Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Portfolio overview

The Foreign Affairs and Trade Portfolio is responsible for: delivering a global network of embassies and missions and international affairs policy capability to support Australia’s interests and influence abroad. The Portfolio, which is comprised of five entities in addition to the Department of Foreign Affairs and Trade (DFAT), works in partnership across government to promote a stable and prosperous regional and global environment.

As the lead entity in the portfolio, DFAT has primary responsibility within government for providing foreign, trade and development policy advice and supporting Australians overseas in need of assistance. Further information is available from the department’s website.

In the 2025–26 Portfolio Budget Statements (PBS) for the Foreign Affairs and Trade portfolio, the aggregated budgeted expenses for 2025–26 total $9.0 billion. The PBS contain budgets for those entities in the general government sector (GGS) that receive appropriations directly or indirectly through annual appropriation Acts.

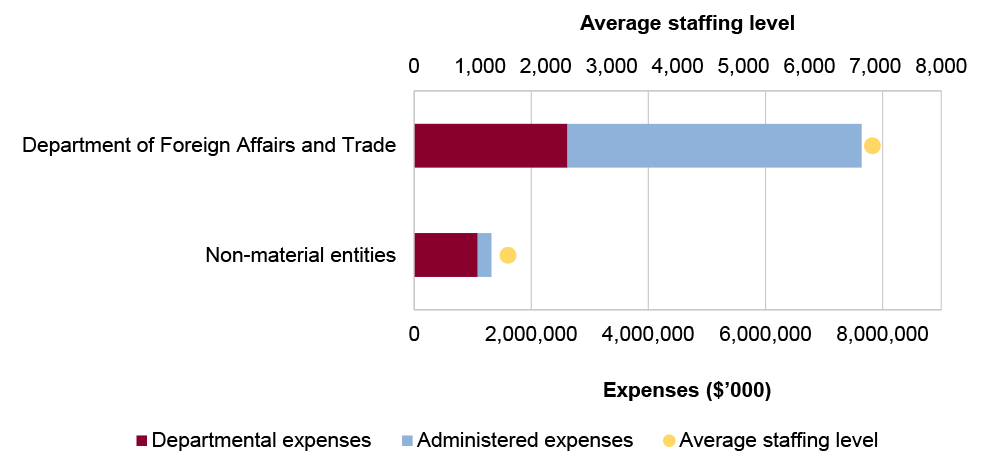

The level of budgeted departmental and administered expenses, and the average staffing level for entities in the GGS within this portfolio are shown in Figure 1. DFAT represents the largest proportion of the portfolio’s expenses, and administered expenses of the portfolio are the most material component, representing 59 per cent of the entire portfolio’s expenses.

Figure 1: Foreign Affairs and Trade portfolio – total expenses and average staffing level by entity

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

Audit focus

In determining the 2025–26 audit work program, the ANAO considers prior-year audit and other review findings and what these indicate about portfolio risks and areas for improvement. The ANAO also considers emerging risks from new investments or changes in the operating environment.

The primary risk identified for the portfolio relates to the management and oversight of the distributed network of overseas posts. Coordinated operation is required for these posts to operate most effectively during international events.

Specific risks in the Foreign Affairs and Trade portfolio relate to governance, service delivery, grants administration and procurement.

Governance

DFAT’s highly decentralised operating model consists of a global network of overseas posts. Ensuring the consistent application of centralised departmental policies, including physical, personal and information security policies, at each post is a key risk in the portfolio.

Service delivery

The portfolio has important service delivery responsibilities including in relation to assisting Australians who are abroad and through processing of passport applications. A key risk is the efficiency of service delivery.

Grants administration

Significant grants administration is undertaken within the portfolio, delivered in the form of international development assistance by the department and through various programs administered by Austrade. The Australian Development Investments and the Australian Infrastructure Investment Facility for the Pacific, which are able to provide assistance via grants or loans, also require effective governance and risk management to achieve value for money. While official development assistance (ODA) is defined as not a grant for the purposes of the Commonwealth Grants Rules and Principles (CGRPs), DFAT applies the principles of the CGRPs to ODA in seeking to achieve value for money outcomes.

Procurement

A key risk for the department and portfolio entities is achieving value for money in accordance with the Commonwealth Procurement Rules. Procurement activity in the portfolio supports a wide range of activities such as passport processing, maintenance of overseas missions and marketing activities to promote tourism in Australia. Recent audits have identified shortcomings in the conduct of procurement processes, including the ethical management of public resources and improvements needed for contract management.

Previous performance audit coverage

The ANAO’s performance audit activities involve the independent and objective assessment of all or part of an entity’s operations and administrative support systems. Performance audits may involve multiple entities and examine common aspects of administration or the joint administration of a program or service.

During the performance audit process, the ANAO gathers and analyses the evidence necessary to draw a conclusion on the audit objective. Audit conclusions can be grouped into four categories:

- unqualified;

- qualified (largely positive);

- qualified (partly positive); and

- adverse.

In the period between 2020–21 to 2024–25 entities within the Foreign Affairs and Trade portfolio were included in tabled ANAO performance audits nine times. The conclusions directed toward entities within this portfolio were as follows:

- none were unqualified;

- two were qualified (largely positive);

- three were qualified (partly positive); and

- four were adverse.

Figure 2 shows the number of audit conclusions for entities within the Foreign Affairs and Trade portfolio that were included in ANAO performance audits between 2020–21 to 2024–25 compared with all audits tabled in this period.

Figure 2: Audit conclusions 2020–21 to 2024–25: entities within the Foreign Affairs and Trade portfolio compared with all audits tabled

Source: ANAO data.

The ANAO’s annual audit work program is intended to deliver a mix of performance audits across seven audit activities: governance; service delivery; grants administration; procurement; policy development; regulation and asset management and sustainment. These activities are intended to cover the scope of activities undertaken by the public sector. Each performance audit considers a primary audit activity. Figure 3 shows audit conclusions by primary audit activity for audits involving entities in the Foreign Affairs and Trade portfolio.

Figure 3: Audit conclusions by activity for audits involving entities within the Foreign Affairs and Trade portfolio, 2020–21 to 2024–25

Source: ANAO data.

Performance statements audit

The audit of the 2024-25 Department of Foreign Affairs and Trade (DFAT) annual performance statements is being conducted following a request from the Minister for Finance on 2 July 2024, under section 40 of the Public Governance, Performance and Accountability Act 2013. The audit is conducted under section 15 of the Auditor-General Act 1997.

DFAT is in its second year of inclusion in the annual performance statements audit program.

The ANAO considers the risk associated with DFAT’s performance statements audit as low. This is due to the effective management and governance over performance reporting.

Key risks for DFAT’s performance statements that the ANAO has highlighted include:

- the appropriateness and completeness of the performance information included in the 2024–25 Corporate Plan to explain its performance for the year; and

- whether the use of case studies is appropriately designed to ensure accurate and meaningful performance reporting.

Financial statements audits

Overview

Entities within the Foreign Affairs and Trade portfolio, and the risk profile of each entity, are shown in Table 1.

Table 1: Foreign Affairs and Trade portfolio entities and risk profile

|

|

Type of entity |

Engagement risk |

Number of higher risks |

Number of moderate risks |

|

Material entities |

||||

|

Department of Foreign Affairs and Trade |

Non-corporate |

Moderate |

1 |

2 |

|

Export Finance Australia |

Corporate |

Moderate |

0 |

3 |

|

Non-material entities |

||||

|

Australian Centre for International Agricultural Research |

Non-corporate |

Low |

||

|

Australian Secret Intelligence Service |

Non-corporate |

Moderate |

||

|

Australian Trade and Investment Commission |

Non-corporate |

Low |

||

|

Tourism Australia |

Corporate |

Moderate |

||

Material entities

Department of Foreign Affairs and Trade

The Department of Foreign Affairs and Trade (DFAT) is responsible for the administration of Australia’s foreign, trade, international development and international security policies.

DFAT’s total budgeted assets for 2025–26 are $10.4 billion, with around 45 per cent of these assets attributable to land and buildings. Official development assistance is $4.0 billion, or 52 per cent of total budgeted expenses (Figure 4).

Figure 4: Department of Foreign Affairs and Trade’s total budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are three key risks for DFAT’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage, including two risks that the ANAO considers potential key audit matters (KAMs).

- Valuation of overseas property, which is subject to complex estimation, judgements and a range of valuation methodologies utilised in determining the fair value of the overseas property portfolio. (KAM – Valuation of overseas properties)

- International development assistance, as there are a broad range of agreements that cover a range of geographical areas with many third-party organisations. (KAM - Accuracy of international development assistance)

- Financial information associated with overseas posts, due to the decentralised operations across the international post network, which may have differing governing arrangements and financial processes across the international post network.

Export Finance Australia

Export Finance Australia provides financing solutions for Australian exporters and interests, including overseas infrastructure development that delivers benefits to Australia.

Export Finance Australia’s total actual assets for 2023–24 were $3.4 billion, with 35 per cent attributable to loans and receivables (excluding loans to the National Interest Account) and 23 per cent attributable to investment securities. Total revenue was $342.8 million, with interest income and other interest income, representing 59 per cent and 22 per cent respectively, and the fair value movement in third party loans and guarantees attributable to 17 per cent, as shown in Figure 5.

Figure 5: Export Finance Australia’s actual financial statements by category ($’000)

Source: ANAO analysis of Export Finance Australia’s 2023–24 Annual Report.

There are three key risks for the Export Finance Australia’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage:

- The valuation and classification of complex financial instruments involving loans provided, bonds, interest rate swaps and cross-currency swaps that are significant in value.

- The valuation and impairment of loans, guarantees, and other investments, due to the judgements and estimates applied to calculate the balances.

- The recognition of interest income earned on interest-bearing financial assets, due to the significant balance.