Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The Auditor-General Annual Report 2015–16

Please direct enquiries relating to annual reports through our contact page.

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ending 30 June 2016. It addresses all applicable obligations under the Public Governance, Performance and Accountability Act 2013 and the Auditor-General Act 1997, the performance measures set out in the outcome and programs framework in the ANAO’s 2015–16 Portfolio Budget Statements and the ANAO’s 2015–19 Corporate Plan and annual reporting requirements set out in other legislation.

Part 1—Foreword by the Auditor-General

The year in review

Following my first full year as Auditor-General for Australia, I am pleased to present this annual report to the Parliament. This year has been one of delivering quality audit services while undergoing change, which naturally comes with new leadership. The way in which the ANAO staff have contributed and responded to change during the year is a credit to their professionalism and adaptability.

Many of the changes have impacts both for the Parliament and the ANAO. Re-designing our reports and taking a digital first approach have been key features of our effort to enable better access to information for the Parliament and for other users. Supported by a new website and more outreach activities, the ANAO is looking to present its work and insights in a way that has greater impact. These changes also support the delivery of recommendations by our Independent Auditor, Mr Peter van Dongen (PwC Managing Partner - Board Relationships) in a report tabled in the Parliament on 18 December 2015, which recommended that the ANAO could improve its communication capabilities.

The ANAO undertook some restructuring during the year to improve our business practices and increase our focus on efficient delivery, particularly by creating opportunities for auditors to leverage effort between financial and performance audit work. The creation of a more senior role within the organisation focusing on professional standards and relationships was an important step, both to ensure we maintain our focus but to also position us for new methodology for the future.

During the year we were successful in negotiating our new enterprise agreement, which will enable us to continue to work on a program of change, the key areas of which are outlined in our Corporate Plan.

The change program supported by the new business structure will increase our focus on service to the Parliament, engaging more actively with audited entities and audit committees, learning from other audit institutions and delivering capacity building activities to the Audit Board of the Republic of Indonesia (BPK) and the Auditor-General’s Office of Papua New Guinea (AGO). Through our investment in change, we will also be looking to the use of more modern ICT and auditing techniques to support our activities, which increasingly involve deeper analysis of large data sets.

The double dissolution of the 44th Parliament resulted in a suspension of my ability to table reports. As a result of the timing of the double dissolution, my report, Interim Phase of the Audits of the Financial Statements of Major General Government Sector Entities for the year ending 30 June 2016, which summarises key financial controls issues in the general government sector, and a number of performance audits were not tabled in the 44th Parliament. Normal work continued in the caretaker period and while the ANAO has taken the opportunity to recalibrate our work program, the change processes discussed above have meant that we would not have met our target of 49 performance audits in 2015–16 even if the Parliament had not been dissolved.

A continuing focus in the year has been on supporting transparency for the Parliament. The Joint Committee of Public Accounts and Audit (JCPAA) inquiry into the Development of the Commonwealth Performance Framework focused on the transparency of performance information for the Parliament. The quality of implementation of the Commonwealth Performance Framework will be an ongoing area of focus for the ANAO, including undertaking audit activity on performance statements. As it currently stands, audits of performance statements under Division 1A of the Auditor-General Act 1997 can be undertaken only when requested by either the Minister for Finance or the responsible minister. This means that without such a request the Parliament receives a lower level of assurance over the quality of performance statements included in annual reports than it does over financial statements where an audit opinion is mandatory. The ANAO has developed methodology to audit performance statements, which will be tested through performance audits of selected entities in the coming year.

The independent Review of Whole-of-Government Internal Regulation, known as the ‘Belcher Red Tape Review’, made a recommendation in relation to the ANAO’s better practice guides that ‘the ANAO take the opportunity, where regulators and policy owners have developed or are developing policy guidance material, to review whether there is a continuing need for it to develop, release and maintain its own separate guidance’. 1 While the better practice guides have been broadly endorsed in my consultation with agency heads and audit committees as useful tools where there is a guidance gap, there is the risk that entities, and potentially the ANAO, may treat them as a standard rather than guidance. Given the recent reforms to the financial framework of the Australian Government through the Public Management Reform Agenda, it is time to assess the ongoing set of better practice guides. None were reviewed or re-issued in the past year, with this assessment in mind.

In 2015–16, the ANAO completed 255 audits of 2014–15 financial statements. Of these, the only qualified audit report related to the Consolidated Financial Statements of the Australian Government. The qualification related to the work required to meet an accounting standard on fair valuation of defence weapons platforms. For the Department of Finance, as the preparer of the Consolidated Financial Statements, future removal of the qualification will require good planning and preparation with the consolidating entities.

Performance audits undertaken in 2015–16 involved 24 entities and covered a range of areas of public administration, including service delivery, regulation and deregulation, grants management and procurement.

The financial and performance audits tabled in 2015–16 identified elements of sound public administration across a range of activities, but also highlighted the importance of:

- looking outward to learn from the experiences of others—avoiding the pitfalls and the costs of ‘reinventing the wheel’;

- maintaining visibility over key responsibilities, delivering accountable decision-making through sound record-keeping, establishing a strong IT control environment to protect data holdings, and appreciating the importance of quality assurance over data and financial reporting—getting the basics right;

- establishing clear responsibilities and accountabilities when engaging third parties to ensure that outcomes are achieved and risks are effectively managed—maintaining effective governance over third-party or joint service delivery;

- adopting a risk management culture that enables entities to move beyond a compliance approach to effectively engage with risk in the delivery of government policies and programs—embedding a risk management culture; and

- measuring and reporting on policy/program impact or effectiveness—knowing what you are trying to achieve and whether you are.

The year ahead

The ANAO has demonstrated throughout the past year a commitment to support the Parliament in providing reports that enable the Executive to be held to account for its use of public resources and the powers conferred on it by the Parliament. The coming year will include delivery of our change program while we undertake our extensive program of financial and performance audits as well as other assurance activities. This will be against a background where we: seek to hold ourselves accountable to the same standards against which we hold others; more actively share our findings and insights within the public sector; and focus on learning from others in our field.

The ANAO continues to look for ways to improve our approach to financial statements audits. During 2016–17, the efficiency and effectiveness of the financial statements audit program will be enhanced by exploring the use of new data tools and expanding the communication of audit findings, conclusions and recommendations that have broader application, including through forums such as the recently established Chief Financial Officers’ Forum.

The ANAO supports the Department of Finance’s endeavour to have future annual reports tabled in a more timely manner and will continue to work with entities to ensure earlier audit completion. The implementation of a reduced disclosure regime for Australian Government entities could also enhance the ability of entities to complete their financial statements in a shorter timeframe.

In April 2015, the Australian Auditing and Assurance Standards Board introduced a requirement (to apply from 15 December 2016 to audits of listed entities) for an auditor’s report to include key matters about how the audit was performed. Key audit matters are those that were of most significance in the audit of the financial statements. Such a change may assist users to understand the entity and the areas of significant management judgment in the financial statements. I will give consideration to applying those standards to the audits of the more material Australian Government entities.

A continuing focus on defence procurement will occur through our priority assurance report, Defence Major Projects Report and associated performance audit reports. Given the interest of the JCPAA and the significant investment by the Australian Government, the ANAO will also commence focused audit work on the sustainment of defence assets.

In implementing our 2016 Annual Audit Work Program, the ANAO will continue to focus performance audit activity across the full scope of the Auditor-General’s mandate. The ANAO identifies subjects for audit through its planning processes and consults annually with the Parliament through the JCPAA, Australian Government entities and stakeholders during the development of the Annual Audit Work Program. For example, in developing the potential performance audit topics for taxation, the ANAO consulted with the Inspector-General of Taxation about the topics in relation to that entity’s work program. More broadly, the ANAO also consulted with the Commonwealth Ombudsman about a wider range of potential audit topics.

2016–17 will also see the continued development of our limited scope assurance review program, which provides the ANAO with the ability to produce more timely reports on issues of contemporary interest to the Parliament.

I commend this report to the Parliament.

Grant Hehir

Auditor-General

Part 2—Report on operational sustainability and capability

The Australian National Audit Office (ANAO) is committed to undertaking its role and achieving its purpose in a way that is operationally sustainable. This involves attracting and retaining talented people with relevant and diverse capabilities and ensuring that existing governance frameworks and business practices are appropriate and sustainable into the future.

Role

The Auditor-General is an independent officer of the Australian Parliament whose responsibilities, as set out in the Auditor-General Act 1997, include undertaking financial statements and performance audits of Australian Government sector entities.

Under the Auditor-General Act 1997, the Auditor-General is responsible for:

- auditing the financial statements of Commonwealth entities, Commonwealth companies and their subsidiaries;

- conducting performance audits, assurance reviews or audits of the performance measures, of Commonwealth entities and Commonwealth companies and their subsidiaries, other than government business enterprises 2;

- conducting a performance audit of a Commonwealth partner as described in section 18B of the Act 3;

- providing other audit services as required by other legislation or allowed under section 20 of the Act; and

- reporting directly to the Parliament on any matter or to a minister on any important matter.

As an independent officer of the Parliament, the Auditor-General has discretion in the performance or exercise of their functions or powers. In particular, the Auditor-General is not subject to direction in relation to: whether or not a particular audit is to be conducted; the way in which a particular audit is to be conducted; or the priority to be given to any particular matter. In the exercise of functions or powers, the Auditor-General must, however, have regard to the audit priorities of the Parliament, as determined by the Joint Committee of Public Accounts and Audit (JCPAA).

In delivering against this mandate, the Auditor-General is assisted by the Australian National Audit Office (ANAO). The ANAO’s work is also governed by auditing standards established by the Auditor-General, which incorporate the standards made by the Auditing and Assurance Standards Board as applied by the auditing profession in Australia. In accordance with these standards, performance audits and financial statements audits are designed to provide a reasonable level of assurance.

Through the delivery of an integrated range of high-quality audit reports and opinions that are timely, cost-effective and conducted in accordance with the ANAO’s Auditing Standards, the ANAO aims to meet the needs and expectations of stakeholders, including the Parliament, the Government, audited entities and the community. In doing so, the ANAO aims to add value to public sector performance and accountability.

In addition, the ANAO plays a leadership role in improving public administration and public sector audit capability in Australia and overseas, through:

- publishing relevant and topical information, such as better practice guides;

- participating in forums and seminars;

- providing development opportunities, including secondments, for audit professionals; and

- deploying experienced staff to audit institutions in Indonesia and Papua New Guinea.

Purpose

The purpose of the ANAO is to improve public sector performance and support accountability and transparency in the Australian Government sector through independent reporting to the Parliament, the Executive and the public.

Values

The ANAO upholds the Australian Public Service (APS) values as set out in the Public Service Act 1999. In addition to APS values, the ANAO places particular focus on respect, integrity and excellence—values that align with the APS values and address the unique aspects of the ANAO’s business and environment. The ANAO’s values guide the office in performing its role objectively, with impartiality and in the best interests of the Parliament, the Executive and the public.

Organisation

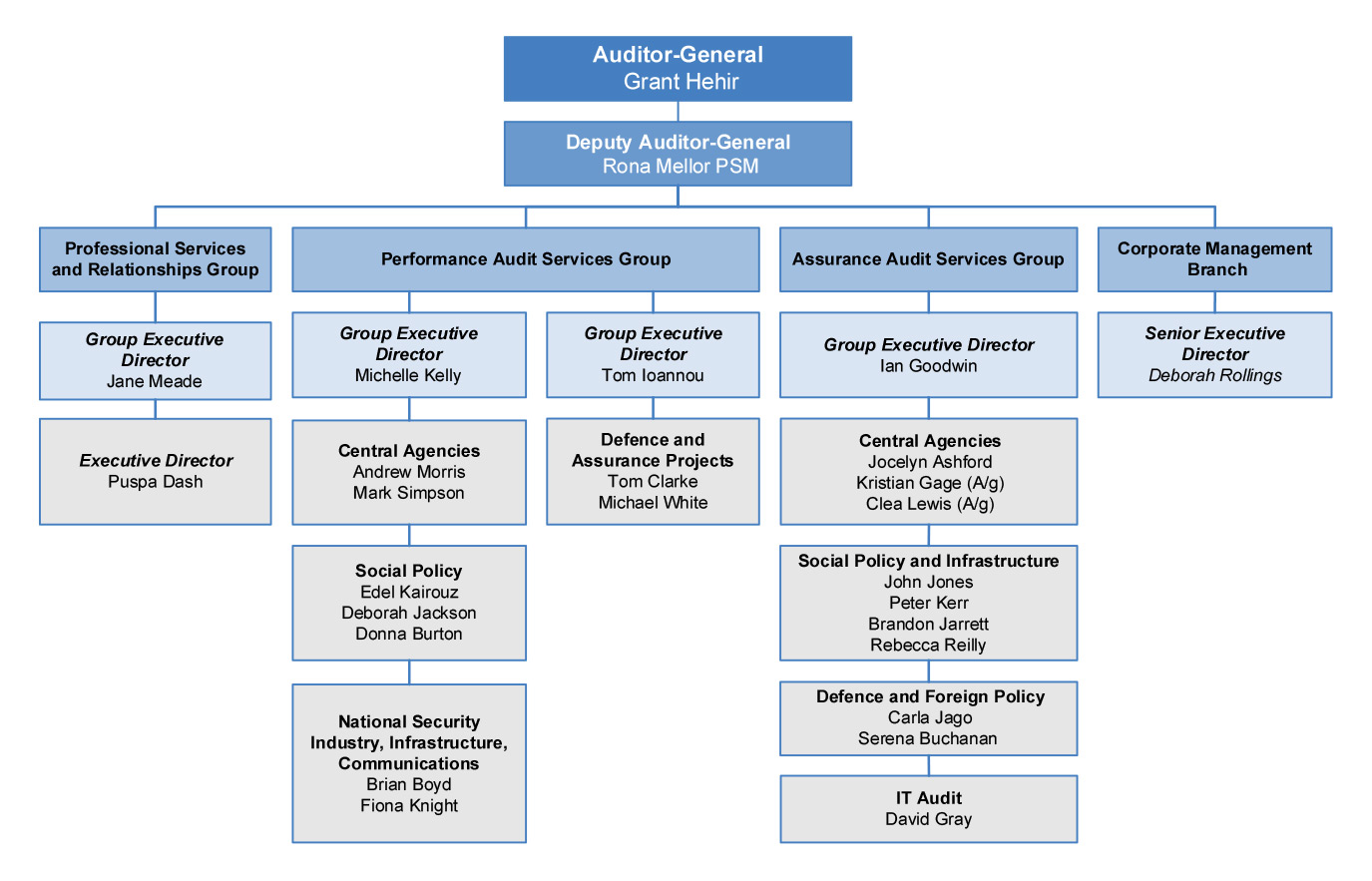

The ANAO is organised into four functional areas:

- Assurance Audit Services Group provides independent assurance on the financial statements and financial administration of all Australian Government entities. It also conducts assurance reviews;

- Performance Audit Services Group contributes to improved public sector administration and accountability by conducting performance audits of Australian Government entities and producing related publications;

- Professional Services and Relationships Group provides technical accounting and auditing support to the service groups and the Auditor-General and manages the ANAO’s external relations; and

- Corporate Management Branch provides administrative support, including the coordination of corporate governance activities, human resources, finance, IT, communications and building services.

The ANAO is located in Canberra.

The organisational and senior management structure of the ANAO at 30 June 2016 is shown in Figure 1.

Figure 1. Organisational and senior management structure at 30 June 2016

Note: A Group Executive Director from the Performance Audit Services Group, Andrew Pope, is on long-term deployment to the Audit Board of the Republic of Indonesia.

Outcome and programs framework

The ANAO’s outcome and programs framework is set out in its Portfolio Budget Statements, which sit administratively within the portfolio of the Prime Minister and Cabinet. Part 3 of the annual report describes the ANAO’s performance against the measures set out in its Portfolio Budget Statements and Corporate Plan for 2015–16.

The framework for 2015–16 consists of one outcome and two programs. In addition to its two programs, the ANAO administers a special appropriation for the remuneration of the Auditor-General.

Figure 2. Outcome and programs framework, 2015–16

|

Outcome 1 |

|

|

To improve public sector performance and accountability through independent reporting on Australian Government administration to the Parliament, the Executive and the public. |

|

|

Program 1.1 Assurance Audit Services |

Program 1.2 Performance Audit Services |

|

The objectives of this program are:

|

The objectives of this program are:

|

|

225 |

225 |

Program 1.1—Assurance Audit Services

The preparation of audited financial statements is a key element of the financial management and accountability regime in the Australian Government sector. The ANAO’s financial statements audits provide an independent examination of the financial accounting and reporting of public sector entities and provide independent assurance that the financial statements have been prepared in accordance with the Government’s financial reporting framework and Australian accounting standards. The ANAO’s audits of financial statements assist Australian Government entities to fulfil their annual accountability obligations under the Public Governance, Performance and Accountability Act 2013 (PGPA Act), the Corporations Act 2001 or other legislation.

Under section 14 of the Auditor-General Act 1997, audit fees are based on a scale determined by the Auditor-General. The audit fees calculated for financial statements audits are based on a cost-recovery model using accrual-based costing to determine an hourly charge-out rate for each staff category. The costing model takes into account all relevant costs, including the attribution of overhead costs. The audit fees for each financial statements audit are disclosed in the annual financial statements of each entity audited by the ANAO.

Non-corporate Commonwealth entities that are governed by the PGPA Act disclose the notional cost (fee) for auditing their financial statements as advised by the ANAO. Notional cost recovery involves accounting for the costs of performing the service without actually billing the recipient.

Corporate Commonwealth entities and Commonwealth companies and their subsidiaries are liable to pay fees for the audit of their financial statements by the ANAO. The ANAO receives such payments as administered receipts on behalf of the Government. The revenue is not used to fund the operations of the ANAO but is paid directly into Consolidated Revenue. The revenue and receipts are reported as administered activities in the ANAO annual financial statements.

An entity may request additional assurance audit services that involve the payment of fees to the Auditor-General under section 20(2) of the Auditor-General Act 1997. Revenue from such payments is retained by the ANAO.

Program 1.2—Performance Audit Services

The ANAO’s performance audit activities involve the audit of all or part of an entity’s operations. In 2015–16, performance audits have continued to examine the effectiveness of public sector program delivery by entities—the extent to which intended outcomes are being achieved and whether processes can be undertaken more effectively—and the extent of compliance with relevant legal and policy frameworks. A greater emphasis is being placed in our audits on whether entities’ management and use of public resources is economical and efficient, reflecting the full scope of the Auditor-General’s mandate. Further, performance audits are targeting areas of public administration beyond implementation, by looking at programs’ design and the quality of advice provided to ministers and the Government.

The ANAO reports to the Parliament on areas where improvements can be made to aspects of public administration and makes specific recommendations to assist public sector entities to improve performance. Performance audits may also involve multiple entities and examine common aspects of administration or the joint administration of a program or service. In 2015–16, cross-entity audits covered topics such as information security, management of grants and entitlements, program management and contract management.

The Auditor-General Act 1997 authorises the Auditor-General to conduct performance audits, assurance reviews or audits of the performance measures of Commonwealth entities, Commonwealth companies and their subsidiaries. The Auditor-General may only conduct a performance audit of a government business enterprise if the Joint Committee of Public Accounts and Audit (JCPAA) requests the audit.

The Auditor-General Act 1997 also authorises the Auditor-General to conduct a performance audit of a Commonwealth partner in certain circumstances. Commonwealth partners include contractors and state and territory bodies that have received money to achieve a Commonwealth purpose and have agreed to use the money in achieving that purpose or have entered into a contract that relates to that purpose. Audits of Commonwealth partners that are part of, or controlled by, state or territory governments must be requested by the responsible minister or the JCPAA.

The ANAO identifies subjects for audit through its planning processes and consults annually with the Parliament, through the JCPAA, and Australian Government entities during the development of the Annual Audit Work Program. In developing potential performance audit topics for taxation, the ANAO consulted with the Inspector-General of Taxation about the topics in relation to that entity’s work program. More broadly, the ANAO also consulted with the Commonwealth Ombudsman about a wide range of potential audit topics.

Management and accountability

Corporate governance

The ANAO has a structured governance framework that facilitates the effective management of business resources and other corporate activities to support the delivery of the ANAO’s outcome.

Executive Board of Management

The Executive Board of Management assists the Auditor-General to meet his statutory responsibilities. The board is responsible for setting and monitoring the ANAO’s strategic directions, overseeing key business opportunities and risks and managing the ANAO’s budget and workforce. The board meets each month. At 30 June 2016, the board’s membership comprised:

- Mr Grant Hehir (Chair), Auditor-General

- Ms Rona Mellor PSM, Deputy Auditor-General

- Mr Ian Goodwin, Group Executive Director, Assurance Audit Services Group

- Ms Michelle Kelly, Group Executive Director, Performance Audit Services Group

- Dr Tom Ioannou, Group Executive Director, Performance Audit Services Group

- Ms Jane Meade, Group Executive Director, Professional Services and Relationships Group

- Ms Deborah Rollings, Senior Executive Director, Corporate Management Branch

- Ms Sue Knox, Chief Financial Officer

Audit Committee

The Audit Committee provides independent assurance and assistance to the Auditor-General on the ANAO’s risk, control and compliance framework, and its financial statement responsibilities. Section 45 of the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and section 17 of the Public Governance, Performance and Accountability Rule 2014 set out the role of the audit committee for Commonwealth entities.

The Audit Committee met five times in 2015–16. During 2015–16, its membership comprised:

- Mr Will Laurie (Chair), external independent member

- Dr Ian Watt AC, external independent member

- Mr Sean Van Gorp, external independent member

Corporate Plan

The ANAO’s 2015–19 Corporate Plan sets out four Key Focus Areas (KFAs), which form the basis of the ANAO’s strategic direction and support how the ANAO manages and reports on its performance:

- being independent and responsive in our relationship with the Parliament and parliamentary committees and when assisting public sector entities to improve their performance;

- providing value-adding audit services;

- maintaining a cooperative and productive working environment which supports our capability to deliver world class services; and

- ensuring there is confidence in the delivery of our services, which represent value for money.

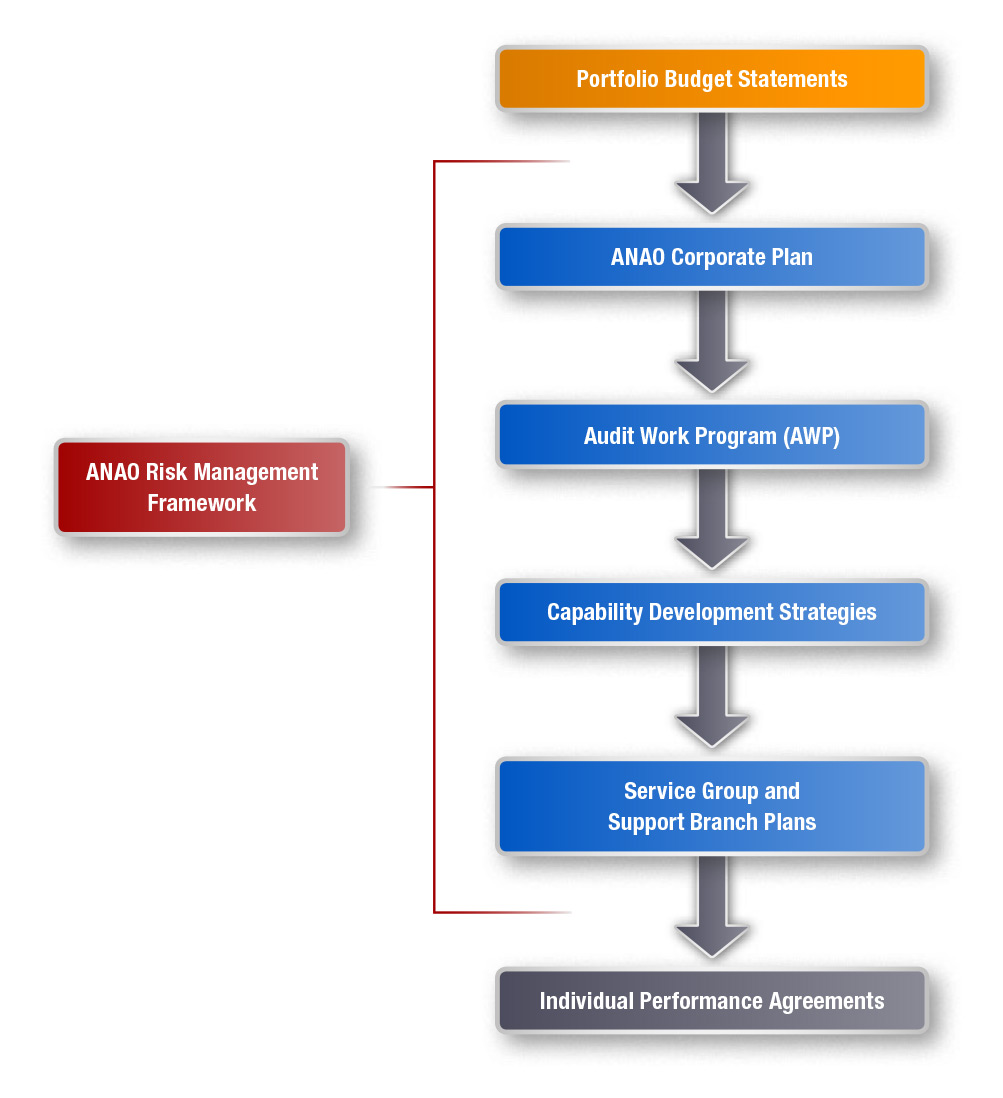

The ANAO’s Corporate Plan details our performance measurement framework, which is based on measuring public value, as a combination of the value created by the ANAO, the value added to Public Sector entities we audit, and the value shared with the Government. Our Plan also recognises that continuing to develop our key capabilities will be central to our ability to deliver on our purpose in the future. The ANAO’s governance and business planning is facilitated by the ANAO’s Strategic Planning Framework.

Strategic planning framework

Key elements of the ANAO’s strategic planning framework for 2015–16 are presented in Figure 3.

Figure 3. Strategic planning framework, 2015–16

Risk management framework

The ANAO’s risk management framework and approach to managing risk is based on adherence to the international standard ISO 31000:2009, which defines risk as ‘the effect of uncertainty on objectives’. For the ANAO, this is the possibility of an event or activity having an adverse impact to such an extent that it prevents the ANAO from achieving its outcomes. The ANAO is committed to the effective management of risks and to ensuring that resources are allocated across our activities so that risks are managed according to our risk appetite. Those allocated responsibility for managing particular risks or being accountable for critical controls must ensure appropriate monitoring and reporting occurs through the ANAO’s existing management reporting and governance framework.

The effective management of risks plays an important role in shaping the ANAO’s strategic direction as outlined in the Corporate Plan and thereby contributes to evidence-based decision making and the successful delivery of the ANAO’s purpose. The Executive Board of Management reviews any serious risk incidents each month, and any risk assessed as ‘high’ or above is monitored as a standard agenda item. Business risks are reviewed at least annually. There were no serious risk incidents in 2015–16, and all risks with controls in place were assessed as ‘medium’ or ‘low’.

Fraud control framework

Consistent with previous years, the ANAO continues to maintain appropriate fraud prevention, detection, investigation, reporting and data collection procedures. The ANAO enhances fraud awareness among staff through various mechanisms, including a fraud e-learning module.

On 1 July 2016, the ANAO released an updated fraud control plan aligned with the PGPA Act. During 2015–16, the ANAO undertook an annual review of the Fraud Control Plan and associated fraud risks to ensure they remain appropriate within the context of the ANAO operating environment. There were no significant fraud risks identified from this review.

The Fraud Control Plan is linked to the risk management framework and consolidates all fraud prevention and detection initiatives in one document.

Having particular regard to the risk to the ANAO’s reputation should fraudulent activity occur, the ANAO periodically reviews its fraud control framework to take into account changes in its operating environment. The Fraud Control Policy, Fraud Risk Assessment and Fraud Control Plan are also reviewed at least every two years.

There were no incidents of fraud in 2015–16. All fraud risks were assessed, and appropriate controls were in place.

The Auditor-General’s fraud control certification is provided below.

1 July 2016

Annual Report 2015–16 — Fraud Control Certification

I, Grant Hehir, Auditor-General for Australia, certify that I am satisfied that the Australian National Audit Office (ANAO) has:

- prepared fraud risk assessments and a fraud control plan;

- put in place appropriate fraud prevention, detection, investigation, reporting and data collection procedures and processes that meet the specific needs of the ANAO; and

- taken all reasonable measures to minimise the incidence of fraud.

Grant Hehir

Ethical standards and independence

The ANAO’s commitment to high ethical and professional standards underpins the quality of its work. For audit professionals, professional independence is a central element of the quality of each audit. It is the avoidance of circumstances that could compromise any member of the audit team’s capacity to act with integrity and exercise objectivity and professional scepticism.

The ANAO’s independence policy requires staff and contractors engaged in audits to comply with the relevant provisions of APES 110 Code of Ethics for Professional Accountants relating to independence. In planning the audit, the audit team must identify and deal with any threats to independence, so that independence of mind and appearance is maintained throughout the audit.

Internal audit

Internal audit provides an independent and objective audit and advisory service that is designed to add value and improve the ANAO’s operations. The service is provided by a contracted specialist firm (Protiviti). A systematic and disciplined approach is taken to evaluate and improve the effectiveness of risk management, control and governance processes. In 2015–16, the ANAO’s internal auditor completed reviews of:

- contract management;

- project budget management;

- annual compliance with the Protective Security Policy Framework;

- annual compliance with financial controls;

- use of technology by the ANAO; and

- implementation of a new human resources information system.

All review recommendations were agreed and implemented.

External scrutiny

The ANAO’s operations, processes and reports are periodically subjected to independent external review.

External audits

Part 7 of the Auditor-General Act 1997 provides for the appointment of an independent auditor who undertakes the audit of the ANAO’s financial statements and carries out selected performance audits. The independent auditor position is a part-time statutory appointment for a period of at least three years and not more than five years.

The current Independent Auditor is Mr Peter van Dongen, PwC Managing Partner - Board Relationships and a member of PwC Australia’s Governance Board. Mr van Dongen was appointed as the Independent Auditor in June 2014.

The most recent Independent Auditor report, Review of Communications Processes, was tabled in the Parliament on 18 December 2015. The ANAO agreed with all three recommendations in the report, which focused on enhancing the ANAO’s communication processes. The Joint Committee of Public Accounts and Audit (JCPAA) conducted an inquiry into this report in February 2016 and determined that there were no outstanding matters arising from the inquiry. Overall, the JCPAA commended the ANAO ‘for its ongoing effective communication with stakeholders and, in particular, with the Parliament via the JCPAA’. A progress report is available on the ANAO’s website.

The ANAO received an unmodified auditor’s report on its financial statements for the year ended 30 June 2016.

Judicial and administrative decisions

No decisions made by a court or administrative tribunal or by the Australian Information Commissioner had an impact on the operations of the ANAO in 2015–16.

External reports on ANAO operations

The purpose of the JCPAA is to hold Commonwealth agencies to account for the lawfulness, efficiency and effectiveness with which they use public moneys. Among its responsibilities, the committee considers the operations and resources of the ANAO. The committee is also required to review all reports that the Auditor-General tables in the Parliament and to report the results of its deliberations to both houses of the Parliament. Officers of the ANAO attend private briefings and public hearings as part of the JCPAA’s review of audit reports. The JCPAA completed six reviews of the Auditor-General’s reports in 2015–16. An outline of the reports on these reviews is provided at Appendix 1.

In 2015–16, the House of Representatives’ Standing Committee on Tax and Revenue conducted an inquiry into the external scrutiny of the Australian Taxation Office. In its May 2016 report, the committee made two recommendations to the ANAO related to increasing the transparency of the scrutiny process, particularly relating to coordination activities between scrutineers such as the Auditor-General and the Inspector-General of Taxation.

The ANAO was not the subject of any agency capability reviews or reports by the Commonwealth Ombudsman in 2015–16.

Compliance with financial law

The ANAO had no significant non-compliance issues with financial law in 2015–16.

Management of Human Resources

For the ANAO, this year has been one of delivering quality audit services while undergoing change. These changes can be reflected in the experience of our 345 employees, who have contributed and adapted with resilience and professionalism. In 2015–16, the ANAO reviewed its business processes and consulted with staff on how these processes impacted on them and the way they did their work. The ANAO’s 2016–19 Enterprise Agreement was premised on the productivity improvements derived from these business process improvements. Improved processes have also enabled more collaboration across service groups, provided more opportunities for staff to diversify their skills and given the ANAO greater ability to optimise the capabilities of its talented workforce.

To help manage the effect of significant changes on its people throughout the year, the ANAO regularly consulted and informed staff about changes, introduced additional mandatory training courses and brought in speakers through the ANAO’s Leaders Speaking Program. 4 Following the December 2015 report, Review of Communications Processes, undertaken by the ANAO’s Independent Auditor, Mr Peter van Dongen, new internal communication processes have been developed and will continue to improve. The ANAO also refined its human resources management processes with the implementation of a new human resources information system (Aurion).

The ANAO has also changed its performance framework and organisational structure to align responsibility and accountability at the levels best positioned to drive organisational improvement. The ANAO started an organisational change program to prioritise change activities over the next few years and is committed to developing the knowledge, skills and expertise of its staff and to recognising and rewarding outstanding performance. Further information and statistics on ANAO staffing is provided at Appendix 2.

ANAO Enterprise Agreement 2016–2019

The ANAO’s Enterprise Agreement 2016–2019 came into effect on 21 April 2016. The agreement states the terms and conditions of employment of the employees of the ANAO, other than terms and conditions applying under a relevant Commonwealth law or implied at common law. The agreement provides for a 2 per cent annual pay increase, which is funded from within existing and known future agency budget and revenue streams. As at 30 June 2016, 317 non-SES staff were engaged under the agreement, while 28 SES staff were employed under common law contracts.

Graduate and undergraduate programs

The ANAO’s graduate program is open to university students who are completing their final year of study or have completed a degree within the past five years. During the 12-month program, the graduates undertake an intensive learning and development program, including technical, people management and general training and skill development. In 2016, the ANAO’s graduate program included 18 graduates: nine in the Assurance Audit Services Group; five in the Performance Audit Services Group; and four in the IT Audit Branch.

The ANAO’s undergraduate employment program provides paid part-time practical work experience to people studying relevant disciplines at universities in Canberra. During 2015–16, nine students took part. The ANAO continued to foster productive relationships with the Australian National University, the University of Canberra, Chartered Accountants Australia and New Zealand and CPA Australia to recruit students for the program.

Employee census

Each year the ANAO participates in the Australian Public Service Commission’s Employee Census. For 2016, the ANAO’s response rate to this survey was 72 per cent, up from 62 per cent in 2015. There were a number of positive improvements noted in this year’s census results compared to 2015, including those related to: open consultation; remuneration and conditions of employment; autonomy; change management; health, safety and wellbeing; and innovation.

In 2016–17, the ANAO will be addressing the key focus areas identified for improvement, including access to learning and development, encouraging and rewarding innovation, visibility of senior leaders and risk management.

Awards and recognition

The ANAO supports an awards system that recognises and rewards individual staff and teams who make a significant contribution to achieving its business objectives, including in such areas as client service, people management, business management, audit management and innovation.

Workplace Consultative Forum

In 2015–16, the Workplace Consultative Forum (WCF) met formally on four occasions to discuss and consider a range of employment-related issues, including a new Performance and Career Development Program and an awards and recognition framework.

Under the ANAO Enterprise Agreement 2016–19, a new forum was established that includes an expanded membership comprising nineteen staff, union and management representatives.

Performance pay

The ANAO’s Performance Management arrangements provide for salary advancement and performance bonuses for eligible staff. In 2015–16, staff rated as ‘outstanding’ were eligible for a bonus of up to 10 per cent of salary. A total of $0.226 million in performance bonuses was paid to eligible staff ($0.364 million was paid in 2014–15). Aggregated information on performance pay and a summary of ratings for the reporting is set out in Appendix 2.

Individual flexibility arrangements

The Auditor-General and employees covered by the ANAO Enterprise Agreement may agree to make an individual flexibility arrangement to vary the effect of any of the terms of the Agreement, where the arrangement meets the genuine needs of the employee and the ANAO. During 2015–16, nine staff had individual flexibility arrangements in place.

Senior executive remuneration

The salary ranges for SES staff are determined by the ANAO’s SES Remuneration Policy and having regard to public sector benchmarks, notably the annual APS remuneration survey. The nature of the work, specific skills and individual contributions to business outcomes are key factors in setting individual SES salaries. SES remuneration payments are set out under Note 2.3 of the financial statements.

Learning and development

During 2015–16, the ANAO supported 46 staff members to undertake professional qualifications and tertiary education, including programs offered by Chartered Accountants Australia and New Zealand, CPA Australia and ISACA. The ANAO also invested in a diverse range of programs to build internal capability, including coaching, technical workshops, well-being and communication skills.

The ANAO learning and development program supports staff to meet continuous professional development (CPD) requirements relating to their membership of professional accounting associations. This includes:

- support to complete 120 hours of CPD over a three-year period, with a minimum of 20 hours to be completed per financial year—this includes 10 hours of formal technical training in relevant areas such as financial statements auditing, accounting or legal frameworks;

- a written declaration that they have complied with the CPD requirements for each financial year; and

- evaluation of training undertaken by staff against the learning and development curriculum.

Work health and safety

As a ‘person conducting a business or undertaking’ under the Work Health and Safety Act 2011, the ANAO has a primary duty of care to ensure the health and safety of workers. The Auditor-General and all ANAO officers are accountable for work health and safety (WHS) outcomes and the actions taken to implement WHS policies and guidelines.

The ANAO is committed to: ensuring that all workers are safe from injury and risk to health while at work; and protecting the health and safety of workers and other people at or near the workplace. The ANAO integrates safe working practices into all areas of operations.

The Workplace Health and Safety Committee is responsible for monitoring and reviewing the WHS policies and practices and advising the ANAO on WHS matters. The committee is chaired by the Senior Executive Director, Corporate Management Branch, and its members are the ANAO’s health and safety representatives. During 2015–16, the committee met four times.

During 2015–16, the ANAO provided health and wellbeing workshops to all staff on topics such as resilience, healthy lifestyles and work-life balance. The ANAO also provided ongoing support by offering ergonomic work station assessments to all staff and new starters and completing 67 ergonomic work station assessments. All staff were also offered influenza vaccinations and health assessments.

There were no notifiable incidents reported in 2015–16 under the Work Health and Safety Act 2011. The ANAO was not subject to any WHS investigations that related to business or undertakings, nor did the ANAO receive any notices given under Part 10 of the Work Health and Safety Act 2011.

Employee Assistance Program

The Employee Assistance Program provides access to free confidential professional counselling services to assist staff and their families with any personal or work-related problems, and offers guidance and advice to managers on staff management.

In 2015–16, the service was used by 22 staff and their family members, including 17 who used the service for the first time. The service was accessed for both work-related and personal circumstances, with counselling support being predominantly for non-work related matters.

Workplace diversity

A successful organisation is one that encourages and welcomes diversity, including diversity of backgrounds, views, thoughts and approaches. The ANAO’s objective is to attract a range of people to build a successful and sustainable organisation and a constructive, open and challenging culture. A positive culture creates opportunities for a variety of different voices to be encouraged and heard.

The ANAO is committed to promoting and supporting social inclusion, equity and diversity, and achieves this by actively building a working environment that supports and encourages staff that have a range of skills and life experiences and different cultural and social backgrounds.

The ANAO’s Diversity Strategy 2013–16 includes measures for recruiting, developing and retaining Indigenous employees. The strategy sets a target of 2.7 per cent Indigenous representation to be achieved by 2016. At 30 June 2016, the ANAO had two employees (less than 1 per cent of staff) who self-identified as Indigenous. The ANAO collaborates with other Australian Government agencies so that it can better meet the employment needs of Indigenous Australians. The ANAO participates in the Australian Public Service Commission’s Pathways recruitment initiatives for Indigenous graduates, and in the Indigenous Australian Government Development Program.

Diversity contact officers

A network of diversity contact officers (DCOs) champion diversity across the ANAO, with a focus on building a positive workplace culture. DCOs provide informal and confidential support to staff that are seeking assistance and guidance on workplace issues, such as harassment and bullying. The DCOs met four times during 2015–16, to share information, discuss developments and devise a future program of activities.

Other management issues

The management activities and services that support the ANAO’s audit functions are undertaken in line with government policies and better practice. Reporting against the following activities is provided at Appendix 3:

- Assets management;

- Purchasing and procurement;

- Consultants;

- Procurement initiatives to support small business;

- Advertising and market research;

- Grant programs;

- Environmental protection and biodiversity conservation;

- Disability reporting;

- Freedom of information; and

- Service charter.

Part 3—Report on performance

Annual performance statement

Introductory statement

I, as the accountable authority of the Australian National Audit Office, present the 2015–16 annual performance statement of the Australian National Audit Office, as required under paragraph 39(1)(a) of the Public Governance, Performance and Accountability Act 2013 (PGPA Act). In my opinion, this annual performance statement is based on properly maintained records, accurately reflects the performance of the entity for the reporting period, and complies with subsection 39(2) of the PGPA Act.

Purpose

The purpose of the ANAO is to improve public sector performance and support accountability and transparency in the Australian Government sector through independent reporting to the Parliament, the Executive and the public (Outcome 1).

The ANAO seeks to achieve its purpose through its audit services, which include:

- financial statements audits of Australian Government entities (Program 1.1); and

- performance audits of Australian Government programs and entities (Program 1.2).

The ANAO audits the annual financial statements of Australian Government entities and the Consolidated Financial Statements of the Australian Government. The Consolidated Financial Statements present the consolidated whole-of-government financial result inclusive of all Australian Government controlled entities, including entities outside the general government sector. These audits are designed to give assurance to the Parliament that an entity’s financial statements fairly represent its financial operations and financial position at year end. The ANAO also undertakes a range of assurance reviews, including an assurance review of defence major projects.

The ANAO’s performance audit activities involve the audit of all or part of an entity’s operations to assess its efficiency or administrative effectiveness. The ANAO identifies areas where improvements can be made to aspects of public administration and makes specific recommendations to assist public sector entities to improve their program management.

Analysis of performance against purpose

The ANAO delivered against its purpose to improve public sector performance and support accountability and transparency in the Australian Government sector. It achieved this through independent performance and financial reporting to the Parliament.

In 2015–16, the ANAO focused not just on the delivery of products, but on improving how it delivered these products. In order to make reports more relevant and accessible to the Parliament, and in doing so increase transparency, the past year saw a change to the format and structure of ANAO audit reports. Reports are now shorter, clearer and contain concise Executive Summaries that can be better used as briefing materials for parliamentarians and parliamentary committees. The ANAO also implemented an updated website in April 2016, which improved the accessibility of our reports on a variety of platforms.

This focus on improving business processes and products achieved good outcomes for improving accountability and transparency, but affected our delivery against a number of performance targets. The ANAO’s performance against targets was also impacted by external factors, such as the double dissolution of the Parliament on 9 May 2016—which meant the Auditor-General was unable to table reports in the final eight weeks of the financial year.

Performance results

The ANAO assesses its performance against its purpose using a range of performance criteria, which were outlined in the ANAO’s 2015–19 Corporate Plan and 2015–16 Portfolio Budget Statements. These criteria include deliverables that assist the ANAO with assessing the value created by its activities and performance measures that help with assessing the value added for the Parliament, the Executive and the public.

Program 1.1 – Assurance Audit Services

The ANAO’s Assurance Audit Services Group provides independent assurance on the financial statements and financial administration of all Australian Government entities. The independent reporting to the Parliament on this activity supports accountability and transparency in the Australian Government sector and directly contributes to the ANAO’s achievement of its purpose.

To assess its performance against its purpose in relation to assurance audit activities, the ANAO measures the number of: financial statement audit opinions issued; other assurance reports produced; and financial statement related reports produced.

|

Criterion 1 |

Number of financial statement audit opinions issued |

|

Source |

|

|

Result |

Achieved a result of 255 against a target of 250 |

The number of financial statement audit opinions issued is a key measure of ANAO core business in achieving its purpose. Financial statement audit opinions provide assurance to the Parliament that the financial statements of the entity comply with Australian accounting standards and other reporting requirements (such as the Public Governance, Performance and Accountability (Financial Reporting) Rule 2015) and present fairly the entity’s financial position and its financial performance and cash flows for the period. The target of 250 reflects the expected number of entities that would require an audit opinion on financial statements for the year ended 30 June 2015. 5

During the 2015–16 financial year, the ANAO completed 255 mandated 6 financial statements audits for the year ended 30 June 2015, which included the Consolidated Financial Statements (CFS) of the Australian Government. There were 51 other financial statements audits relating to 2014–15 completed as agreed with entities under section 20 of the Auditor-General Act 1997.

Where an entity’s financial statements have been prepared in accordance with the Government’s financial reporting framework, and fairly represent its financial operations and position, the audit opinion is ‘unmodified’. Without modifying the opinion, an auditor’s report may include:

- an ‘Emphasis of Matter’ paragraph, which draws the reader’s attention to matters disclosed in the financial statements that, in the auditor’s judgement, are of fundamental importance to the understanding of the financial statements; and

- a ‘Report on Other Legal and Regulatory Requirements’, which addresses additional responsibilities supplementary to the auditor’s reporting responsibilities for the financial statements.

The need to modify an audit opinion can arise for a number of reasons, including material misstatement of the final balances or insufficient appropriate audit evidence to enable the Auditor-General to form an opinion. Auditing standards establish three types of modified opinions, namely a qualified opinion, an adverse opinion and a disclaimer opinion.

As shown in Table 1, for the period covering the financial year ended 30 June 2015, 254 unmodified financial statements auditor’s reports were issued, of which 12 contained an Emphasis of Matter paragraph, and none included a Report on Other Legal and Regulatory Requirements. There was one modified auditor’s report issued concerning the Consolidated Financial Statements of the Australian Government. The auditor’s report on the Consolidated Financial Statements for the year ended 30 June 2015 expressed the qualified opinion that, except for the possible effects of the non-compliance with AASB 1049 Whole-of-Government and General Government Sector Financial Reporting in relation to the valuation of specialist military equipment, the statements complied with Australian Accounting Standards and presented fairly the financial operations and position of the Australian Government. 7

Table 1. Summary of auditor’s reports on mandatory financial statements audits for the 2013–14 and 2014–15 financial years

|

|

Financial year ended |

|

|

|

30 June 2015 |

30 June 2014 |

|

Unmodified auditor’s reports issued |

254 |

259 |

|

12 |

8 |

|

0a |

15a |

|

Modified auditor’s reports issuedb |

1 |

0 |

|

Total reports |

255 |

259 |

|

Reports outstandingc |

1 |

0 |

|

Total audits |

256 |

259 |

|

|

|

|

Note a: In the financial year ended 30 June 2015, the ANAO changed its reporting policy so that Reports on Other Legal and Regulatory Requirements matters were not reported in the auditor’s report where the entity disclosed the breaches in the notes to the financial statements and the breach was not a result of a significant breakdown in controls. In this period, actual and/or potential breaches for 10 entities were identified and reported by these entities in the notes to the financial statements and were therefore not reported in the auditor’s report.

Note b: There was one modified auditor’s report issued concerning the Consolidated Financial Statements of the Australian Government.

Note c: There were two outstanding auditor’s reports at the time of tabling of report No.15 2015–16, Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2015. One of these reports has subsequently been issued.

|

Criterion 2 |

Number of other assurance reports produced |

|

Source |

|

|

Result |

Achieved a result of 54 against a target of 45 |

In addition to the conduct of mandated financial statements audits, the ANAO undertakes other assurance activities to support accountability and transparency in the Australian Government sector. In 2015–16, the ANAO completed 54 other assurance activities. One large assurance activity undertaken each year by the ANAO is the priority assurance review of major defence equipment acquisition projects and the production of the ANAO’s Major Projects Report.

The 2014–15 Major Projects Report, which reported on 25 Major Projects, was tabled in January 2016 and was the eighth annual report to the Parliament. It built on previous reports, further enabling longitudinal analysis, and identified that: except for the Air Warfare Destroyer, all projects continued to operate within their total approved budget; maintaining Major Projects on schedule remained an ongoing challenge; and the development of Defence capability information required additional management attention.

|

Criterion 3 |

Number of financial statement related reports produced |

|

Source |

|

|

Result |

Achieved a result of 1 against a target of 2 |

To support accountability and transparency in the Australian Government sector, the Auditor-General presents insights and findings from financial statements in two independent reports to the Parliament during the financial year:

- Audits of the Financial Statements of Australian Government Entities—this report is generally tabled in December each year and summarises results of all financial statements audits.

- Interim Phase of the Audits of the Financial Statements of Major General Government Sector Agencies—this report is generally tabled in June each year and comprises 21 portfolio departments and other entities that account for at least 95 per cent of the revenues and expenses of the General Government Sector. The report summarises the interim phase of the audits of these entities, including a review of the governance arrangements related to entities’ financial reporting responsibilities, and an examination of relevant internal controls.

The Auditor-General tabled the first financial statement related report for 2015–16, Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2015 in December 2015. This report contained the results of all 2014–15 financial statements audits completed across the Australian Government sector, including the CFS, together with a description and the implications of each moderate and high risk audit finding. It also provided information about key governance and control activities, and commented on key developments in the financial reporting and auditing framework that affect the Australian Government and its reporting entities.

The Auditor-General was due to present the second financial statement report for tabling in the Parliament in June 2016. Due to the double dissolution of the Parliament of Australia on 9 May 2016, the Auditor-General was unable to present this report to the Parliament before the end of the financial year.

To assess its performance against its purpose in relation to improving public sector performance and supporting accountability and transparency in the Australian Government sector, the ANAO measures the percentage of: parliamentarians surveyed expressing satisfaction with assurance provided by ANAO audit opinions issued in relation to the financial statements of the Australian Government and its entities; and Australian Government entities that are provided with an audit opinion for tabling in the Parliament, acknowledge the value added by ANAO services, and acknowledge staff knowledge of their business and operating context is improving year on year.

|

Criterion 4 |

Percentage of parliamentarians surveyed expressing satisfaction with assurance provided by ANAO audit opinions issued in relation to the financial statements of the Australian Government and its entities |

|

Source |

|

|

Result |

Achieved a result of 80 per cent against a target of 90 per centa |

Note a: Based on the ANAO Parliamentary Survey completed in March 2015.

The ANAO’s purpose of supporting accountability and transparency in the Australian Government sector through independent reporting to the Parliament reflects the Auditor-General’s relationship with the Parliament as an independent officer. To assess parliamentarians’ satisfaction with the ANAO’s performance, the ANAO engaged an independent research firm to conduct a survey each Parliament (approximately once every three years). This survey is used, among other things, to gauge how satisfied parliamentarians are with the assurance provided by ANAO audit opinions issued in relation to the financial statements. In the survey conducted during the 44th Parliament (March 2015), the ANAO achieved a result of 80 per cent against a target of 90 per cent. One limitation with this measure is that the result remains static for up to three years.

|

Criterion 5 |

Percentage of Australian Government entities that are provided with an audit opinion for tabling in the Parliament |

|

Source |

|

|

Result |

Achieved a result of 99.6 per cent against a target of 100 per cent |

The ANAO’s achievement of its purpose is dependent on the provision of an audit opinion on entities financial statements. A signed auditor’s report for tabling in the Parliament was provided for all 255 entities that completed signed financial statements. However, one auditor’s report is outstanding for an entity 8 that has not yet submitted signed financial statements for the year ended 30 June 2015. This criterion relates to the discussion provided at Criterion 1.

|

Criterion 6 |

Percentage of Australian Government entities that acknowledge the value added by ANAO services |

|

Source |

|

|

Result |

Achieved a result of 96 per cent against a target of 90 per cent |

The ANAO conducts an annual survey to gain feedback from entities on the conduct of the audit of their financial statements for the previous financial year. This measure assists the ANAO with determining how entities view our performance against our purpose. The 2015–16 report on the conduct of the audit of 2014–15 financial statements presented the views of 146 entities (a response rate of 81 per cent, a slight decrease from 82 per cent in the previous year). The survey results were positive and consistent with previous years, as illustrated in Table 2.

Table 2. Survey of entities on the conduct of audits of their financial statements, 2014–15 to 2015–16

|

Respondents acknowledged that |

Percentage |

|

|

2015–16 |

2014–15 |

|

|

ANAO services added value |

96 |

95 |

|

ANAO staff had the required understanding and skills to perform their audits |

96 |

93 |

|

|

|

|

|

Criterion 7 |

Percentage of Australian Government entities that acknowledge staff knowledge of their business and operating context is improving year on year |

|

Source |

|

|

Result |

Achieved a result of 65 per cent against a target of 90 per cent |

The ANAO also sought entities’ views on whether ANAO staff were improving their knowledge of the entity’s business and operating context year on year. The ANAO needs to balance continuity of staff on audit portfolios from year to year (to build on the knowledge of an entity’s operations) with the need to maintain independence and follow auditing standards on the regular rotation of auditors. The percentage of entities acknowledging that ANAO staff improve their knowledge of an entity from year to year was lower (65 per cent) than the target. As 96 per cent of respondents believed that ‘ANAO staff had the required understanding and skills to perform their audits’, underperformance on this target is unlikely to have negatively impacted on the achievement of the ANAO’s purpose.

Program 1.2 – Performance Audit Services

The ANAO’s performance audit activities involve audits of all or part of an entity’s operations and result in independent reports to the Parliament, which contribute to the ANAO’s achievement of its purpose to improve public sector administration.

In 2015–16, performance audits have continued to examine the effectiveness of public sector program delivery by entities—the extent to which intended outcomes are being achieved and whether processes can be undertaken more effectively—and the extent of compliance with relevant legal and policy frameworks. A greater emphasis is being placed on whether entities’ management and use of public resources is economical and efficient, reflecting the full scope of the Auditor-General’s mandate. Further, performance audits are targeting areas of public administration beyond implementation, by looking at the design of programs and the quality of advice provided to ministers and the Government.

The ANAO reports to the Parliament on areas where improvements can be made to aspects of public administration and makes specific recommendations to assist public sector entities to improve performance. Performance audits may also involve multiple entities and examine common aspects of administration or the joint administration of a program or service. In 2015–16, cross-entity audits covered topics such as information security, management of grants and entitlements, program management and contract management. In response to ongoing parliamentary interest in entities’ implementation of ANAO audit recommendations, the annual audit work program includes a selection of audits that will examine an entity’s progress in implementing recommendations arising from a previous performance audit. In 2015–16 the ANAO completed two audits that followed-up entities’ progress in implementing recommendations arising from a previous performance audit. 9

To assess its performance against its purpose in relation to performance audit activities, the ANAO measures the number of: performance audits presented; better practice guides and other reports produced; and appearances and submissions to parliamentary committees.

|

Criterion 8 |

Number of performance audits presented |

|

Source |

|

|

Result |

Achieved a result of 35 against a target of 49 |

In 2015–16, the Auditor-General had presented 35 performance audits prior to the Parliament being dissolved by the Governor-General on 9 May 2016. The double dissolution affected the number of performance audits presented to the Parliament as the Auditor-General was unable to present reports to the Parliament during the period 9 May to 30 June 2016. Other factors also impacted on the ANAO’s tabling program in 2015–16, including: significant changes to the management structure in the Performance Audit Services Group, changes to report design and structure and a drive to improve and even out the annual tabling program. This all contributed to a reduced number of performance audits produced. Without the impact of double dissolution, the Auditor-General would most likely have tabled between 40 and 42 performance audit reports against the target of 49.

Performance audits undertaken in 2015–16 involved 24 entities and covered a range of areas of public administration, including service delivery, regulation and deregulation, grants management and procurement.

During 2015–16, significant changes were made to the design of performance audit reports in order to make them more accessible and easier to read. Report preparation processes were reviewed and revised to support enhancing the quality of reports and to reduce the timeframes for the delivery of audit reports.

Table 3 shows the average cost and length of time taken to complete performance audits tabled in the past two financial years.

Table 3. Number, cost and duration of tabled performance audit reports, 2014–15 to 2015–16

|

Year |

Number of performance audits |

Time taken to complete reports (months) |

Cost per report |

|||

|

|

Target |

Result |

Average |

Range |

Average |

Range |

|

2015–16 |

49 |

35 b |

11.6 |

6.9–18.6 |

526 |

230–767 |

|

2014–15 |

49 |

49 |

11.2 |

6.4–21.4 |

520 |

202–860 |

|

|

|

|

|

|

|

|

Note a: Cost is calculated on a nominal cost-recovery basis using an accrual-based costing model.

Note b: Due to the double dissolution of the Parliament on 9 May 2016, further audit reports could not be tabled for the remainder of the 2015–16 financial year.

The ANAO moved to increase electronic communication with entities, including expressing an expectation that audit evidence and entity records be provided to the ANAO electronically. The publication of advice about new ‘Audits in Progress’ on the ANAO website is scheduled to be within two days of the audit being designated to commence in entities.

The Auditor-General also receives requests to conduct audits and investigations. The development and publication of responses, primarily to requests from parliamentarians, are undertaken in addition to planned performance audits and within existing resourcing. Table 4 shows the number of items of correspondence received from parliamentarians and subsequently published on the ANAO’s website, which contained requests for audits or investigations.

Table 4. Parliamentarians’ correspondence and ANAO responses, 2015–16

|

Year |

Number of requests received from parliamentarians |

Requests that resulted in an audit |

Requests that resulted in a limited scope assurance review |

Percentage of requests that resulted in an audit or a limited scope assurance review |

|

2015–16 |

21 |

6 |

3 |

43 |

|

|

|

|

|

|

|

Criterion 9 |

Number of better practice guides and other reports produced |

|

Source |

|

|

Result |

Achieved a result of 3 against a target of 3 |

In addition to performance audits and financial statements audits, the Auditor-General undertakes other assurance activities. These can consist of reviews undertaken by agreement with the auditee, either at their request, or in response to requests from ministers or parliamentary committees, or at the discretion of the Auditor-General. In 2015–16, three limited scope assurance reviews were undertaken by the Performance Audit Services Group:

- Australian Bid Football World Cup;

- Palmerston Hospital—Milestone Payment; and

- Government advertising campaign: Welcome to the Ideas Boom.

The ANAO had anticipated publishing three better practice guides in 2015–16, however, no new guides were published or reviewed. The ANAO is currently reviewing its approach to the development of better practice guides in light of the Public Management Reform Agenda, including implementation of the Public Governance, Performance and Accountability Act 2013; and findings from an independent Review of Whole-of-Government Internal Regulation. 10

|

Criterion 10 |

Number of appearances and submissions to parliamentary committees |

|

Source |

|

|

Result |

Achieved a result of 30 against a target of 20 |

The ANAO supports the work of the Parliament by providing independent assurance and opinion, including information, assistance and briefings, to ministers, shadow ministers and other parliamentarians and to parliamentary committees, particularly the Joint Committee of Public Accounts and Audit (JCPAA). This includes briefings on audit reports, written submissions and appearances to committee inquiries. In 2015–16, representatives of the ANAO made 30 appearances before and submissions to, parliamentary committees, which exceeded the target.

To assess its performance against its purpose in relation to improving public sector performance and supporting accountability and transparency in the Australian Government sector, the ANAO measures the percentage of: parliamentarians surveyed expressing satisfaction with ANAO services directed towards improving Australian Government administration; recommendations included in performance audit reports agreed by audited entities; and Australian Government entities that acknowledge the value added by ANAO services.

|

Criterion 11 |

Percentage of parliamentarians surveyed expressing satisfaction with ANAO services directed towards improving Australian Government administration |

|

Source |

|

|

Result |

Achieved a result of 88 per cent against a target of 90 per centa |

Note a: Based on the ANAO Parliamentary Survey completed in March 2015.

In order to continue to improve the support the ANAO provides to parliamentarians, the ANAO has placed greater emphasis on examining the extent to which intended outcomes are being achieved and whether entities’ management and use of public resources is economical and efficient. The ANAO’s annual audit work program includes a selection of audits that will examine an entity’s progress in implementing recommendations arising from a previous performance audit and changes have been made to the report design and structure. The newly formatted and more succinct audit report executive summaries serve as briefing summaries for the JCPAA, Senate Estimate Committees and other parliamentary committees as relevant to their portfolio of interest.

|

Criterion 12 |

Percentage of recommendations included in performance audit reports agreed by audited entities |

|

Source |

|

|

Result |

Achieved a result of 94 per cent against a target of 90 per cent |

The ANAO’s performance audits make recommendations to improve the administration, accountability and service delivery of audited entities. Entities are not required to agree to the recommendations of performance audits, but recommendations have more impact and are better positioned to improve public administration when the entity agrees and commits to making improvements. Throughout a performance audit, the ANAO keeps entities informed on findings and discusses potential recommendations to ensure entities understand the basis and intention of recommendations and can contribute to their development. This approach has resulted in a consistently high percentage of entities agreeing to ANAO recommendations. Table 5 provides details of the extent to which entities have agreed to ANAO performance audit recommendations.

Table 5. Agreement to recommendations in performance audit reports, 2014–15 to 2015–16

|

Year |

Recommendations (no.) |

Recommendations fully agreed (%) |

Recommendations agreed with some qualification (%) |

Recommendations not agreed (%) |

|

2015–16 |

103 |

94.0 |

6.0 |

0 |

|

2014–15 |

122 |

91.0 |

7.0 |

2.0 |

|

|

|

|

|

|

Where an entity has agreed to a recommendation, implementation of that recommendation should be timely and in line with its intended outcome to achieve the benefits envisaged. In 2015–16, entities’ implementation of recommendations, and the broader achievement of improved administration of government entities, remained a focus for the JCPAA. The ANAO also conducts follow-up audits to assess how effectively an entity has implemented ANAO recommendations from a previous audit. In 2015–16, the ANAO conducted two follow-up audits. 11

|

Criterion 13 |

Percentage of Australian Government entities that acknowledge the value added by ANAO services |

|

Source |

|

|

Result |

Achieved a result of 84 per cent against a target of 90 per cent |

Each year, in order to assess entity views on the impact of performance audits, the ANAO seeks feedback by means of a survey and an interview with the responsible manager of the audited entity. The survey is completed by an independent firm of consultants engaged by the ANAO. Key matters on which feedback is sought include: the audit process; audit reporting; and the value of the ANAO’s performance audit services more generally. The response rate from auditees surveyed for the 2015–16 reporting period was 79 per cent, consistent with 80 per cent in 2014–15. Overall, the client survey indicated that the results were positive, as illustrated in Table 6.

Table 6. Survey of entities on the conduct of performance audits, 2014–15 to 2015–16

|

Respondents acknowledged that |

Percentage |

|

|

2015–16 |

2014–15 |

|

|

ANAO services added value |

84 |

84 |

|

ANAO staff demonstrated the professional knowledge and audit skills required to conduct the audit |

91 |

86 |

|

|

|

|

ANAO-wide

To assess its performance against its purpose in relation to ANAO-wide activities, the ANAO: measures the number of engagements that contribute to public sector auditing and support developing nations; measures the percentage of audit committee members who acknowledge the value added by ANAO audit services; and evaluates whether the ANAO independent Quality Assurance Program indicates that audit conclusions are appropriately supported and the ANAO quality assurance framework is operating effectively.

|

Criterion 14 |

Number of engagements that contribute to public sector auditing and support developing nations |

|

Source |

|

|

Result |

Achieved a result of 49 against a target of 40 |

To achieve its purpose, the ANAO needs to maintain its capability at the forefront of contemporary audit practice. One contribution to this achievement is the ANAO’s national and international engagements and contributions to further the profession of public sector auditing. The ANAO engages with state and territory audit offices, relevant Australian professional associations and international supreme audit institutions. The ANAO values these relationships and their role in keeping the ANAO at the forefront of auditing techniques and methodologies, the continuous improvement of ANAO work practices and in presenting opportunities to collaborate with and support developing nations.

Australasian Council of Auditors-General