Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Administration of Concessional Loans Programs

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the Department of Agriculture and Water Resources' establishment and administration of the Farm Finance and Drought Concessional Loans programs.

Summary and recommendations

Background

1. Since 2013, Australian Governments have announced $3.55 billion in funding for concessional loans to assist farm businesses to improve their debt servicing capacity or recover from the effects of drought.1 The audit examined the first two concessional loans programs established by the Department of Agriculture and Water Resources (the department) the:

- Farm Finance Concessional Loans Program ($420 million in 2013–14 and 2014–15); and

- Drought Concessional Loans Program ($280 million in 2013–14 and 2014–15).2

2. Under each program, the Australian Government has provided loan funding to the states and the Northern Territory (the jurisdictions) to establish and fund schemes that provide concessional loans to eligible farming businesses.3 The schemes that were established offered five-year interest-only loans to eligible farm businesses. The maximum loan amount available was $1 million or up to 50 per cent of the farm business’ eligible debt (whichever was lower).4 Loans can be used to restructure existing debt or provide new debt for specified activities. The department advised that, as at 29 February 2016, there were:

- 410 farm finance concessional loan recipients, with loans totalling $196.690 million (46.8 per cent of the total funding available); and

- 320 drought concessional loan recipients, with loans totalling $192.377 million (71.2 per cent of total funding available).

3. The first loans are due for repayment in 2018–19.

Conclusion

4. The effectiveness of the Department of Agriculture and Water Resources’ design and establishment of the Farm Finance Concessional Loans Program was adversely impacted by a number of factors, primarily: the department’s (and the Australian Government’s) limited experience in delivering concessional loan programs; the condensed timeframe set by government to design and implement the program once a public announcement had been made; and the department’s inability to appropriately consult with the intended delivery partners prior to the program’s announcement due to confidentiality considerations. In comparison, the experience gained by the department through the design and implementation of the Farm Finance Concessional Loans Program meant that it was better placed to design the latter Drought Concessional Loans Program.

5. While the department ultimately established workable arrangements with the states and the Northern Territory to deliver both concessional loan programs, there were shortcomings evident in design decisions and implementation activities. These shortcomings included the absence of: an economic analysis of the costs and benefits of providing a subsidy to assist farm businesses; appropriate modelling to estimate potential demand and ultimately the required funding profile for each program; sufficiently robust arrangements to ensure that funding conditions were met before payments were made and that reported jurisdictional performance information was accurate and complete; and a sound performance measurement and reporting framework to determine whether the objectives set by government are being achieved.

6. Given the relatively novel nature of concessional loan arrangements across the Commonwealth and the challenges that the department faced in implementing these programs with limited support, it will be important for the department to communicate the lessons learned from these early programs—both in relation to future departmental programs and also more widely across other public sector entities.

Supporting findings

Program design and planning for implementation

7. The department had limited evidence on which to establish the need for a Farm Finance Concessional Loans Program and did not: prepare an analysis of the costs and benefits of providing assistance to farming businesses through a subsidy; or develop modelling to determine the number of potentially eligible applicants, which was needed to inform key design elements. Further, the department did not include in its advice to government robust default rate data that would have better informed an assessment of the financial risks associated with establishing concessional loans programs to assist farming business. The department did, however, appropriately inform government that its advice was affected by the short timeframe available to prepare the program proposal and confidentiality considerations that meant that jurisdictions (proposed delivery partners) were unable to be consulted.

8. For the later Drought Concessional Loans Program the department outlined the interest cost savings that would accrue to farm businesses, but did not provide a cost-benefit analysis to demonstrate that a subsidy would be an effective policy intervention to address the needs of farm businesses experiencing drought conditions or determine the potential number of applicants.

9. When designing the Farm Finance Concessional Loans Program the department considered existing Commonwealth and Queensland government concessional loans programs, with the Farm Finance Concessional Loans Program proposal that was ultimately approved by government largely informed by the Queensland Government’s program. Subsequently, the earlier Farm Finance Concessional Loans Program was used as the model for the design of the latter Drought Concessional Loans Program.

10. Key design parameters were not finalised until after the program had been announced as their development was to be informed by consultation with jurisdictional delivery partners. Further, in the absence of robust data to indicate potential demand for either program, the department was not well positioned to make informed estimates of total required funding and payments to delivery partners or tailor administrative arrangements to cater for the resulting workload.

11. While the risk assessments prepared by the department for both programs were reasonable, the department’s inexperience in implementing concessional loan programs meant that it did not have a full appreciation of the range of implementation risks present for the Farm Finance Concessional Loans Program. The department’s advice about risk for the Drought Concessional Loans Program was more considered—informed by the experience gained from implementing the earlier concessional loan program.

12. The department did not establish an implementation plan for the Farm Finance Concessional Loan Program. Although a comprehensive assessment of risks to the implementation of the program was undertaken and the development of an implementation plan for the Farm Finance Concessional Loans Program had been commenced, the plan was not completed or approved. The department eventually documented its approach to the delivery of the Farm Finance Concessional Loans Program as part of the Drought and Rural Assistance Program Plan, which was prepared once all Farm Finance schemes had commenced. An implementation plan was developed and approved for the Drought Assistance Package, which included the Drought Concessional Loans Program as part of the suite of measures to provide in-drought support to farm businesses. As well as documenting key risks to implementation, the plan outlined how the program would be implemented and the arrangements for monitoring implementation.

Program delivery

13. While the agreements established by the department provided an appropriate delivery framework, weaknesses in administrative arrangements and documentation meant that the department was unable to appropriately demonstrate that it had confirmed that the established conditions precedent for each agreement had been satisfied for seven of the 13 schemes prior to releasing funding. Although the agreements are operating as anticipated, the department’s failure to adequately establish that all conditions precedent were met has exposed the Commonwealth to additional risk regarding the operation of the governing agreements.

14. The variations in the timing of access to concessional loans and benefits able to be accessed were reasonable as the decentralised delivery approach meant that these aspects were required to be negotiated and agreed bilaterally between governments. However, there would be merit in the department monitoring scheme differences to manage risks to fairness and consistency, such as the inconsistent assessment of applications against criteria set by the Commonwealth.

15. The department established effective arrangements to: make timely and accurate payments to, and correctly record payments from, each jurisdiction. However, the department had limited assurance that: all requirements for payment specified in the agreements had been met before payments were made; the discretionary payment that was made was necessary; and amounts reported to the department and used to inform program monitoring are accurate and complete.

16. Effective arrangements have been established to support communication by the jurisdictions, with the department:

- implementing comprehensive communication plans for all schemes;

- establishing a Communication Network and holding meetings with delivery partners; and

- reviewing the effectiveness of communication activities.

Monitoring and reporting on program performance

17. The effectiveness of the arrangements established by the department to monitor funding structures and program delivery is mixed. Arrangements are in place to monitor program delivery, including the: formation of a dedicated Program Board to monitor each program; collection and collation of information from each jurisdiction regarding loan portfolio and delivery arrangements; and preparation of regular reports and the conduct of periodic reviews to inform oversight. The effectiveness of these arrangements is, however, undermined by processes that provide limited assurance that the information reported by jurisdictions is complete and accurate. Further, there is scope to augment information collected from jurisdictions to assess impairment to better inform the departmental Executive and, where relevant, Ministers, of the likelihood, costs and impact of default.

18. The department has not established appropriate arrangements to evaluate the impact or effectiveness of each program.

19. The Parliament and the public have been informed about the implementation of each concessional loan program, primarily through the department’s annual reports. However, sufficient information to enable stakeholders to determine the extent to which the objectives of each program are being met has not been reported.

Recommendations

|

Recommendation No.1 Paragraph 3.9 |

To provide the required assurance that conditions precedent have been met for agreements endorsed under future programs, the ANAO recommends that the Department of Agriculture and Water Resources:

Department of Agriculture and Water Resources’ response: Agreed. |

|

Recommendation No.2 Paragraph 3.29 |

The ANAO recommends that the Department of Agriculture and Water Resources obtain appropriate assurance that all relevant funding agreement requirements have been met before related payments are released. Department of Agriculture and Water Resources’ response: Agreed. |

|

Recommendation No.3 Paragraph 4.8 |

To underpin robust governance arrangements for the concessional loan programs, the ANAO recommends that the Department of Agriculture and Water Resources review and validate information reported by jurisdictions to ensure that it is complete and accurate. Department of Agriculture and Water Resources’ response: Agreed in part. |

|

Recommendation No.4 Paragraph 4.41 |

To improve accountability and support effective program management, the ANAO recommends that the Department of Agriculture and Water Resources:

Department of Agriculture and Water Resources’ response: Agreed. |

Summary of Department of Agriculture and Water Resources’ response

20. The Department of Agriculture and Water Resources’ summary response is provided below:

The Department of Agriculture and Water Resources (the department) considers the report and findings provide a basis for further improvements to the development and on-going management of the government’s concessional loans schemes. As noted in the report, concessional loans programmes are a relatively new form of assistance across the Commonwealth.

The department has committed to improving its administration of concessional loans schemes and has already implemented a number of procedures to strengthen the administration of current and future schemes. The department’s employment of new measures will continue to be refined with increased knowledge, understanding and experience of the risks and issues associated with concessional loans schemes.

The department is working closely with the state and territory governments to establish the delivery and eligibility settings for the 2016–17 scheme announced in the Agricultural Competitiveness White Paper.

1. Background

Introduction

1.1 In 2012, in the context of generally favourable real net farm cash incomes5 and interest rates that had been declining over recent years6, the farming and finance sectors expressed concerns to the then Australian Government that some farming enterprises were finding it increasingly difficult to service debt due to a range of factors impacting:

- income, such as high input costs, extreme weather conditions, low commodity prices and/or exchange rate fluctuations; and

- access to credit, including lower land valuations and tightened credit market conditions following the Global Financial Crisis.7

1.2 To assist farm businesses to improve their debt servicing capacity the then Government announced that it would make concessional loans available as a form of debt relief.8 Subsequently, the current Government has made concessional loans available to assist farm businesses to manage and recover from the effects of drought. Since 2013, $3.55 billion in funding for concessional loans has been announced through the following programs:

- $420 million (2013–14 and 2014–15) for the Farm Finance Concessional Loans Program;

- $280 million (2013–14 and 2014–15) for the Drought Concessional Loans Program9;

- $100 million (2014–15) for the Drought Recovery Concessional Loans Program for farm businesses in Queensland and New South Wales;

- $250 million (2015–16) to extend the Drought and Drought Recovery Concessional Loans Programs; and

- $2.5 billion (2016–17 to 2025–26) for a new Drought Concessional Loans Program.

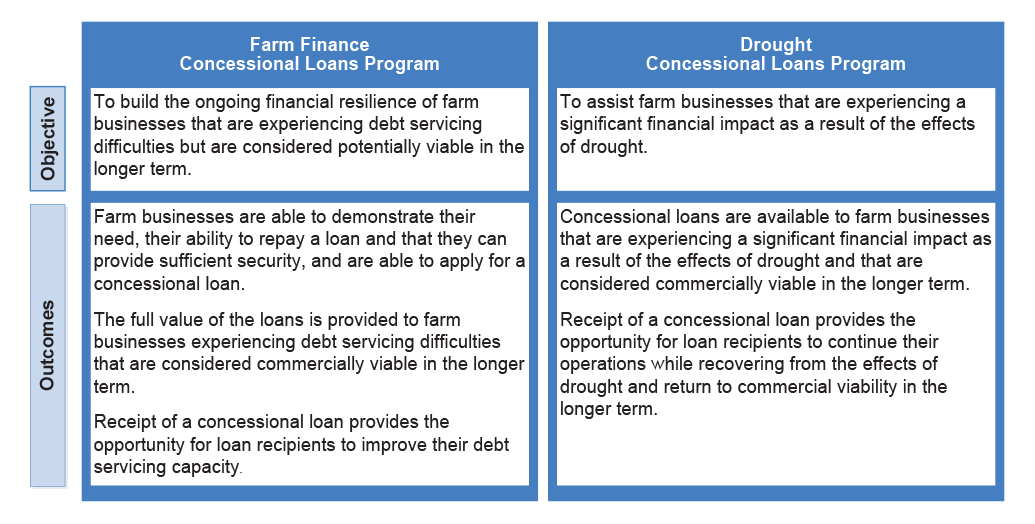

1.3 Prior to the establishment of the Farm Finance Concessional Loans Program, the Department of Agriculture and Water Resources (the department) had not administered a concessional loans program. In this audit, the ANAO examined the first two concessional loan programs established by the department on behalf of the Government—the Farm Finance Concessional Loans Program and the initial Drought Concessional Loans Program. The objective and outcomes of each program are outlined Figure 1.1.

Figure 1.1 Objectives and outcomes of concessional loan programs

Source: ANAO based on departmental information.

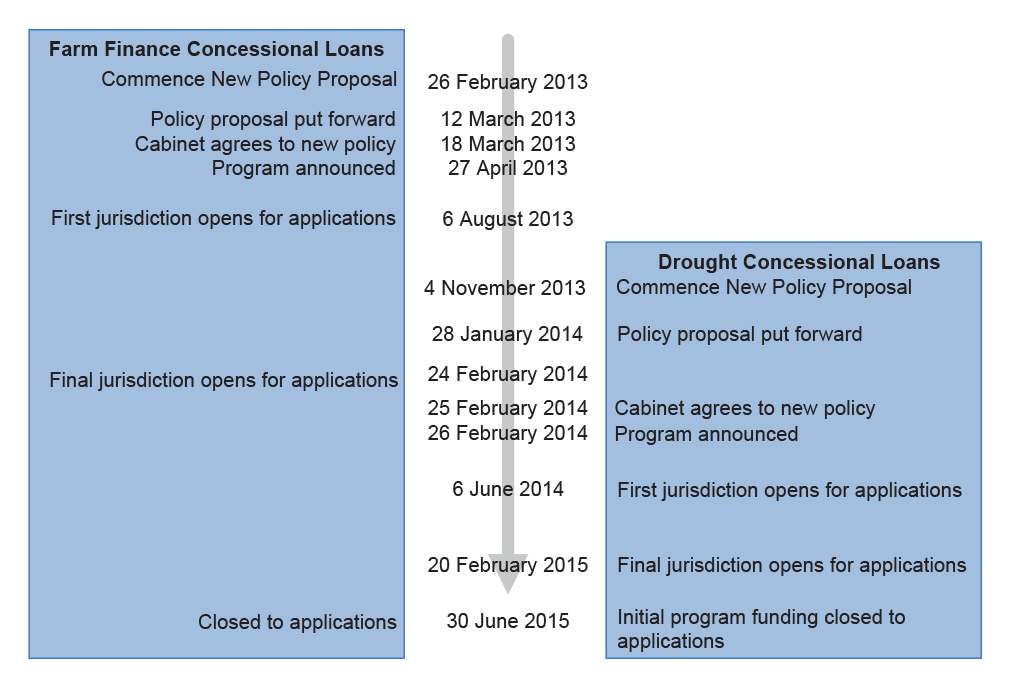

1.4 The key dates in the development, implementation and delivery of each program are outlined in Figure 1.2.

Figure 1.2: Key dates for the concessional loans programs

Source: ANAO from departmental information.

Funding and delivery arrangements

1.5 Given the absence of specific legislative powers to enable the Commonwealth to deliver concessional loans directly to farming businesses10, under each concessional loans program funds were loaned to the states and the Northern Territory (the jurisdictions) to establish schemes to provide loans to eligible farming businesses.11

1.6 The department is responsible for administering each program, including:

- implementing funding and delivery arrangements with the jurisdictions for each scheme; and

- monitoring and reporting on program delivery.

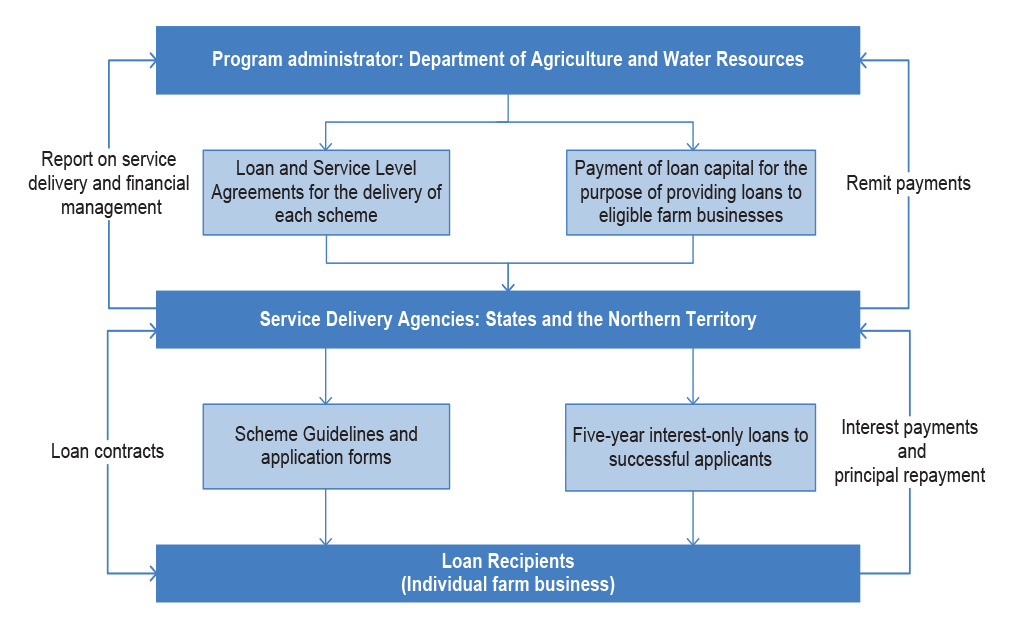

1.7 Scheme delivery arrangements were negotiated bilaterally with each jurisdiction and are underpinned by a loan agreement and a service level agreement that outline roles and responsibilities, reporting and performance requirements and the terms and conditions of the Commonwealth’s loan. The programs’ delivery arrangements are shown in Figure 1.3.

Figure 1.3: Delivery arrangements for the concessional loans programs

Source: ANAO from departmental information.

1.8 Decentralised delivery models generally involve more complex arrangements than centralised models. In the case of the concessional loans programs, schemes are administered by a diverse range of entities with differing levels of loan management experience, including: state government departments12; a state-based statutory authority13; and a private sector banking institution.14 Further, Farm Finance Concessional Loans Schemes have been tailored to address jurisdictions’ needs (within broad approved parameters), including in terms of maximum and minimum loan amounts, loan types and access to extensions of term (as shown in Table 1.1). Scheme Guidelines inform potential applicants of the eligibility and assessment criteria, as well as the terms and conditions that apply to each loan.

Table 1.1 Farm Finance Concessional Loans Scheme settings

|

Jurisdiction |

Loan type |

Loan amount (max) |

Extended loan term (years) available at commercial rate of interest |

|

New South Wales |

Debt restructuring |

$650 000 |

One |

|

Queensland |

Debt restructuring |

$1 million. Increased from $650 000 (6 November 2013) |

Two |

|

Victoria |

Debt restructuring |

$650 000 |

Two |

|

Productivity enhancement (added September 2014) |

$650 000 Minimum $100 000 |

||

|

Western Australia |

Productivity enhancement |

$400 000. Increased from $200 000 (May 2014) Minimum $50 000 |

Two (added 16 January 2015) |

|

Debt restructuring (added 16 January 2015) |

Loan totalling $1 million for debt restructuring and/or productivity enhancement. |

||

|

South Australia |

Debt restructuring |

$650 000 Minimum $200 000 |

No extension. |

|

Tasmania |

Debt restructuring and productivity enhancement |

$650 000 |

Two |

|

Northern Territory |

Debt restructuring |

$1 000 000 |

Two |

Source: ANAO analysis of departmental information.

1.9 Table 1.2 outlines the funds allocated by the Australian Government to each scheme in 2013–14 and 2014–15.15

Table 1.2 Funds allocated to each concessional loan scheme

|

Jurisdiction |

Farm Finance Concessional Loan Scheme ($m) |

Drought Concessional Loan Scheme ($m) |

|

Total program funding |

420 |

280 |

|

Queensland |

100 |

100 |

|

New South Wales |

90 |

100 |

|

Victoria |

70 |

30 |

|

South Australia |

50 |

10 |

|

Western Australia |

50 |

20 |

|

Tasmania |

30 |

n/a |

|

Northern Territory |

30 |

10 |

|

Total funding allocated |

420 |

270 |

|

Unallocated funding |

|

10a |

Note a: Unallocated Drought Concessional Loans Program funding was redirected to the Drought Recovery Concessional Loans Program.

Source: Department of Agriculture and Water Resources.

1.10 The department advised that, as at 29 February 2016, there were:

- 410 farm finance concessional loan recipients, with loans totalling $196.690 million (46.8 per cent of the total funding available); and

- 320 drought concessional loan recipients, with loans totalling $192.377 million (71.2 per cent of total funding available).

Terms and conditions of farm businesses’ concessional loans

1.11 The schemes established under each program provided interest-only loans to eligible farm businesses. The maximum loan amount available was $1 million or up to 50 per cent of the farm business’ eligible debt (whichever was lower).16 Loans could be used to restructure existing debt or provide new debt for:

- productivity enhancements (Farm Finance Concessional Loans Program); and

- operating expenses and/or drought recovery and preparedness activities (Drought Concessional Loans Program).

1.12 The loan principal is to be repaid in full at the end of a five-year term. However, some jurisdictions’ Farm Finance Concessional Loan Schemes and all jurisdictions’ Drought Concessional Loan Schemes allow loans to be extended for up to two years at a commercial rate of interest.

Interest rate applied to concessional loans

1.13 The Australian Government sets the concessional interest rate; the rate is reviewed every six months and is to be revised if the Commonwealth Five Year Bond rate moves more than +/-10 basis points.17 In line with reductions in the bond rate, the concessional interest rate has also fallen (as outlined in Table 1.3).

1.14 The latest reduction was announced by the Minister on 27 July 2015, at which time he advised farm business that the programs were delivering an interest rate subsidy of 50 per cent or better at the current concessional interest rate. Based on the total program funding loaned to farm businesses at the current rate, a 50 per cent subsidy delivers benefits to farm businesses of approximately $12.85 million per annum across the two programs (as outlined in Table 1.3).18

Table 1.3: Concessional interest rate and cost of providing a subsidy

|

Program |

Initial rate (per cent) |

Rate as at 1 January 2016 (per cent) |

Total loans to farm businesses as at 30 June 2015 ($million) |

Value of the 50 per cent subsidy per annum at the current concessional interest rate ($million) |

|

Farm Finance Concessional Loans Program |

4.5 |

3.55 |

196.690 |

6.98 |

|

Drought Concessional Loans Program |

4.0 |

3.05 |

192.377 |

5.87 |

|

Total |

12.85 |

|||

Source: Scheme Guidelines and the Hon. B. Joyce MP (the then Minister for Agriculture, now the Minister for Agriculture and Water Resources), ‘Interest rates drop for farm business concessional loans schemes’, Parliament House, Canberra, 27 July 2015.

Audit approach

1.15 The objective of the audit was to assess the effectiveness of the department’s establishment and administration of the Farm Finance and Drought Concessional Loans programs.19 To form a conclusion against the audit objective, the ANAO adopted the following high level audit criteria:

- was each program appropriately designed and was implementation effectively planned?

- were arrangements for the delivery of concessional loans appropriate?

- were program monitoring and reporting arrangements sound?

1.16 The ANAO examined departmental records, including key documentation supporting the establishment of each scheme (Loan Agreements, Service Level Agreements, Scheme Guidelines and application forms). In addition, the ANAO conducted interviews with departmental officers and obtained feedback from key stakeholders.

1.17 The audit was conducted in accordance with the ANAO Auditing Standards at a cost to the ANAO of approximately $486 921.87.

2. Program design and planning for implementation

Areas examined

The ANAO examined the department’s advice to government on the design of each program, including whether the department had: effectively established the need for each concessional loan program; considered existing models of concessional loan programs; and a well-developed understanding of the risks to program implementation and the achievement of outcomes. The ANAO also examined whether the department had developed an appropriate plan to support its implementation of each program.

Conclusion

The effectiveness of the Department of Agriculture and Water Resources’ design and establishment of the Farm Finance Concessional Loans Program was adversely affected by a number of factors including the:

- department had limited evidence on which to establish the need for a Farm Finance Concessional Loans Program and did not prepare an analysis of the costs and benefits of providing assistance to farming businesses to demonstrate that a subsidy was the best policy intervention to address the concerns raised with government;

- absence of an existing suitable concessional loan program model in conjunction with the department’s inexperience with the delivery of concessional loan programs;

- short timeframe available to prepare the policy proposal; and

- confidentiality considerations prior to the program’s announcement that meant that jurisdictions (the intended delivery partners) were not able to be consulted about the delivery arrangements prior to the announcement of the program.

As the design of key elements of the Farm Finance Concessional Loans Program were finalised after the program was announced by the Government, the timely implementation of the program was made more challenging. To manage the Government’s expectations for timely delivery, the department finalised aspects of program design in parallel with implementation within each jurisdiction.

The department did not establish an implementation plan for the Farm Finance Concessional Loan Program. Although an assessment of risks to implementation was undertaken and the development of an implementation plan for the program had been commenced, the plan was not completed or approved. The department ultimately documented its approach to the delivery of the program in a Drought and Rural Assistance Program Plan and subordinate plan. These plans were not, however, finalised until Farm Finance Concessional Loans schemes had commenced in each jurisdiction.

In comparison to the initial program, the department was better placed to design and implement the Drought Concessional Loans Program. The program’s design was guided by the department’s earlier experience implementing the Farm Finance Concessional Loans Program and implementation was informed by an appropriate planning framework. As was the case with the earlier program, advice did not include a cost-benefit analysis to support the use of subsidy to support drought affected farm businesses and the jurisdictions were not consulted about their intended role prior to the announcement of the program. The absence of consultation with the jurisdictions made it more difficult for the department to effectively design and plan the program.

Did the department effectively establish the need for each concessional loan program?

The department had limited evidence on which to establish the need for a Farm Finance Concessional Loans Program and did not: prepare an analysis of the costs and benefits of providing assistance to farming businesses through a subsidy; or develop modelling to determine the number of potentially eligible applicants, which was needed to inform key design elements. Further, the department did not include in its advice to government robust default rate data that would have better informed an assessment of the financial risks associated with establishing concessional loans programs to assist farming business. The department did, however, appropriately inform government that its advice was affected by the short timeframe available to prepare the program proposal and confidentiality considerations that meant that jurisdictions (proposed delivery partners) were unable to be consulted.

For the later Drought Concessional Loans Program the department outlined the interest cost savings that would accrue to farm businesses, but did not provide a cost-benefit analysis to demonstrate that a subsidy would be an effective policy intervention to address the needs of farm businesses experiencing drought conditions or determine the potential number of applicants.

Farm Finance Concessional Loans Program

2.1 The department advised the then Minister for Agriculture, Fisheries and Forestry that representatives of the rural and banking sectors at the Rural Finance Roundtable had revealed growing concerns that some farming enterprises were finding it increasingly difficult to service debt. There were, however, differing views as to the extent of the debt servicing issue and the sustainability of debt levels.20 In this context, the department advised that growth in average farm business debt had slowed and additional studies/surveys were needed to obtain a clearer picture about whether farm businesses were experiencing financial hardship due to high levels of debt.

2.2 However, the department did not undertake further studies/surveys to inform its advice to government and relied on evidence that it could readily obtain to develop a proposal to provide concessional loans. The circumstances affecting the drafting of the submission were outlined in advice prepared for the then Departmental Secretary that outlined that the department had only been able to undertake a preliminary assessment of key aspects of the proposed program (resources, risks, timeframe and milestones) due to the extremely tight timeframe given to develop the submission and the department’s inability to consult and engage with key stakeholders. Notwithstanding these limitations, a policy proposal for the Farm Finance Concessional Loans Program, which was designed by the department in consultation with the Department of the Treasury, was included in a package of measures for the then Government to consider as a means to respond to the concerns that had been raised at the roundtable meeting.

2.3 The Government was advised by the department that there was a case to provide concessional loans to farm businesses that continued to be affected by financial pressures and were facing significant interest liabilities so they could: remain on the land; have access to increased cash flow; and obtain finance for productivity improvements. While there was evidence available to indicate that certain farm businesses in specific farming segments had high levels of debt, the need for intervention by government was not clearly demonstrated as:

- advice also outlined that debt levels were expected to fall without intervention;

- modelling was not undertaken to establish the number of expected loan applicants/recipients for the program;

- the department did not conduct an economic analysis of the costs and benefits of providing interest rate subsidies to farm businesses; and

- there were existing concessional loans programs in Queensland and New South Wales and the advice prepared by the department did not outline whether a Commonwealth program would duplicate or complement the existing arrangements.

2.4 The Government was informed by the department that there was risk involved in providing loans to farm businesses in financial difficulty, particularly in the event of default as funds would be lost unless pursued by government. The department advised the Government that, based on experience, a default rate of eight per cent was likely.21 The department advised the ANAO that this rate had been provided as verbal advice by the Department of the Treasury (Treasury) and the then Department of Finance and Deregulation (Finance). The department did not, however, retain evidence of this advice provided by Treasury and/or Finance.

2.5 In the absence of reliable default rate data, there would have been merit in the department including in its advice to government comparable data, such as, readily available information about default rates in agricultural loan portfolios held by the financial sector. Such information would have better informed decision-makers about the impact that defaults may have in future years on the program’s costs and on government budgeting. Further, robust default rate data would have assisted the Government to better assess the financial risks associated with establishing concessional loans programs to assist farming businesses. While advice recognised the upfront financial cost involved in funding the loans and the potential for defaults to occur, the department further advised the Government that it expected to recoup all expenditure over the life of the program. Further, the program costings that were agreed with Finance assumed a zero default rate (the advice provided on program costings was inconsistent with earlier advice of an eight per cent default rate based on previous experience). The department advised that it had relied on Finance’s advice regarding the assumed level of default for the costings because it had not previously administered concessional loan programs and did not have relevant departmental data to develop its own costings.

Drought Concessional Loans Program

2.6 Drought concessional loans aim to assist farm businesses that are experiencing a significant financial impact as a result of the effects of drought. The department proposed that concessional loans would assist farmers to make on-farm improvements that would otherwise not be possible during a drought or to manage during, and recover from, drought ‘more easily’ than if they had to meet repayments on loans at a full commercial interest rate. The department advised government that concessional loans were needed to assist the farming sector to survive and recover from drought. To support its proposal to government, the department provided:

- rainfall deficiency maps to demonstrate areas that had been experiencing extended periods of poor rainfall;

- data indicating farm business income shortfalls under current drought conditions;

- estimates of fixed running costs for broadacre farm businesses based on modelling by the Australian Bureau of Agricultural and Resource Economics22; and

- modelling of the potential financial savings for individual loan recipients that could be achieved through lower interest costs.

2.7 Notwithstanding the rationale for the policy intervention, successive reviews of the Australian Government’s drought policy have found that interest rate subsidies have been ineffective and raised concerns that subsidies could result in farm businesses being less responsive to drought conditions.23 On this basis, the proposal developed by the department to introduce a new subsidy to assist drought affected farm businesses would have been strengthened if an economic analysis of the costs and benefits of the proposed subsidy had been included.

2.8 While the department did not determine the number of potential loan applicants, it did advise the Government of the factors that would likely impact demand. While indicative recipient numbers were provided, these numbers were based on the proposed available funding, divided by the average debt levels of farm finance concessional loan recipients.

Did the department consider existing models for concessional loan programs?

When designing the Farm Finance Concessional Loans Program the department considered existing Commonwealth and Queensland government concessional loans programs, with the Farm Finance Concessional Loans Program proposal that was ultimately approved by government largely informed by the Queensland Government’s program. Subsequently, the earlier Farm Finance Concessional Loans Program was used as the model for the design of the latter Drought Concessional Loans Program.

Key design parameters were not finalised until after the program had been announced as their development was to be informed by consultation with jurisdictional delivery partners. Further, in the absence of robust data to indicate potential demand for either program, the department was not well positioned to make informed estimates of total required funding and payments to delivery partners or tailor administrative arrangements to cater for the resulting workload.

Identifying the concessional loan program model and program parameters

2.9 The department advised the ANAO that, while concessional loans were not unique, there were relatively few operating examples to draw on when it was designing the Farm Finance Concessional Loans Program24 and that it was the first Australian Government entity to implement this concessional loans program model. The department also advised that the design of the Farm Finance Concessional Loans Program was informed by a desk-based review of the Queensland Government’s Sustainability Loans and First Start Loans programs25 and of the joint Australian Government–State National Disaster Relief and Recovery Arrangements.26 However, at the point at which the Government was to approve the policy proposal for the Farm Finance Concessional Loans Program, the department had provided little advice about key program parameters, such as eligibility criteria, delivery arrangements and program settings, although the Queensland Government’s program was referenced. Departmental records indicate that more detailed advice could not be provided because the department had not consulted stakeholders and the framework for delivering concessional loans had not been decided. These program parameters were finalised after the program was announced and the jurisdictions had subsequently been consulted.

2.10 As outlined earlier, the Drought Concessional Loans Program was modelled on the earlier Farm Finance Concessional Loans Program. On this basis, the department was better placed to provide more comprehensive advice on the key parameters for the Drought Concessional Loans Program due to its experience with the former concessional loan program. The department’s advice for the Drought Concessional Loans Program outlined the proposed delivery arrangements, eligibility criteria and program settings.

Program costs

2.11 The costs for both programs were developed by the department and agreed with Finance. In the case of the Farm Finance Concessional Loans Program, the department’s briefing to government included the following design parameters:

- the maximum loan value for each eligible farm business should be $650 00027; and

- administered funding of up to $840 million was needed for Farm Finance Concessional Loans across 2013–14 and 2014–15.28

2.12 In relation to the Drought Concessional Loans Program, the department proposed that:

- the maximum loan value for each eligible farm business should be $1 million (the maximum funding available under some Farm Finance Concessional Loans Schemes)29; and

- up to $280 million in funding was required across 2013–14 and 2014–15.

2.13 The department did not document the basis on which the proposed funding envelope for each program was determined. In the absence of modelling to determine the potential number of eligible applicants for each program, as outlined earlier, the department was unable to confirm that the total program funding amounts would be sufficient to address (or would exceed) the potential demand from farming businesses. Further, while the maximum loan value proposed by the department for the Farm Finance Concessional Loans Program was higher than the average broadacre farm debt levels reported by the department, it was not evident whether the funding that was being made available was appropriate or adequate.

Assumptions about administration costs

2.14 The costings for the Farm Finance Concessional Loans Program were prepared on the basis that delivery partners would absorb the costs of delivering the scheme in their jurisdictions. In advice to its then Secretary, the department indicated that it had only undertaken a preliminary assessment of the resources needed to administer the program in each jurisdiction because of ‘the extremely tight timeframes given to develop the proposal and its inability to consult and engage with nominated program delivery partners’.

2.15 Ultimately, the jurisdictions did not agree to absorb delivery costs and additional funding of $17.9 million was provided by the Australian Government to meet the costs of administering the Farm Finance Concessional Loans Program. The costings for the later Drought Concessional Loans Program allowed $10 million towards the jurisdictions’ ‘reasonable’ administration costs. The department did not define the composition of ‘reasonable’ costs.

2.16 The department agreed delivery fees with the jurisdictions after each program had been announced. Fee arrangements were outlined in the service level agreements with the Government:

- setting a standard delivery fee per scheme ($2.5 million) after consultation with the jurisdictions for Farm Finance Concessional Loans Program; and

- negotiating differing fees with each jurisdiction for the Drought Concessional Loans Program.

2.17 Delivery fees paid by the Australian Government were designed to cover the jurisdictions’ costs of administering the schemes, including: establishing systems and skills necessary to deliver the concessional loans schemes; assessing applications; the ongoing management of concessional loans established with farm businesses; and performance reporting to inform the department of actions taken to deliver the schemes. While an upfront fixed fee approach is simpler for the Australian Government to administer, the costs per application assessed or approved are ultimately impacted by the number of applications received by each jurisdiction. Table 2.1 outlines the range of costs per application assessed or approved across each program.

Table 2.1: Costs per application assessed or approved

|

|

Lowest cost ($) |

Highest cost ($) |

|

Farm Finance Concessional Loans Program |

||

|

Cost per application assessed |

8561.64 |

96 153.85 |

|

Cost per successful application |

21 367.52 |

416 666.67 |

|

Drought Concessional Loans Program |

||

|

Cost per application assessed |

9677.42 |

500 000.00 |

|

Cost per successful application |

12 396.69 |

500 000.00 |

Source: ANAO analysis of departmental data.

2.18 In the case of the Drought Concessional Loans Program, the Government agreed to different service delivery fee levels across jurisdictions, even in those cases where the same loan funding amount was allocated and the same minimum services were to be delivered. The department did not document the rationale for determining that differing fee levels were appropriate or represented value for money when the jurisdictions did not bear the costs of default and already had established systems to deliver a concessional loans program. The department did, however, take steps to obtain better value for money from the arrangement with South Australia given the low number of successful applications for its Farm Finance Concessional Loans Scheme and was expected to have a low number of drought concessional loan applications. In this case, the department negotiated that no additional delivery fee would be paid for the Drought Concessional Loans Scheme. However, the average cost per successful South Australian application remained high across the two programs ($416 666 each for the six farm finance and drought concessional loan application assessed as successful). To inform future fee negotiations, there would be benefit in the department reviewing the setting of fees and documenting the basis on which the approach to negotiating fees and fee levels delivers value for money to the Commonwealth.

Did the department demonstrate that it had a well-developed understanding of the risks to program implementation and the achievement of program outcomes?

While the risk assessments prepared by the department for both programs were reasonable, the department’s inexperience in implementing concessional loan programs meant that it did not have a full appreciation of the range of implementation risks present for the Farm Finance Concessional Loans Program. The department’s advice about risk for the Drought Concessional Loans Program was more considered—informed by the experience gained from implementing the earlier concessional loan program.

Assessment of risk

2.19 As required for New Policy Proposals, each concessional loan program proposal outlined the five highest risks to the program’s successful implementation and an overall program risk rating (as outlined in Table 2.2). The risk ratings were determined using Finance’s Risk Potential Assessment Tool.30

2.20 As outlined earlier, the lack of consultation with the jurisdictions was the basis of a number of risks identified in the department’s assessment for the Farm Finance Concessional Loans Program. When combined with the department’s limited experience in the delivery of concessional loans programs, and tight timeframes to develop the program proposal for consideration by government, the lack of consultation adversely impacted the quality and depth of the advice provided about each proposal’s risks.

2.21 As is evident from Table 2.2, there was a lack of alignment between the ratings assigned to the five highest risks for the Farm Finance Concessional Loans Program (ratings of ‘medium’ to ‘very high’) and the overall program risk (rated as ‘low’). The department advised that the overall program risk rating of ‘low’ was the result of an error in completing the template. On this basis, there is scope for the department to strengthen the oversight of risk assessment activities for new policy proposals to ensure that the significant implementation risks to government associated with programs that require urgent implementation and involve new or complex delivery systems attract appropriate additional risk mitigations/treatments.31

Table 2.2: Top-five risks and overall program risk rating

|

Risk Area |

Risk rating |

Overall program risk rating |

|

Farm Finance Concessional Loans Program |

||

|

Contractual/Delivery arrangements |

Very High |

LOW |

|

Other Jurisdictions/ Agencies/ Business areas |

High |

|

|

Financial |

Medium |

|

|

Organisational/ Cultural change |

Medium |

|

|

Innovation |

Medium |

|

|

Drought Concessional Loans Program |

||

|

Government priority |

Very High |

VERY HIGH |

|

Stakeholders |

Very High |

|

|

All other |

Very High |

|

|

Other Jurisdictions/ Agencies/ Business areas |

Very High |

|

|

Procurement |

Very High |

|

Source: ANAO summary of the Risk Potential Assessment Tool prepared for the Farm Finance Concessional Loans and Drought Concessional Loans proposals.

2.22 Despite a lack of consultation with the jurisdictions, the department had a more thorough understanding of the risks posed by the Drought Concessional Loans Program due to experience gained by implementing the Farm Finance Concessional Loans Program. The overall program risk rating (‘very high’) that was communicated to government for the Drought Concessional Loans Program accurately reflected the ratings for the top-five risks identified for the program (all were rated ‘very high’). Further, the department retained documentation outlining all risks entered into the Risk Potential Assessment Tool and provided a copy of the Drought Concessional Loans Program assessment to Finance as required.

Did the department develop an appropriate plan to support its implementation of each program?

The department did not establish an implementation plan for the Farm Finance Concessional Loan Program. Although a comprehensive assessment of risks to the implementation of the program was undertaken and the development of an implementation plan for the Farm Finance Concessional Loans Program had been commenced, the plan was not completed or approved. The department eventually documented its approach to the delivery of the Farm Finance Concessional Loans Program as part of the Drought and Rural Assistance Program Plan, which was prepared once all Farm Finance schemes had commenced. An implementation plan was developed and approved for the Drought Assistance Package, which included the Drought Concessional Loans Program as part of the suite of measures to provide in-drought support to farm businesses. As well as documenting key risks to implementation, the plan outlined how the program would be implemented and the arrangements for monitoring implementation.

Planning to implement the Farm Finance Concessional Loans Program

2.23 The department advised the ANAO that planning for the Farm Finance Concessional Loans Program occurred in parallel with the establishment of schemes within each jurisdiction. This approach was taken due to time pressures to deliver loans, although the delivery model had not been decided prior to the program’s announcement.32 The department advised that despite taking steps, such as engaging a project manager, it struggled to meet the Government’s expectations surrounding the timing of program delivery.

2.24 In accordance with the department’s established program implementation processes, officers began developing an implementation plan for the Farm Finance Concessional Loans Program.33 However, the plan was not completed or approved and the department did not document its approach to implementing the program. In the absence of an appropriate overarching program implementation plan or documented delivery approach, there was an increased risk to successful implementation, particularly given the complex, decentralised delivery model involving a range of jurisdiction specific arrangements.

Risk assessment

2.25 The department prepared a comprehensive assessment of risks to the successful implementation and delivery of the Farm Finance Concessional Loans Program. On 27 May 2013, the department held a workshop with officers from other relevant government departments to identify risks in the following areas: eligibility and assessment; stakeholders; political and reputational; financial; program compliance; loan recipient compliance; policy outcomes; capability and capacity; legal; implementation; and communication. The department documented mitigation and management strategies for the risks identified.

2.26 The program’s overall risk rating was now considered by the department to be ‘high’34, with the most significant risks (following mitigation) being political and reputation risk—caused by loan recipient default and delivery agency foreclosure on the loan. The ANAO compared the two risk assessments prepared for the program and noted that the later assessment expanded on the earlier assessment. The latter assessment was well developed, detailed and outlined how these risks would be managed. Further, the latter risk assessment’s ‘high’ overall risk rating more accurately reflected the highest rated risks identified.

Internal audit of the establishment of the Farm Finance Package

2.27 The ANAO’s findings in relation to the planning arrangements for the Farm Finance Concessional Loans Program accord with an earlier internal audit undertaken by the department. In November 2013, the department’s Internal Audit Branch advised its Executive that the establishment of the Farm Finance Package (which includes the concessional loans program) required improvement, primarily because a number of key planning documents had not been developed. The department agreed to develop and implement a plan for the Farm Finance Program to improve program and project management and governance. The aforementioned Drought and Rural Assistance Program Plan was developed to address this requirement and to support the department’s implementation and delivery of all drought and rural assistance programs.

Drought and Rural Assistance Program Plan

2.28 The Drought and Rural Assistance Program Plan was approved on 5 May 2014. The plan outlined the overarching governance arrangements, including a Program Board, to oversee and monitor all drought and rural assistance programs administered by the department.35 High-level arrangements for stakeholder management and communications, and risk and issues management were also outlined. Additional detail on these arrangements and program specific risks was provided in the Drought Assistance Package Implementation Plan (approved 8 May 2014) and the Farm Finance Concessional Loans Scheme Project Plan (approved 6 June 2014). The subordinate plans outlined objectives, outcomes, timeframes, roles and responsibilities, risks, budgets and resourcing and deliverables relevant to each concessional loans program.

2.29 The Drought Assistance Package Implementation Plan outlined three ‘high’ risks (following mitigation) for the Drought Concessional Loans Program, including financial loss to the Commonwealth and delayed implementation. These risks were identified through a workshop involving departmental officers from a range of areas, including finance, communications, risk management, governance, the Australian Bureau of Agricultural and Resource Economics and an officer from the Australian Government Solicitor, held on 27 March 2014 and updated on 12 May 2014. The Drought Concessional Loans Program was assessed as having a ‘very high’ implementation risk (equivalent to the initial risk advice provided to government).

3. Program delivery

Areas examined

The ANAO examined whether the department had established: effective agreements for each program; effective arrangements to manage loan funding; and effective arrangements to support communication of the schemes by the jurisdictions.

Conclusion

The department had established workable effective delivery arrangements that enabled concessional loans to be made available to farm businesses across Australia and to ensure that potential applicants were aware of the opportunity to access loans. However, the arrangements would have been strengthened by:

- retaining documentation to demonstrate that the conditions precedent for each scheme were satisfied; and

- establishing processes to confirm that payment conditions (including conditions precedent and advice that milestones had been achieved) have been met before funding is transferred to jurisdictions.

Recommendations and suggested improvements

The ANAO has made two recommendations aimed at providing greater assurance that requirements established in agreements regarding conditions precedent and payments have been met.

In addition, the ANAO has suggested that there would be merit in the department:

- monitoring scheme differences to manage risks to fairness and consistency;

- finalising guidance on the financial processes and procedures for concessional loans programs; and

- strengthening its assurance as to the completeness and accuracy of the financial information reported by the jurisdictions.

Did the department establish effective agreements for each program?

While the agreements established by the department provided an appropriate delivery framework, weaknesses in administrative arrangements and documentation meant that the department was unable to appropriately demonstrate that it had confirmed that the established conditions precedent for each agreement had been satisfied for seven of the 13 schemes prior to releasing funding. Although the agreements are operating as anticipated, the department’s failure to adequately establish that all conditions precedent were met has exposed the Commonwealth to additional risk regarding the operation of the agreements.

The variations in the timing of access to concessional loans and benefits were reasonable as the decentralised delivery approach meant that these aspects were required to be negotiated and agreed bilaterally between governments. However, there would be merit in the department monitoring scheme differences to manage risks to fairness and consistency, such as the inconsistent assessment of applications against criteria set by the Commonwealth.

Establishing arrangements for each scheme

3.1 The department consulted widely to develop template documents—guidelines and loan and service level agreements—which were used to support the negotiation of scheme arrangements with each jurisdiction. The scheme guidelines informed potential applicants of, among other things: the application period; funding availability; how to apply; eligibility and assessment criteria and the terms and conditions of the loans. Guidelines were agreed bilaterally with each jurisdiction and approved by the Government as follows:

- Farm Finance Concessional Loans Schemes between 15 July 2013 and 3 December 2013; and

- Drought Concessional Loans Schemes between 3 June 2014 and 28 January 2015.

3.2 Once the guidelines were approved for each scheme, the loan agreement and service level agreements could be finalised. Officers with appropriate delegations executed agreements for the:

- Farm Finance Concessional Loans Schemes between 24 July 2013 and 19 February 2014; and

- Drought Concessional Loans Schemes between 5 June 2014 and 18 February 2015.

3.3 The department included conditions precedent in agreements to obtain assurance that the jurisdictions could legally deliver concessional loans and had the systems, processes and capability to do so.36 The satisfaction of the conditions precedent was necessary: to establish the service level agreements; and for the Commonwealth to be obliged to make loan payments.37

Confirming that conditions precedent had been satisfied

3.4 Each jurisdiction was required to demonstrate that it could satisfy the conditions precedent for its scheme. To inform the department’s determination that the conditions precedent had been satisfied, the jurisdictions submitted a range of evidence for the department’s consideration, such as legal opinions to advise that there were no legal impediments to the establishment of the scheme. However, the department was unable to demonstrate that for each scheme it had systematically:

- collected and assessed appropriate evidence regarding each condition precedent; and

- determined that each condition precedent had been met.

3.5 While some decisions relating to whether conditions precedent were satisfied had been recorded, the evidence considered and/or the date of the decision was not. For example, in the case of one scheme a senior officer had confirmed that the conditions precedent had been met, but the evidence supporting this decision was not attached or recorded with the decision. Further, a ‘status’ table was used for one Farm Finance Concessional Loans Scheme and all the Drought Concessional Loans Schemes to track the status of each conditions precedent. Some status tables indicated that conditions had been met, however, these tables were not signed or dated and the relevant evidence was not attached or filed with the status table.

3.6 Notwithstanding required improvements in the department’s recording keeping practices, sufficient evidence had been retained to demonstrate that, of the 13 schemes, conditions precedent had been satisfied for seven schemes. The evidence retained by the department indicated that the conditions precedent for the remaining six schemes had only been partially met. For example, the department did not document:

- whether it was satisfied with the Memorandum of Understanding signed between joint delivery partners for two schemes as required by the conditions precedent. The department advised the ANAO that it had provided comments on the draft memoranda and it had not identified any issues with the final version of the memoranda; and

- its rationale for accepting evidence that did not fully address the requirement stated in the condition precedent, such as one instance where the approval provided by a state Treasurer did not reflect the wording required by the condition precedent. While the department advised that it considered the approval was sufficient to meet the condition, this decision had not been officially recorded. On this basis, it was unclear whether the lack of alignment between the condition precedent requirements and the approval provided had been considered at the time the initial payments were made.

3.7 Further, there were weaknesses in the department’s verification processes to confirm that conditions precedent had been met. For example, the department accepted unsigned legal opinions from jurisdictions as assurance that four schemes could be delivered as required.38 The finalisation of legal opinions provides greater certainty in the event that the opinion must be relied on at a later date.

3.8 Greater attention was required from the department to ensure that each condition precedent has been fully met to ensure that the risks anticipated in establishing a decentralised delivery approach were to be managed adequately. While the agreements are operating as anticipated, the department’s failure to appropriately document the satisfaction of all conditions precedent unnecessarily exposed the Commonwealth to additional risks that:

- payments were made in advance of receiving adequate assurance that the jurisdictions could deliver their schemes; and

- it is unable to act on its powers under an agreement if the agreement has not been made operable.

Recommendation No.1

3.9 To provide the required assurance that conditions precedent have been met for agreements endorsed under future programs, the ANAO recommends that the Department of Agriculture and Water Resources:

- establish suitable guidance for staff on verifying the satisfaction of conditions precedent;

- reinforce to staff the importance of following established guidance; and

- retain records to demonstrate that conditions precedent have been satisfied.

The Department of Agriculture and Water Resources’ response: Agreed

3.10 The Department of Agriculture and Water Resources (the department) has implemented improvements to its procedures that address this recommendation.

3.11 The department had arrangements in place to ensure the conditions precedent for each jurisdiction and scheme had been met. Departmental officers collected advice and documentation to inform an assessment and, where appropriate, liaised with the Australian Government Solicitor and state and territory officials to confirm that the evidence provided was sufficient to meet the condition.

3.12 To strengthen assurance that conditions precedent have been met, and records are maintained that demonstrate this, the department has developed more robust processes to explicitly record the status of and supporting evidence for each condition precedent. This documentation is verified by a senior officer. This process has been implemented for the 2015–16 concessional loans schemes and will be in place for future schemes.

3.13 Departmental officers are made aware of the required verification processes and departmental recordkeeping practices, including the use of the Records Management Portal (and previously TRIM), to ensure that all records are maintained to demonstrate that conditions precedent have been met.

Access to concessional loans

3.14 Applicants’ ability to access support under the concessional loan programs was dependent on the timing of the scheme being opened in each jurisdiction. As agreements for schemes were negotiated bilaterally, the schemes were opened consecutively rather than concurrently. The date that each scheme opened is outlined in Table 3.1.

Table 3.1: Date schemes opened

|

Jurisdiction |

Farm Finance Concessional Loans Schemes |

Drought Concessional Loans Schemes |

|

New South Wales |

6 August 2013 |

20 June 2014 |

|

Queensland |

16 August 2013 |

6 June 2014 |

|

Victoria |

23 July 2013 |

6 February 2015 |

|

Western Australia |

20 January 2014 |

23 September 2014 |

|

South Australia |

20 December 2013 |

20 February 2015 |

|

Tasmania |

13 January 2014 |

n/a |

|

Northern Territory |

24 February 2014 |

10 December 2014 |

Source: ANAO analysis of media releases and department records of scheme opening dates.

3.15 There was a delay of up to eight months between the first and last scheme opening for each program, which meant that potential applicants in those jurisdictions that were able to finalise arrangements early had access to financial benefits ahead of potential applicants in similar circumstances in other jurisdictions. The time taken to agree guidelines and agreements was a result of the department’s limited experience in the delivery of concessional loan programs and the variable arrangements already in place across jurisdictions to support the delivery of concessional loans. The department advised that timeliness was also affected by variable levels of engagement by individual jurisdictions and the impact of government elections.39 The establishment of decentralised delivery arrangements is complex and can, due to the number of different arrangements to be agreed, affect the ability of the department to open schemes simultaneously. Each successful applicant had access to a concessional loan for a term of five years irrespective of the date schemes opened.

3.16 The department’s website included advice to potential Farm Finance Concessional Loans Program applicants that schemes may differ, including the types of loans offered by jurisdictions.40 Other areas in which schemes varied were broadly drawn to the attention of stakeholders and potential applicants during the course of program delivery, primarily through a Frequently Asked Questions page on the department’s website.41

3.17 Schemes also varied in terms of the application requirements and assessment approaches.42 Table 3.2 provides some examples of the different application requirements within each program.

Table 3.2: Examples of the different application requirements

|

Application requirement |

Examples from Farm Finance Concessional Loans Scheme Guidelines |

Examples from Drought Concessional Loans Scheme Guidelines |

|

Cash flow (projections and actuals) |

New South Wales—monthly cash flow projections for the next 12 months. Queensland—monthly cash flow projections for the current and subsequent 12 month periods. Western Australia—actual monthly cash flow data for the past year and monthly cash flow budgets for the subsequent 12 months. Tasmania—cash flow projections for the next three years. |

New South Wales—a monthly cash flow budget for the next 24 months. Queensland—monthly cash flow projections for the current and subsequent 12 month periods. South Australian—a five year budget. |

|

Support from existing lenders |

South Australia required priority over loan security from the applicant’s existing lender. Western Australia required the applicant’s main lender to: validate the applicant’s identify (a 100 point check) and the information provided in the application; and provide, in writing, details of loan security requirements, priority over assets and ongoing support. In 2013–14, New South Wales required contact details for the applicant’s main lender but did not require applicants to obtain the support of lenders prior to submitting an application. In 2014–15, the application form was amended and a completed ‘Lenders Certificate of Support’ was to be submitted with the application form. |

|

Source: ANAO analysis of departmental information.

3.18 In August 2015, the department reviewed three jurisdictions’ systems and processes for managing their Farm Finance Concessional Loans schemes. This review identified that the jurisdictions’ approaches to applying the criteria and assessing each application were not consistent. For example, the jurisdictions applied different ratio thresholds to calculate the suitability of security and different focus areas to determine the applicant’s capacity to repay the loan. Further, additional criteria were included in the guidelines of some schemes. For example, guidelines for: the Western Australian scheme specified a dollar amount for assessing non-farm and liquid assets; and New South Wales, South Australia, Queensland and the Northern Territory schemes included an additional criterion relating to the percentage of current debt that an applicant could borrow.43

3.19 The department considered that identified differences in the assessment processes posed a risk to the fairness and consistency of schemes across jurisdictions. To ensure greater consistency in the application and assessment process, the department has indicated that it will explore more streamlined delivery mechanisms for future programs. While it is reasonable for decentralised delivery arrangements to differ due to variations in the delivery environment, in the absence of the streamlined delivery mechanisms proposed there would be merit in the department monitoring scheme differences to manage risks to the fairness and consistency of the schemes.

Did the department establish effective arrangements to manage loan funding?

The department established effective arrangements to: make timely and accurate payments to, and correctly record payments from, each jurisdiction. However, the department had limited assurance that: all requirements for payment specified in the agreements had been met before payments were made; a discretionary payment that was made was necessary; and amounts reported to the department and used to inform program monitoring are accurate and complete.

3.20 Under the concessional loan programs, the department is responsible for managing:

- payments made to the jurisdictions (loan capital and service delivery fees) during 2013–14 and 2014–15. A payment schedule, including any requirements to be met, was agreed with each jurisdiction; and

- incoming payments from the jurisdictions (loan principal repayments and interest due to the Commonwealth) during the life of each farm businesses’ concessional loan.

3.21 The department approved a framework and policy document for Farm Finance Loans Management in October 2013 and updated the document to reflect administrative differences for the later concessional loans programs. This document outlines the governance arrangements, policies and processes that regulate the financial management of the loans, including agency performance and monitoring, financial and credit risk management, accounting treatment and impairment of assets for the Farm Finance Concessional Loans Program.

3.22 In addition, the department has drafted, but not yet approved as at 8 December 2015, detailed guidance on the processes for: monitoring the performance of concessional loans; and escalating and reporting non-compliance and credit risk matters. This guideline consolidates loan management arrangements for all current concessional loan programs and provides further detail on how processes will operate. The department should finalise additional guidance as a priority to confirm the financial processes, roles and procedures that should be applied to all concessional loans programs.

Payments to the jurisdictions

3.23 The department obtained the relevant approvals required to authorise the spending of the total amount of Commonwealth funding specified in each loan and service level agreement. The ANAO examined all 51 payments made by the department to the jurisdictions under the agreements as outlined in Table 3.3. Individual payments to jurisdictions ranged from $100 000 to $50 million.

Table 3.3: Sample of payments to the jurisdictions, 1 July 2013–30 June 2015

|

Program |

Loan payments |

Service delivery fee |

||

|

No. |

$ million |

No. |

$ million |

|

|

Total payments for each program, as at 30 June 2015 |

29 |

545 |

22 |

24.6 |

|

Farm Finance Concessional Loans Program payments |

19 |

285 |

16 |

17.5 |

|

Drought Concessional Loans Program payments |

10 |

260 |

6 |

7.1 |

Source: ANAO.

3.24 Each of the 51 payments matched the amount due according to the agreement. Of the 51 payments, 49 were made on time with two payments made late.44

Meeting payment schedule requirements

3.25 In relation to 32 of the 51 payments examined, the payment schedule in each funding agreement specified the conditions precedent to be met and/or milestone activities required from the jurisdiction before payments were made.45 For the 13 schemes, the payment schedules of:

- 12 schemes required conditions precedent to be satisfied prior to payment of the initial loan and service delivery fee payments of each scheme (24 payments totalling $149.6 million)46; and

- 10 schemes included payments with milestone activities attached, such as, the opening of application periods or that a sufficient number of applications had been received to exhaust current funding. For the 14 payments with milestones (totalling $240 million), evidence of the milestones being met was to be provided by the jurisdiction prior to payment by the department.47

3.26 The department’s concessional loan program area was responsible for ensuring that the payment schedule requirements had been met before authorising payment by the finance area. However, the department obtained limited assurance that all requirements had been met before payments were made, primarily because:

- the department did not routinely document that the conditions precedent had been satisfied. The department’s records indicated that payment authorisations included advice that conditions precedent had been met for one scheme;

- payment authorisations for 19 of the 35 Farm Finance Concessional Loans Scheme payments examined had been completed by the finance area. When payment authorisations did not originate from the program area, documentation had not been retained by the department to clearly indicate that requirements had been met; and

- the jurisdictions did not routinely provide required evidence that milestone activities had been met prior to payment. For the 14 payments with milestone requirements, the department had obtained the necessary evidence for three payments and had documented that requirements had been met for one payment (although the evidence that had been relied upon to make its decision was not documented or retained).

3.27 The ANAO’s sample included one discretionary payment made to Queensland.48 The scheme’s loan agreement allowed the department to make an additional payment on 30 June 2014 using funds allocated for the jurisdiction’s 2014–15 loan payments. The department did not document the basis on which it made the payment prior to 30 June 2014 or the basis on which the early payment was required. The department subsequently advised the ANAO that ‘given the high levels of uptake and increase in the volume of applications received leading up to the end of the financial year, the Commonwealth made the additional payment to ensure that there were sufficient funds available to fund Drought Concessional Loans to eligible farm businesses’. However, as at 15 July 2014, Queensland had received Drought Concessional Loan applications totalling $12.7 million and had approved applications totalling $2.147 million. On this basis, the need for funding payments to be brought forward prior to 1 July 2014 had not been established as the initial payment of $20 million had not been exhausted.

3.28 Given the identified shortcomings in procedures and practices relating to payments made under the concessional loan programs, the department should strengthen procedural requirements and reinforce to staff that payments are only to be made after requirements established in agreements have been met, including documenting the departmental assessment. The ANAO noted that there was evidence of improved assessment and record keeping relating to more recent concessional loan program payments. In relation to the last three payments made in June 2015, a minute had been prepared that outlined the basis on which payment was to be made, including evidence that any payment schedule requirements had been met.

Recommendation No.2

3.29 The ANAO recommends that the Department of Agriculture and Water Resources obtain appropriate assurance that all relevant funding agreement requirements are met before related payments are released.

The Department of Agriculture and Water Resources’ response: Agreed

3.30 The department has implemented improvements to its procedures that address this recommendation.

3.31 For the 2015–16 concessional loans schemes, the department has developed a more robust process to ensure conditions precedent, and any other requirements, are met prior to the payment of loan or administration funds to jurisdictions. These processes will be extended to ensure any conditions for subsequent payments are met before payment is made.

3.32 The importance of payments being made on time, and only once all requirements have been met, has been reiterated to departmental officers. The improved arrangements outlined in the department’s response to recommendation one include ensuring compliance with departmental recordkeeping practices and the use of decision logs for the department to be satisfied all requirements have been met by each jurisdiction for each scheme.

3.33 The programme area has developed a tracking system to document payments of loan and administrative funds for the current 2015–16 scheme and future schemes. Invoices are sent to the programme area and only submitted for processing and payment once the programme area is satisfied all requirements have been met.

Payments from the jurisdictions