Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

ANAO Annual Report 2023–24

Please direct enquiries through our contact page.

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ended 30 June 2024. The report addresses all applicable obligations under the Public Governance, Performance and Accountability Act 2013; the Public Governance, Performance and Accountability Rule 2014; the Auditor-General Act 1997; the performance measures set out in the outcome and programs framework in the ANAO’s Portfolio Budget Statements 2023–24 and in the ANAO Corporate Plan 2023–24; and annual reporting requirements set out in other relevant legislation.

Part 1 — Review by the acting Auditor-General

I am pleased to present the Australian National Audit Office (ANAO) Annual Report 2023–24 to the Parliament. This reporting period has seen the ANAO continue to fulfil its mandate under the Auditor-General Act 1997 through the delivery of high-quality reporting.

The year in review

The ANAO is a professional organisation that is well regarded for its strong technical and specialist skills. Through our independent audit work, we provide assurance to the Parliament on the executive government’s use of resources. In 2023–24, the ANAO continued to deliver on its purpose through the efforts and commitment of our people.

Workplace capability

In August 2023, the ANAO received the results from our participation in the Australian Public Service (APS) Employee Census 2023. I was pleased to see the 89 per cent response rate to the survey, as this high response rate gives me assurance that the results are truly representative of how our staff feel about their work and workplace. The data collected through the census was positive, reflecting a workforce that strongly believes in the purpose and objectives of our organisation. Ninety-seven per cent of respondents agreed that they understand how their role contributes to achieving an outcome for the Australian public, and 94 per cent believe strongly in the purposes and objectives of the ANAO.

It was also pleasing to see that staff positively assessed the leadership by their Senior Executive Service (SES) manager and the ANAO’s approach to communication and change. The ANAO’s SES manager leadership index score was 10 points above the APS average and the communication and change index score was 6 points above the APS average. Through the census, we also identified two areas of focus and action — innovation and wellbeing. We released an action plan to address these focus areas in December 2023, and actions are well underway to implement the plan.

Parliamentary engagement

Over the reporting period, we actively engaged with the Parliament, primarily through the Joint Committee of Public Accounts and Audit (JCPAA). The work of the JCPAA and other parliamentary committees assists our reports to have an impact across the public sector — particularly as the Parliament continues to seek system-level transparency and assurance over the operation and effectiveness of public sector frameworks and the proper use of public resources to achieve intended results.

Through our submissions to the Parliament and our audit reports, we’ve contributed to the work of the JCPAA and the recommendations it has made on assurance of cybersecurity frameworks, and improvements to the Commonwealth Grants Rules and Guidelines and Commonwealth Procurement Rules. We’ve also observed progress of legislative changes arising from our work in telehealth and findings made in our financial statements audit work on the Commissioner of Taxation’s powers to manage debt.

Integrity and ethics

Building the integrity of the Australian public sector remains a key focus within the public service following the report of the Royal Commission into the Robodebt Scheme, and the ongoing suite of APS reforms aimed at addressing related issues within public administration. The ANAO has an important role to play as the public sector auditor in identifying opportunities to strengthen integrity across Commonwealth entities. Along with the Commonwealth Ombudsman, National Anti-Corruption Commissioner, Australian Federal Police Commissioner and APS Commissioner, the Auditor-General seeks to identify systemic integrity issues, based on our audit work, to contribute to improvements within the sector.

In June 2024, the JCPAA concluded its inquiry into probity and ethics in the Australian public sector, publishing Report 502: The never-ending quest for the golden thread, reviewing five performance audit reports. The report makes 11 recommendations, including recommending that the Public Governance, Performance and Accountability Act 2013 (PGPA Act) framework be amended to introduce a requirement for entities to develop, maintain and report on an overarching integrity framework.

As an integrity agency, the ANAO recognises that maintaining strong institutional integrity is critical to our operations. To support this posture, we established the ANAO Integrity Framework in June 2020. In December 2023, we published our framework — and, for the first time, a report against the framework — to provide increased transparency of the measures we undertake to maintain a high-integrity culture within the ANAO. I see this framework, and our public reporting against it, as an important mechanism in publicly demonstrating transparency and accountability of our own operations.

Public sector ethics, integrity and probity will remain a focus of our work. Performance audits continue to identify that, in routine areas of public administration (such as record keeping, governance, procurement, conflict of interest management and risk management), performance consistently falls short. In the last five years, the ANAO has made negative comments on record keeping in over 90 per cent of performance audit reports presented to the Parliament. Of particular concern is that all 45 performance audit reports tabled in 2023–24 made negative comments on record keeping. The ANAO has also identified deficiencies in enforcing the requirements and managing the risks associated with gifts, benefits and hospitality — another area of public service administration that has clear requirements across established legislation, including the Public Service Act 1999 and PGPA Act. These basic areas of administration matter, and getting them right can be an indicator of culture. They are areas covered by the law, policies and frameworks and therefore can indicate an entity’s attitude to other aspects of its responsibilities.

Report on performance

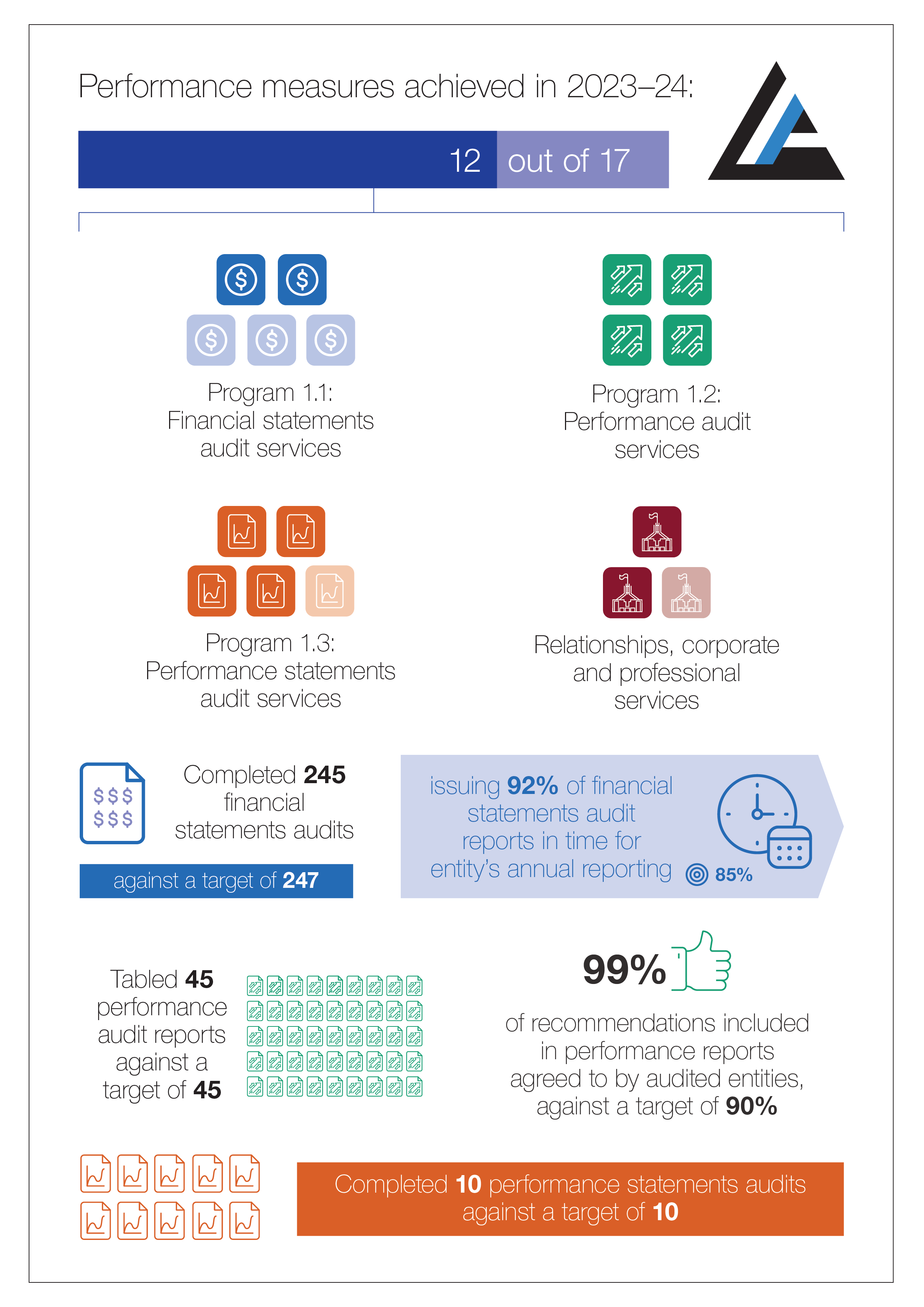

We report in detail on the ANAO’s performance during 2023–24 in Part 3 — ‘Report on performance’. During 2023–24, the ANAO issued reports on 245 mandated financial statements audits, conducted 10 performance statements audits, and presented 45 performance audit reports to the Parliament. Through this work, the Auditor-General provides independent assurance as to whether the executive is operating and accounting for its performance in accordance with the Parliament’s intent. The ANAO makes recommendations to audited entities through each of these audit products where we identify areas of control weakness, risk or noncompliance.

Financial statements audit services

In 2023–24, a total of 196 findings were reported to entities as a result of the 2022–23 financial statements audits (2021–22: 205). The findings included nine significant, 36 moderate, 137 minor and 14 legislative breaches. This compares with results from the previous year that included five significant, 35 moderate, 144 minor and 21 legislative findings. The highest number of significant and moderate findings for the 2022–23 audit cycle were in the categories of governance of legal and other matters impacting entity financial statements, IT governance (including security, change management and user access), and accounting and control of non-financial assets.

During the audits of 2022–23 financial statements, IT control environment findings continued as a theme, particularly in relation to IT security controls. This remains a key area of concern for the public sector in an environment of increasing cybersecurity risk. Four of the nine significant findings were in relation to weaknesses in the IT control environment, including weaknesses in change management, removal of user access, design and implementation of IT general controls, and IT governance. Entities should continue to improve their IT control environments, particularly as the sector considers the implementation of emerging technologies in their administration environments.

Four significant findings raised during the 2022–23 audit cycle related to weaknesses in entities’ consideration of legal matters when preparing their financial statements. The ANAO identified legal matters that entities had not previously communicated, nor had the entities considered the potential impact on their financial statements. In some cases, adjustments to balances and disclosures were required in the financial statements.

Of the legislative breaches, three were significant legislative breaches, one of which was identified during the 2022–23 audit cycle; the other two remain unresolved from prior years. There were 11 non-significant breaches relating to noncompliance with determinations made by the Remuneration Tribunal for remuneration of key management personnel (incorrect payments) and noncompliance with requirements of the Commonwealth Procurement Rules.

Performance audit services

The ANAO’s performance audit program continues to provide assurance to the Parliament and to promote accountability, transparency and improvement in public administration. In 2023–24, the ANAO presented 45 performance audit reports to the Parliament, which met the target for this measure outlined in the ANAO Corporate Plan 2023–24. In the delivery of these performance audits, we achieved the intended coverage outlined in the Annual Audit Work Program 2023–24.

The 45 performance audit reports presented to the Parliament in 2023–24 contained 255 recommendations. Entities agreed in full with 94.1 per cent of these recommendations. The degree to which accountable authorities agree with recommendations is an important indicator of their acknowledgement of areas of administration that need attention. Importantly, agreement to recommendations is reported to the Parliament to support accountability. The number of recommendations is an increase on the previous year (194 recommendations in 40 audit reports, with 91.2 per cent agreed in full), reflecting both the increase in audit reports presented, and also the nature of the reports themselves. Of the 45 performance audit reports tabled in 2023–24, 9 per cent of audits included a conclusion that was adverse, 40 per cent included a conclusion of ‘partly effective’, and 51 per cent included a conclusion of ‘largely effective’. No audit reports included a conclusion of ‘fully effective’.

Performance statements audit services

During 2023–24, the ANAO continued its rollout of the annual performance statements audit program. In February 2024, the ANAO published its findings from the 2022–23 performance statements audits of 10 entities.

The 2022–23 audit cycle indicated improvement in the quality of reporting from 2021–22. In particular, a reduced proportion of entities received a qualified conclusion in an auditor’s report, and the number of measures that were included in the basis for a qualified conclusion decreased. The audit program has demonstrated that mandatory annual performance statements audits encourage entities to invest in the ongoing capabilities needed to plan, monitor and report high-quality performance information. Following a request from the Minister for Finance on 18 July 2023, the ANAO commenced 14 performance statements audits in 2023–24.

The ANAO acknowledges the work of entities in improving performance reporting. Entities will need to make an ongoing effort to provide high-quality performance information to the Parliament that demonstrates their effective stewardship of public resources. Completeness of reports (that is, the inclusion of relevant key activities, performance measures and targets) and good-quality approaches to measuring and assessing performance and results remain areas for attention in the development of performance statements. The ANAO continues to improve its approach to performance statements auditing through the execution of its work, feedback from the sector and input from its expert advisory panel.

Supporting the Parliament

The ANAO continues to provide support to the work of the JCPAA in delivering its statutory role in the Parliament. During 2023–24, the JCPAA presented four reports to the Parliament following inquiries into Auditor-General audit reports. Two of these JCPAA reports followed inquiries into performance audit reports covering procurement, and probity and ethics; one report examines the ANAO’s performance statements work; and one report considers the 2021–22 Major Projects Report on Defence acquisitions. The ANAO provided eight private briefings to the JCPAA and attended 19 public hearings to support the committee’s inquiries. In addition to the support provided to the JCPAA, the ANAO supported the work of the Parliament more broadly by providing submissions, information, assistance and briefings to parliamentarians and other parliamentary committees. The ANAO also provided briefing material to each Senate estimates committee, on ANAO work in a committee’s portfolio of focus, before each round of estimates hearings.

International engagement

During 2023–24, the ANAO continued its support to capacity-building programs — funded through the Department of Foreign Affairs and Trade — in Indonesia and Papua New Guinea. The ANAO also continued to participate in the activities of the Pacific Association of Supreme Audit Institutions (PASAI). The ANAO engaged with the broader international and national auditing community on several activities aligned with the strategic objectives and key focus areas set out in the ANAO’s strategic planning framework. These engagements contribute strongly to the ANAO’s awareness, learning and sharing of international best practice in the public auditing profession.

The year ahead

The impactful delivery of the Auditor-General’s functions relies on independence, an appropriate legislative basis for the conduct of auditing work, funding to successfully deliver the audit program, and the availability of skilled and trained people to carry out our work agenda.

Legislative mandate

In March 2022, the JCPAA presented Report 491: Review of the Auditor-General Act 1997 to the Parliament. Among other things, the committee made recommendations on the Auditor-General’s independence and mandate. These recommendations included making annual performance statements audits a mandatory function of the ANAO (rather than at ministerial request), amending and clarifying the types of entities subject to audit by the Auditor-General, and amending the processes related to the issuing of certificates by the Attorney-General for the omission of sensitive information from public audit reports. The JCPAA also recommended a consideration of matters regarding modernising the information-gathering powers included in the Auditor-General Act 1997. The government is yet to respond to the committee’s recommendations.

The modernisation of legislation to support contemporary powers for the Auditor-General is increasingly necessary, in particular as they relate to information gathering. The Auditor-General Act 1997 came into effect when information gathering largely relied on paper-based files and documentation, and physical visits to entity premises. As the public sector continues to digitise and automate its functions and generate and hold more data, and considers the use of artificial intelligence in the delivery of services, the ANAO must be empowered to audit more effectively in the context of new technology.

Sustainable funding

Independence of public audit offices is a key part of the accountability framework. The International Organization of Supreme Audit Institutions (INTOSAI) sets out eight principles in its 2007 Mexico Declaration to guide the independence of audit institutions. Principle 8 refers to financial and managerial/administrative autonomy and the availability of appropriate human, material and monetary resources. To achieve the Parliament’s expectation of the presentation of 48 performance audit reports per year and deliver the functions mandated in the Auditor-General Act 1997, ongoing sustainability of funding for the ANAO remains an issue.

Appropriate funding of the ANAO has been a focus of the JCPAA in its role in making recommendations to the government on the ANAO’s budget. While the ANAO did not seek supplementation in the 2024–25 Budget, the JCPAA noted in its statement on the Budget estimates that ‘the Committee has been grappling with the unsustainability of ANAO’s long term financial position and the risk arising to its operational independence and ability to perform its vital statutory roles at an appropriate level of output’. The JCPAA also noted that ‘the ANAO will require additional funding in future years if it is to meet both its legislative requirements and other outputs under the present framework.’ The committee further noted the impact of the efficiency dividend on the ANAO’s budget.

Achieving sustainable funding will be a priority for the ANAO in 2024–25, in an environment of increasing costs of delivering high-quality audit products to the Parliament, the growth in the performance and performance statements audit programs, maintaining the security of sensitive information, and the prospect of new audit requirements (for example, for climate change disclosures by entities).

Audit work program

Over the coming year, the ANAO has several focus areas in its audit work program.

Changes in the technological landscape

The ANAO has been considering its approach to auditing the changing and advancing technological landscape of the public sector. Alongside increasing parliamentary interest, the report of the Royal Commission into the Robodebt Scheme highlighted the need for public sector entities to be able to provide assurance over the operation of automated decision-making. We have begun research activities into what audit methodology, audit tool changes and skills may be required to support audit work in this area. A performance audit into the Australian Taxation Office’s adoption of artificial intelligence is underway to both provide assurance to the Parliament and assist us in identifying further capability we may need to develop to undertake audits of emerging technologies into the future.

For the ANAO, like other audit offices, there is an opportunity to explore how automation can improve the audit process. While audit standards require human judgement, decision-making and scepticism, the ANAO has identified audit processes that can be automated. We have developed tools to achieve this, with oversight by our Quality Committee, to ensure adherence to the ANAO auditing standards and our audit methodology. Further, work is underway to govern the use of emerging technology within the ANAO’s business, recognising that information collected for audit purposes is the subject of strict confidentiality provisions in the Auditor-General Act 1997. We identified governance of the adoption of emerging technology as an issue across the sector through our auditing of 2022–23 financial statements, and we will continue to monitor this area as the government provides guidance to the sector.

Climate-related disclosures

Reporting of climate-related disclosures is an emerging area of audit focus. The first stage of sustainability reporting under the Net Zero in Government Operations Strategy is the introduction of mandatory climate-related disclosures in annual reports. The Treasury is leading the corporate climate-related financial disclosure policy rollout for companies reporting under the Corporations Act 2001. The reporting requirements will be set out in standards developed by the Australian Accounting Standards Board (AASB). Climate disclosures will be subject to similar assurance requirements to those currently in the Corporations Act for financial reports. Entities will also be required to obtain an assurance report from their financial auditors, with assistance from technical climate and sustainability experts where required. Assurance requirements will be set out in standards issued by the Auditing and Assurance Standards Board. Five Commonwealth companies will be impacted by the Corporations Act requirements, with proposed commencement for financial reporting years starting on or after 1 January 2025.

The Department of Finance is leading the Commonwealth climate disclosure policy rollout for Commonwealth entities and Commonwealth companies not captured by the thresholds set out in the proposed amendments to the Corporations Act. The department is developing a reporting framework based on the proposed AASB standards. The ANAO is working with the Department of Finance to develop an assurance and verification regime for climate disclosures. Readiness to audit climate disclosures will be a key focus for the ANAO in 2024–25. In preparing, we will consider the Auditor-General’s audit mandate, internal resourcing requirements, the training needed to support staff development, and access to specialist expertise to support the implementation of this activity. We will also consider the readiness of the sector for preparing these disclosures and how the audit process can be used to drive enhanced disclosure across Commonwealth entities.

Resourcing a growing audit program

The performance statements audit program will continue to grow. The Minister for Finance has requested that the ANAO audit the performance statements of 21 entities for 2024–25. Implementation of the audit program has already shown positive outcomes and the ANAO will continue to promote accountability of entities’ stewardship of public resources through high-quality performance reporting. It has been pleasing to observe both entities and parliamentarians engaging with performance statements findings, seeking to better understand what ‘good’ performance looks like in the context of public service delivery. The ANAO will continue to work with entities through the audit process to seek fair presentation of performance information which is meaningful to the users.

This coming year, the target for performance audit increases to 48, consistent with the Parliament’s expectations. As the number of performance audits completed each year grows, it will be a challenge to ensure that we remain suitably and skilfully resourced. In an employment market where attracting and retaining suitability qualified staff remains difficult, we will continue to assess the most appropriate resourcing approach to delivering our priorities across all audit disciplines.

Major projects report on Defence acquisitions

The 2022–23 Major Projects Report on Defence acquisitions was presented to the Parliament in February 2024. The Auditor-General’s independent assurance report on the 2022–23 Major Projects Report drew attention to the non-publication of information by Defence. Similar to the 2021–22 Major Projects Report, Defence had assessed that some of the details of project performance would or could be reasonably expected to cause damage to the security, defence or international relations of the Commonwealth without sanitisation of the data presented in the report. The major projects report provides a reduced level of transparency and therefore accountability to the Parliament and other stakeholders compared to reporting in 2020–21 and prior years. A continuation or expansion of this approach by the Department of Defence may reduce the value of the ANAO’s work on this important audit engagement and therefore its value to the Parliament — a matter that will continue to be discussed with the JCPAA in the year ahead.

Sharing audit insights

In 2024–25, we plan to more actively engage with the public sector to share the insights we gain from our audit work. We have observed an increasing demand from the public sector for products that translate our audit findings into helpful guidance that can be easily understood and implemented. Supporting the sector to understand who we are, what we do, and what we find through our work is important and recognised in our purpose. It is an area of both opportunity and risk — we need to remain mindful of our independence as the public sector auditor and not stray into the world of consulting. It is a fine line, and one we intend to tread carefully, recognising that we have insight to add to the public sector’s thinking. The ANAO is committed to building and enhancing our capability to convert technical audit findings into valuable resources for the public sector.

Grant Hehir’s contribution to auditing

Finally, I’d like to acknowledge the former Auditor-General for Australia, Mr Grant Hehir, who retired in mid-February 2024. Grant executed his functions and other duties with dignity, respect and independence. His commitment to transparency of public sector performance was a hallmark of his approach. I’m pleased that his vision for the auditing of non-financial performance information, contained in performance statements, has moved forward and the ANAO will continue to bring assurance of this important information to the Parliament into the future. This is the first new audit function for the ANAO since the 1980s when performance auditing was introduced.

Grant had an impact in supporting public auditors in the Pacific in his role as Chair of the Governing Board of PASAI; and through his strong relationships with the Auditor-General in Papua New Guinea and the Chair of the Audit Board of Indonesia, we shared and learned. Likewise, his leadership in the Australasian Council of Auditors-General was regarded as exemplary.

Importantly, Grant also ensured the ANAO never lost sight of its role in supporting the Parliament. This drove his commitment to quality in all that we do. His approach to appearing in the Parliament in a respectful and helpful way is a benchmark for all senior public officials. His leadership within the ANAO was highly regarded and has set a high standard for all of us for the future. The success of the ANAO’s performance for 2023–24 was largely due to his investment in our purpose and capability and sets us up well for the future. On behalf of the ANAO, we thank him for his service through his role as Auditor-General for Australia.

Dr Caralee McLiesh PSM has been appointed as the 16th Auditor-General for Australia. I am looking forward to working with her to continue the important work of the ANAO when her term commences on 4 November 2024.

Rona Mellor PSM

Acting Auditor-General

Part 2 — Overview of the ANAO

This part provides an overview of the ANAO’s purpose, role and values, our organisational structure, and our relationships with the Australian Parliament and other national and international bodies.

About the ANAO

The Australian National Audit Office (ANAO) is a specialist public sector agency providing a full range of audit and assurance services to the Parliament and entities within the Australian Government sector. It works to improve public sector performance and accountability through independent reporting on Australian Government administration to the Parliament, the executive government and the public.

The Auditor-General Act 1997 establishes the Auditor-General as an independent officer of the Parliament. While the ANAO resides within the Prime Minister and Cabinet portfolio, the normal relationship between ministers and their portfolio agency heads does not apply to the independent work of the Auditor-General and the ANAO.

Purpose

The purpose of the ANAO is to support accountability and transparency in the Australian Government sector through independent reporting to the Parliament, and thereby contribute to improved public sector performance.

The ANAO delivers its purpose under the Auditor-General’s mandate as set out in the Auditor-General Act 1997, and in accordance with the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the Public Service Act 1999.

The executive arm of government is accountable to the Parliament for its use of public resources and the administration of legislation passed by the Parliament. The Auditor-General provides independent assurance as to whether the executive is operating and accounting for its performance in accordance with the Parliament’s intent.

Role

The Governor-General, on the recommendation of the Joint Committee of Public Accounts and Audit (JCPAA) and the Prime Minister, appoints the Auditor-General for a term of 10 years. As an independent officer of the Parliament, the Auditor-General has complete discretion in performing or exercising the functions or powers under the Auditor-General Act 1997 (the Act). In particular, the Auditor-General is not subject to direction in relation to:

- whether a particular audit is to be conducted;

- the way a particular audit is to be conducted; or

- the priority given to any particular matter.

In exercising the functions or powers under the Act, the Auditor-General must have regard to the audit priorities of the Parliament, as determined by the JCPAA, and any reports made by the committee under the Public Accounts and Audit Committee Act 1951.

Under the Act, the Auditor-General’s functions include:

- auditing the annual financial statements of Commonwealth entities, and Commonwealth companies and their subsidiaries (section 11 of the Act);

- auditing the annual consolidated financial statements in accordance with the PGPA Act (section 12 of the Act);

- auditing annual performance statements of Commonwealth entities in accordance with the PGPA Act (section 15 of the Act);

- conducting performance audits and assurance reviews of Commonwealth entities and Commonwealth companies and their subsidiaries (sections 17 and 18 of the Act);

- conducting a performance audit of a Commonwealth partner (section 18B of the Act);

- providing other audit services as required by other legislation or allowed under section 20 of the Act; and

- reporting directly to the Parliament on any matter or to a minister on any important matter.

The ANAO supports the Auditor-General in this role.

Values

The ANAO upholds the Australian Public Service (APS) Values as set out in the Public Service Act 1999. The ANAO places particular focus on respect, integrity and excellence — values that align with the APS Values and address the unique aspects of the ANAO’s business and operating environment. The ANAO’s values guide the office in performing its role objectively, with impartiality, and in a manner that supports the Parliament.

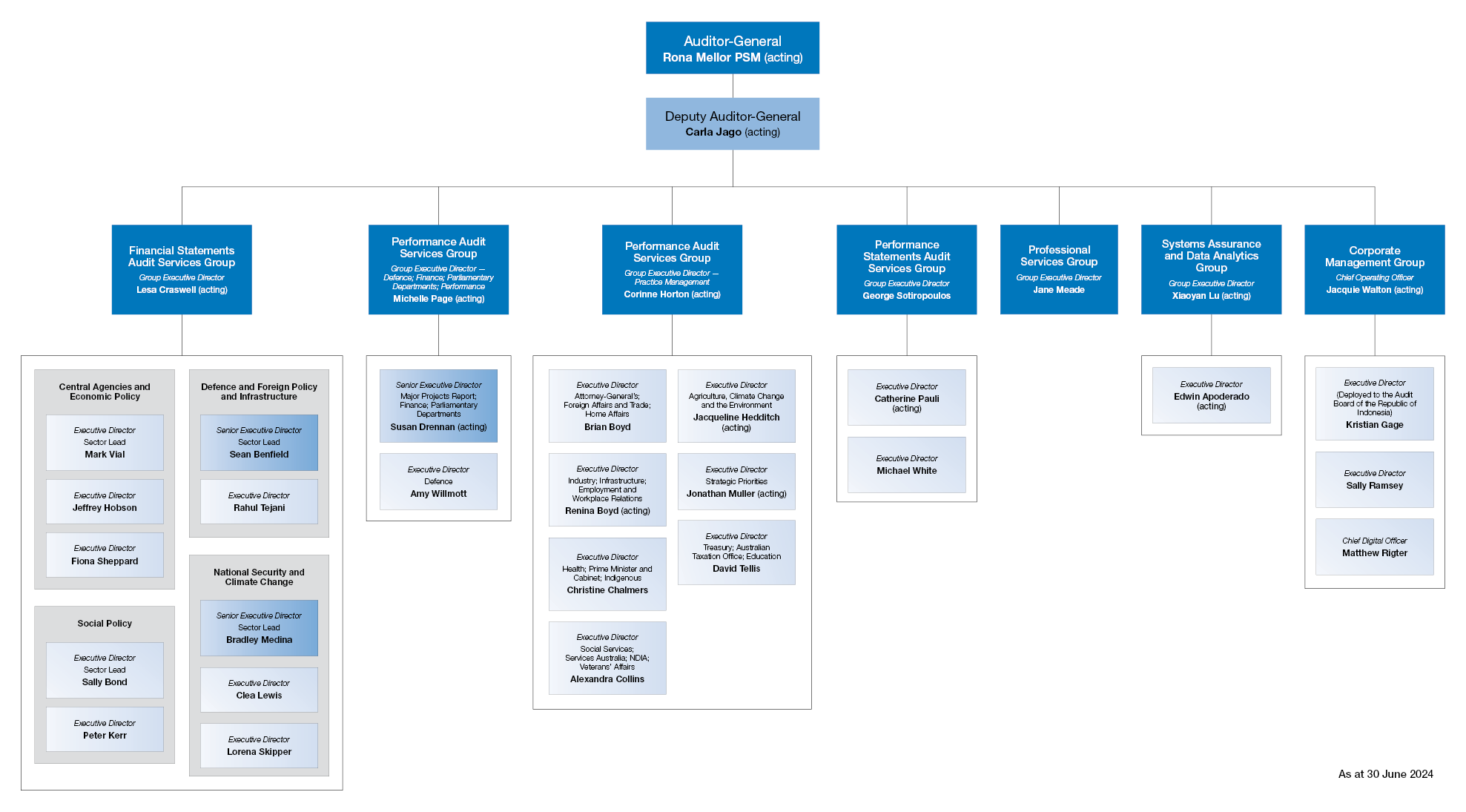

Organisational structure

To deliver on its purpose, the ANAO is organised into six functional areas:

- Financial Statements Audit Services Group provides independent assurance on the financial statements and financial administration of all Australian Government entities. It also conducts assurance reviews.

- Performance Audit Services Group conducts performance audits and assurance reviews of Australian Government entities and their activities, and produces performance audit publications, including the annual major projects report on Defence equipment acquisitions, and information reports.

- Performance Statements Audit Services Group conducts audits of Australian Government entities’ annual performance statements and measures.

- Corporate Management Group leads corporate strategy, assurance and operations for the ANAO. It provides enabling services based on specialised knowledge in the areas of finance, human resources, information technology, governance, communications, parliamentary engagement, change management, legal support and the management of the ANAO’s external relations.

- Professional Services Group1 provides technical accounting, audit advice and support to the Auditor-General; and establishes, manages and monitors the implementation of the quality management and integrity frameworks.

- Systems Assurance and Data Analytics Group provides IT and data analytics support to the ANAO’s full range of audit work.

The ANAO’s organisational structure at 30 June 2024 is shown in Figure 2.1.

Figure 2.1: Organisational structure at 30 June 2024

Notes: NDIA stands for National Disability Insurance Agency.

Performance Audit Services Group Executive Director, Strategic Priorities was succeeded by Daniel Whyte as of 8 August 2024.

Relationships

In pursuing its purpose, the ANAO maintains key relationships with the Parliament, various national bodies and counterparts, as well as international counterparts, as described below.

The ANAO’s engagement strategies detail our approach to key relationships with the Parliament, peers in the public sector auditing community, and the public sector.

The ANAO website contains further information about the ANAO’s relationships.

Parliament

The ANAO’s primary relationship is with the Australian Parliament, and the ANAO’s key interaction with the Parliament is through the Joint Committee of Public Accounts and Audit (JCPAA). The Auditor-General’s reports assist the Parliament to hold government entities to account and to drive improvements in public administration. The Auditor-General and ANAO support the work of the Parliament by providing independent reporting, assurance and assistance. The ANAO’s assistance includes the provision of submissions and information, appearances before parliamentary committees, and briefings to parliamentarians. The Parliament and its committees also scrutinise the work and administration of the ANAO.

Joint Committee of Public Accounts and Audit

Among its responsibilities, the JCPAA considers the operations and resources of the ANAO, including the ANAO draft budget estimates, about which it makes recommendations to both houses of parliament. The JCPAA is required to review all ANAO reports that are tabled in the Parliament and to report the results of its deliberations to both houses of parliament. The committee’s functions in relation to the ANAO are specified in the Public Accounts and Audit Committee Act 1951. The JCPAA of the 47th Parliament commenced on 26 July 2022.

The JCPAA commenced four inquiries reviewing Auditor-General reports throughout 2023–24 and tabled four reports adopted in 2022–23.2 As at 30 June 2024, four inquiries remain in progress. An outline of inquiries and JCPAA reports is provided in Table 2.1.

On 2 September 2020, the JCPAA resolved to undertake a review of the Auditor-General Act 1997. The JCPAA tabled Report 491: Review of the Auditor-General Act 1997 on 31 March 2022. The report included 27 recommendations (six directed to the ANAO) on independence and interaction of the Auditor-General Act 1997 with other legislation. The ANAO provided an implementation update on recommendation no.26 on 4 October 2023. At 30 June 2024, the ANAO has one remaining recommendation to address out of the six recommendations directed to the ANAO.

In 2023–24, ANAO officers provided a total of eight private briefings and attended 19 public hearings to assist the committee in undertaking its functions.

Table 2.1: JCPAA inquiries and reports in 2023–24

National relationships

In addition to its relationship with the Parliament, the ANAO has important relationships with the accountable authorities of Australian Government entities, the Australasian Council of Auditors-General (which includes the state and territory auditors-general), and professional accounting bodies and standard-setting boards.

Accountable authorities

Accountable authorities of Australian Government entities have primary responsibility for and control over their entity’s operations. As such, the ANAO’s work focuses on the duties and responsibilities of accountable authorities (including the proper use and/or management of public resources) and the governance frameworks that accountable authorities put in place in their entities. The ANAO engages with entities at a number of levels to strengthen relationships and promote improved financial reporting and public sector administration, including through attendance at entity audit committees.

The ANAO’s ongoing relationships with chief financial officers (CFOs), officials responsible for preparing performance statements, and audit committees help the ANAO achieve its purpose to both support accountability and transparency in the Australian Government sector and improve public sector performance. As part of this work, the ANAO conducts forums for CFOs and officials responsible for preparing performance statements, and for audit committee chairs, to share insights on emerging and topical audit issues and requirements affecting Australian Government entities.

In 2023–24, the ANAO hosted the Financial and Performance Reporting Forum (formerly the CFO forum) on two occasions — in July 2023 and December 2023. The forums were attended by approximately 136 and 129 CFOs and entity representatives, respectively. The ANAO presented the forums as webinars, providing the opportunity to share information about issues arising in audits and key focus areas of the audit program, including IT general controls and cybersecurity, and developments in performance statements audits. The ANAO published recordings of the webinars on its website after each live delivery.

Audit committees are a requirement of the PGPA Act and play an important assurance role in entities’ governance frameworks. The ANAO presented forums for audit committee chairs in person and virtually in July 2023 and December 2023. The forums were attended by 57 and 63 audit committee chairs, respectively. The forums provided an opportunity to share insights from the audit program, and relevant updates and information, to assist committees to meet the requirements of the PGPA Act and associated rules. The ANAO published a communiqué on its website after each forum.

Australasian Council of Auditors-General

The Auditor-General is a member of the Australasian Council of Auditors-General (ACAG), which comprises the auditors-general of Australia, New Zealand, Papua New Guinea and Fiji, along with the auditors-general of each Australian state and territory. ACAG’s objective is to promote and strengthen public sector audit in Australasia through leadership, collaboration, engagement, advocacy and peer support. The ANAO contributes to ACAG’s work by attending business meetings and subcommittee meetings, preparing discussion papers, participating in information exchanges, contributing to submissions to standard-setting bodies, undertaking annual benchmarking and client surveys, and conducting peer reviews.

Professional accounting bodies and standard-setting boards

The ANAO is actively involved in the work of two professional accounting bodies in Australia, CPA Australia and Chartered Accountants Australia and New Zealand (CA ANZ). Ms Carla Jago, acting Deputy Auditor-General, is a member of CA ANZ’s ACT Regional Council as well as a member of the CA ANZ Council. The ANAO has recognised employer status under CPA Australia’s Recognised Employer Program, which includes organisations that are committed to providing their employees with the highest standard in professional development and support.

The ANAO provides input to the development of accounting and auditing standards through contributing to ACAG responses to exposure drafts for new or amended standards proposed by the Australian Accounting Standards Board, the Auditing and Assurance Standards Board, the Accounting Professional and Ethical Standards Board, and the International Public Sector Accounting Standards Board.

International relationships

The ANAO engages with international auditing organisations and associations to maintain its capability in contemporary audit practices, and actively seeks opportunities to collaborate and share information with the international auditing community. The ANAO participates in peer-to-peer forums that facilitate international public auditing dialogue and align with the strategic objectives and key focus areas set out in the ANAO’s strategic planning framework. The ANAO has established bilateral capacity-building partnerships with Indonesia and Papua New Guinea under Australia’s international development program.

Engagement with international audit institutions

The supreme audit institution (SAI) is the highest public sector auditing function of the state or supranational organisation. Engagement with other SAIs allows the ANAO to participate in international dialogue on best-practice public administration and developments in public sector auditing. The ANAO responds to requests from SAIs directly, including by hosting and presenting to visiting delegations, providing information and participating in surveys. The ANAO’s international peer engagements also enable the ANAO’s commitment to being a learning organisation and provides the opportunity for the ANAO to learn about the work of other audit offices, discuss common challenges, and gain a deeper understanding of international best practice. International engagements are aligned with the ANAO’s strategic interests and developments in the Australian public sector, such as environmental auditing and IT and data practices.

In 2023–24, in-person engagements returned to pre-COVID-19 levels and many international events were delivered in a face-to-face format only. Virtual engagements also continued throughout the year.

The ANAO is a member of the International Organization of Supreme Audit Institutions (INTOSAI). INTOSAI’s mission is to support its members in contributing effectively to the accountability of the public sector, promoting public transparency and good governance, and fostering economical, effective and efficient government programs for the benefit of all.

The ANAO is a member of the three INTOSAI working groups and one subcommittee:

- the Working Group on IT Audit;

- the Working Group on Environmental Auditing;

- the Working Group on Impact of Science and Technology on Auditing; and

- the Performance Audit Subcommittee.

The ANAO has a representative member on the Forum for INTOSAI Professional Pronouncements (FIPP). The FIPP aims to support professional development by ensuring that INTOSAI provides a clear and consistent set of professional audit standards. The FIPP achieves this by reviewing and monitoring INTOSAI’s framework of professional pronouncements. In 2023–24, Ms Jane Meade, Group Executive Director, Professional Services Group, continued to be a member of the forum.

The ANAO participates in annual conferences and virtual meetings for each of these working groups and the Performance Audit Subcommittee.

The ANAO also routinely contributes to the activities of two INTOSAI regional organisations:

- the Asian Organization of Supreme Audit Institutions (ASOSAI); and

- the Pacific Association of Supreme Audit Institutions (PASAI).

In 2023–24, the Auditor-General and ANAO officials participated in several international engagements to discuss contemporary audit practices and specific areas of development in public sector audit, as listed below.

International Organization of Supreme Audit Institutions

- 32nd annual meeting of the Working Group on IT Audit in the United Arab Emirates in October 2023, attended by one ANAO official;

- Forum for INTOSAI Professional Pronouncements in Austria in November 2023, attended by one ANAO official, and virtual meetings attended by one ANAO official in September 2023, January 2024, March 2024, May 2024 and June 2024;

- International training on Sustainable Development Goals auditing with a focus on the energy transition as a part of the green economy, a collaborative initiative of the Audit Board of the Republic of Indonesia and INTOSAI’s Working Group on Environmental Auditing, in Indonesia in November–December 2023, attended by two ANAO officials;

- 22nd assembly of the Working Group on Environmental Auditing in Finland in January 2024, attended by one ANAO official;

- 15th annual meeting of the Performance Audit Subcommittee in Georgia in March 2024, attended by one ANAO official;

- Meeting to discuss the Working Group on Environmental Auditing’s ClimateScanner project, an initiative that aims to develop and disseminate a rapid review method and tool for assessing government action on climate change, in Fiji in June 2024, attended by one ANAO official; and

- Virtual participation by two ANAO officials in meetings of the Task Force on INTOSAI Auditor Professionalisation.

Pacific Association of Supreme Audit Institutions

- 14th Annual General Meeting (virtual) in September 2023, attended by the Deputy Auditor-General;

- Governance and Leadership Women Symposium in Samoa in February 2024, attended by one ANAO official;

- 25th Congress hosted by Cook Islands in May 2024, attended by the Acting Deputy Auditor-General and one other ANAO official; and

- IntoSAINT (INTOSAI Self-Assessment of Integrity) assessment of the Office of the Auditor-General of Fiji in June 2024, attended by one ANAO official.

Asian Organization of Supreme Audit Institutions

- International seminar on ‘How to meet the public expectation on supreme audit institutions’ in Indonesia in December 2023, attended by one ANAO official; and

- Participation in a meeting of the 13th ASOSAI research project on ‘Remote audit for supreme audit institutions: Future and challenges’, in collaboration with the Audit Board of the Republic of Indonesia as project leader, attended by one ANAO official.

Other forums

- 18th Joint Strike Fighter Supreme Audit Institution Conference in Denmark in October 2023, attended by one ANAO official; and

- Meeting of the MIKTA (Mexico, Indonesia, Republic of Korea, Türkiye and Australia) supreme audit institution group in Korea in May 2024, attended by one ANAO official.

Australia’s international development program

The ANAO, through a partnership agreement with the Department of Foreign Affairs and Trade, is participating in Australia’s international development program to assist and support the audit offices of Indonesia and Papua New Guinea to build institutional capacity and facilitate the sharing of auditing knowledge across all three organisations. The partnership supports the Australian Government’s sectoral development initiative to build effective governance institutions and strengthen institutional relationships.

Australia–Indonesia Partnership for Economic Development (Prospera)

The ANAO’s activities under the Australia–Indonesia Partnership for Economic Development (Prospera) with the Audit Board of the Republic of Indonesia (Badan Pemeriksa Keuangan — BPK) continue to support BPK’s efforts to strengthen its audit functions. The program is aligned with the BPK’s strategic plan objectives of delivering beneficial and high-quality audits and has been pivotal in facilitating knowledge exchange between the ANAO and BPK. The key focus areas of the 2023–24 work program were on performance and financial audit management, quality assurance systems and processes, and strategic leadership and organisational development to support audit management and capability. Recognising the maturity of the partnership, in addition to supporting the development of audit and organisational capability, the ANAO engaged with BPK on topics of mutual interest and benefit to both offices. A new area of engagement in 2023–24 was on auditing performance information.

A mix of in-person and virtual delivery methods continued throughout 2023–24, to maintain broader outreach and engagement, supported by the deployed ANAO officer. The deployed officer, whose term was extended for a further 12 months to August 2025, continued to play a critical role in meeting program objectives.

The ANAO, in partnership with BPK, delivered 16 of the 17 planned activities for 2023–24. Following the resignation of Mr Grant Hehir as Auditor-General in February 2024, the planned senior management dialogue has been deferred until 2024–25. During the reporting period, the ANAO hosted nine secondees from BPK for various activities under the Prospera program, with a focus on technical knowledge transfer and training. These activities strengthened the relationship between the two organisations and deepened opportunities for two-way learning.

Papua New Guinea Institutional Partnerships Program

The Papua New Guinea (PNG) Institutional Partnerships Program supports the development of long-term institutional relationships between Australian and PNG government entities. The ANAO’s activities under the program support the efforts of the PNG Auditor-General’s Office (PNG AGO) to strengthen the management of its audit functions, in line with the objectives set out in the PNG AGO’s Strategic Plan 2022–2027. The focus areas of the 2023–24 work program were management of institutional linkages, quality assurance, performance audit, information technology audit support, governance frameworks, and organisational capacity development.

In 2022–23, the ANAO’s financial statements audit and compliance adviser to the PNG AGO completed their deployment and returned to Australia. A new adviser commenced in September 2023 to continue the support provided to the PNG AGO through this role. Both the senior adviser and financial and compliance audit adviser have continued to play a critical role in the delivery of program objectives.

The ANAO, in partnership with the PNG AGO, delivered 11 of the 12 planned activities for 2023–24 across three streams: supporting organisational development; supporting individual development and leadership capabilities; and technical audit support and training. A planned high-level visit to support the PNG AGO to host its first meeting of the Australasian Council of Auditors-General did not proceed as planned in May 2024 and was deferred to October 2024. The funds for this activity supported a visit of three senior ANAO officials to the PNG AGO to provide leadership on financial statements audit and corporate functions.

Part 3 — Report on performance

Annual performance statements

As the accountable authority of the Australian National Audit Office (ANAO), I present the 2023–24 annual performance statements as required under subsection 39(1)(a) and (b) of the Public Governance, Performance and Accountability Act 2013 (PGPA Act), and section 16F of the Public Governance, Performance and Accountability Rule 2014.

In my opinion, these annual performance statements are based on properly maintained records, accurately reflect the performance of the entity for the reporting period and comply with subsection 39(2) of the PGPA Act.

Rona Mellor PSM

Acting Auditor-General

9 August 2024

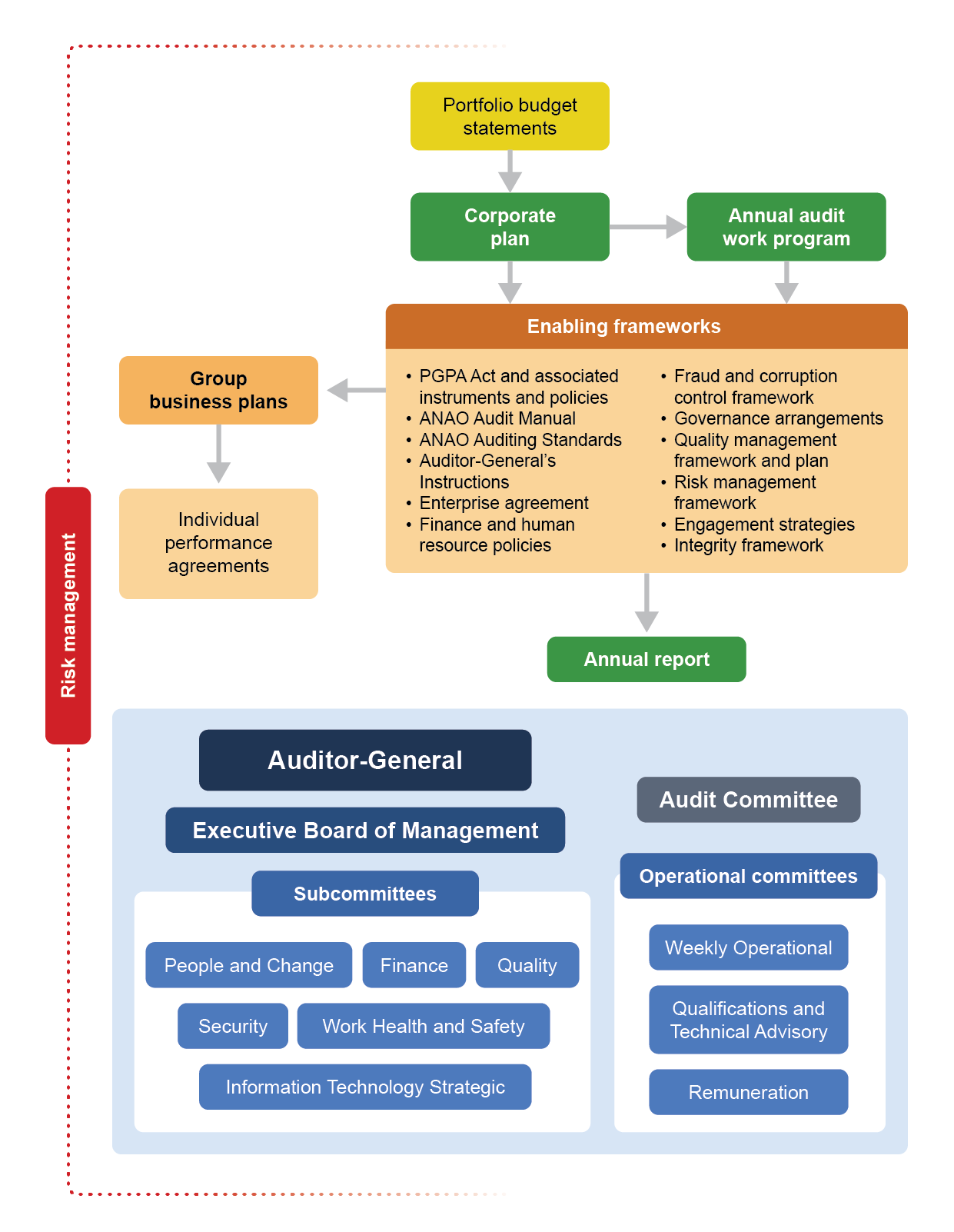

Performance framework

The ANAO’s performance framework allows us to monitor and measure:

- what we did (output);

- how well we did it (quality and/or efficiency); and

- what the benefits were (effectiveness/or impact).

Taken together, the performance measures tell a story of the ANAO’s achievement of its purpose.

The output measures relay progress in the delivery of the ANAO’s audit work. This work provides transparency and holds executive government to account by supporting the consideration and scrutiny by Parliament.

The ANAO performance framework also includes measures relating to quality and efficiency. The quality and efficiency measures are intended to demonstrate efficient use of taxpayer resources and a commitment to quality in our work.

The effectiveness and impact measures provide information on entities’ implementation of audit findings and recommendations, and the extent to which the Parliament’s engagement with our work leads to improvements in public sector administration.

Corporate plan and portfolio budget statements

The ANAO measures its performance against its purpose using a range of performance measures, which are outlined in the Portfolio Budget Statements 2023–24 and the ANAO’s Corporate Plan 2023–24.

The purpose of the ANAO is to support accountability and transparency in the Australian Government sector through independent reporting to the Parliament, and thereby contribute to improved public sector performance.

In its Portfolio Budget Statements 2023–24, the ANAO’s sole outcome (Outcome 1) is ‘to improve public sector performance and accountability through independent reporting on Australian Government administration to the Parliament, the Executive and the public’.

The ANAO seeks to achieve its purpose and outcome through its audit services, which include:

- Program 1.1: Financial Statements Audit Services;

- Program 1.2: Performance Audit Services;

- Program 1.3: Performance Statements Audit Services; and

- Shared performance criteria for Programs 1.1, 1.2 and 1.3.

The ANAO’s outcome and programs framework for 2023–24 is shown in Table 3.1.

Table 3.1: ANAO’s outcome and programs framework for 2023–24

|

Outcome 1 |

|

To improve public sector performance and accountability through independent reporting on Australian Government administration to the Parliament, the Executive, and the public. |

|

Program 1.1: Financial Statements Audit Services |

|

This program contributes to the outcome through:

|

|

Program 1.2: Performance Audit Services |

|

This program contributes to the outcome through:

|

|

Program 1.3: Performance Statements Audit Services |

|

This program contributes to the outcome through:

|

|

Shared performance criteria for Programs 1.1, 1.2 and 1.3 |

|

The ANAO has a number of performance criteria that apply to programs 1.1, 1.2 and 1.3, and are reported on collectively. All programs contribute to the outcome by:

|

Analysis of performance against our purpose

Overall, in 2023–24, the ANAO achieved 12 performance measures out of 17, an increase in the number of performance outcomes achieved in 2022–23:

- For Program 1.1: Financial Statements Audit Services, two out of five measures were met.

- For Program 1.2: Performance Audit Services, four out of four measures were met.

- For Program 1.3: Performance Statements Audit Services, four out of five measures were met.

- For relationships, corporate and professional services, two out of three measures were met.

The ANAO carried out its annual audit work program for 2023–24, having regard to the priorities and interests of the Parliament and providing a balanced program of activity that was informed by risk.

Through the audit program, the ANAO promoted accountability, transparency and improvements to public administration; followed up on past recommendations; identified trends for improvement or declines in performance across the public sector; and applied all of the Auditor-General’s mandate.

The ANAO Corporate Plan 2023–24 was updated on 26 March 2024 to reflect the following changes:

- organisational structure changes — changed ‘Professional Services and Relationships Group’ to ‘Professional Services Group’

- Measure 3 — change type from ‘Efficiency / Qualitative’ to ‘Efficiency / Quantitative’

- Measure 15, reporting mechanism 4 — replaced text to reflect updated JCPAA feedback process

- Measure 16, reporting mechanism 3 — replaced references to ‘insights’ with ‘lessons’

The following sections provide more detailed analysis of the ANAO’s performance results for Program 1.1: Financial Statements Audit Services, Program 1.2: Performance Audit Services, Program 1.3: Performance Statements Audit Services and ANAO-wide activities relating to relationships and corporate and professional services.

Performance results for Program 1.1: Financial Statements Audit Services

The primary purpose of financial statements is to provide relevant and reliable information to users about a reporting entity’s financial performance and position. The preparation of timely and accurate audited financial statements is an important indicator of the effectiveness of an entity’s financial management, which fosters confidence in an entity on the part of users.

The ANAO’s financial statements audits, undertaken in accordance with the ANAO Auditing Standards, provide an independent examination of the financial accounting and reporting of public sector entities. They provide independent assurance that financial statements have been prepared in accordance with the Australian Government’s financial reporting framework and Australian accounting standards and present fairly the financial performance of the entity. The ANAO’s assurance audits contribute to improvements in the financial administration of Australian Government entities.

The Auditor-General presents reports on audits of financial statements to the Parliament twice a year. The first of these reports, Interim Report on Key Financial Controls of Major Entities, reports on ANAO coverage of key financial systems and controls in major Commonwealth entities. The second report, Audits of the Financial Statements of Australian Government Entities, reports on the results of the financial statements audits of all Commonwealth entities. The independent reporting to the Parliament on this activity supports accountability and transparency in the Australian Government sector.

Performance measures

To assess performance against our purpose in relation to financial statements audit activities, the ANAO measures the:

- number of mandated financial statements audit reports issued;

- percentage of mandated financial statements audit reports issued in time to meet entity annual reporting timeframes;

- average cost of a financial statements audit;

- percentage of moderate or significant findings from mandated financial statements audit reports agreed to by audited entities; and

- percentage of moderate or significant findings that are addressed by mandated audited entities within 24 months of reporting.

|

Measure 1 |

Number of mandated financial statements audit reports issued |

|

|

Source |

ANAO Corporate Plan 2023–24 Portfolio Budget Statements 2023–24, Program 1.1, p. 98 |

|

|

Result |

Achieved a result of 245 against a target of 247 |

NOT MET |

The number of financial statements auditor’s reports issued is a key measure of the ANAO’s core business in achieving its purpose. Under the Auditor-General Act 1997, the Auditor-General’s functions include the mandatory auditing of the annual financial statements of Commonwealth entities, Commonwealth companies and their subsidiaries, and the consolidated financial statements. This measure reports on the number of those reports issued.

During 2023–24, the ANAO completed all of the 245 mandated financial statements audits for the year ended 30 June 2024. This included the consolidated financial statements of the Australian Government. While all 245 mandated financial statements audits were completed, this measure shows as not met due to the original measure specifying a target of 247 mandated financial statements audits. This number was set prior to changes as a result of machinery of government changes and movements in the number of corporate entities. The ANAO plans to revise the measure in the 2024–25 corporate plan to reflect a percentage rather than a number to better represent the completion of mandated audits.

|

Measure 2 |

Percentage of mandated financial statements audit reports issued in time to meet entity annual reporting timeframes |

|

|

Source |

ANAO Corporate Plan 2023–24 Portfolio Budget Statements 2023–24, Program 1.1, p. 98 |

|

|

Result |

Achieved a result of 91.84% against a target of 85% |

MET |

In order to support timely reporting of entities’ financial performance to the Parliament through annual reports, the ANAO aims to issue 85 per cent of auditor’s reports within three months of the financial year-end reporting date.

Providing timely auditor’s reports also supports entities in meeting requirements to provide audit cleared financial information to the Department of Finance in accordance with deadlines that are set to assist the Australian Government to prepare the Final Budget Outcome by 30 September for the financial statements with 30 June year end, and the consolidated financial statements by 30 November each year. The consolidated financial statements present whole-of-government financial results, inclusive of all Australian Government-controlled entities.

Achievement of this measure relies on entities providing the ANAO with auditable financial statements within the required timeframe. The ANAO reported in the end of year report that 72 per cent of entities delivered financial statements in line with an agreed timetable.

|

Measure 3 |

Average cost of a financial statements audit does not increase from the prior year |

|

|

Source |

ANAO Corporate Plan 2023–24 Portfolio Budget Statements 2023–24, Program 1.1, p. 98 |

|

|

Result |

Achieved a result of 4.42% against a target of 0% |

NOT MET |

Delivering cost-effective audits is one way the ANAO can demonstrate the efficient use of taxpayer resources in our work. This measure captures the average cost of delivering mandated financial statements audits and allows comparison over time.

Increases in cost are attributed to:

- increased fees charged by contracted firms for audit work;

- additional work as a result of the changes to ASA 315 Identifying and Assessing the Risks of Material Misstatement;

- additional work on entity audits where there are large numbers of findings; and

- machinery of government changes related to the creation of new entities.

These increases have been partially offset by reductions in audit fees on entities where efficiencies in the audit have been found.

Table 3.2: Cost of financial statements audit reports, 2020–21 to 2022–23

|

Audit cycle |

Percentage increase Target (%) |

Average cost per mandated audit ($) |

Range of audit fees charged ($) |

Actual result (%) |

|

2022–23 |

0 |

176,842 |

2,000–3,500,000 |

4.42 |

|

2021–22 |

0 |

169,350 |

5,500–3,675,000 |

4.97 |

|

2020–21 |

0 |

161,331 |

5,500–3,890,000 |

−1.79 |

Note: Cost is calculated on a nominal cost recovery basis using an accrual-based costing model.

|

Measure 4 |

Percentage of moderate or significant findings from mandated financial statements audit reports agreed to by audited entities |

|

|

Source |

ANAO Corporate Plan 2023–24 Portfolio Budget Statements 2023–24, Program 1.1, p. 99 |

|

|

Result |

Achieved a result of 97.92% against a target of 90% |

MET |

The ANAO provides entities with audit findings and recommendations to improve internal controls and business processes based on observations noted during the conduct of financial statements audits. These matters are reported to the accountable authority and copied to the chair of the audit committee and the chief financial officer via an interim management letter, a closing report or a final management letter. The ANAO seeks to confirm all factual observations concerning the audit findings with entities before finalising these reports. Included in the measure of agreed recommendations are situations where the audited entity agrees with the ANAO’s factual observations, but the entity may suggest an alternative method to resolve the issue.

The audit findings and recommendations are reported using a rating scale whereby significant and moderate risk issues are reported individually to the audited entities, the relevant minister and the Parliament.3 Lower risk issues are also reported individually to each entity, and in aggregate in the ANAO’s reports to the Parliament.

A total of 196 findings (prior year: 205) were reported to entities as open as a result of the 2022–23 financial statements audits at the time of the end of year report. There are currently 195 open findings that have been agreed to by entities. These comprised nine significant (prior year: 5), 36 moderate (prior year: 35), 137 minor (prior year: 144) and 14 legislative findings (prior year: 21). The highest number of findings are in the categories of governance of legal and other matters impacting entity financial statements; IT governance including security, change management and user access; and accounting for and management of non-financial assets.

One moderate finding was disagreed.

All audit findings and recommendations are followed up as part of the audit of the following year’s financial statements.

|

Measure 5 |

Percentage of moderate or significant findings that are addressed by mandated audited entities within 24 months of reporting |

|

|

Source |

ANAO Corporate Plan 2023–24 Portfolio Budget Statements 2023–24, Program 1.1, p. 99 |

|

|

Result |

Achieved a result of 85.71% against a target of 90% |

NOT MET |

The ANAO measures the percentage of moderate and significant findings that are addressed by entities in order to measure the impact that the ANAO’s audit work has on public administration. This measure captures findings (moderate and significant) that are addressed by audited material entities within 24 months, resulting in improvements to the public sector control environment. ‘Addressed’ means that the entity has responded to and actioned the audit finding. The ANAO reviews all findings during the interim and/or final phases of the annual financial statements audit process. The ANAO reports on entities’ actions in response to findings in the Interim Report on Key Financial Controls of Major Entities and in an end-of-year report on the final results of the financial statements audits.

Audit findings are reported to entities at the conclusion of each year’s financial statements audit. To determine whether these findings have been addressed by entities within 24 months of reporting, a full 24-month period is required from the audit cycle when the findings were raised. The audit cycle generally runs from October to September. Therefore, this performance measure for 2023–24 considers whether the audit findings in the 2020–21 audit cycle had been addressed by mandated entities within 24 months of reporting, which was up to the conclusion of the 2022–23 audit cycle.

During the 2020–21 audit cycle there were two significant and 19 moderate findings raised, of these 18 (two significant and 16 moderate) had been addressed by the conclusion of the 2022–23 audit cycle.

Performance results for Program 1.2: Performance Audit Services

The Auditor-General’s functions or powers include conducting performance audits and assurance reviews (including the Defence Major Projects Report) of Commonwealth entities and Commonwealth companies and their subsidiaries. The ANAO’s performance audit reports are tabled in the Parliament of Australia to support accountability and transparency and thereby contribute to improved public sector performance. Performance audit reports provide independent reporting that supports the Parliament to scrutinise the operations of executive government and the proper use of resources as required under the Public Governance, Performance and Accountability Act 2013, the Public Service Act 1999 and any enabling legislation. The ANAO conducts performance audits in accordance with the ANAO Auditing Standards.

Performance measures

To assess performance against our purpose in relation to performance audit activities, the ANAO measures the:

- number of performance audits presented to the Parliament;

- cost of these audits (our efficiency); and

- percentage of recommendations agreed to and the status of their implementation by entities (our impact and effectiveness).

|

Measure 6 |

Number of performance audit reports presented to Parliament |

|

|

Source |

ANAO Corporate Plan 2023–24 Portfolio Budget Statements 2023–24, Program 1.2, p. 97 |

|

|

Result |

Achieved a result of 45 against a target of 45 |

MET |

In 2023–24, the Auditor-General tabled 45 performance audit reports in the Parliament (Table 3.3) against a target of 45 performance audit reports.

In addition to the 45 performance audits tabled in the Parliament, the ANAO tabled Auditor-General Report No. 14 2023–24 2022–23 Major Projects Report in February 2024. The Major Projects Report is an annual priority assurance review of the Department of Defence’s (Defence’s) major defence equipment acquisitions, undertaken under the Auditor-General Act 1997 at the request of the Parliament’s Joint Committee of Public Accounts and Audit (JCPAA). Its purpose is to provide information and assurance to the Parliament on the performance of selected acquisitions. The review includes information relating to the cost, schedule and progress towards delivery of required capability of individual projects as at 30 June each year.

Table 3.3: Number of performance audit reports, 2016–17 to 2023–24

|

|

Number of performance audit reports |

|

|

|

Target |

Result |

|

2023–24 |

45 |

45 |

|

2022–23 |

42 |

40 |

|

2021–22 |

40 |

40 |

|

2020–21 |

42 |

42 |

|

2019–20 |

48 |

42 |

|

2018–19 |

48 |

48 |

|

2017–18 |

48 |

47 |

|

Measure 7 |

Average cost of a performance audit does not increase from the prior year |

|

|

Source |

ANAO Corporate Plan 2023–24 Portfolio Budget Statements 2023–24, Program 1.2, p. 97 |

|

|

Result |

Achieved a result of 4.96% decrease against a target of a greater than 0% reduction |

MET |

The average cost of audits delivered in 2023–24 decreased compared to audits delivered in 2022–23 (Table 3.4). The decrease in the average cost was primarily due to the completion of multiple audits on some large topics instead of conducting one larger audit on the topic and conducting six audits in a series. Audits conducted in a series benefit from adopting standard methodologies and test programs, applied across a range of entities, resulting a lower average cost and shorter audit durations. Four audits examined compliance with corporate credit card requirements and two audits examined compliance with gifts, benefits and hospitality requirements. The average cost across these six audits was $315,541.

Table 3.4: Cost of performance audit reports, 2017–18 to 2023–24

|

|

Percentage increase |

Cost per performance audit ($’000) |

Actual result (%) |

|

|

|

Target (%) |

Average |

Range |

|

|

2023–24 |

0 |

496,450 |

197,000–869,000 |

–4.96 |

|

2022–23 |

0 |

522,342 |

196,000–949,000 |

7.50 |

|

2021–22 |

0 |

486,118 |

159,000–1,106,000 |

−6.60 |

|

2020–21 |

0 |

520,496 |

234,000–984,000 |

18.00 |

|

2019–20 |

0 |

439,000 |

186,000–904,000 |

5.00 |

|

2018–19 |

0 |

419,000 |

131,000–670,000 |

−0.70 |

|

2017–18 |

0 |

422,000 |

159,000–786,000 |

−9.80 |

Note: Cost is calculated on a nominal cost recovery basis using an accrual-based costing model.

|

Measure 8 |

Percentage of recommendations included in performance audit reports agreed to by audited entities |

|

|

Source |

ANAO Corporate Plan 2023–24 Portfolio Budget Statements 2023–24, Program 1.2, p. 97 |

|

|

Result |

Achieved a result of 99.22% against a target of 90% |

MET |

The ANAO makes recommendations in performance audit reports to support the Parliament in its role in holding entities to account for their use of public money, and to seek to improve public administration. Throughout a performance audit, the ANAO keeps entities informed of findings and discusses potential recommendations to ensure entities understand the basis and intention of recommendations. Table 3.5 provides a breakdown of audited entities’ responses to the ANAO’s recommendations against the total number of recommendations made. Only recommendations that were agreed without qualification are included as ‘agreed’ recommendations in the result for this measure, unless the qualification did not contradict the overall recommendation.

In 2023–24, 253 recommendations were counted as ‘agreed’ (this includes 13 recommendations that were agreed with qualification and assessed to be ‘agreed’), and two recommendations were not agreed.

Table 3.5: Agreement to recommendations in performance audit reports, 2017–18 to 2023–24

|

|

Recommendations |

||||

|

|

Total number |

Fully agreed (%) |

Agreed with qualifications (%) |

Not agreed (%) |

Noted or no response by entities (%) |

|

2023-24 |

255 |

94.12 |

5.10 |

0.78 |

0.00 |

|

2022–23 |

194 |

91.23 |

2.58 |

2.58 |

3.61 |

|

2021–22a |

161 |

95.70 |

2.50 |

1.90 |

0.00 |

|

2020–21 |

165 |

92.10 |

6.10 |

1.20 |

0.60 |

|

2019–20 |

141 |

90.80 |

1.40 |

2.80 |

5.00 |

|

2018–19a |

146 |

89.72 |

6.84 |

0.68 |

2.74 |

|

2017–18 |

126 |

84.90 |

9.50 |

2.40 |

3.20 |

Note a: The percentages for 2021–22, 2018–19 do not total 100 per cent due to rounding.

|

Measure 9 |

Percentage of ANAO recommendations implemented within 24 months of a performance audit report being presented |

|

|

Source |

ANAO Corporate Plan 2023–24 Portfolio Budget Statements 2023–24, Program 1.2, p. 97 |

|

|

Result |

Achieved a result of 80.01% against a target of 70% |

MET |

The ANAO seeks advice annually from all relevant entities on progress in implementing audit recommendations over a two-year implementation period. The ANAO also monitors entities’ implementation of performance audit recommendations by attending entity audit committees and conducting audits that follow up on entity progress in implementing previously made recommendations.

The self-reported data for audit recommendations made in 2021–22 suggests that entities are implementing ANAO recommendations largely within 24 months of the recommendation being agreed (Table 3.6). For those recommendations that have not yet been implemented, the majority of entities have advised that work is underway.

This measure is based on entity self-reporting on implementation of recommendations. The ANAO has undertaken a series of performance audits on entities’ implementation of parliamentary and ANAO recommendations.4 These audits have shown that some entities have reported ANAO recommendations as being implemented when the evidence has shown that they have not actually been implemented. These performance audits of the implementation of recommendations do not cover all entities and the results may not be representative of the whole population. The audits undertaken to date in this series have identified that 18 per cent of recommendations that entities had reported as implemented were assessed by the ANAO as not implemented.

Table 3.6: Percentage of performance audit recommendations implemented within 24 months

|

|

Recommendations |

|||

|

Year in which recommendations made |

Recommendations (number) |

Implemented (%) |

Not implemented (%) |

No response provided (%) |

|

2021–22a |

161 |

80.01 |

19.88 |

0.00 |

|

2020–21 |

165 |

76.97 |

20.61 |

2.42 |

|

2019–20a |

141 |

84.00 |

7.00 |

8.00 |

|

2018–19 |

146 |

79.00 |

19.00 |

2.00 |

|

2017–18 |

126 |

81.00 |

19.00 |

0.00 |

Note a: The percentages for 2019–20 and 2021–22 do not total 100 per cent due to rounding.

Performance results for Program 1.3: Performance Statements Audit Services

Section 39 of the Public Governance, Performance and Accountability Act 2013 (PGPA Act) requires the accountable authority of a Commonwealth entity to prepare annual performance statements that provide information about the entity’s performance in achieving its purposes and include a copy of the statements in the entity’s annual report. Section 40 of the PGPA Act provides that the responsible Minister for a Commonwealth entity or the Finance Minister may request the Auditor-General to examine and report on the entity’s annual performance statements.

On 16 January 2023, the Finance Minister requested that the Auditor-General undertake assurance audits of 10 entities’ 2022–23 performance statements under section 40 of the PGPA Act. The Auditor-General conducted the ten audits under section 15 of the Auditor-General Act 1997.

Performance statements audit services contribute to the ANAO achieving its purpose. The intent of performance statements audits is to drive improvements in the transparency and quality of entities’ performance reporting, and, in turn, increase entities’ accountability to the Parliament and public.

To assess performance against our purpose in relation to performance statements audit activities, the ANAO measures the: