements to its business planning performance framework, including how it assesses the appropriateness of performance criteria, during the 2018–19 performance reporting cycle.

23 The Internal Steering Committee consists of four members being the: Group Manager (Workplace Relations Programs Group); Group Manager (Finance, Legal and Governance Group); Branch Manager (Fair Entitlements Guarantee Branch); and Branch Manager (Recovery and Litigation Branch).

24 The ANAO’s review found that matter assessment and selection followed the established governance processes. A review of funding assessment documents also found that processes undertaken were in accordance with the commercial focus of the program to help increase recoveries in a cost-effective manner.

25 Each matter can have multiple approvals—a matter can be initially approved by the Branch Manager and subsequently referred to the Internal Steering Committee to seek additional funding above the funding threshold or approval for court proceedings.

26 Of the 58 liquidator funding applications, as at February 2018, eight applications were still in progress and 12 applications had been rejected.

27 Of the 176 matters pursued for recovery actions, 13 matters did not achieve a recovery (five direct funded matters; three liquidator funded matters; and five unfunded matters) and have been closed. As at February 2018, 80 matters were in progress.

28 Recovery activities and legal proceedings conducted for liquidator funded matters can take a significant amount of time to finalise before results are achieved.