Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Portfolio overview

The Education Portfolio is responsible for creating a better future for all Australians through education. The portfolio is comprised of six entities, including the Australian National University, Australian Research Council and the Department of Education. The entities within the portfolio are responsible for policy, program and regulation responsibilities and delivering better outcomes for students, educators and teachers in early learning and care centres, schools and higher education providers. Further information is available from the department’s website.

In the 2025–26 Portfolio Budget Statements (PBS) for the Education portfolio, the aggregated budgeted expenses for 2025–26 total $68.1 billion. The PBS contain budgets for those entities in the general government sector (GGS) that receive appropriations directly or indirectly through annual appropriation Acts.

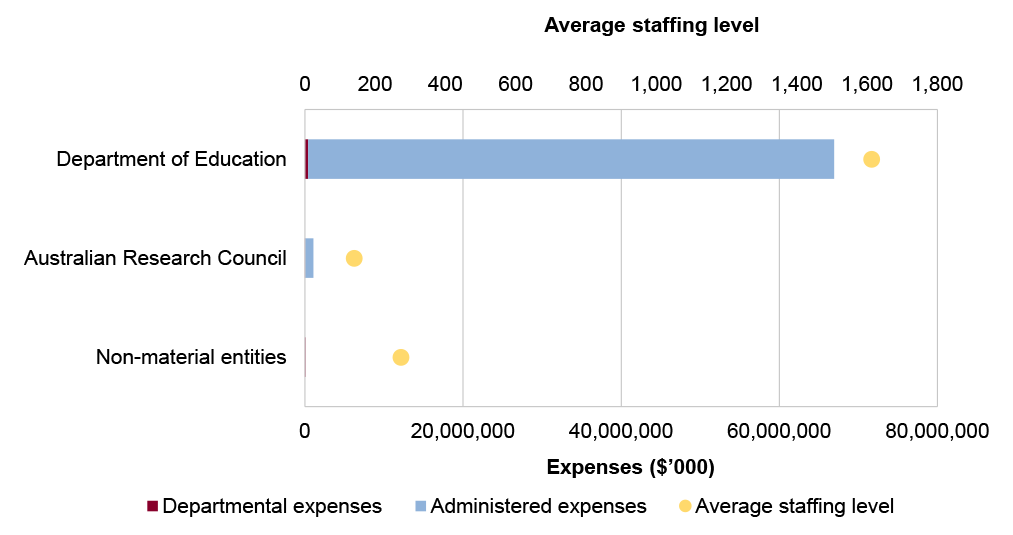

The level of budgeted departmental and administered expenses, and the average staffing level for entities in the GGS within this portfolio are shown in Figure 1. The Department of Education represents the largest proportion of the portfolio’s expenses, and administered expenses of the portfolio are the most material component, representing 99 per cent of the entire portfolio’s expense.

Figure 1: Education portfolio – total expenses and average staffing level by entity

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

Audit focus

In determining the 2025–26 audit work program, the ANAO considers prior-year audit and other review findings and what these indicate about portfolio risks and areas for improvement. The ANAO also considers emerging risks from new investments or changes in the operating environment.

The primary risks identified by the ANAO for the portfolio relate to the effective management of funding programs, including using performance measurement, monitoring and evaluation to inform policy development and program management and assess the achievement of outcomes.

Specific risks in the Education portfolio relate to governance, policy development, regulation and financial management.

Governance

Past audits of the department have made recommendations to improve performance measurement and monitoring, including effective use of data. The department needs to effectively use performance measurement and monitoring to inform policy development and program management, including understanding the contribution of program activity to the achievement of outcomes.

The department uses service delivery partners for activities including payments and information communications technology (ICT) infrastructure. The use of service delivery partners does not reduce accountability. The department needs to ensure that service and quality control expectations are agreed and maintained, shared risks are identified and effectively managed, appropriate oversight arrangements are in place, and that its business is appropriately prioritised.

Portfolio entities need to ensure they have in place fit-for-purpose governance arrangements supported by effective systems of control and accountability.

Policy development

The department is responsible for significant funding for early childhood education and care, schools, and higher education, and is involved in setting national education policies. The department needs to consult with states and territories to undertake effective policy development and program delivery.

Regulation

The department has risks relating to approving, monitoring and enforcing requirements for entities to access funding programs in early childhood education and care, schooling, and higher education. It also needs to work with states and territories and other regulators to regulate international education providers. There are specific risks in relation to expenditure due to provider fraud and non-compliance in the Child Care Subsidy, due to reliance on information provided by payment recipients.

Portfolio entities involved in standard setting and regulation are the Tertiary Education Quality and Standards Agency (TEQSA), the Australian Institute for Teaching and School Leadership Limited (AITSL), and the Australian Curriculum, Assessment and Reporting Authority (ACARA). These entities need to ensure they prioritise compliance and assurance activities where appropriate. These activities should be risk based and data driven.

Financial management

The department has specific risks in financial management relating to the valuation of assets and liabilities of the Higher Education Loan Program receivable and the Higher Education Superannuation Program liability. These valuations require judgement to be applied in selecting appropriate underlying assumptions. This raises risks related to transparency, consistency and appropriateness of the valuations.

Previous performance audit coverage

The ANAO’s performance audit activities involve the independent and objective assessment of all or part of an entity’s operations and administrative support systems. Performance audits may involve multiple entities and examine common aspects of administration or the joint administration of a program or service.

During the performance audit process, the ANAO gathers and analyses the evidence necessary to draw a conclusion on the audit objective. Audit conclusions can be grouped into four categories:

- unqualified;

- qualified (largely positive);

- qualified (partly positive); and

- adverse.

In the period between 2020–21 to 2024–25 entities within the Education portfolio were included in tabled ANAO performance audits 8 times. The conclusions directed toward entities within this portfolio were as follows:

- none were unqualified;

- six were qualified (largely positive);

- two were qualified (partly positive); and

- none were adverse.

Figure 2 shows the number of audit conclusions for entities within the Education portfolio that were included in ANAO performance audits between 2020–21 and 2024–25 compared with all audits tabled in this period.

Figure 2: Audit conclusions 2020–21 to 2024–25: entities within the Education portfolio compared with all audits tabled

Source: ANAO data.

The ANAO’s annual audit work program is intended to deliver a mix of performance audits across seven audit activities: governance; service delivery; grants administration; procurement; policy development; regulation and asset management and sustainment. These activities are intended to cover the scope of activities undertaken by the public sector. Each performance audit considers a primary audit activity. Figure 3 shows audit conclusions by primary audit activity for audits involving entities in the Education portfolio.

Figure 3: Audit conclusions by activity for audits involving entities within the Education portfolio, 2020–21 to 2024–25

Source: ANAO data.

Performance statements audit

The audit of the 2024–25 Department of Education annual performance statements is being conducted following a request from the Minister for Finance on 2 July 2024, under section 40 of the Public Governance, Performance and Accountability Act 2013. The audit is conducted under section 15 of the Auditor-General Act 1997.

Education is in its fourth year of inclusion in the annual performance statements audit program. The ANAO considers the risk associated with the Education performance statements audit as low. This is due to Education having been audited for a number of years, with the measures and processes being well understood and mature.

Key risks for Education’s performance statements that the ANAO has highlighted include:

- performance measures which may not provide meaningful information to assist the user measure and assess the department’s performance in achieving its purposes;

- the completeness of performance reporting information, where incomplete information may increase the risk that readers of performance statements will be unable to determine if the work undertaken by Education and the funding provided is appropriately supporting achievement of the desired outcomes; and

- whether the analysis presented in the performance statements is meaningful and enables the reader to form an informed view on the entity’s performance in achieving its purposes in the reporting period.

Financial statements audits

Overview

Entities within the Education portfolio, and the risk profile of each entity, are shown in Table 1.

Table 1: Education portfolio entities and risk profile

|

|

Type of entity |

Engagement risk |

Number of higher risks |

Number of moderate risks |

|

Material entities |

||||

|

Department of Education |

Non-corporate |

Moderate |

2 |

2 |

|

Australian Research Council |

Non-corporate |

Low |

1 |

1 |

|

Non-material entities |

||||

|

Australian Curriculum, Assessment and Reporting Authority |

Corporate |

Low |

||

|

Australian Institute for Teaching and School Leadership Limited |

Company |

Low |

||

|

Australian National University |

Corporate |

Moderate |

||

|

Tertiary Education Quality and Standards Agency |

Non-corporate |

Low |

||

|

Other audit engagements (including Auditor-General Act 1997 section 20 engagements) |

||||

|

Australian Children’s Education and Care Quality Authority – financial statements audit |

||||

Material entities

Department of Education

The Department of Education is responsible for leading implementation of national policy and programs that help to build a strong future by supporting the early childhood education and care and schooling systems, developing strong frameworks for Australia’s young people, and enabling access to higher education, so that Australia can maximise personal, social and economic outcomes.

The Department of Education’s total budgeted expenses for 2025–26 are $66.9 billion, with grants and personal benefits representing 68 per cent and 24 per cent, respectively, as shown in Figure 4. Trade and other receivables represent 89 per cent of total budgeted assets, while grants provisions (encompassing the Higher Education Superannuation Provision) represent 76 per cent of total budgeted liabilities.

Figure 4: Department of Education’s total budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are four key risks for the Department of Education’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage, including three risks that the ANAO considers potential key audit matters (KAMs).

- The estimation and valuation of the Higher Education Loan Program (HELP) receivable and related line items, as the valuation involves significant and complex judgements about the timing and recoverability of HELP debts, discount factors, and future employment and salary rates, which contain a significant degree of uncertainty and are influenced by the economic environment. (KAM – Valuation of the Higher Education Loan Program (HELP) receivable)

- The accuracy of the Child Care Subsidy (CCS) payments, due to reliance on information provided by payment recipients and child care service providers. (KAM – Accuracy of ‘Assistance to families with children’ personal benefit expenses)

- The estimation and valuation of the Higher Education Superannuation Program (HESP) due to the complexity of the actuarial estimation process. (KAM – Valuation of Higher Education Superannuation Program (HESP) provision)

- The completeness and accuracy of financial statement balances, as a result of the complexity and range of IT systems that are used to maintain information and process payments.

Australian Research Council

The Australian Research Council (ARC) is responsible for administering the National Competitive Grants Program (NCGP), assessing the quality, engagement and impact of research, and providing advice and support on research matters. The Amendment Bill to change the Australian Research Council Act 2001, which came into effect from 1 July 2024, saw the accountable authority for the ARC become an independent ARC Board rather than the CEO.

ARC’s total budgeted expenses for 2025–26 are $1.1 billion, with 97 per cent of these expenses attributable to grants as shown in Figure 5.

Figure 5: Australian Research Council’s budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are two key risks for the ARC’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage.

- Administered Grants Expenditure (Administered Grant Liabilities) due to the significance of the payments made and the self-assessment nature of the grants; and

- Right-of-use assets and lease liabilities due to the pending expiration of current lease arrangements and the complexity to calculate and recognise the right-of-use assets and lease liabilities in accordance with relevant accounting standards.